In today’s fast-paced world, financial literacy is more important than ever. With the rise of personal debt, volatile markets, and complex investment options, knowing how to manage your money effectively has become a crucial life skill.

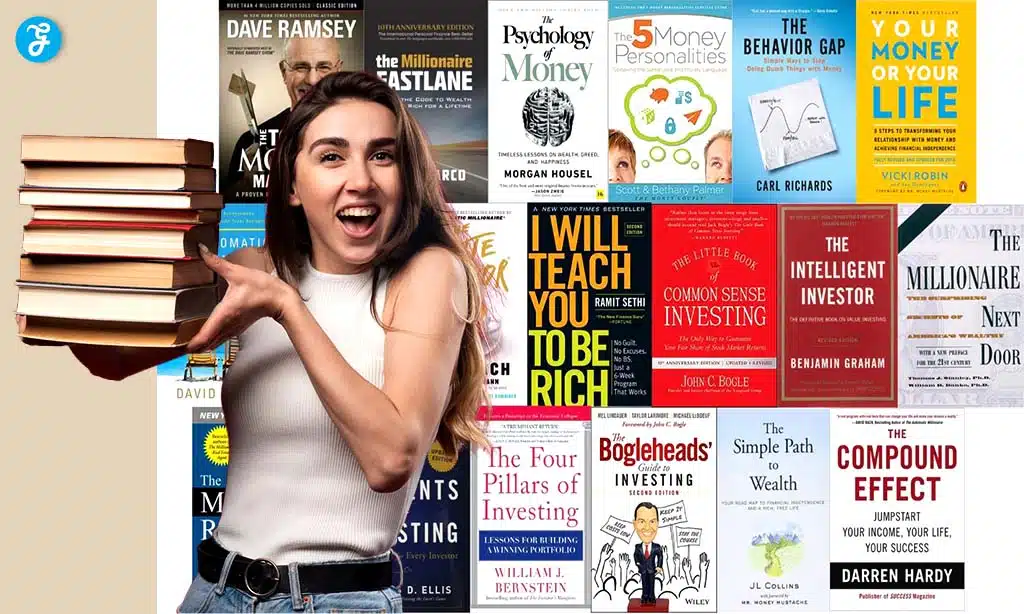

Thankfully, there’s a wealth of knowledge available through some of the best personal finance books ever written. These books offer timeless wisdom, actionable strategies, and insights into wealth-building, debt management, and financial independence.

Whether you’re looking to gain control over your finances, invest smartly, or achieve long-term financial freedom, the following list of the Top 10 Personal Finance Books will equip you with the tools you need.

Each book on this list covers different aspects of personal finance, so there’s something here for everyone—from beginners to seasoned investors. Let’s dive into the must-read books that will help you take control of your financial future.

Best 10 Personal Finance Books in 2024

Let’s take a look at 10 must-have books that will help you master personal finance.

1. “Rich Dad Poor Dad” by Robert Kiyosaki

Key Takeaways from the Book

- Understanding the Rich vs. Poor Mindset:

In Rich Dad, Poor Dad, Robert Kiyosaki shares the story of his two father figures: his biological father (Poor Dad) and the father of his best friend (Rich Dad).

Through these contrasting characters, Kiyosaki illustrates the difference in mindset between the wealthy and the middle class or poor. His “Poor Dad” focuses on job security, formal education, and working for money, while his “Rich Dad” emphasizes financial education, entrepreneurship, and making money work for you.

- Building Wealth Through Investments:

A key lesson from this book is understanding the importance of investing in assets. Kiyosaki stresses the need to buy assets that generate passive income, such as real estate, stocks, and businesses, instead of liabilities like cars and luxury items.

The focus is on building wealth through smart investments rather than relying on a paycheck.

Why You Should Read It

This book is ideal for those looking to shift their financial mindset. It’s particularly powerful for individuals who want to break free from the traditional idea of working for money and instead learn how to make money work for them. If you’re looking for a practical introduction to financial independence, Rich Dad Poor Dad is a great starting point.

2. “The Total Money Makeover” by Dave Ramsey

Key Takeaways from the Book

- The Baby Steps Approach:

Dave Ramsey’s The Total Money Makeover presents a clear, step-by-step process for getting out of debt and achieving financial freedom.

Ramsey’s Baby Steps approach starts with saving a small emergency fund and builds up to becoming completely debt-free, investing for retirement, and even paying off your home early. Each step is broken down into manageable actions, making the plan easy to follow.

