Investing in the stock market can be a rollercoaster ride, especially in a world that’s rapidly changing. The key to enduring success lies in adopting a disciplined stock market strategy.

Discipline allows investors to navigate the highs and lows with confidence, keeping emotions in check and ensuring that their portfolio is built to withstand volatility.

In this article, we’ll explore 15 expert-backed tips to help you maintain stock market discipline and achieve your long-term investment goals in 2025 and beyond.

Why Stock Market Discipline Matters in 2025

The stock market in 2025 is influenced by technological advancements, geopolitical shifts, and a heightened focus on sustainability. With these factors driving market trends, having a clear and disciplined strategy becomes more crucial than ever.

By focusing on a staying disciplined stock market strategy, you can:

- Minimize emotional decision-making.

- Protect your investments during periods of market turbulence.

- Stay aligned with your long-term financial goals.

Current Trend: According to financial analysts, sectors like renewable energy and AI are poised for significant growth, making disciplined investing essential to capitalize on these opportunities.

15 Tips for Staying Disciplined with Your Stock Market Strategy

1. Set Clear Financial Goals

Every successful investment journey begins with clear goals. Whether you’re saving for retirement, a home, or your child’s education, having specific targets ensures your portfolio aligns with your needs.

- Short-term goals: Saving for a vacation or emergency fund.

- Long-term goals: Retirement planning or building wealth over decades.

- Actionable Tip: Use apps like Mint or Personal Capital to track your progress.

Practical Example: If your goal is to retire in 20 years with $1 million, calculate the annual returns and contributions needed to reach that target using a compound interest calculator.

| Goal Type | Time Horizon | Example Investments |

| Short-term | 1-5 years | High-yield savings, bonds |

| Medium-term | 5-10 years | Balanced mutual funds, ETFs |

| Long-term | 10+ years | Index funds, growth stocks |

2. Understand Your Risk Tolerance

Risk tolerance is the level of market volatility you can handle without panicking. Assessing your risk tolerance helps create a portfolio that suits your temperament.

- Low Risk: Bonds, dividend-paying stocks.

- Moderate Risk: Balanced funds, blue-chip stocks.

- High Risk: Growth stocks, emerging markets.

Tool: Use online risk tolerance calculators to determine your ideal risk level. Morningstar offers an intuitive tool to guide investors in assessing their comfort with market swings.

Case Study: An investor with a high-risk tolerance might allocate 70% to growth stocks and 30% to bonds, while a conservative investor might reverse these allocations for stability.

| Risk Level | Key Characteristics | Example Investments |

| Low | Conservative, steady returns | Treasury bonds, REITs |

| Moderate | Balanced risk and growth | Blue-chip stocks, balanced ETFs |

| High | Aggressive growth focus | Emerging markets, tech stocks |

3. Build a Diversified Portfolio

Diversification spreads risk across various sectors, asset classes, and geographies. This ensures that a downturn in one area doesn’t drastically affect your entire portfolio.

- Example: Combine tech stocks, healthcare ETFs, and real estate investment trusts (REITs).

- Pro Tip: Rebalance your portfolio annually to maintain diversification.

| Asset Class | Percentage Allocation | Example Investments |

| Stocks | 60% | S&P 500 ETFs, tech stocks |

| Bonds | 30% | Government bonds, corporate bonds |

| Alternatives | 10% | REITs, commodities |

4. Avoid Emotional Decision-Making

Market volatility often triggers fear or greed, leading to impulsive decisions. A staying disciplined stock market strategy helps you keep emotions at bay.

- Pitfalls: Selling during dips or buying based on hype.

- Solution: Stick to your predefined investment plan.

Example: During the 2020 pandemic, disciplined investors who refrained from panic-selling saw significant portfolio recovery by 2021.

| Emotion-Driven Action | Potential Consequence | Disciplined Alternative |

| Selling during a dip | Locking in losses | Holding steady |

| Buying during a bubble | Overpaying for overvalued assets | Sticking to valuation-based decisions |

5. Stick to a Predefined Investment Plan

Creating an Investment Policy Statement (IPS) can help you stay disciplined. An IPS outlines your goals, risk tolerance, and asset allocation strategy.

