Tax efficiency is an essential aspect of real estate investment, especially for those operating in the UK’s dynamic property market. With the right strategies, real estate investors can legally minimize their tax liabilities and optimize their returns.

However, navigating the UK tax system can be challenging, particularly with frequent legislative changes and the complexity of tax regulations.

This article provides eight actionable and practical tax-saving tips for real estate investors in UK, designed to help you maximize profitability while staying compliant with the law.

Essential Tax-Saving Tips for Real Estate Investors in UK

1. Leverage Mortgage Interest Tax Relief

Mortgage interest is often one of the largest expenses for property investors. While recent legislative changes have reduced the level of relief available, there are still opportunities to benefit from tax savings for real estate investors in UK:

- Basic Rate Relief: All landlords can claim a flat-rate 20% tax credit on mortgage interest, which helps offset rental income.

- Plan Ahead: Changes in relief structures make it essential to evaluate the impact on your investment returns.

- Explore Alternatives: Restructuring your mortgage or switching to interest-only payments can provide further flexibility.

Example: For a rental property generating £12,000 annually with £4,000 in mortgage interest, claiming the relief could save you up to £800 per year.

| Mortgage Interest Relief | Before 2020 | Now (Flat 20%) |

| Higher-rate Taxpayers | Up to 40% | Limited to 20% |

| Basic-rate Taxpayers | 20% | 20% |

Pro Tip: Keep detailed records of all mortgage payments and interest statements to simplify the claims process during tax filings.

2. Claim Capital Allowances

Capital allowances allow property investors to offset the cost of certain tangible assets against taxable profits. These tax-saving tips for real estate investors in UK include:

- Fixtures like lighting and heating systems.

- Energy-efficient equipment installed during renovations.

- Integral features such as electrical wiring and plumbing systems.

How to Claim:

- Identify qualifying expenses, such as appliances or systems.

- Use detailed receipts and invoices to back your claims.

- Consult a tax specialist to ensure compliance with HMRC guidelines and maximize your claims.

Example Table of Eligible Expenditures:

| Item | Eligibility | Claim Limit |

| Bathroom Fittings | Yes | No limit |

| Energy-efficient Boilers | Yes | Enhanced rates |

| Structural Repairs | No | N/A |

| Heating Systems | Yes | No limit |

Case Study: A landlord who installed a new energy-efficient heating system and lighting fixtures worth £8,000 claimed capital allowances, reducing taxable income by the full amount.

3. Utilize Private Residence Relief (PRR)

Private Residence Relief can reduce your Capital Gains Tax liability when selling a property that was once your main residence. If you’ve lived in the property before letting it out, you may qualify for partial relief, making it an important tax-saving tip for real estate investors in UK.

Maximizing PRR:

- Document your periods of residence and letting.

- Combine PRR with Letting Relief to reduce taxable gains further.

- Keep records of all residency documentation and rental agreements.

Example: A property owned for 10 years, with 5 years as the main residence and 5 years rented out, may allow for a proportional reduction in CGT. If the total gain is £100,000, PRR could reduce the taxable amount to £50,000.

| Ownership Period | Residence | Relief Eligibility |

| 5 Years | Main Home | Fully eligible |

| 5 Years | Rented | Partially eligible |

Pro Tip: Consider professional advice to calculate PRR accurately and leverage the maximum allowable relief.

4. Set Up a Limited Company

For those with multiple properties, operating through a limited company can significantly reduce tax burdens. Corporate tax rates are typically lower than personal income tax rates, and profits can be reinvested more efficiently. This is one of the most effective tax-saving tips for real estate investors in UK.

Key Benefits:

- Corporate tax rate: 19% (as of 2025).

- Dividends paid to shareholders may be taxed at a lower rate compared to personal rental income.

Additional Advantages:

- Enhanced privacy, as properties owned by a company are listed under the company name.

- Access to certain business loans and financing options not available to individual investors.

Considerations:

- Higher administrative costs and legal obligations.

- Limited access to mortgage products compared to personal ownership.

Comparison Table:

| Ownership Type | Tax on Rental Income | Flexibility for Profits |

| Personal Ownership | 20-45% | Limited |

| Limited Company | 19% | High |

Example: An investor earning £50,000 annually from rental properties could save up to £6,000 in taxes by operating through a limited company instead of personal ownership.

