Portugal continues to attract international buyers due to its breathtaking landscapes, Mediterranean lifestyle, and a welcoming real estate market.

Whether you are a retiree looking for a peaceful retreat, an investor seeking opportunities, or a family in search of a new home, buying property in Portugal offers numerous advantages. However, foreign buyers must understand the legal framework to ensure a seamless purchase process.

This comprehensive guide will walk you through the 8 legal requirements for buying property in Portugal as a foreigner, covering every step from acquiring a tax number to securing financing and registering your property. With a solid understanding of these processes, you will be better prepared to navigate the market and make a sound investment.

1. Legal

Foreigners, including both EU and non-EU nationals, can buy property in Portugal. However, there are certain legal requirements and residency guidelines that vary depending on your nationality.

Overview of Eligibility for Foreign Buyers

- EU Nationals: Citizens of the European Union (EU) can purchase property in Portugal under the same conditions as Portuguese nationals. There are no special restrictions on property ownership for EU residents, making the process straightforward.

- Non-EU Nationals: Foreigners from outside the EU can also buy property in Portugal, though they must meet specific conditions related to residency or investment.

Types of Residence Permits and Their Impact on Property Ownership

Foreign nationals, particularly those from outside the EU, may be interested in long-term residency options when purchasing property. Here are some of the most common residence permits that allow property purchases:

- Golden Visa: The Golden Visa is an investment-based residency program aimed at non-EU nationals. To qualify, you must invest in property valued at €500,000 or more. The visa grants residency to both the investor and their immediate family, and it can eventually lead to permanent residency or even citizenship after five years.

- D7 Visa: Often referred to as the “Retirement Visa,” the D7 Visa allows non-EU nationals to live in Portugal if they can demonstrate sufficient income from passive sources, such as pensions or rental income. This is ideal for retirees who want to live in Portugal long-term.

Are There Restrictions for Non-EU Citizens?

While there are no blanket restrictions on property ownership for non-EU citizens, certain areas may have restrictions. For example, in Lisbon, Porto, and some coastal regions, there are rules in place that limit non-EU property investments in designated zones. Always consult with a local lawyer or real estate expert to ensure you’re complying with these restrictions.

2. Obtaining a Portuguese Tax Identification Number (NIF)

In Portugal, whether you’re a resident or not, you will need a Portuguese Tax Identification Number (NIF) to buy property. This number is essential for completing any transaction that involves financial matters in the country.

Why an NIF is Required for Foreign Property Buyers

The NIF is necessary for all financial transactions, including buying property, signing contracts, and even setting up utility services. Without an NIF, you will not be able to finalize a property transaction in Portugal, making this step one of the first tasks to complete.

How to Apply for an NIF in Portugal

Getting an NIF is relatively simple, and you can do it by visiting the Finanças (Tax Office) in Portugal. Foreign nationals can also designate a representative, such as a lawyer, to apply on their behalf.

Key documents for NIF registration:

- A valid passport (or EU identification card if applicable)

- Proof of address (in your home country or in Portugal)

- Residency visa or residence permit (if applicable)

| Document Needed | Purpose |

| Passport | Proof of identity |

| Proof of Address | Verification of current residence |

| Residence Visa | For non-EU nationals needing residency |

You can typically receive your NIF within a few days, and it’s valid for life. However, you will need to update your details with the tax office if you change your address or legal status in Portugal.

3. Opening a Portuguese Bank Account

Having a local bank account is crucial when purchasing property in Portugal, as it allows you to make payments, transfer funds, and manage your property’s financial responsibilities.

Why a Portuguese Bank Account is Necessary for Property Transactions

The bank account is used to handle the payment of taxes, utility bills, and legal fees, among other expenses. It is also necessary for wire transfers related to the property transaction.

How to Open an Account as a Foreigner

Opening a bank account in Portugal is straightforward for foreigners, though it may take longer than expected depending on the bank and the type of account.

Steps to Open a Bank Account:

- NIF: As discussed earlier, you will need a Portuguese NIF to open an account.

- Proof of Identity: A passport or EU identity card is required.

- Proof of Address: A utility bill or lease agreement will suffice.

- Initial Deposit: Some banks require an initial deposit to activate the account.

Most banks in Portugal offer a variety of account types, including accounts designed specifically for non-residents. It’s advisable to compare fees and services between different banks to find the best option for your needs.

| Banking Requirement | Purpose |

| NIF | Necessary for opening any bank account |

| Proof of Address | Verification of residence |

| Initial Deposit | Required to activate the account |

4. Due Diligence and Property Research

Before committing to a property purchase, it’s crucial to conduct proper due diligence to ensure the property is free from any legal or financial issues.

Importance of Researching Property Ownership and Legal Status

Conducting thorough research minimizes the risk of encountering legal or financial problems later on. It is important to verify the seller’s ownership rights, check for any liens on the property, and ensure the property complies with zoning laws.

What to Check in Property Documentation

- Property Deed (Escritura Pública): The official document that proves the seller’s ownership of the property.

- Land Registry (Registo Predial): Confirms that the seller is the legal owner and the property is free of liens.

| Key Document | Description |

| Property Deed (Escritura) | Confirms the seller’s ownership of the property |

| Land Registry | Shows the legal status of the property |

By working with a local lawyer or real estate professional, you can verify the authenticity of these documents and ensure that the property is legally sound.

5. Engaging a Lawyer for Property Transactions

Hiring a lawyer is an important step for foreign buyers to ensure that the purchase process adheres to Portuguese law and that your interests are protected.

