Planning for retirement can feel overwhelming. You work hard your entire life, but how do you make sure you have enough savings to live comfortably after retiring? Many people in India face this challenge and worry about securing their future.

They often find themselves stuck between options that seem either too risky or too limiting.

Here’s where Unit Linked Insurance Plans (ULIPs) step in. ULIPs offer a smart mix of investment and insurance under one policy, helping build a financial cushion for retirement years.

This blog will explain what ULIPs are, their benefits for retirement planning in India, and how to pick the right one.

Ready to learn more? Keep reading!

What is a ULIP?

A ULIP, or Unit Linked Insurance Plan, is a mix of investment and life insurance. Part of the premium goes to provide life cover, while the rest is invested in equity funds, debt funds, or both.

It allows you to grow your money while keeping your family protected.

These plans offer flexibility to switch between funds based on your risk appetite and market conditions. For example, if markets are volatile, you can shift from equity funds to safer debt options with fund switching benefits.

ULIPs also come with tax benefits under Section 80C for premiums paid and Section 10(10D) for maturity gains.

Why Are ULIPs Important for Retirement Planning in India?

Planning for retirement can feel like preparing for a long journey. ULIPs help by offering growth, protection, and options in one package.

Dual Benefit of Investment and Insurance

ULIPs combine life insurance with smart investing. One part of your premium builds a safety net for loved ones, while the other grows wealth in capital markets. This dual approach adds financial security to retirement planning.

Investing isn’t just about returns; it’s also about protection.

Policyholders enjoy control by choosing between equity funds or debt funds based on their risk appetite. With flexibility like fund switching and partial withdrawals, ULIPs adapt to life’s changes without compromising long-term goals.

Power of Compounding for Long-Term Growth

Compounding grows your money faster over time. In ULIPs, the premium you invest earns returns and these returns are reinvested. Over years, this snowball effect builds a large retirement corpus.

Starting early amplifies this power. For example, investing ₹10,000 monthly in a ULIP for 20 years at an 8% annual return can grow to around ₹59 lakh. But delaying by just five years reduces it significantly to about ₹38 lakh!

Flexibility in Investment Options

ULIPs give policyholders the freedom to choose where their money goes. You can pick between equity funds for high-risk, high-return goals or debt funds for safer options. Some plans even let you balance your investment by switching funds during the policy term.

This fund-switching feature helps adapt to market changes or personal goals without extra hassle. For example, if markets drop, you could shift from equity to bonds. This control ensures your retirement savings grow at a pace that fits your risk appetite and needs.

Key Benefits of ULIPs for Retirement

ULIPs pack a punch with benefits that grow your savings, cut taxes, and give peace of mind—ready to learn how they do it?

Market-Linked Returns for Wealth Creation

A part of your ULIP premiums goes into funds tied to the stock market. These include equity funds, debt funds, or a mix of both. Over time, this investment grows based on market performance.

With long-term goals like retirement, staying invested helps benefit from compounding.

The flexibility to switch between funds allows you to manage risk effectively. For example, equity works best for growth early in life while debt gives stability closer to retirement age.

Insurance companies offer tools to track how your money performs in these markets through net asset value (NAV). This makes ULIPs a smart choice for building wealth steadily over years.

Tax Benefits Under Section 80C and 10(10D)

Section 80C of the Income Tax Act allows tax exemptions on ULIP premiums up to ₹1.5 lakh per year. This includes deductions for life insurance coverage, making it attractive for retirement planning.

For policyholders who invest in unit-linked insurance plans, this benefit helps reduce taxable income while building a retirement corpus.

Maturity payouts and death benefits under Section 10(10D) are also tax-free if specific conditions are met. As long as your premium is not more than 10% of the sum assured, you can enjoy full exemption on returns.

These provisions make ULIPs an effective tool for both wealth creation and financial security post-retirement.

Regular Income Post-Retirement

ULIPs can give you steady income after retirement. Some plans, like HDFC Life Click 2 Wealth, offer tax-free payouts and premium waivers to make life easier. You can invest in equity funds or debt funds based on your risk appetite.

These options help grow your retirement corpus while also offering life insurance coverage.

Unit-linked pension plans let you choose how to allocate your money. Policyholders may use partial withdrawals for extra cash when needed without disturbing the policy term. ULIPs are flexible and provide both market-linked returns and financial stability during retirement life.