- Case Study: An investor who adhered to their IPS during the 2020 crash saw a full recovery by 2021.

- Actionable Tip: Write your IPS with specifics, such as “Maintain 60% in equities and 40% in bonds. Rebalance annually.”

| Component | Description |

| Goals | Define short and long-term objectives |

| Risk Tolerance | Specify acceptable levels of volatility |

| Asset Allocation | Determine target percentages for each asset class |

| Rebalancing Strategy | Set frequency for reviewing allocations |

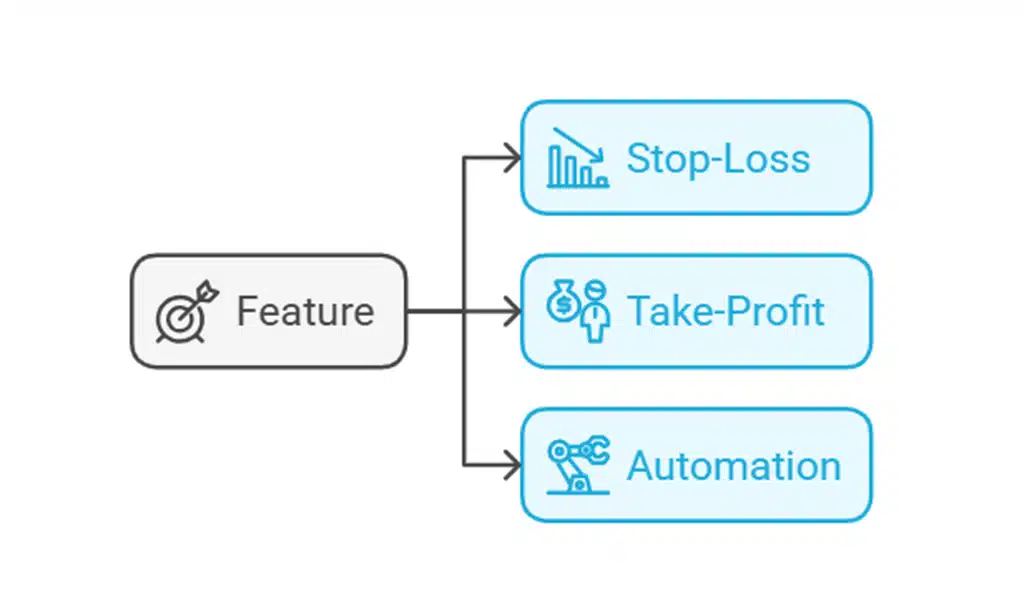

6. Use Stop-Loss and Take-Profit Strategies

Automated tools like stop-loss orders protect your investments by selling when prices fall below a set threshold. Take-profit orders secure gains by selling when prices reach a predetermined level.

- Example: Set a 10% stop-loss and a 20% take-profit order on individual stocks.

- Tool: Many brokers, such as TD Ameritrade and Interactive Brokers, offer these automated options.

| Feature | Benefit |

| Stop-Loss | Minimizes potential losses |

| Take-Profit | Locks in gains |

| Automation | Removes emotion from decision-making |

7. Focus on the Bigger Picture

Short-term market noise often distracts investors. Instead of reacting to daily fluctuations, keep your eyes on long-term trends.

- 2025 Trends: Green energy, AI advancements, and global recovery post-pandemic.

Case Study: An investor who focused on the renewable energy sector in 2020 saw compounded returns as the industry boomed through 2025.

| Trend | Growth Potential in 2025 |

| Renewable Energy | Expected CAGR of 8% |

| Artificial Intelligence | Driving automation in multiple industries |

| Healthcare | The aging population boosting demand for innovations |

8. Continuously Educate Yourself

Financial literacy is the cornerstone of successful investing. Stay informed about market trends, economic indicators, and investment strategies.

- Resources:

- Books: “The Intelligent Investor” by Benjamin Graham.

