Meta Platforms (NASDAQ: META), the parent company of Facebook, Instagram, and WhatsApp, released its Q1 2025 earnings report on Wednesday after market hours, surpassing Wall Street’s expectations in both revenue and profit. The company also issued a strong forecast for Q2, indicating that its advertising business remains robust despite looming concerns around global tariffs and regulatory scrutiny.

However, alongside the positive earnings news, Meta also announced an increase in its capital expenditure guidance for the year — a move that surprised some investors and analysts.

Q1 2025 Financial Highlights: Strong Performance Across Core Segments

In the first quarter of 2025, Meta reported:

- Revenue: $42.31 billion, exceeding analysts’ expectations of $41.3 billion (according to Bloomberg consensus).

- Earnings Per Share (EPS): $6.43, much higher than the forecasted $5.25.

- Net Income: $16.6 billion, reflecting a 35% increase from $12.3 billion in Q1 2024.

- Advertising Revenue: $41.39 billion, beating the projected $40.5 billion.

- Daily Active People (DAP): 3.43 billion across its family of apps — a 6% rise year-over-year.

- Reality Labs Loss: The metaverse-focused division reported an operating loss of $4.21 billion.

Compared to the same period last year (Q1 2024), when the company reported $36.4 billion in revenue and EPS of $4.71, Meta has demonstrated substantial growth in its advertising and core business.

The company’s operating margin remained strong at 41%, showcasing efficient cost control even as it aggressively expands in the AI and hardware sectors.

Capital Expenditures: Boosted AI Investment and Infrastructure Development

Meta revised its full-year capital expenditure forecast upwards to $64 billion to $72 billion, compared to the earlier projection of $60 billion to $65 billion. The increase reflects the company’s accelerated investment in building advanced AI infrastructure, custom data centers, and developing proprietary silicon chips.

CEO Mark Zuckerberg emphasized during the earnings call that “this is a foundational year for building the next generation of AI-powered experiences,” highlighting that Meta AI — its advanced large language model — and related technologies will be deeply embedded across all its apps and devices.

These investments are aimed at keeping Meta competitive with other AI leaders like OpenAI, Google DeepMind, and Anthropic.

Q2 2025 Guidance: Strong Revenue Forecast Despite Ad Market Concerns

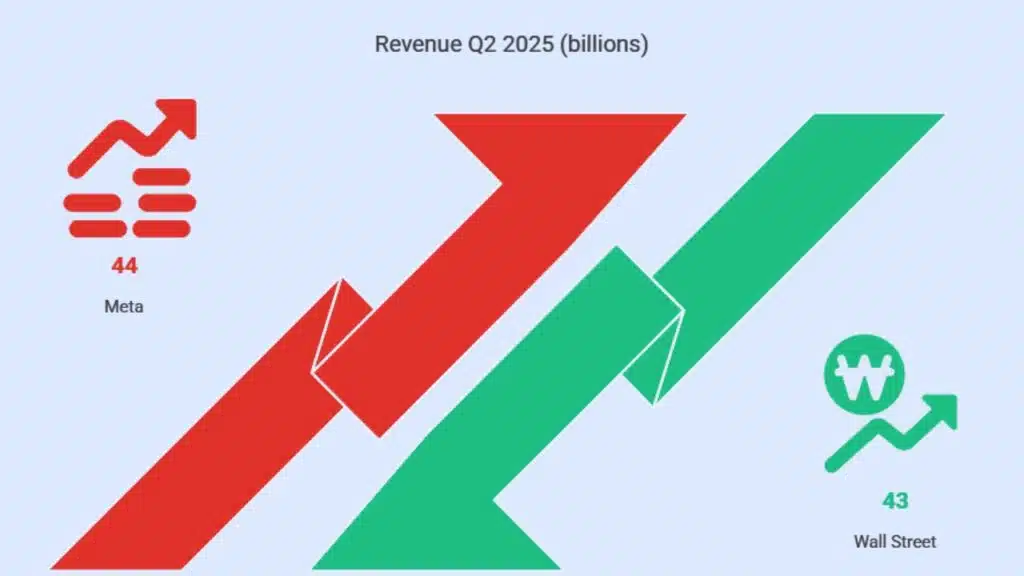

For the second quarter, Meta provided revenue guidance of $42.5 billion to $45.5 billion, with the midpoint ($44 billion) slightly above Wall Street’s consensus estimate.

