The U.S. dollar has long stood as the world’s most powerful currency. But in 2025, that dominance is facing real pressure. President Donald Trump’s return to political influence, along with his aggressive trade stance, is shaking the foundation of global finance.

Countries like China and Japan are pulling away from U.S. Treasury bonds. New alliances like BRICS are growing stronger. And the possibility of a world trading without the dollar is no longer just a theory—it’s becoming a reality.

Is Trump risking dollar dominance? This article explores how Trump’s policies may be speeding up a shift away from dollar dominance, what role BRICS and other global players are playing, and what it all means for the U.S. economy and the rest of the world.

The Dollar’s Role in Global Trade: A Quick Overview

For decades, the U.S. dollar has been the go-to currency for international trade, energy pricing (especially oil), and global finance. This status gave the U.S. major advantages: cheaper imports, easier borrowing, and global influence through institutions like the IMF and World Bank.

But now, as the U.S. increasingly uses the dollar as a political weapon—through sanctions and restrictions—many countries are reconsidering their dependency on it.

Trump’s Trade Wars and Rising Tensions in 2025

Donald Trump’s “America First” approach has reignited trade tensions, especially with China. His latest rhetoric and policies include:

- Increased tariffs on Chinese electronics and machinery

- Threats to cut ties with the World Trade Organization (WTO)

- Proposals to withdraw U.S. influence from global financial institutions like the IMF

These moves, intended to protect American jobs, may be having the opposite effect by pushing other nations to form new alliances and financial systems.

China and Japan: Dumping U.S. Treasuries

In a historic shift, both China and Japan have reduced their holdings of U.S. Treasury bonds in early 2025. This sends a clear message: major economies are diversifying away from the dollar.

According to the U.S. Treasury Department:

- Japan’s holdings dropped by nearly 18% in 12 months.

- China sold off $103 billion in Treasury securities in Q1 2025 alone.

This kind of selloff can raise borrowing costs in the U.S., weaken the dollar, and create instability in global markets.

BRICS and the Rise of BRICS PAY

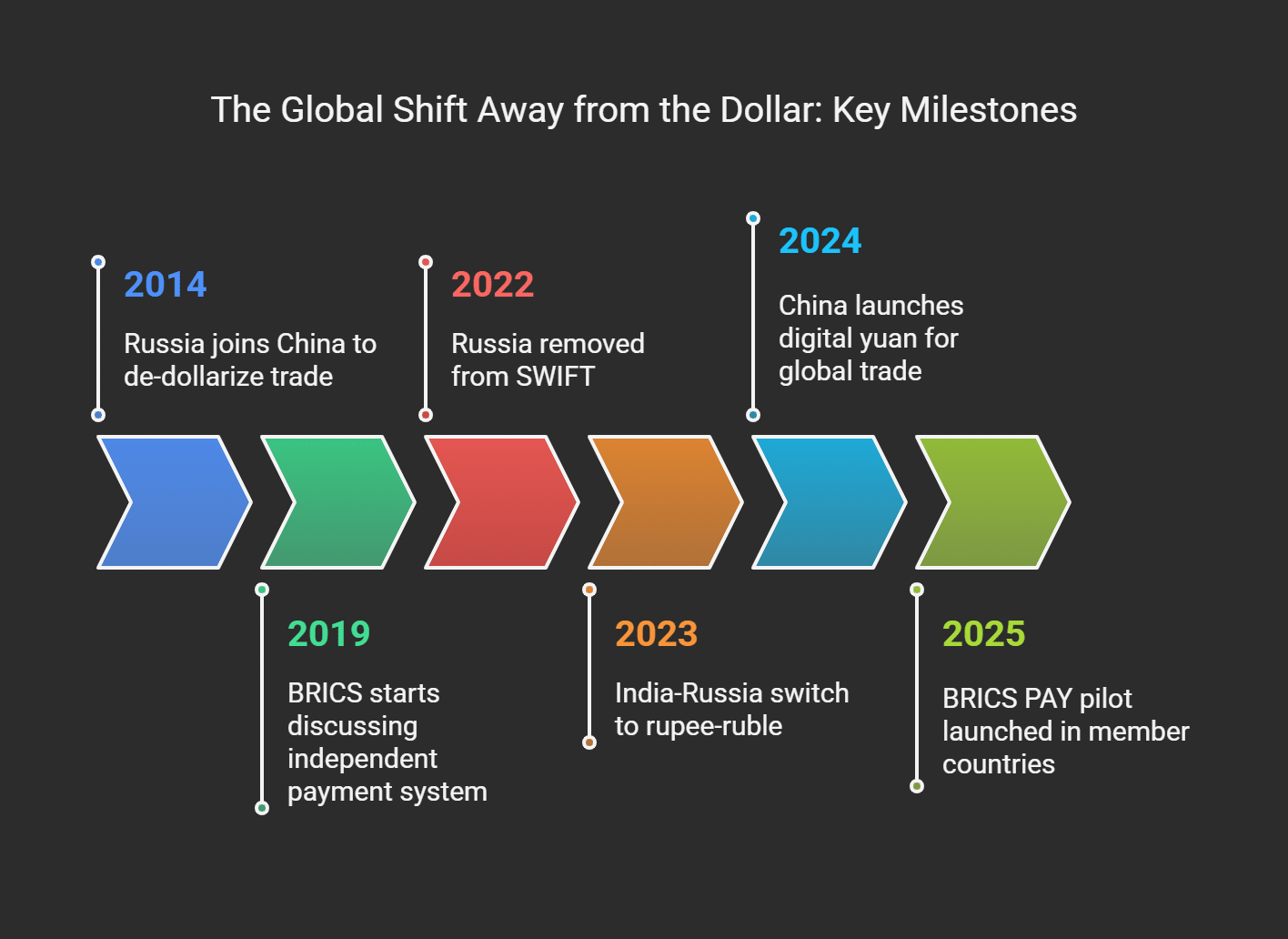

BRICS—the economic bloc made up of Brazil, Russia, India, China, and South Africa—is no longer just a symbolic partnership. In 2025, it is a growing power center that challenges the U.S.-led order.