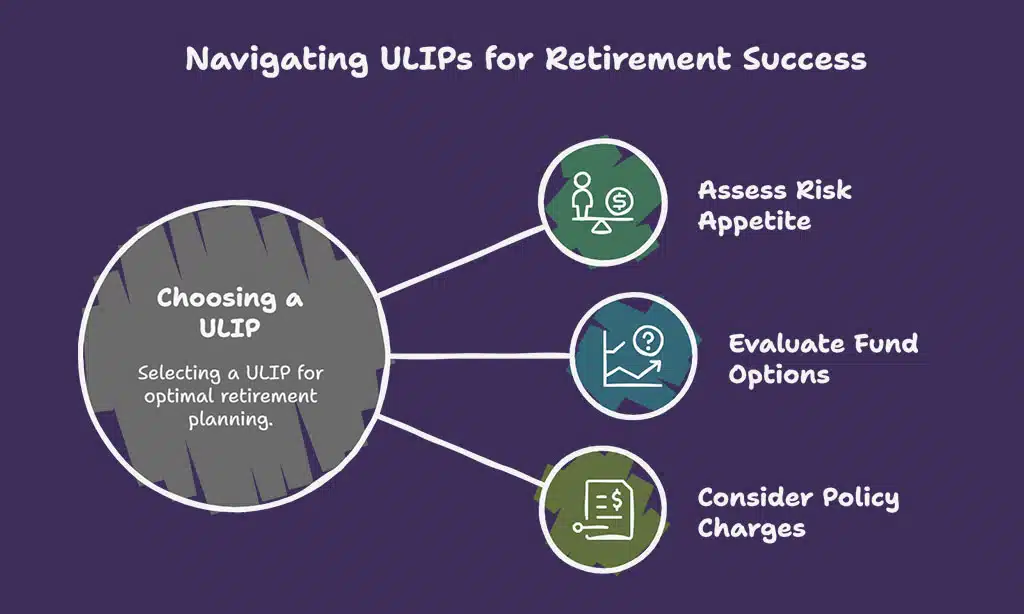

How to Choose the Right ULIP for Retirement

Picking a ULIP for retirement can shape your financial future. Know what suits your needs and weigh every option carefully.

Assess Your Risk Appetite

Think about how much risk you’re comfortable with. ULIPs invest in equity funds, debt funds, or both. Equity funds have higher returns but come with more risks. Debt funds are safer but may grow slower.

Your age and goals matter too. A 30-year-old can take more investment risks than someone close to retirement life. Check your financial stability before deciding. If unsure, talk to an insurance agent for help matching your plan to your needs!

Evaluate Fund Options and Performance

Check the performance of equity funds and debt funds in the policy. Equity funds may suit higher-risk investors looking for market-linked returns. Debt funds often work better for conservative investors who want stable growth.

Look at past data, but don’t rely only on it—markets can change.

Study how fund managers handle investments. Some plans also allow fund switching, giving you control over your portfolio during market ups and downs. Be sure to read the policy document carefully to understand premium allocation and charges that might affect returns.

Consider the Policy Charges and Tenure

Policy charges can eat into your returns. Look at premium allocation charges, mortality charges, and surrender fees in the policy document. Some ULIPs also have fund management fees that lower your wealth creation potential over time.

A longer tenure usually helps you build a bigger retirement corpus. ULIPs work best as long-term investment products due to the power of compounding. A 10-15 year commitment may offer better market-linked returns and loyalty additions from the insurer.

Choose a plan with charges that feel fair for its benefits.

Takeaways

Planning for retirement is vital, and ULIPs can simplify the process. They offer both investment growth and life insurance in one plan, making them a wise choice. With tax perks and market-linked returns, they build wealth while ensuring safety.

Choosing the right ULIP based on goals and risk tolerance can make all the difference. Start early, stay committed, and secure your future with smart financial choices!

FAQs

1. What is a ULIP, and how does it help in retirement planning?

A Unit Linked Insurance Plan (ULIP) combines investment and insurance. It helps build a retirement corpus through market-linked returns while offering life insurance coverage for financial security.

2. Are there tax benefits with ULIPs in India?

Yes, ULIPs offer tax exemptions under Section 80C on premiums paid and under Section 10(10D) on maturity proceeds, subject to the Income-Tax Act.

3. How do fund-switching options work in ULIPs?

Fund switching allows policyholders to move investments between equity funds and debt funds based on their risk appetite or market conditions during the policy term.

4. Can I make partial withdrawals from my ULIP before retirement?

Yes, after the lock-in period ends, partial withdrawals are allowed. This can provide flexibility if you need money for emergencies or other needs during your retirement life.

5. What charges should I consider when buying a ULIP?

Key charges include premium allocation charges, mortality charges for life cover, surrender charges if you end early, and fund management fees related to capital markets investments.

6. Is investing in a ULIP risky for long-term financial planning?

ULIPs carry investment risks since they are linked to capital markets like equity or debt funds. However, they also offer wealth creation opportunities over time depending on your chosen portfolio strategy and risk tolerance level.