Picking the right crop insurance can feel tricky. Farmers deal with risks like bad weather, pests, and market changes. Choosing between government-backed or private crop insurance adds another challenge.

Federal crop insurance comes with subsidies to help farmers save money on premiums. Private insurers offer more customized plans but may cost more. This guide explains both options clearly, so you can make the best choice for your farm operations.

Keep reading!

How Government Crop Insurance Works

The government offers crop insurance to help farmers manage risks like bad weather or low yields. It lowers costs for farmers by sharing expenses through subsidies and other support programs.

Federal Crop Insurance Program (FCIP) overview

The Federal Crop Insurance Program (FCIP) helps farmers protect their crops. It started during the Dust Bowl to guard against losses caused by natural disasters like droughts and floods.

The program offers multiple-peril crop insurance, which covers many risks in one policy. Farmers buy these policies through private insurance providers, but the government oversees everything through the USDA’s Risk Management Agency (RMA).

Premiums for federal crop insurance are heavily subsidized. This lowers costs for agricultural producers. For example, farmers pay only part of their premium while the government covers the rest.

Private insurers also get reimbursements from the Federal Crop Insurance Corporation (FCIC) to sell and manage these policies. These partnerships reduce risk for both insurers and farmers, ensuring protection for high-yielding crops across growing seasons successfully each year.

Subsidized premiums and administrative costs

Farmers pay less for federal crop insurance because the U.S. Department of Agriculture (USDA) covers part of their premiums. This subsidy lowers their out-of-pocket costs, making it more affordable for agricultural producers.

Premium subsidies can vary but often cover a significant portion, minimizing financial stress during a natural disaster or bad growing season.

Private companies help manage policies under the Federal Crop Insurance Program (FCIP). These insurers also get reimbursements from the government to handle administrative and operating expenses.

Using this public-private partnership ensures farmers benefit from expert services while still keeping rates low.

How Private Crop Insurance Works

Private crop insurance offers choices through various insurers. Policies are regulated by state departments to ensure fairness and compliance.

Coverage options through private insurers

Private insurers offer various crop insurance plans. These are regulated by state insurance departments. Farmers can choose options like crop-hail insurance, which covers damage from hailstorms.

Unlike federal programs, private policies aren’t part of the Federal Crop Insurance Program (FCIP). They also do not receive premium subsidies from the government.

Coverage is often more flexible through private insurers. Policies may cater to specialty crops or specific risks, such as fire or extreme weather events. Insurers balance costs and risks using tools like reinsurance markets and underwriting gains.

State rules guide these practices to protect both farmers and companies.

“State regulations ensure fair practices for all policyholders.”

Regulation by state insurance departments

State insurance departments oversee private crop insurance. They make sure companies follow rules and protect farmers. These departments set standards for premium rates, policy terms, and coverages.

The National Association of Insurance Commissioners helps maintain fairness across states. Each department monitors how insurers operate to prevent unfair practices. This system ensures that farmers get reliable options in their area.