- The Importance of Living Debt-Free:

Ramsey’s core philosophy revolves around living a debt-free life. He’s a strong advocate of avoiding credit cards and loans, preferring a cash-only lifestyle where you save up for large purchases instead of financing them.

He believes that financial freedom starts with eliminating debt and taking control of your spending.

Why You Should Read It

If you’re struggling with debt or looking for a solid plan to achieve financial stability, this book is a must-read. Ramsey’s straightforward advice and no-nonsense approach to managing money have helped millions of people get their finances in order. His Baby Steps are particularly useful for those who need a structured plan to follow.

3. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

Key Takeaways from the Book

- Re-evaluating Your Relationship with Money:

Your Money or Your Life takes a unique approach to personal finance by encouraging readers to examine the role that money plays in their lives.

The authors argue that money is a reflection of the life energy we expend, and they urge readers to think critically about whether their spending habits align with their values.

This book challenges the notion that more money equals more happiness and instead focuses on achieving a balanced, fulfilling life.

- Achieving Financial Independence:

The book introduces the concept of financial independence (FI), where you have enough savings and passive income to support your lifestyle without relying on a traditional job.

Robin and Dominguez offer a nine-step plan to achieve FI, which includes tracking your spending, calculating your “real” hourly wage, and investing in low-cost index funds. The ultimate goal is to achieve financial independence and live life on your terms.

Why You Should Read It

This book is perfect for anyone who wants to redefine their relationship with money and prioritize financial independence. It’s not just about getting rich; it’s about living a life that aligns with your values and freeing yourself from the need to work for money.

Your Money or Your Life offers a holistic approach to personal finance that is both practical and philosophical.

4. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Key Takeaways from the Book

- The Habits of Wealthy People:

In The Millionaire Next Door, Stanley and Danko explore the lives of ordinary people who have quietly accumulated significant wealth. The book reveals that most millionaires don’t lead extravagant lifestyles; instead, they live frugally, save diligently, and invest wisely.

They prioritize financial independence over flashy cars and large homes, debunking the myth that millionaires are always outwardly wealthy.

- Wealth Accumulation is Not About Flashy Lifestyles:

One of the key lessons from the book is that wealth accumulation is more about disciplined saving and investing than high incomes.

Many of the millionaires interviewed in the book lived in modest homes, drove used cars, and avoided luxury purchases. The message is clear: It’s not how much you earn that matters, but how much you save and invest.

Why You Should Read It

This book is a valuable read for anyone looking to understand the real habits of millionaires. It challenges common stereotypes about wealth and provides a data-driven look at how ordinary people can build extraordinary wealth by living below their means. If you’re interested in the habits that lead to long-term financial success, The Millionaire Next Door is a must-read.

5. “The Intelligent Investor” by Benjamin Graham

Key Takeaways from the Book

- Value Investing Principles:

The Intelligent Investor is considered one of the most influential investment books of all time. Written by Benjamin Graham, the father of value investing, the book introduces readers to the concept of buying undervalued stocks and holding them for the long term. Graham emphasizes the importance of thorough research, discipline, and patience in investing.

- The Importance of Long-Term Investing:

Graham’s approach to investing focuses on the long term. He argues that investors should ignore short-term market fluctuations and instead concentrate on the intrinsic value of the companies they invest in. By buying stocks at a price lower than their intrinsic value, investors can reduce their risk and increase their potential for long-term gains.

Why You Should Read It

If you’re interested in stock market investing, The Intelligent Investor is a must-read. It provides a solid foundation in value investing and offers timeless advice for navigating the stock market.

Even though it was written decades ago, its principles are still highly relevant today. This book is particularly useful for those who want to adopt a disciplined, long-term approach to investing.

6. “I Will Teach You to Be Rich” by Ramit Sethi

Key Takeaways from the Book

- Practical Personal Finance Advice:

Ramit Sethi’s I Will Teach You to Be Rich offers a modern, no-nonsense approach to personal finance. The book covers a range of topics, including automating your finances, investing in low-cost index funds, and saving for big-ticket items like a home or vacation.

Sethi’s advice is practical and actionable, making it easy for readers to start improving their finances immediately.

- Focus on Enjoying Life While Being Financially Smart:

One of the standout features of this book is Sethi’s focus on enjoying life while managing money wisely. He advocates for spending extravagantly on the things you love while cutting costs mercilessly on things that don’t matter.

This approach makes personal finance less about deprivation and more about aligning your spending with your values.

