Car insurance is a significant expense for most drivers in the United States, but did you know that where you live can greatly influence how much you pay?

Cities with favorable conditions such as low accident rates, fewer thefts, and mild weather often offer more affordable premiums.

Understanding where to find these lowest car insurance rates cities in the U.S. can help you save thousands of dollars annually.

In this article, we’ll explore the lowest car insurance rates cities in U.S., highlight why rates vary, and share actionable tips to lower your premiums.

Understanding Car Insurance Costs

Several variables influence your car insurance premium, including:

- Demographics: Your age, gender, and marital status affect your rates. For example, young, single drivers typically pay more due to their perceived risk.

- Location-Based Factors: Living in a city with low accident and crime rates can reduce premiums.

- Driving History: Drivers with clean records enjoy lower rates compared to those with tickets or accidents.

- Vehicle Factors: The make, model, and year of your car influence repair and replacement costs, impacting your premium.

Why Some Cities Have Lower Car Insurance Rates

Cities with the lowest car insurance rates cities in the U.S. share common traits:

- Low Population Density: Fewer cars mean fewer accidents.

- Favorable Weather: Mild conditions reduce weather-related claims.

- Crime and Theft Rates: Areas with less vehicle theft and vandalism lead to lower costs for insurers.

Top 10 Cities With the Lowest Car Insurance Rates

#1: Green Bay, Wisconsin

Green Bay is a standout city for affordable car insurance, thanks to its relatively low population density and strong emphasis on road safety.

Known for its community-driven initiatives and low crime rates, the city creates an ideal environment for low-risk driving.

Residents also benefit from an affordable cost of living, which translates into competitive insurance rates. No wonder Green Bay ranks among the lowest car insurance rates cities in the U.S.

Average Annual Car Insurance Rate: $942

Why Green Bay Has Low Rates:

| Key Factor | Details |

| Crime Rate | Among the lowest in Wisconsin |

| Accident Statistics | Fewer accidents reported |

| Weather Conditions | Favorable year-round |

Tips for Getting Even Lower Rates in Green Bay:

- Bundle home and auto insurance policies.

- Opt for higher deductibles to reduce premiums.

- Compare quotes annually to ensure competitive pricing.

#2: Winston-Salem, North Carolina

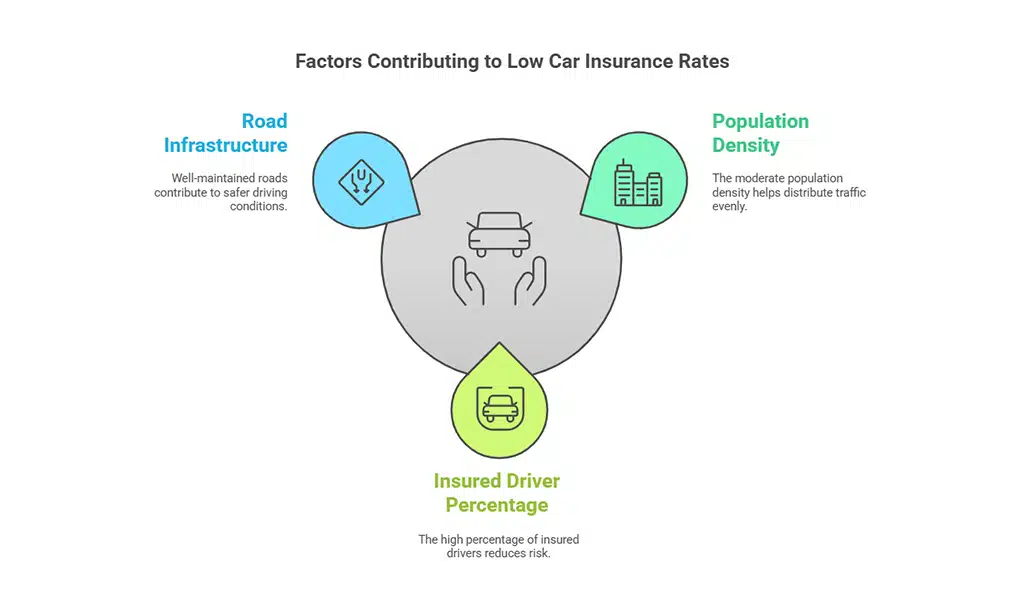

Winston-Salem boasts an attractive mix of moderate traffic levels and high rates of insured drivers.

