Life is unpredictable, and while we can’t control every event, we can prepare for the financial implications of life’s uncertainties. Life insurance is more than a policy; it’s a safety net designed to protect your loved ones when they need it most.

As we step into 2025, understanding the nuances of life insurance has never been more critical. This guide explores how life insurance secure your family future, why it’s essential, and how to choose the right policy to meet your needs.

Why Life Insurance Is a Crucial Investment in 2025

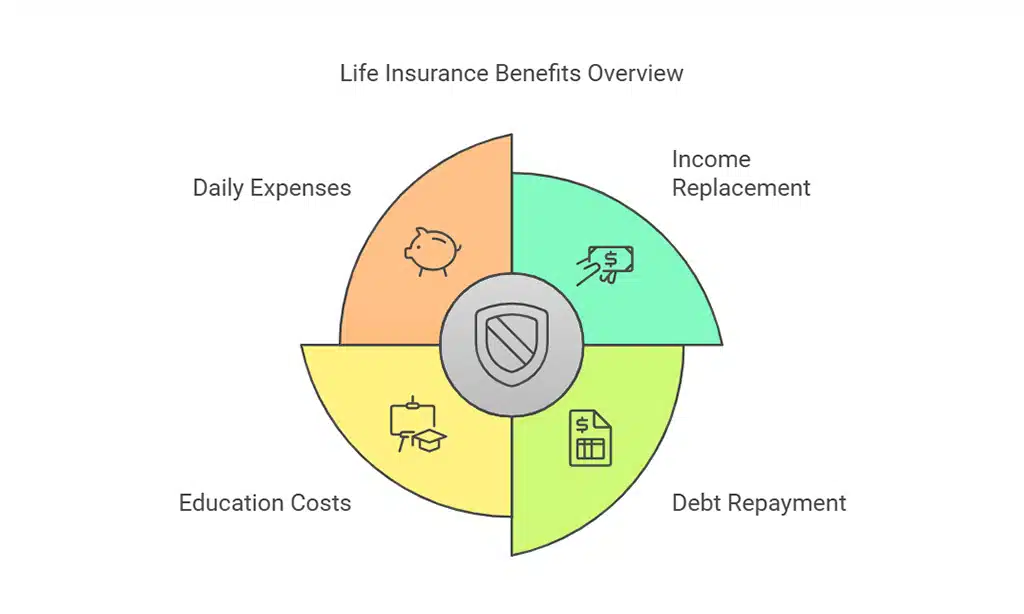

Life insurance provides a financial safety net for your loved ones in the event of your untimely death. It ensures that your family can maintain their standard of living, covering essential expenses such as mortgage payments, education costs, and daily living expenses.

In 2025, as the cost of living continues to rise, the need for this protection becomes even more apparent. For instance, the average cost of a four-year college education in the U.S. is projected to surpass $120,000 by 2025—a burden life insurance can help ease.

| Key Benefits of Life Insurance | Impact on Family Security |

| Income replacement | Ensures steady cash flow |

| Debt repayment | Covers mortgages, loans, etc. |

| Education costs | Secures children’s future |

| Daily expenses | Maintains standard of living |

Practical Example: Consider a family of four where the primary breadwinner earns $80,000 annually. If this income is lost due to an unexpected tragedy, life insurance can ensure that mortgage payments, utility bills, and school fees are covered without disruption.

Trends Impacting the Importance of Life Insurance in 2025

The financial landscape is shifting rapidly, with factors such as inflation, economic uncertainties, and rising healthcare costs making life insurance a vital part of financial planning. According to recent studies, inflation is expected to grow at an annual rate of 3.5% in 2025, reducing purchasing power and increasing the financial strain on families.

| Trend | Impact on Life Insurance |

| Inflation | Reduces real value of savings |

| Economic uncertainties | Necessitates a financial safety net |

| Rising healthcare costs | Increases family obligations |

To address these challenges, many insurers are offering inflation-adjusted policies that increase death benefits over time, ensuring your family remains financially secure.

Types of Life Insurance Policies to Consider

There are 3 types of life insurance that are widely popular right now.

Term Life Insurance

Term life insurance is a cost-effective option that provides coverage for a specified period. It is ideal for young families or individuals seeking temporary financial protection. For example, a 30-year-old can secure a $500,000 policy for around $25 per month. Such policies are excellent for covering high-impact needs like a 20-year mortgage or a child’s education.