Why Hiring a Lawyer is Critical for Foreign Buyers

A lawyer will act on your behalf, conducting all necessary checks, reviewing contracts, and guiding you through the legal complexities of purchasing property in Portugal. Additionally, they can handle the legal documentation, including drafting or reviewing the promissory contract and final deed of sale.

What a Lawyer Should Do in the Purchasing Process

- Verify the seller’s ownership and property documents

- Review the promissory contract and advise on any amendments

- Represent you at the notary for the signing of the final deed

- Help with any disputes that may arise during or after the purchase

A lawyer’s assistance is especially crucial when dealing with complex property transactions, such as those involving inheritance or business partnerships.

6. Understanding the Tax Implications of Property Ownership

Tax planning is essential when buying property in Portugal. There are several taxes involved, both during the property purchase and throughout the ownership period.

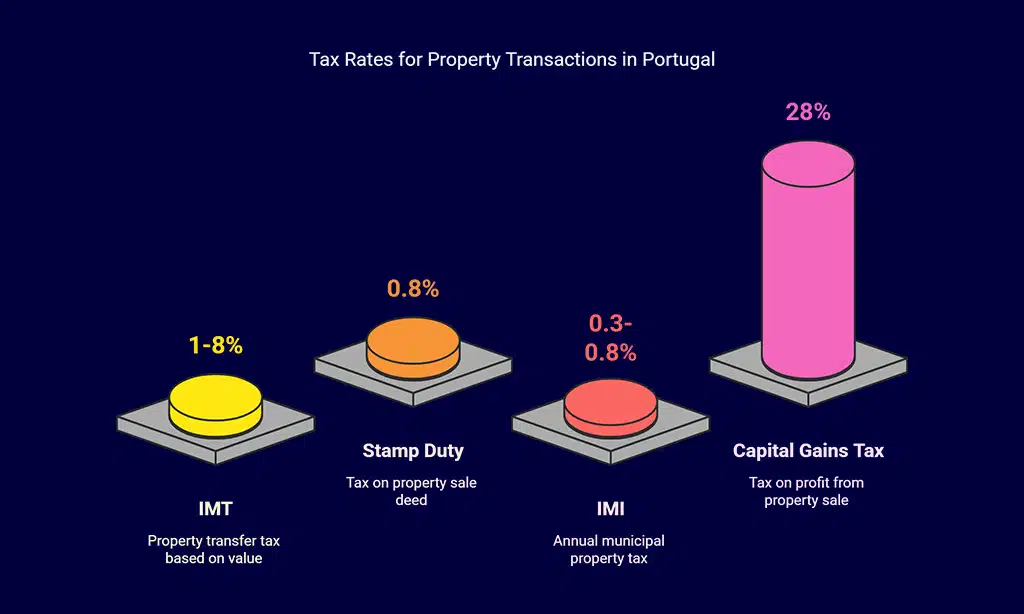

Taxes Involved in Property Purchases in Portugal

- IMT (Property Transfer Tax): This tax is calculated based on the value of the property or its market value. The rates vary based on the property’s value and location.

- Stamp Duty: Charged on the deed of sale, this is generally around 0.8% of the property’s value.

Ongoing Property Taxes

- IMI (Municipal Property Tax): This annual tax is levied on the value of the property and ranges from 0.3% to 0.8%.

- Capital Gains Tax: If you sell the property for a profit, you will be liable for capital gains tax, which is generally 28% for non-residents.

| Tax | Description | Rate |

| IMT | Property Transfer Tax | 1% – 8% (based on value) |

| Stamp Duty | Tax on the deed of sale | 0.8% |

| IMI | Annual Municipal Property Tax | 0.3% – 0.8% |

| Capital Gains Tax | Tax on profit from property sale | 28% for non-residents |

7. Property Financing for Foreign Buyers

While securing a mortgage in Portugal may seem complicated for foreign buyers, it’s possible with the right approach and preparation.

Mortgage Options Available for Foreign Buyers

Most banks in Portugal will offer a mortgage to foreign buyers, though non-EU nationals may be required to provide a larger deposit or demonstrate higher financial stability. Typically, foreign buyers can secure up to 70% of the property’s value, depending on the bank’s policies.

Requirements to Secure a Mortgage

- Proof of income: Including employment contracts or proof of business ownership

- Credit history: Banks will review your financial history to assess your ability to repay the loan

- Down payment: Foreign buyers often need to make a larger down payment compared to local residents

| Document Needed | Purpose |

| Proof of Income | To show your financial capability |

| Credit History | To assess your repayment ability |

| Down Payment | Typically 30% – 40% for foreign buyers |

8. Signing the Purchase Agreement and Finalizing the Sale

After securing financing and completing all necessary legal checks, the final step is to sign the purchase agreement and transfer the property ownership.

Key Steps in the Property Purchase Process

- Promissory Contract: A preliminary contract that outlines the terms and conditions of the sale.

- Final Deed of Sale (Escritura Pública): This legally transfers the ownership from the seller to the buyer in the presence of a notary.

- Property Registration: After the deed is signed, the property must be registered in the Land Registry, finalizing the transaction.

| Step | Description |

| Promissory Contract | Initial agreement outlining terms of sale |

| Final Deed of Sale | Legal transfer of property ownership |

| Property Registration | Official registration with the Land Registry |

Wrap Up: Successfully Navigating the Property Buying Process in Portugal

Buying property in Portugal as a foreigner can be an exciting and profitable investment, but it’s crucial to understand the legal requirements for buying property in Portugal as a foreigner.

By following the steps outlined in this guide—from obtaining an NIF to finalizing the sale—you’ll be well-equipped to navigate the Portuguese property market with confidence.

Whether you’re purchasing for personal use or as an investment, this knowledge will help ensure a smooth and successful transaction.