In recent years, the financial landscape has undergone a revolutionary shift, with How Decentralized Finance Is Shaping the Future of Fintech becoming a major point of discussion. Built on blockchain technology, Decentralized Finance (DeFi) removes intermediaries like banks and financial institutions, enabling permissionless and borderless financial services. As DeFi continues to expand, it is redefining fintech by providing more accessible, transparent, and efficient financial solutions.

Traditional financial systems are often restricted by geographical limitations, lengthy processing times, and high transaction fees. DeFi, however, introduces a borderless financial ecosystem that operates 24/7, allowing users from any part of the world to participate in financial activities without relying on banks. The rise of DeFi has also led to the creation of new financial instruments, offering users enhanced opportunities for wealth generation through decentralized lending, staking, and yield farming.

With the rapid adoption of digital assets and blockchain-powered solutions, the future of finance is shifting towards decentralization. This article explores how DeFi is reshaping fintech, its key innovations, challenges, and the future outlook. It also examines how traditional financial institutions are beginning to integrate DeFi concepts to enhance their offerings and keep up with the digital financial revolution.

What Is Decentralized Finance (DeFi)?

DeFi refers to a new financial ecosystem that operates on blockchain networks, primarily Ethereum. Unlike traditional finance, which relies on centralized entities such as banks and brokers, DeFi applications use smart contracts to automate transactions, making financial services more efficient, transparent, and accessible.

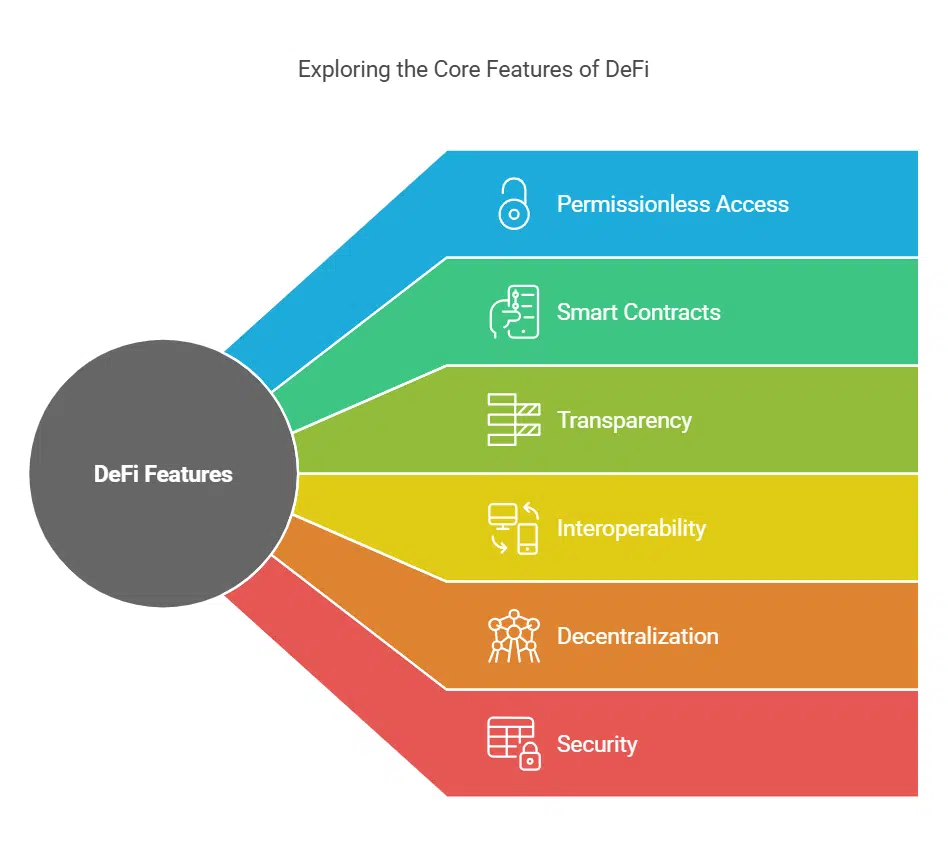

Key Features of DeFi

| Feature | Description |

|---|---|

| Permissionless | Anyone with an internet connection can access DeFi platforms. |

| Smart Contracts | Automated self-executing contracts that eliminate intermediaries. |

| Transparency | Transactions are recorded on public ledgers, ensuring full transparency. |

| Interoperability | Different DeFi protocols can interact seamlessly. |

| Decentralization | No central authority controls funds or transactions. |

| Security | Blockchain encryption ensures data and transaction security. |

| Liquidity Provision | Users can provide liquidity to DeFi pools and earn rewards. |

How Decentralized Finance Is Shaping the Future of Fintech

DeFi is bringing a wave of innovations that are reshaping the financial landscape. These technological advancements are making financial services more efficient, accessible, and cost-effective.