- Websites: Investopedia, Morningstar.

- Apps: Robinhood, E*TRADE.

Example: Regularly attending webinars or subscribing to newsletters from financial experts can provide actionable insights into market movements.

| Resource | Format | Best For |

| The Intelligent Investor | Book | Fundamental investing principles |

| Investopedia | Website | Learning about financial terminology |

| Robinhood Learn | Mobile App | Bite-sized lessons on investing basics |

9. Analyze Key Financial Metrics

Understanding financial ratios and metrics is critical for evaluating stocks.

- Must-Know Metrics:

- Price-to-Earnings (P/E) Ratio.

- Return on Equity (ROE).

- Earnings Per Share (EPS).

Example: A stock with a P/E ratio significantly higher than the industry average may indicate overvaluation.

| Metric | Definition | Why It Matters |

| P/E Ratio | Price divided by earnings per share | Assesses valuation relative to earnings |

| ROE | Net income divided by shareholder equity | Measures profitability and efficiency |

| EPS | Earnings divided by total shares | Indicates company profitability per share |

10. Stay Updated on Market Trends

The stock market’s landscape changes rapidly. Staying informed ensures your staying disciplined stock market strategy is relevant.

- News Apps: CNBC, Seeking Alpha.

- Global Events: Monitor geopolitical developments and central bank policies.

Example: In 2025, staying updated on central bank interest rate policies can significantly impact bond and equity performance.

| Source | Type | Coverage |

| CNBC | TV and Online | Breaking financial and economic news |

| Seeking Alpha | Online | Investor insights and analysis |

| Bloomberg | TV, Online, Mobile App | Global market data and reports |

11. Reinvest Dividends

Dividend reinvestment is a powerful way to compound returns over time. By reinvesting dividends, investors can benefit from exponential growth as their holdings increase.

- Benefits: Compounding accelerates portfolio growth, especially in dividend-paying stocks.

- Example: An investor holding $10,000 in dividend-paying stocks at a 4% yield sees their portfolio grow faster by reinvesting dividends.

| Scenario | Growth Over 10 Years |

| No Reinvestment | $14,802 |

| With Reinvestment | $17,908 |

12. Monitor and Rebalance Your Portfolio

Regular monitoring ensures your asset allocation stays aligned with your goals, while rebalancing mitigates drift caused by market performance.

- Frequency: Quarterly or annually.

- Example: If stocks grow from 60% to 70% of your portfolio, rebalancing sells excess stocks to buy bonds or other underweighted assets.

| Portfolio Allocation | Action Required |

| Stocks (70%), Bonds (30%) | Sell stocks, buy bonds |

| Balanced (60%/40%) | No action needed |

13. Focus on Cost Management

Investment fees can erode returns over time. Minimizing costs is vital for maximizing profits.

- Actionable Tip: Opt for low-cost index funds or ETFs.

| Fee Rate | 10-Year Growth (Starting at $10,000) |

| 0.10% | $26,744 |

| 1.00% | $23,678 |

| 2.00% | $20,960 |

14. Learn from Mistakes

Every investor faces setbacks. The key is identifying mistakes, analyzing their causes, and avoiding similar errors in the future.

- Example: Overtrading often reduces returns due to excessive fees. Learning to hold investments longer improves outcomes.

| Common Mistake | Lesson Learned |

| Overtrading | Reduces profits due to fees |

| Lack of Diversification | Increases risk in downturns |

15. Seek Professional Advice When Needed

For complex financial decisions, working with an advisor can ensure optimal strategies.

- Benefits: Customized plans, tax efficiency.

| Advisor Type | Best For |

| Robo-Advisor | Automated, low-cost solutions |

| Financial Planner | Comprehensive long-term planning |

| Tax Specialist | Maximizing after-tax returns |

Takeaways

The journey to long-term success in the stock market requires discipline, informed decision-making, and a clear strategy.

By implementing these 15 tips and maintaining a disciplined stock market strategy, you can navigate the ever-changing financial landscape with confidence. Start today, and make 2025 your most profitable year yet!