When it comes to filing taxes, efficiency and accuracy are essential. The process can be daunting, especially if you are unfamiliar with the intricacies of the UK’s tax system.

With the right tax preparation services that save you time and money in UK, you can streamline the process and focus on other priorities, whether for your business or personal finances.

This comprehensive guide explores seven of the best tax preparation solutions available in the UK, detailing how each service can help optimize your tax filing experience.

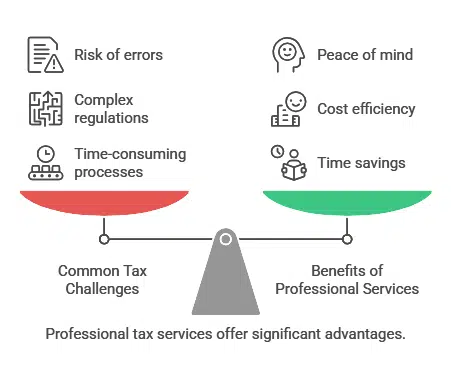

Why Tax Preparation Services Are Essential?

Tax preparation involves more than just filling out forms. From understanding complex regulations to avoiding costly errors, there are many reasons to invest in professional assistance.

Common Challenges of Filing Taxes in the UK

- Time-consuming processes: Calculating taxes, gathering documents, and ensuring accuracy can take hours.

- Complex regulations: The UK’s tax system involves various rules and updates that can be difficult to track.

- Risk of errors: Simple mistakes can lead to audits, penalties, or lost tax savings opportunities.

Benefits of Professional Tax Services

- Time savings: Professionals handle the heavy lifting, so you can focus on your priorities.

- Cost efficiency: Avoiding mistakes and maximizing deductions ensures you save money.

- Peace of mind: Experts ensure compliance with HMRC regulations, reducing stress.

7 Tax Preparation Services in the UK That Save You Time and Money

Below are the 7 tax preparation services in the UK that will save you money and time.

1. HMRC-Approved Online Tax Software

Technology has revolutionized tax preparation, making it easier than ever to file returns with precision. These platforms are designed for individuals, freelancers, and small business owners who want a hassle-free tax filing experience. With automated calculations and seamless integrations, they reduce errors and save valuable time.

- Popular Options:

- QuickBooks

- Xero

- FreeAgent

- Features to Look For:

- User-friendly interfaces.

- Automated calculations to avoid manual errors.

- Integration with bank accounts for real-time updates.

| Software | Key Features | Pricing |

| QuickBooks | Automated tax calculations, invoicing tools | Starting at £12/month |

| Xero | Comprehensive VAT management, bank reconciliation | Starting at £22/month |

| FreeAgent | Self-assessment filing for freelancers | Free with NatWest accounts |

Practical Tip: Many of these software solutions offer free trials. Take advantage of them to explore features before committing to a subscription.

Actionable Insight: If you’re self-employed, prioritize software that simplifies expense categorization and mileage tracking—a common source of tax deductions.

2. Chartered Accountants for Personalized Assistance

For individuals and businesses seeking tailored guidance, chartered accountants offer unparalleled expertise. They are particularly valuable for managing complex tax situations, such as capital gains, property income, or international tax compliance. Their personalized approach ensures every detail is addressed.

- What They Offer:

- One-on-one consultation.

- Assistance with tax planning and strategy.

- Guidance on complex tax scenarios, such as property income or capital gains.

- Reputed Firms in the UK:

- PwC UK

- Deloitte UK

- KPMG UK

| Firm | Specializations | Contact |

| PwC UK | Tax planning for businesses, audits | www.pwc.co.uk |

| Deloitte UK | Corporate and individual tax strategy | www2.deloitte.com |

| KPMG UK | Compliance and VAT advisory | home.kpmg/uk |

Case Study: A small business in London used a chartered accountant from PwC to navigate VAT complexities. The result? They saved over £10,000 annually by identifying overlooked deductions.

Pro Tip: Always verify if the accountant is registered with a recognized body like ICAEW or ACCA for assurance of their credentials.

3. Tax Preparation Mobile Apps

The rise of mobile technology has made it possible to handle tax preparation on the go. These apps are ideal for freelancers and individuals who need a quick and accessible solution to manage their taxes.

- Top Apps to Consider:

- GoSimpleTax

- Taxfiler

- Receipt Bank

- Advantages:

- Upload and store receipts digitally.

- Track expenses in real-time.

- File taxes directly through the app.

| App | Key Features | Pricing |

| GoSimpleTax | Self-assessment filing, receipt capture | Starting at £9/month |

| Taxfiler | Cloud-based filing for professionals | Starting at £10/month |

| Receipt Bank | Expense tracking, receipt storage | Free and paid plans |

Pro Tip: Apps like GoSimpleTax provide a step-by-step guide to ensure you meet HMRC deadlines effortlessly.