Key developments:

- BRICS PAY, a new digital payment system, has launched pilot projects in several member countries.

- BRICS aims to create an independent financial structure free from SWIFT, the U.S.-controlled global payment messaging network.

- Saudi Arabia, Kuwait, and the UAE have expressed interest in joining BRICS, which would bring massive oil wealth into the alliance.

“This could be the start of a new global currency bloc,” says Dr. Mei Zhang, economist at the Asia Global Institute.

If successful, BRICS PAY could replace the dollar in oil trade, which would significantly reduce global dollar demand.

What If the U.S. Leaves the IMF?

Trump has floated the idea of the U.S. withdrawing from the International Monetary Fund (IMF). While the idea seems extreme, it reflects growing dissatisfaction with multilateral institutions.

If this happens:

- The BRICS New Development Bank (NDB) could become the top lender for developing nations.

- Loans might come with fewer conditions than IMF loans.

- Countries in Africa, Asia, and Latin America may turn to BRICS for financial support, further weakening U.S. soft power.

Top 10 Countries Reducing Dollar Dependence in 2025

| Country | Key Actions |

|---|---|

| China | Promoting the yuan in international trade and expanding the Cross-Border Interbank Payment System (CIPS). |

| Russia | Settling energy exports in rubles and yuan; developing alternatives to SWIFT. |

| India | Engaging in bilateral trade agreements using the rupee, notably with Russia and the UAE. |

| Brazil | Conducting trade with China using the yuan; exploring BRICS currency initiatives. |

| Iran | Utilizing alternative currencies and cryptocurrencies to bypass U.S. sanctions. |

| Saudi Arabia | Considering accepting non-dollar currencies for oil sales; strengthening ties with BRICS nations. |

| South Africa | Advocating for local currency use in trade within the African continent and BRICS. |

| Malaysia | Implementing the Local Currency Settlement Framework with ASEAN countries. |

| Argentina | Settling imports from China in yuan to preserve dollar reserves. |

| Turkey | Increasing trade settlements in local currencies with Russia and China. |

Moving Away from the Dollar: Already in Motion

Here’s a snapshot of how key nations are shifting away from U.S. dollar dependence in 2025:

Many countries are already trading without the U.S. dollar:

- India and Russia now settle energy trade in rupees and rubles.

- China and Brazil use yuan and reais for bilateral trade.

- ASEAN countries are exploring regional currency arrangements.

This shift isn’t theoretical. It’s happening right now, driven by politics, economics, and digital innovation.

Mini Case Study: India-Russia Bypass the Dollar

In early 2025, India paid for $12 billion worth of Russian oil using rupees, bypassing the U.S. dollar and the SWIFT system. This bilateral agreement allowed both nations to avoid the impact of U.S. sanctions and currency exchange costs. The move also set an example for other developing countries, such as Iran, Malaysia, and Brazil, which are now exploring similar models.

This case highlights how strategic partnerships and local currency settlements are accelerating the global shift away from dollar dependence.

The Tech Danger: Semiconductor Supply Chains

Trump’s trade stance also risks breaking down global supply chains—especially in semiconductors and electronics.

If China, Taiwan, or South Korea were to restrict chip exports to the U.S.:

- Prices for laptops, phones, and cars in the U.S. could triple.

- Production delays would hit industries from automotive to defense.

- Building domestic capacity could take 10+ years and cost hundreds of billions.

A semiconductor cold war is a real threat,” warns Intel CEO Pat Gelsinger.

Could Americans Start Leaving the Country?

It may sound far-fetched, but growing political and economic uncertainty could lead to wealth migration.

In 2025, record numbers of Americans have already applied for second passports, especially in:

- Portugal

- Canada

- UAE

- Singapore

If inflation spikes and the dollar crashes, even middle-class citizens might consider moving abroad for stability and a better quality of life.

FAQs: Key Questions About Dollar Dominance and BRICS

1. Why is BRICS challenging the U.S. dollar?

BRICS countries want more financial independence and fewer restrictions tied to U.S. sanctions. They are building alternative systems like BRICS PAY to trade using their own currencies and reduce dollar dependency.

2. Can the U.S. dollar actually lose its reserve status?

Yes, it’s possible—though it would take time. As more countries shift to local currency trade and build payment systems outside SWIFT, the dollar’s global role may decline significantly over the next decade.

3. What does a weaker dollar mean for everyday Americans?

A weaker dollar could make imports more expensive, raise inflation, and reduce the buying power of U.S. consumers. Travel, tech products, and gas could all cost more.

Takeaways: A New Financial World Order?

Trump’s trade policies and foreign stance may be accelerating a shift that was already underway. The dollar is still dominant, but that grip is loosening.

The rise of BRICS, alternative payment systems like BRICS PAY, and bilateral trade deals without the dollar all suggest that the world is preparing for a post-dollar future.

If the U.S. does not adapt—by embracing diplomacy, rebuilding trust, and investing in domestic manufacturing—it risks losing its most powerful tool: the dollar.

The global financial map is being redrawn. Whether the U.S. leads or lags behind will shape the next century.