1. Smart Contracts and Automation

Smart contracts are the backbone of DeFi. These self-executing contracts run on blockchain networks, automating processes like lending, borrowing, and trading without intermediaries.

| Benefit of Smart Contracts | Explanation |

| Efficiency | Transactions are automated, reducing delays. |

| Lower Costs | Eliminates middlemen, reducing fees. |

| Trust & Security | Code-based execution minimizes human errors. |

| Programmability | Enables complex financial applications with automated execution. |

2. DeFi Lending and Borrowing

DeFi platforms allow users to lend or borrow funds without traditional banks. Users can stake their crypto assets as collateral and access loans instantly.

| Platform | Lending APY | Borrowing APY | Unique Feature |

| Aave | Up to 10% | 3-6% | Flash loans with no collateral. |

| Compound | 8-12% | 4-7% | Users earn governance tokens (COMP). |

| MakerDAO | 5-9% | 3-5% | Uses DAI, a decentralized stablecoin. |

3. Decentralized Exchanges (DEXs)

DEXs enable users to trade cryptocurrencies directly from their wallets without intermediaries. Popular DEXs include Uniswap, SushiSwap, and PancakeSwap.

| Benefits of DEXs | Explanation |

| Lower Fees | No intermediaries mean reduced transaction costs. |

| Security | Users retain full control over their assets. |

| Transparency | Every transaction is publicly recorded on the blockchain. |

| Greater Asset Diversity | Supports a wide variety of digital assets, including emerging tokens. |

4. Yield Farming & Staking

Yield farming allows users to earn interest by providing liquidity to DeFi protocols, while staking involves locking up assets to secure networks and earn rewards.

| Method | Explanation |

| Yield Farming | Users provide liquidity and earn passive income. |

| Staking | Users lock crypto in a network to earn rewards. |

| Liquidity Mining | Users earn tokens for supplying liquidity to DEX pools. |

How DeFi Is Reshaping the Future of Fintech

The fintech industry is evolving with DeFi’s growth. The following are some key areas where DeFi is making a significant impact:

1. Financial Inclusion

DeFi eliminates barriers to financial services, providing access to banking and lending for the unbanked population.

| Challenge | DeFi Solution |

| No Bank Access | DeFi wallets enable direct transactions. |

| High Loan Interest | DeFi lending offers competitive rates. |

| Limited Investment Opportunities | DeFi platforms offer global, permissionless investing. |

2. Cost Efficiency & Faster Transactions

Traditional banking systems involve lengthy processes and high fees, whereas DeFi provides instant transactions at a fraction of the cost.

| Factor | Traditional Banking | DeFi |

| Transaction Speed | Days | Seconds |

| Fees | High | Low |

| Accessibility | Limited | Global |

| Transaction Transparency | Requires third-party audits | Fully auditable on blockchain |

3. Transparency & Security

Blockchain technology ensures that all DeFi transactions are transparent and tamper-proof, reducing fraud.

Challenges and Risks in DeFi Adoption

While DeFi presents numerous advantages, it also faces challenges:

| Challenge | Explanation |

| Regulatory Uncertainty | Governments are still developing regulations for DeFi. |

| Security Risks | Smart contract bugs and hacking threats. |

| Scalability Issues | High transaction fees during network congestion. |

| Market Volatility | Crypto prices fluctuate significantly. |

| User Education | DeFi requires a learning curve for adoption. |

The Future of DeFi in Fintech

As DeFi continues to evolve, we can expect:

- Increased integration with AI for improved automation.

- Regulatory frameworks to bring more legitimacy.

- Greater adoption of DeFi by traditional financial institutions.

- The rise of Central Bank Digital Currencies (CBDCs) alongside DeFi innovations.

| Trend | Expected Impact |

| AI Integration | Smarter automation and fraud detection. |

| Regulation | Increased legitimacy and user trust. |

| Institutional Adoption | More stability and mainstream use. |

| Layer 2 Scaling Solutions | Lower fees and improved scalability. |

Takeaways

The fintech industry is evolving rapidly, and How Decentralized Finance Is Shaping the Future of Fintech is at the heart of this transformation. By offering decentralized and permissionless financial solutions, DeFi is democratizing access to financial services, breaking down traditional barriers, and fostering innovation. While regulatory and security concerns remain, the continued advancement of blockchain technology and fintech integration will likely solidify DeFi’s role in the future of finance.

As DeFi matures, its adoption by both individual users and traditional financial institutions is increasing. Banks and fintech companies are beginning to explore DeFi-driven solutions, integrating blockchain-based services into their existing frameworks to improve efficiency and security. This convergence between traditional finance and DeFi indicates that decentralization is not merely a trend but a fundamental shift in how financial services will operate in the future.

While challenges like regulatory uncertainties and security risks persist, DeFi’s future remains promising. With the continued advancement of blockchain technology, the development of robust regulatory frameworks, and the expansion of user education, DeFi is set to revolutionize the fintech industry even further, ultimately paving the way for a decentralized and democratized financial future.