This forecast defied concerns that geopolitical tensions, particularly involving U.S.-China tariffs, might hurt Meta’s ad revenues. Analysts had previously warned that Meta’s heavy reliance on Chinese advertisers (e.g., Shein, Temu) could be a vulnerability if trade tensions escalated.

Despite this, Meta saw a 5% increase in total ad impressions and a 10% rise in average ad prices during Q1 — clear indicators that advertiser demand remains healthy.

Reality Labs: Heavy Losses, But a Long-Term Bet on the Metaverse

Reality Labs, the division focused on building AR/VR products and the metaverse, recorded a loss of $4.21 billion this quarter. This follows a $16 billion loss for the full year 2024 and indicates continued heavy spending with little short-term return.

Meta reiterated its long-term commitment to the metaverse, stating that future computing platforms, including mixed reality and smart glasses, are strategic bets that require patience.

“We remain committed to building the future of social interaction through immersive technology,” CFO Susan Li stated during the call.

FTC Trial: Meta Faces Serious Legal Threats Over Alleged Monopoly

In addition to financial performance, Meta is dealing with a significant legal battle with the Federal Trade Commission (FTC). The FTC has accused Meta of maintaining an illegal monopoly in the personal social networking market, citing its acquisitions of Instagram (2012) and WhatsApp (2014) as part of a “buy-or-bury” strategy to eliminate competition.

The FTC is seeking a court order to force Meta to divest both Instagram and WhatsApp — a move that would dismantle the core of the company’s social media empire.

- According to court documents, Zuckerberg initially offered to settle the case for $450 million.

- The FTC countered with a demand of $30 billion.

- Meta later raised its offer to $1 billion, but the FTC lowered its demand only to $18 billion, resulting in a legal standoff.

The trial, which began in April 2025, is expected to stretch into the summer. The outcome could have significant implications not just for Meta, but for the broader tech industry and antitrust enforcement trends in the U.S.

Relationship with Trump Administration: A Strategic Shift

Another layer of controversy surrounds Meta’s evolving relationship with the Trump administration.

- In December 2024, Meta donated $1 million to President Trump’s second-term inauguration fund.

- Zuckerberg has reportedly met with Trump several times, including a notable meeting at Mar-a-Lago, and has expressed interest in establishing a more collaborative relationship with federal regulators.

- In January 2025, Meta reportedly reached a $25 million settlement with Trump over his platform bans, which followed the January 6 Capitol riot. This payment was in exchange for dropping a lawsuit and allowing for a formal “review” process for reinstatement.

Some critics have raised questions about the implications of these financial and political moves, while others see them as a pragmatic effort by Meta to maintain stability and protect its business interests under a more regulatory-focused government.

Meta’s Stock Reaction and Market Performance

Despite a positive earnings report, Meta’s stock has experienced some volatility in 2025:

- Up over 5% in premarket trading following the Q1 earnings announcement.

- Down more than 7% year-to-date, possibly due to investor anxiety over increased spending and legal challenges.

- Still up more than 25% over the past 12 months, thanks to AI-driven optimism and stronger ad performance in late 2024.

Jefferies analyst Brent Thill wrote in a pre-earnings investor note that Meta’s exposure to ad spending cuts, especially from China-based advertisers, has been a source of concern. He also pointed out that Meta, unlike peers like Amazon or Google, lacks a diversified cloud or enterprise software business — making it more vulnerable to ad market shifts.

Meta’s Q1 2025 performance showcases a company that is financially strong and operationally focused, yet navigating intense external pressures — including regulatory scrutiny, international trade risks, and shifting political dynamics. Its continued investment in AI and the metaverse demonstrates long-term vision, while its solid ad revenue growth confirms that it remains a dominant force in digital marketing.

However, the outcome of the FTC trial and the geopolitical landscape surrounding digital trade could reshape the company’s future dramatically. For now, Meta appears determined to push forward aggressively, even if it means spending more and taking on bigger legal and political risks.

The Information is Collected from AOL and Yahoo.