Why You Should Read It

This book is ideal for anyone looking for a straightforward, relatable guide to personal finance. Sethi’s conversational tone and emphasis on taking immediate action make it a great choice for millennials and anyone who wants to get their financial house in order without sacrificing enjoyment. If you’re looking for a balanced approach to managing your money, I Will Teach You to Be Rich is a fantastic resource.

7. “The Simple Path to Wealth” by JL Collins

Key Takeaways from the Book

- The Power of Index Funds:

The Simple Path to Wealth is a comprehensive guide to investing in index funds, written in a way that’s accessible to beginners. Collins advocates for investing in low-cost index funds as the simplest and most reliable way to build wealth. He explains how index funds allow you to own a piece of the entire market, minimizing risk and maximizing long-term growth.

- Financial Freedom through Simplicity:

Collins’ philosophy revolves around simplifying your financial life. He argues that you don’t need to complicate your investments or try to time the market to achieve financial success. Instead, by consistently investing in index funds and avoiding high fees,

you can achieve financial independence faster than you might think.

Why You Should Read It

If you’re new to investing or looking for a simple, effective strategy to build wealth, this book is for you. Collins breaks down complex financial concepts into easy-to-understand advice, making it accessible to anyone. His emphasis on simplicity and long-term investing makes The Simple Path to Wealth a great resource for those looking to achieve financial independence without the stress of managing a complicated portfolio.

8. “Broke Millennial” by Erin Lowry

Key Takeaways from the Book

- Financial Advice for Millennials:

Broke Millennial is a personal finance guide written specifically for younger generations navigating the financial challenges of the digital age. Lowry covers a wide range of topics, from budgeting and saving to dealing with student loans and managing credit. Her advice is practical and tailored to the unique financial struggles faced by millennials.

- Navigating Personal Finance Challenges in the Digital Age:

Lowry addresses the realities of managing money in today’s world, including the rise of fintech apps, the gig economy, and the burden of student loan debt. She provides actionable tips for overcoming these challenges and building a solid financial foundation, even if you’re starting from scratch.

Why You Should Read It

This book is perfect for millennials and young adults just starting their financial journey. It’s packed with relatable examples and real-world advice on how to manage money in a way that’s both practical and realistic. Broke Millennial is a great choice for anyone looking to take control of their finances without feeling overwhelmed.

9. “Think and Grow Rich” by Napoleon Hill

Key Takeaways from the Book

- The Power of Mindset in Wealth Creation:

In Think and Grow Rich, Napoleon Hill explores the psychological aspects of wealth creation. The book emphasizes that success starts with your mindset, and Hill outlines the importance of setting clear financial goals, maintaining a positive mental attitude, and being persistent in the pursuit of wealth. He argues that the power of thought is a key driver in achieving financial success.

- Principles of Success:

The book presents 13 principles for financial success, which include desire, faith, specialized knowledge, and persistence.

Hill’s principles are based on the stories and experiences of successful entrepreneurs and business leaders, making the book a blend of personal development and financial advice.

Why You Should Read It

This classic personal finance book is perfect for anyone looking to focus on the mental and psychological aspects of wealth-building. Think and Grow Rich is more than just a financial guide—it’s a blueprint for personal and financial success that emphasizes the power of mindset and determination.

10. “The Psychology of Money” by Morgan Housel

Key Takeaways from the Book

- How Behavior Influences Financial Success:

The Psychology of Money delves into the behavioral side of finance, exploring how our emotions, biases, and decisions influence our financial success.

Housel argues that understanding human behavior is just as important as understanding financial markets when it comes to building wealth. The book is full of real-life examples of how people’s behavior with money often contradicts their financial goals.

- The Importance of Managing Risk and Uncertainty:

Housel also discusses how managing risk and preparing for uncertainty are key components of financial success. He explains that while we can’t control market conditions or predict future financial crises, we can control our behavior and plan for the unexpected.

This approach helps readers develop a more balanced, resilient relationship with money.

Why You Should Read It

This book is a great choice for anyone who wants to better understand the psychology behind financial decisions. The Psychology of Money offers valuable insights into why people make irrational financial choices and how you can overcome these tendencies to build long-term wealth. It’s a must-read for anyone looking to improve their financial mindset and make better financial decisions.

Takeaway

Reading personal finance books is one of the best ways to improve your financial literacy and take control of your financial future.

Whether you’re a beginner looking for basic money management tips or a seasoned investor seeking advanced strategies, the books on this list offer valuable insights into building wealth, managing debt, and achieving financial independence.

Start with the book that resonates most with your current financial situation and begin your journey toward financial success today.