In India’s rapidly evolving business landscape, financial stability is paramount for companies aiming for long-term growth. However, economic fluctuations, delayed payments, and insolvency risks pose significant challenges for businesses of all sizes.

This is where credit insurance plays a crucial role. The role of credit insurance in India’s growing economy is becoming increasingly important, as it helps businesses mitigate risks associated with unpaid invoices and defaulting clients.

Credit insurance acts as a financial safety net, enabling businesses to expand confidently while safeguarding cash flow and reducing bad debt risks. This article explores the role of credit insurance in India’s growing economy, highlighting its benefits, operational framework, and future prospects.

Understanding Credit Insurance and Its Importance

Credit insurance is a risk management tool that protects businesses from financial losses due to non-payment by buyers. It ensures that companies receive compensation for unpaid invoices, thereby securing their cash flow and financial health.

Key Features:

- Covers commercial and political risks leading to non-payment

- Offers protection against domestic and international trade risks

- Enhances credit risk assessment through insurer expertise

- Provides coverage for businesses of all sizes, from MSMEs to large corporations

- Enables better financial planning and forecasting by mitigating uncertainty

- Facilitates business expansion by reducing credit-related apprehensions

| Feature | Benefit |

| Commercial & Political Risk Coverage | Shields businesses from non-payment risks due to market instability |

| Domestic & International Protection | Expands business reach with confidence |

| Credit Risk Assessment | Helps businesses make informed credit decisions |

| Customizable Policies | Tailored coverage options for different industries |

| Cash Flow Stability | Ensures liquidity by securing payments |

| Business Expansion Support | Encourages risk-free trade with new markets |

Why Businesses in India Need Credit Insurance

India’s economy is characterized by fast-paced growth, increasing trade opportunities, and evolving financial dynamics. However, challenges such as delayed payments and insolvencies impact business sustainability. The role of credit insurance in India’s growing economy is evident as it:

- Prevents cash flow disruptions by covering default risks

- Supports MSMEs and exporters in mitigating financial uncertainty

- Encourages business expansion by reducing credit-related apprehensions

- Strengthens supply chain relationships by ensuring consistent payments between suppliers and buyers

- Facilitates access to credit from financial institutions by improving a company’s risk profile

- Improves business credibility by showcasing financial security to stakeholders

The Growing Indian Economy and the Need for Credit Insurance

India is one of the world’s fastest-growing economies, with an expanding market for trade and investment. The country’s GDP growth, increasing foreign trade, and rise in startups have created a dynamic economic environment. However, businesses face challenges such as late payments, default risks, and unpredictable market shifts.

| Indicator | 2023 Data |

| GDP Growth Rate | 6.4% |

| MSME Contribution to GDP | 30% |

| Export Growth Rate | 13.2% |

| Number of Registered Startups | 100,000+ |

| Total Value of Trade Credit in India | $300 Billion+ |

| Corporate Insolvency Cases | 1,900+ (2023) |

How Credit Insurance Supports India’s Expanding Markets

As businesses scale operations, their exposure to credit risks grows. The role of credit insurance in India’s growing economy helps in:

- Reducing default risks in domestic and international trade

- Enhancing financial stability by ensuring liquidity

- Increasing investor confidence by protecting revenue streams

- Providing access to better financing options by improving a company’s creditworthiness

- Encouraging trade partnerships by assuring suppliers of secure payments

- Strengthening MSME sector growth by minimizing financial uncertainties

Key Benefits of Credit Insurance for Indian Businesses

Protection Against Payment Defaults

Payment defaults are one of the primary concerns for Indian businesses, especially MSMEs. Credit insurance ensures that businesses receive compensation when customers fail to pay due to insolvency or protracted default.