Whole Life Insurance

Whole life insurance offers lifetime coverage and builds cash value over time. It’s ideal for those seeking long-term financial security and a savings component. The cash value can be borrowed against or used as an emergency fund, making it a versatile option. For example, a whole life policyholder might use accumulated cash value to fund a child’s wedding.

Universal Life Insurance

Universal life insurance provides flexible premiums and coverage options, making it suitable for changing financial needs. It’s particularly beneficial for business owners or individuals with fluctuating incomes. For instance, a business owner could adjust premiums during slower financial periods to maintain coverage without strain.

| Policy Type | Best For | Key Feature | Example Use Case |

| Term Life | Young families | Affordable premiums | Covering mortgage or child education |

| Whole Life | Long-term planners | Cash value growth | Estate planning |

| Universal Life | Business owners | Flexible premiums and terms | Adapting to variable income |

How Life Insurance Secure Your Family Future

Life insurance ensures that your family has the financial resources to cover expenses and maintain their lifestyle in your absence. For instance, a policy with a death benefit of $1 million can replace a $100,000 annual income for ten years, giving your family a cushion to adjust to new circumstances.

Real-life Scenario: Sarah, a mother of two, lost her husband unexpectedly. His $500,000 term life policy ensured the mortgage was paid off, children’s school fees were covered, and she had funds to support the family during this difficult transition.

| Expense | Estimated Cost | How Life Insurance Helps |

| Mortgage payments | $1,500/month | Covers ongoing housing expenses |

| Funeral costs | $7,000 – $12,000 | Pays for end-of-life arrangements |

| Education expenses | $120,000 (4-year degree) | Secures future for children |

Building Wealth and Saving for the Future

Certain types of life insurance, such as whole life and universal life policies, allow you to build cash value. This savings component can be used for emergencies, education, or even retirement planning. For instance, a universal life policy can accumulate a cash value of $50,000 after 20 years, which can be accessed for major expenses.

Actionable Tip: Regularly review your policy’s cash value growth and explore how it can align with your evolving financial goals.

Tax Advantages of Life Insurance

Life insurance policies often come with significant tax benefits:

- Death benefits are typically tax-free for beneficiaries, allowing them to use the entire amount for expenses.

- Cash value growth is tax-deferred, meaning you won’t pay taxes on the interest or investment gains until you withdraw them.

| Tax Benefit | Advantage |

| Tax-free death benefit | Maximizes financial support to family |

| Tax-deferred cash value growth | Enhances savings potential |

How to Choose the Right Life Insurance Policy in 2025

Before selecting a policy, assess your financial obligations, including your family’s daily expenses, debts, and future goals like education or retirement. Use online tools to calculate the coverage amount you need. For example, experts recommend a coverage amount that is 10-12 times your annual income.

| Factor | How to Evaluate |

| Income replacement | Multiply annual income by 10-12 |

| Debt obligations | Add total debt, including mortgages |

| Future expenses | Estimate education and retirement costs |

Practical Insight: If you’re unsure about your family’s future needs, consult a financial planner to create a comprehensive roadmap.

Comparing Policy Options

Research various policies and compare premiums, benefits, and added features such as riders. Use the table below for a quick comparison:

| Feature | Term Life | Whole Life | Universal Life |

| Duration | Fixed term | Lifetime | Flexible |

| Premiums | Low | High | Adjustable |

| Cash Value | No | Yes | Yes |

| Flexibility | Limited | None | High |

Common Mistakes to Avoid

- Over-insuring or under-insuring: Ensure your policy matches your actual financial needs.

- Ignoring policy exclusions: Read the fine print to understand what is and isn’t covered.

Interactive Tools and Resources for Planning Your Life Insurance in 2025

Life insurance calculators help determine the right coverage based on your income, debts, and goals. Many insurers offer free calculators on their websites. For example, XYZ Insurance’s online tool allows users to input their financial data and receive customized recommendations within minutes.

Practical Tip: Look for calculators that factor in inflation and future costs for more accurate results.

Comparison Tables for Life Insurance Policies

Use comparison tables to understand policy features, costs, and benefits quickly. For example, see the table in the previous section for a detailed overview of policy types.

Wrap-Up: Ensuring a Secure Future with Life Insurance

Life insurance is an essential tool for safeguarding your family’s financial future. In 2025, its importance is magnified by economic challenges and rising costs. By choosing the right policy and understanding its benefits, you can provide your loved ones with security and peace of mind.

Act now to explore your options and consult with a trusted insurance advisor. Remember, life insurance to secure your family’s future is not just a financial decision; it’s a commitment to those you care about most.