Running a small business in the UAE comes with several tax obligations, but did you know that you can significantly reduce your taxable income by utilizing various deductions?

Understanding the tax deductions every small business in UAE should use can help business owners optimize their expenses, increase savings, and remain compliant with UAE tax laws.

By strategically leveraging these deductions, businesses can reduce financial strain and reinvest in growth, enhancing operational efficiency and long-term sustainability.

In this guide, we’ll explore the most essential tax deductions for small businesses in the UAE, offering practical insights on how to maximize these benefits.

Whether you operate in a free zone or on the mainland, knowing how to leverage these deductions can be a game-changer for your financial strategy.

Understanding Tax Deductions for Small Businesses in UAE

Tax deductions allow businesses to subtract certain expenses from their total taxable income, reducing their overall tax liability. These deductions are legal and are designed to support businesses by minimizing costs associated with operations, staffing, and growth.

Businesses that take full advantage of tax deductions can increase profitability and reinvest in key areas such as marketing, workforce development, and innovation.

Who Qualifies for These Deductions?

All registered small businesses, startups, freelancers, and sole proprietors in the UAE can benefit from tax deductions. However, the exact deductions available may depend on the business structure and location (free zone vs. mainland).

Compliance with VAT (Value Added Tax) and corporate tax regulations is also essential when claiming deductions. Understanding the criteria and required documentation ensures that businesses avoid penalties while maximizing financial benefits.

10 Tax Deductions Every Small Business in UAE Should Use

Maximizing tax deductions is a crucial strategy for reducing overall business expenses and improving financial health. By identifying the right deductions, business owners can reinvest saved money into growth opportunities, employee benefits, and business expansion.

Below, we explore the tax deductions every small business in UAE should use to optimize financial performance and maintain compliance with local tax regulations.

1. Office Rent & Utilities

A physical workspace is essential for business operations, whether it’s a leased office, co-working space, or home office setup. Rent and utilities represent significant overhead expenses that can be deducted from taxable income, helping businesses cut costs while ensuring smooth operations.

Pro Tip: Consider negotiating long-term lease agreements to secure better rental rates and maximize deductions.

| Expense Type | Deductibility | Documentation Required |

| Office Rent | Fully deductible | Lease agreement, rent receipts |

| Electricity & Water Bills | Fully deductible | Utility bills, payment receipts |

| Internet & Phone | Fully deductible | Service provider invoices |

2. Business Setup & Licensing Fees

Starting and maintaining a business in the UAE requires obtaining trade licenses and regulatory approvals, which can be costly. These expenses, including license renewals, permit fees, and regulatory charges, are tax-deductible, reducing financial burdens for entrepreneurs.

Example: A startup in Dubai’s free zone saves thousands annually by claiming deductions on trade license fees.

| Expense Type | Deductibility | Documentation Required |

| Trade License Fees | Fully deductible | Payment receipts, licensing documents |

| Visa Processing Fees | Fully deductible | Government-issued receipts |

| Legal & Registration Fees | Fully deductible | Service contracts, invoices |

3. Employee Salaries & Benefits

Payroll is one of the largest expenses for businesses, and fortunately, salaries, benefits, and end-of-service gratuities are tax-deductible. Offering employee perks such as health insurance and training not only attracts top talent but also lowers taxable income.

Tip: Employee wellness programs can also be deducted under training and development expenses.

| Expense Type | Deductibility | Documentation Required |

| Employee Salaries | Fully deductible | Payroll records, bank statements |

| Health Insurance | Fully deductible | Insurance premium receipts |

| Training Programs | Fully deductible | Training invoices, certificates |

4. Marketing & Advertising Expenses

Promoting your business is crucial, and expenses related to marketing campaigns, digital advertising, and branding are deductible. Whether running social media ads, SEO campaigns, or influencer collaborations, these costs help businesses grow while reducing tax liability.

Example: A local e-commerce company increased its revenue by 40% after investing in targeted digital advertising, which was fully deductible.

| Expense Type | Deductibility | Documentation Required |

| Digital Advertising | Fully deductible | Ad invoices, campaign reports |

| Social Media Marketing | Fully deductible | Agency contracts, receipts |

| Content Creation | Fully deductible | Freelancer invoices, contracts |

5. Business Travel & Transportation Costs

Entrepreneurs and employees often travel for business meetings, networking, and training. These travel costs, including flights, accommodations, and local transportation, are deductible if directly related to business operations.

Tip: Keep detailed records of business travel expenses and maintain a travel log for tax audits.