Case Study: An Indian textile exporter faced a loss of INR 50 million due to a European buyer’s bankruptcy. Credit insurance covered 90% of the outstanding amount, ensuring business continuity and financial stability.

| Risk | Impact | Credit Insurance Solution |

| Customer Insolvency | Loss of receivables | Compensation for unpaid invoices |

| Payment Delays | Cash flow disruptions | Ensured payment security |

| Economic Instability | Unpredictable risks | Risk assessment & mitigation |

| High Credit Exposure | Increased financial stress | Credit insurance coverage |

Facilitating Better Credit Management

With comprehensive risk assessment tools provided by credit insurers, businesses can:

- Evaluate customer creditworthiness before extending trade credit

- Enhance financial planning through proactive risk mitigation

- Ensure consistent revenue flow without the fear of bad debts

- Leverage insurer insights to adjust trade credit terms strategically

- Strengthen relationships with lenders by securing future credit lines

- Reduce dependence on high-interest loans by maintaining stable cash flow

Boosting Business Growth and Expansion

By safeguarding against payment risks, credit insurance enables companies to:

- Expand operations without financial uncertainty

- Engage in higher-value transactions confidently

- Develop stronger relationships with international trade partners

- Access new markets by reducing financial exposure concerns

- Improve business valuation by reducing risk liabilities

- Negotiate better supplier and buyer agreements with secured payments

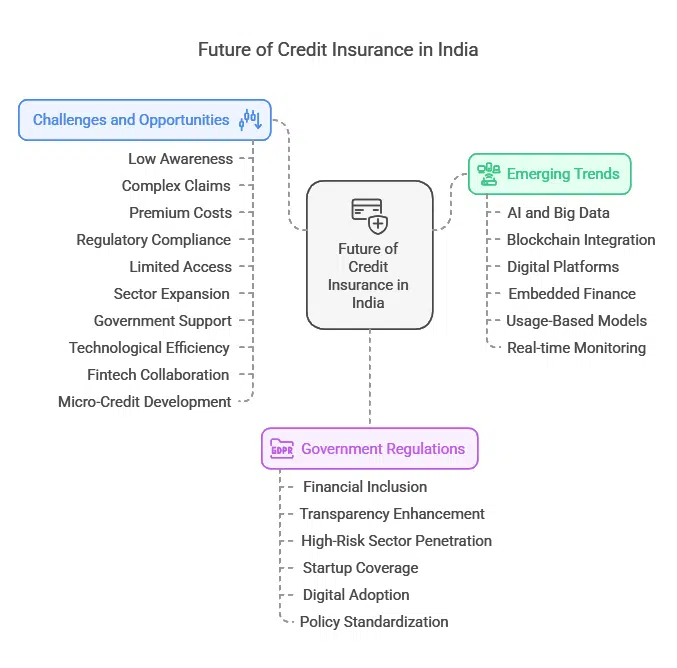

The Future of Credit Insurance in India’s Financial Landscape

Emerging Trends and Innovations

The role of credit insurance in India’s growing economy is set to evolve with technological advancements, including:

- AI and Big Data Analytics for better risk assessment

- Blockchain Integration to enhance transparency in trade transactions

- Digital Insurance Platforms for streamlined policy management

- Embedded Finance Solutions making credit insurance more accessible to SMEs

- Usage-Based Insurance Models offering flexible coverage

- Real-time Credit Monitoring to detect early signs of financial distress

Government Regulations and Policies

The Indian government, through RBI and IRDAI, regulates credit insurance policies to protect businesses. Recent policies aim to:

- Promote financial inclusion for MSMEs

- Enhance transparency in trade credit practices

- Strengthen insurance penetration in high-risk sectors

- Provide more accessible coverage for startup ecosystems

- Encourage digital adoption for efficient policy management

- Standardize credit insurance policies to simplify compliance

Challenges and Opportunities in the Sector

Challenges:

- Low awareness among small businesses

- Complex claim procedures in some cases

- Premium costs for high-risk industries

- Regulatory compliance complexity for insurers

- Limited access for new startups and small-scale enterprises

Opportunities:

- Expansion of credit insurance to new business sectors

- Increased government support for MSMEs

- Technological advancements driving efficiency

- Collaborations with fintech firms to create hybrid solutions

- Development of micro-credit insurance for small traders

Takeaways

The role of credit insurance in India’s growing economy is undeniable. As businesses navigate the complexities of financial risks, credit insurance provides much-needed security against payment defaults. It not only ensures business continuity but also fosters a more confident trade environment, enabling companies to expand without financial constraints.

As India moves toward becoming a global economic powerhouse, the adoption of credit insurance will play a crucial role in sustaining business growth, reducing financial uncertainty, and promoting a resilient trade ecosystem.

Investing in credit insurance today can be the key to ensuring long-term business success in India’s evolving economic landscape.