Additional Insight: Receipt Bank’s OCR (Optical Character Recognition) feature can significantly reduce the time spent manually entering data by automatically extracting key details from receipts.

4. Self-Assessment Tax Filing Services

For freelancers, contractors, and self-employed individuals, self-assessment services simplify a notoriously complicated process. These services are designed to eliminate confusion and ensure compliance with HMRC regulations.

- Key Benefits:

- Step-by-step filing guidance.

- Automatic reminders to meet HMRC deadlines.

- Support for calculating allowable expenses.

- Top Services:

- TaxScouts

- 1-Tap Tax

| Service | Key Features | Pricing |

| TaxScouts | Expert-assisted filing, fixed fee | £119 per return |

| 1-Tap Tax | Automated expense tracking | Starting at £5/month |

Pointers to Simplify the Process:

- Register for self-assessment online with HMRC.

- Gather your income and expense records.

- Use a specialized service to file returns accurately.

Actionable Insight: Double-check the list of allowable expenses for your industry, as this can lead to significant tax savings.

5. Payroll and Business Tax Services

For SMEs and startups, outsourcing payroll and business tax preparation can lead to significant time savings. These services ensure compliance while allowing you to focus on growth.

- Services Provided:

- Payroll management.

- VAT and corporate tax filings.

- Employee benefits compliance.

- Recommended Providers:

- ADP UK

- Sage Payroll

| Provider | Features | Pricing |

| ADP UK | Comprehensive payroll solutions | Custom pricing |

| Sage Payroll | Cloud-based payroll for SMEs | Starting at £7/month |

Case Study: A startup in Manchester partnered with ADP UK to manage payroll and VAT filings, reducing administrative hours by 50%.

Pro Tip: Consider payroll services that integrate with accounting software for seamless financial management.

6. Free Tax Helplines and Advisory Services

For individuals looking to save money, free helplines and advisory services offer essential support. These services are particularly useful for low-income taxpayers and senior citizens.

- Government and Charity-Run Helplines:

- HMRC’s self-assessment helpline.

- TaxAid and Tax Help for Older People (charity-run organizations).

- How They Save You Money:

- Free expert guidance.

- Answers to complex tax-related questions.

| Service | Target Audience | Contact |

| HMRC Helpline | General taxpayers | 0300 200 3310 |

| TaxAid | Low-income individuals | www.taxaid.org.uk |

| Tax Help for Older People | Senior citizens | www.taxvol.org.uk |

Practical Tip: Keep a list of questions ready when contacting a helpline to maximize the value of the consultation.

Additional Insight: TaxAid often holds free workshops to educate taxpayers about their rights and filing processes—a resource worth exploring.

7. Comprehensive Tax Advisory Firms

If you have a complex tax situation, full-service advisory firms provide end-to-end solutions. They’re ideal for high-net-worth individuals and international businesses.

- What They Offer:

- Strategic tax planning for high-net-worth individuals and corporations.

- Representation during audits or investigations.

- Multi-jurisdictional tax support for international businesses.

- Notable Firms:

- Grant Thornton UK LLP

- BDO UK

| Firm | Specializations | Contact |

| Grant Thornton UK | Corporate tax, global mobility | www.grantthornton.co.uk |

| BDO UK | Tax dispute resolution, audits | www.bdo.co.uk |

Example: An international business with operations in Europe and Asia partnered with BDO UK to optimize their tax strategy across multiple jurisdictions, saving £50,000 annually.

Actionable Tip: Consult with advisory firms that specialize in your specific industry to gain tailored insights.

How to Choose the Best Tax Preparation Service for Your Needs?

Factors to Consider

- Pricing: Ensure the service fits within your budget without compromising quality.

- Features: Look for automation, real-time support, and compliance tools.

- Reputation: Check user reviews and professional accreditations.

Questions to Ask a Tax Preparation Service

- What guarantees do you offer regarding accuracy and compliance?

- Can you provide support in the event of an HMRC audit?

- How do you ensure data security?

Additional Tip: If your tax situation is relatively simple, consider free or low-cost services before opting for premium options.

Benefits of Using These Tax Preparation Services

Saving Time and Reducing Stress

Professionals and software handle the heavy lifting, giving you more time to focus on your personal or business goals.

Maximizing Tax Savings

Expertise ensures that you claim all eligible deductions, reducing your tax bill significantly.

Avoiding Errors and Penalties

Avoiding mistakes means fewer penalties, audits, and costly corrections.

Takeaways

The right tax preparation services that save you time and money in UK can make all the difference, whether you’re filing personal taxes or managing business finances.

By leveraging the tools, professionals, and resources discussed above, you can streamline your tax filing process and maximize your savings.

Take the time to evaluate your needs and choose the solution that aligns best with your financial goals.