Its well-maintained infrastructure and local emphasis on traffic safety make it a prime candidate for affordable insurance. The city’s balanced economy supports affordable living and car insurance.

This combination makes Winston-Salem one of the lowest car insurance rates cities in the U.S.

Average Annual Car Insurance Rate: $1,012

Why Winston-Salem Has Low Rates:

| Key Factor | Details |

| Population Density | Moderate |

| Insured Driver Percentage | High |

| Road Infrastructure | Well-maintained |

Tips for Getting Even Lower Rates in Winston-Salem:

- Maintain a clean driving record.

- Enroll in a defensive driving course.

- Explore discounts for safe vehicle technology.

#3: Raleigh, North Carolina

Raleigh, the capital city of North Carolina, excels in urban planning, contributing to its affordable car insurance rates.

With a focus on reducing congestion and promoting road safety, Raleigh has become one of the lowest car insurance rates cities in the U.S. for residents seeking cost-effective premiums.

Average Annual Car Insurance Rate: $1,024

Why Raleigh Has Low Rates:

| Key Factor | Details |

| Urban Planning | Reduces congestion and accidents |

| Crime Rate | Comparatively low |

| Insurance Competition | Highly competitive market |

Tips for Getting Even Lower Rates in Raleigh:

- Install anti-theft devices in your vehicle.

- Compare quotes from multiple insurers annually.

- Use telematics programs to monitor and reward safe driving habits.

#4: Fort Collins, Colorado

Fort Collins is known for its strong community engagement in safe driving initiatives and low vehicle theft rates.

This proactive culture, coupled with the city’s mild climate, helps keep insurance premiums affordable for its residents. Fort Collins stands out as one of the lowest car insurance rates cities in the U.S.

Average Annual Car Insurance Rate: $1,042

Why Fort Collins Has Low Rates:

| Key Factor | Details |

| Driving Culture | Emphasis on safety |

| Theft Rates | Among the lowest in Colorado |

| Climate | Favorable weather conditions |

Tips for Getting Even Lower Rates in Fort Collins:

- Take advantage of good student discounts if applicable.

- Limit annual mileage to qualify for low-mileage discounts.

- Regularly review your policy for cost-saving opportunities.

#5: Boise, Idaho

Boise combines low population density with favorable weather conditions, making it an excellent city for low car insurance premiums.

Its residents’ consistent safe driving records further contribute to its affordability. Boise is a great example of the lowest car insurance rates cities in the U.S.

Average Annual Car Insurance Rate: $1,056

Why Boise Has Low Rates:

| Key Factor | Details |

| Population Density | Low |

| Weather Conditions | Minimal adverse weather |

| Driving Records | Clean records among residents |

Tips for Getting Even Lower Rates in Boise:

- Drive a vehicle with strong safety ratings.

- Avoid lapses in coverage to maintain insurer trust.

- Bundle your insurance policies for additional savings.

#6: Omaha, Nebraska

Omaha offers affordable car insurance rates due to its stable economy and relatively low number of uninsured drivers.

This Midwestern city also benefits from a strong sense of community and low crime rates, which positively impact insurance premiums.

It’s no surprise that Omaha is among the lowest car insurance rates cities in the U.S.

Average Annual Car Insurance Rate: $1,064

Why Omaha Has Low Rates:

| Key Factor | Details |

| Economic Stability | Promotes affordability |

| Uninsured Driver Rate | Comparatively low |

| Driving Culture | Safe and community-focused |

Tips for Getting Even Lower Rates in Omaha:

- Shop for multi-policy discounts.