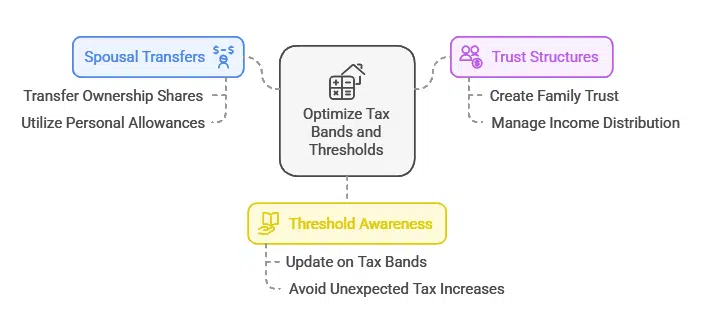

5. Optimize Tax Bands and Thresholds

Strategically distributing rental income can reduce overall tax liability. This is particularly useful for married couples or partnerships and is one of the easiest-to-implement tax-saving tips for real estate investors in UK.

Tips for Optimization:

- Spousal Transfers: Transfer ownership shares to utilize both partners’ personal allowances.

- Trust Structures: Create a family trust to manage income distribution effectively.

- Threshold Awareness: Stay updated on changes to tax bands and thresholds to avoid unexpected tax increases.

Current Income Tax Bands (2025):

| Band | Tax Rate | Threshold |

| Personal Allowance | 0% | Up to £12,570 |

| Basic Rate | 20% | £12,571-£50,270 |

| Higher Rate | 40% | £50,271-£150,000 |

Example: By transferring 50% of ownership to a spouse earning below the higher-rate threshold, a landlord could save £2,000 in income tax annually.

6. Deduct Maintenance and Repair Costs

Routine maintenance and repairs are fully deductible from your rental income. These expenses differ from capital improvements, which are added to the property’s cost base for future CGT calculations. Regularly reviewing these costs is an actionable tax-saving tip for real estate investors in UK.

Examples of Deductible Repairs:

- Fixing a leaking roof.

- Replacing worn carpets.

- Painting to restore original conditions.

Case Study: A landlord spent £2,000 on property repairs. Deducting this from rental income of £15,000 lowered taxable income to £13,000, resulting in £400 saved in taxes.

7. Deduct Professional Services Expenses

Professional fees, including accounting, legal, and property management services, are tax-deductible. This not only reduces your taxable income but also ensures compliance with complex tax laws. Including such costs is a straightforward tax-saving tip for real estate investors in UK.

Why It Matters:

- Proper bookkeeping can uncover additional allowable expenses.

- Professional advice often identifies overlooked opportunities.

| Service Type | Deductibility | Notes |

| Accounting Services | Fully deductible | Retain detailed invoices. |

| Letting Agent Fees | Fully deductible | Includes tenant-finding fees. |

| Legal Advice | Partially deductible | Depends on scope. |

8. Defer Capital Gains Tax with Reinvestment

Capital Gains Tax (CGT) can be deferred by reinvesting proceeds from property sales into qualifying assets. This strategy is particularly effective for long-term investors and a must-know tax-saving tip for real estate investors in UK.

Strategies:

- Utilize Rollover Relief for reinvestments in similar properties.

- Take advantage of government-backed incentives for reinvestment in specific sectors.

Example: Selling a property for £200,000 with a £50,000 gain and reinvesting the full amount into another property can defer CGT until the new property is sold.

| Scenario | Without Reinvestment | With Reinvestment |

| Gain Taxed Immediately | £50,000 | £0 |

| Tax Deferred | £0 | £50,000 |

Pro Tip: Work with a tax advisor to identify qualifying investments that align with your long-term goals.

Advanced Strategies for Long-Term Tax Savings

Understanding Inheritance Tax (IHT) Reliefs

Inheritance Tax can erode the value of your property portfolio if not managed properly. Effective strategies include:

- Business Property Relief: Reduces IHT liability for qualifying investments.

- Trusts: Allow for structured and tax-efficient asset transfers.

Example: Transferring a portfolio valued at £500,000 into a trust reduced taxable estate value by £150,000, saving up to £60,000 in IHT.

Wrap Up

Navigating the complexities of UK tax laws can be daunting, but implementing these tax-saving tips for real estate investors in UK can significantly enhance your financial outcomes.

By leveraging reliefs, deductions, and advanced planning strategies, you can maximize your returns while ensuring compliance.

Proactive tax planning is the cornerstone of a successful investment journey, so don’t hesitate to consult with experts or adopt technology to streamline your efforts.