| Expense Type | Deductibility | Documentation Required |

| Flight Tickets | Fully deductible | Airline invoices, itineraries |

| Hotel Accommodations | Fully deductible | Booking receipts |

| Fuel & Transportation | Fully deductible | Fuel receipts, mileage logs |

6. Depreciation of Business Assets

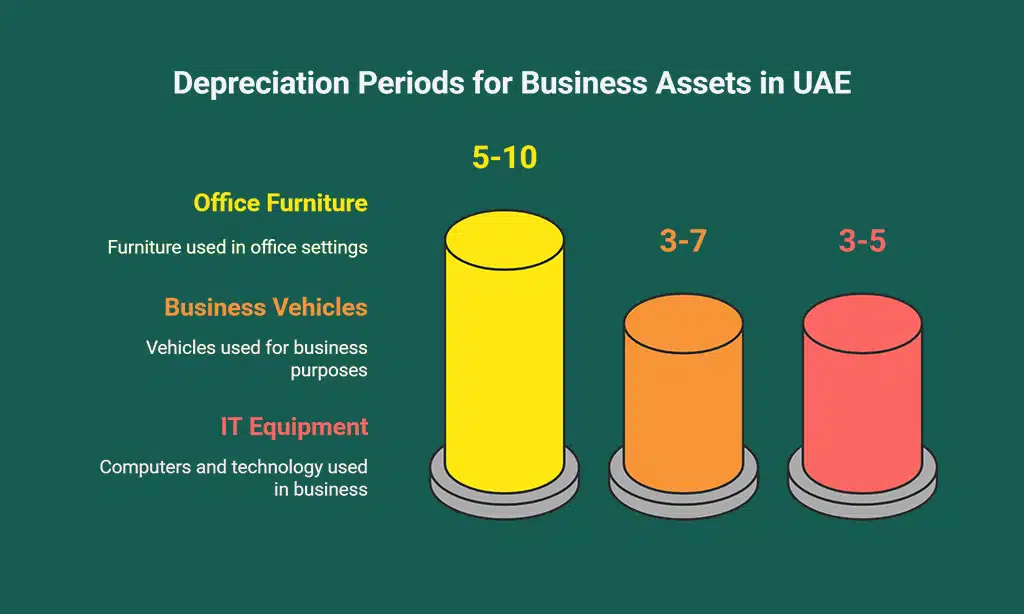

Assets such as computers, office furniture, and company vehicles lose value over time. The UAE allows businesses to deduct depreciation costs, ensuring they claim tax benefits for long-term investments.

| Asset Type | Depreciation Period | Documentation Required |

| Office Furniture | 5-10 years | Purchase invoices |

| Business Vehicles | 3-7 years | Vehicle registration, invoices |

| IT Equipment | 3-5 years | Hardware receipts |

7. Professional Services & Consultancy Fees

Hiring legal, financial, and business consultants can optimize operations and ensure compliance. These fees are fully deductible, making it easier for businesses to manage risks and scale effectively.

Many small businesses rely on expert services such as accounting, legal representation, and strategic business planning, which can be costly but are necessary for compliance and financial stability.

Example: A tech startup in Dubai consulted with a financial advisor to streamline its bookkeeping process, reducing errors and improving tax efficiency. The cost of these services was fully deductible, allowing the company to reinvest its savings into product development.

| Service Type | Deductibility | Documentation Required |

| Accounting & Tax Services | Fully deductible | Invoices, contracts |

| Legal Consultancy | Fully deductible | Retainer agreements, legal invoices |

| Business Advisory | Fully deductible | Service contracts, consultancy reports |

8. IT & Software Expenses

Technology investments are vital for efficiency. Expenses on cloud computing, cybersecurity, and subscription-based tools are tax-deductible, benefiting businesses in the long run. Small businesses can claim deductions for software used in daily operations, including CRM tools, project management platforms, and cybersecurity solutions.

Pro Tip: Investing in automation tools can reduce labor costs and enhance productivity while being fully deductible.

| IT Expense Type | Deductibility | Documentation Required |

| Cloud Storage | Fully deductible | Subscription invoices |

| Cybersecurity Solutions | Fully deductible | Payment receipts, security compliance reports |

| Software Licenses | Fully deductible | Licensing agreements, invoices |

9. Insurance Premiums

Protecting assets and employees is crucial. Business insurance costs, including liability, property, and employee insurance, can be deducted from taxable income. This helps small businesses manage financial risks associated with workplace accidents, natural disasters, and legal liabilities.

Example: A retail business in Abu Dhabi faced an unexpected property damage issue. Since their business insurance covered such events, they were able to claim the premiums as tax deductions, reducing their financial burden.

| Insurance Type | Deductibility | Documentation Required |

| Business Liability Insurance | Fully deductible | Insurance policy, premium payment receipts |

| Property Insurance | Fully deductible | Policy documents, damage claims |

| Employee Health Insurance | Fully deductible | Payroll records, insurance agreements |

10. Bad Debts & Unpaid Invoices

Unpaid client invoices can be written off as bad debts, allowing businesses to claim them as losses. If a customer fails to pay, businesses can deduct the amount from their taxable income, ensuring financial stability despite revenue losses.

Pro Tip: Regularly follow up with clients and maintain clear documentation of all outstanding invoices to strengthen your tax deduction claims.

| Bad Debt Type | Deductibility | Documentation Required |

| Unpaid Customer Invoices | Fully deductible | Past due invoices, email correspondence |

| Loan Write-Offs | Fully deductible | Loan agreements, payment default records |

| Legal Collection Fees | Fully deductible | Lawyer invoices, court documentation |

Takeaways

Understanding and utilizing tax deductions every small business in UAE should use can significantly reduce taxable income and improve profitability. By keeping proper financial records, leveraging professional advice, and staying compliant with tax regulations, businesses can maximize savings while ensuring sustainability.

Final Tip: Regularly review your financial statements and consult a tax advisor to identify new deductions that align with changing UAE tax policies.

If you want to make the most of your tax deductions, consult with a financial expert today and start optimizing your business expenses! 🚀