- Utilize loyalty discounts if you’ve been with an insurer for years.

- Periodically review your policy to ensure optimal coverage.

#7: Madison, Wisconsin

Madison stands out with its public transportation options, which help reduce road congestion and accident rates.

This Wisconsin city’s emphasis on environmental sustainability and insured drivers contributes to its status as one of the lowest car insurance rates cities in the U.S.

Average Annual Car Insurance Rate: $1,072

Why Madison Has Low Rates:

| Key Factor | Details |

| Public Transportation | Reduces road traffic |

| Insured Driver Percentage | High |

| Crime Rate | Low vehicle theft |

Tips for Getting Even Lower Rates in Madison:

- Opt for pay-per-mile insurance if you drive less frequently.

- Take advantage of good driver discounts.

- Consider telematics programs that reward safe driving.

#8: Huntsville, Alabama

Huntsville is an excellent example of a city with affordable car insurance rates, thanks to its low traffic density and fewer weather-related claims.

Its rapidly growing tech and defense industries attract residents who prioritize safe and responsible driving, ensuring Huntsville remains among the lowest car insurance rates cities in the U.S.

Average Annual Car Insurance Rate: $1,078

Why Huntsville Has Low Rates:

| Key Factor | Details |

| Traffic Density | Low |

| Weather Claims | Fewer compared to coastal areas |

| Economy | Growing and stable |

Tips for Getting Even Lower Rates in Huntsville:

- Bundle renters and auto insurance for discounts.

- Pay your premiums annually to avoid installment fees.

- Maintain a high credit score for better rates.

#9: Des Moines, Iowa

Des Moines ranks high for affordable car insurance rates, thanks to its low crime rates and favorable local insurance laws.

This city’s safe driving culture and manageable population density contribute significantly to its affordability, making it a top pick for the lowest car insurance rates cities in the U.S.

Average Annual Car Insurance Rate: $1,084

Why Des Moines Has Low Rates:

| Key Factor | Details |

| Crime Rate | Low vehicle theft and vandalism |

| Insurance Laws | Favorable |

| Population Density | Moderate |

Tips for Getting Even Lower Rates in Des Moines:

- Regularly update your mileage with your insurer.

- Enroll in a defensive driving course.

- Look for paperless billing and auto-pay discounts.

#10: Lincoln, Nebraska

Lincoln combines a safe driving culture with low population density to maintain affordable car insurance premiums.

This Nebraska city’s local initiatives for road safety and community engagement ensure it remains one of the lowest car insurance rates cities in the U.S.

Average Annual Car Insurance Rate: $1,092

Why Lincoln Has Low Rates:

| Key Factor | Details |

| Safe Driving Initiatives | Promoted by local authorities |

| Population Density | Low |

| Weather Conditions | Minimal adverse weather |

Tips for Getting Even Lower Rates in Lincoln:

- Compare rates semi-annually for potential savings.

- Leverage discounts for low mileage or usage.

- Install advanced safety features in your vehicle.

How to Lower Your Car Insurance Rates Anywhere

Practical Tips for Savings

- Shop Around: Compare quotes from multiple insurers to find the best deal.

- Increase Your Deductible: Higher deductibles often lower premiums.

- Utilize Discounts: Look for good driver, student, or multi-policy discounts.

- Maintain a Good Credit Score: Insurers often reward financially responsible individuals with lower rates.

Common Mistakes That Increase Your Rates

- Letting your policy lapse.

- Ignoring discounts you qualify for.

- Failing to review your coverage regularly.

Takeaways

Living in one of the lowest car insurance rates cities in the U.S. can significantly reduce your financial burden.

By understanding the factors that influence rates and exploring ways to lower your premiums, you can save even more.

Whether you’re a resident of Green Bay, Winston-Salem, or any of the other cities mentioned, making informed decisions about your insurance will pay off in the long run.

Take action today by comparing rates and applying the tips shared in this article to ensure you’re getting the best deal possible.