Managing unexpected expenses can be challenging, but having reliable monetary support helps ease sudden monetary burdens. A credit with a fixed interest rate ensures predictable monthly payments, preventing financial surprises or budgetary strain. Seeking guidance from a trusted advisor allows borrowers to make informed lending decisions confidently. Many individuals prefer installment credits due to their structured repayment plans and flexible borrowing options.

Installment loans in Idaho provide a convenient way to handle urgent expenses without disrupting economic stability. Borrowers benefit from manageable repayment terms, making these credits popular during monetary difficulties. This article explores practical strategies to manage unexpected costs using installment credits effectively. Understanding these insights will help borrowers make smarter monetary decisions and maintain better control over their expenses.

1. Selecting the Right Lender

Choosing a reliable lender helps borrowers secure manageable repayment options that suit their economic situation. Loan solution experts in Idaho provide installment credits with tailored terms that align with different budgetary needs. Understanding lender policies ensures borrowers avoid unexpected repayment difficulties in the long run. A well-structured repayment plan prevents monetary strain and promotes responsible borrowing habits.

Finding a lender with transparent policies protects borrowers from hidden fees and unexpected loan adjustments. Short-term funding specialists offer fixed repayment structures that help individuals manage costs without sudden financial shocks. Comparing different lenders ensures borrowers select the most flexible and affordable option. Responsible monetary planning minimizes future debt accumulation and promotes economic stability.

2. Understanding Interest Rates and Loan Terms

Before borrowing, understanding loan terms helps borrowers avoid excessive interest payments and economic strain. Trusted lending services provide installment credits with clear conditions, ensuring borrowers make informed budgetary decisions. Reading the fine print prevents misunderstandings and unexpected financial obligations. Choosing loans with fixed interest rates ensures consistent monthly payments and predictable budgeting.

Analyzing different interest rates helps borrowers identify the most cost-effective lending option. Installment loan experts in Idaho educate borrowers on the impact of long-term interest accumulation and loan affordability. Selecting credits with lower interest rates reduces overall repayment costs and monetary burdens. Borrowers who understand loan conditions experience better financial control and stress-free repayment.

3. Prioritizing Essential Expenses

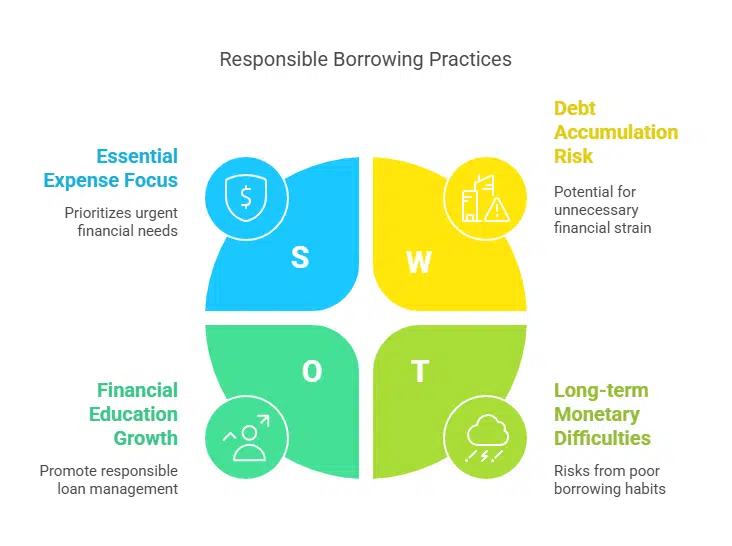

Using installment credits responsibly ensures borrowers cover urgent costs without creating unnecessary debt obligations. Finance experts in Idaho help borrowers focus on essential expenses such as medical bills, home repairs, and car maintenance. Managing funds ensures economic stability and prevents over-reliance on borrowing. Smart spending habits reduce financial stress and promote responsible loan management.

Non-essential spending can lead to unnecessary debt accumulation and long-term monetary difficulties. Short-term funding specialists encourage borrowers to use loans strictly for urgent needs to maintain stability. Avoiding unnecessary purchases ensures borrowed funds serve their intended purpose without causing additional monetary strain. Disciplined financial habits help individuals maintain control over their economic situation.

4. Creating a Budget Plan

A clear budgeting plan ensures borrowers allocate funds for loan payments without affecting daily expenses. Trusted lending services provide repayment structures that align with individual income levels for smoother financial management. Proper planning prevents late payments, avoiding penalties and credit score damage. Borrowers who plan their budgets carefully experience less economic stress.

Setting aside a fixed amount for funding repayments promotes consistency and responsible monetary behavior. Installment loan experts in Idaho emphasize adjusting budgets to accommodate repayment obligations. Cutting non-essential costs ensures installment payments remain manageable and sustainable. Well-planned budgets help borrowers achieve economic security without unnecessary burdens.

5. Making Early Loan Payments to Reduce Interest Costs

Early payments lower the total repayment amount and reduce long-term interest costs. Idaho’s lending solution experts advise borrowers to make additional payments to minimize monetary obligations. Reducing outstanding balances quickly helps borrowers save money over time. Taking proactive financial steps ensures smoother and stress-free finance management.

Borrowers who pay off credits early experience improved economic freedom and reduced borrowing costs. Short-term funding specialists encourage clients to allocate extra income toward installment credits to shorten repayment periods. Avoiding extended interest accumulation helps borrowers clear debts faster and with less expense. Financial discipline leads to long-term economic stability and increased savings.

6. Exploring Refinancing Options

Loan refinancing allows borrowers to modify repayment terms for better monetary flexibility and affordability. Idaho’s trusted lending services offer refinancing solutions that help individuals lower monthly payments and manage debt efficiently. Extended repayment periods can provide financial relief without overwhelming borrowers. Refinancing ensures manageable loan obligations tailored to individual economic circumstances.

Seeking refinancing options helps borrowers avoid defaulting on credits and facing late penalties. Installment financing experts assist in restructuring repayment plans for those struggling with financial commitments. Negotiating better terms with lenders ensures borrowers maintain stability while fulfilling obligations. Smart financial decisions contribute to long-term economic well-being and debt reduction.

Unexpected expenses should never disrupt your financial security when reliable financing solutions are available for assistance. Finding a trusted personal financing specialist ensures you receive expert guidance and secure a loan that fits your needs. With installment loans in Idaho, borrowers can access flexible repayment terms that align with their monthly budget. Explore your loan options now and confidently and easily control your financial future.