Key Differences Between Government and Private Crop Insurance

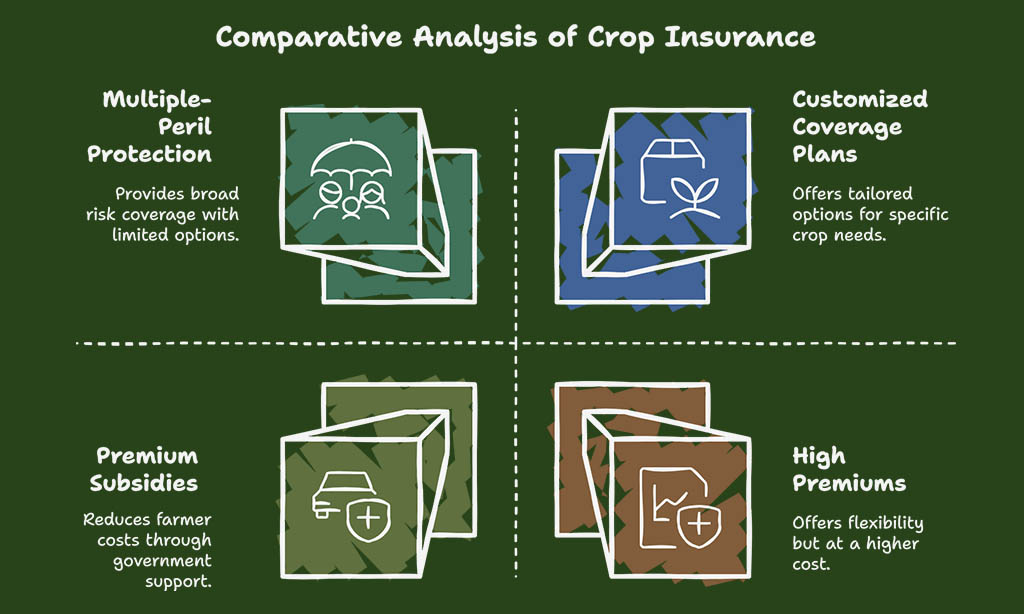

Government crop insurance often includes taxpayer-funded support, making it more affordable for farmers. Private crop insurance offers flexible plans but may come with higher premiums.

Cost and premium structures

Federal crop insurance programs lower costs by offering premium subsidies. The government covers part of the farmer’s premium, reducing out-of-pocket expenses. Private insurers also receive reimbursements for managing policies under federal rules.

Private crop insurance premiums are not subsidized like federal plans. Farmers pay the full cost, which can be higher but offers more customized options. State insurance departments oversee these private policies instead of federal agencies like the Federal Crop Insurance Corporation (FCIC).

Coverage options and flexibility

Private crop insurance offers a variety of coverage plans. Farmers can select specific options customized to their crops, like high-yielding or specialty crops. State insurance departments regulate these policies, ensuring fairness while allowing flexibility in coverage terms.

Government crop insurance focuses more on multiple-peril protection under programs like the Federal Crop Insurance Program (FCIP). This often includes natural disasters and other broad risks, but choices may be limited compared to private insurers.

Premium subsidies reduce costs for farmers, making this an affordable safety net.

Risk-sharing mechanisms

The Federal Crop Insurance Program (FCIP) shares risks between the government, farmers, and insurance companies. The government helps by subsidizing premiums and reimbursing private insurers for losses.

This reduces financial pressure on farmers during natural disasters like droughts or floods.

Insurance companies also share risks under the Standard Reinsurance Agreement (SRA). They take part of the financial responsibility for high-yielding crops and losses in tough growing seasons.

This partnership creates a stronger safety net for agricultural producers across the United States.

Factors to Consider When Choosing Crop Insurance

Farmers should assess their specific risks and financial needs before selecting coverage. Comparing both cost and benefits can help ensure the right choice for protecting crops.

Type of risks covered

Federal crop insurance covers natural disasters like drought, floods, and hail. It also protects against low market prices for agricultural commodities. Specialty crops and organic farmers are included in these protections.

The Federal Crop Insurance Program (FCIP) provides this coverage with premium subsidies.

Private crop insurance often includes risks not covered by federal programs. For example, it may offer standalone crop-hail policies regulated by state insurance departments. High-yielding crops can also be insured through private insurers for added protection during the growing season.

Budget and affordability

Crop insurance can be expensive. The Federal Crop Insurance Program (FCIP) helps with costs by offering premium subsidies. Farmers pay less because the government covers a big part of the price.

Private crop insurance, on the other hand, doesn’t have these same subsidies, so it might cost more.

Costs depend on the type of coverage and risks involved. High-yielding crops or specialty crops may need broader plans, increasing premiums. Farmers must match their needs with what they can afford while considering potential risks like natural disasters or low yields during growing seasons.

Regional availability

Federal crop insurance is available nationwide. Private crop insurance policies depend on state regulations and may vary by location. Farmers in areas prone to natural disasters, like floods or droughts, often rely on federal plans for broad protection.

Some private insurers focus only on specific crops or regions. Specialty crops grown in limited zones might need private coverage. State insurance departments oversee these policies to ensure fairness for farmers across different areas.

Takeaways

Government and private crop insurance both help farmers manage risks. They differ in cost, flexibility, and coverage options. Government policies often come with lower premiums due to subsidies.

Private plans may offer more customized protection but can be pricier. Farmers need to consider their budget and the specific risks they face each growing season. Choosing the right option ensures better financial security for agricultural producers.

FAQs

1. What is the federal crop insurance program?

The federal crop insurance program helps agricultural producers manage risks like natural disasters or poor yields. It’s run by the Risk Management Agency (RMA) and supported by premium subsidies from the government.

2. How does private crop insurance differ from government crop insurance?

Private crop insurance is offered by private companies, while government-backed programs involve public-private partnerships under agreements like the Standard Reinsurance Agreement (SRA). Both aim to protect farmers but have different structures for risk sharing and underwriting gains.

3. Who oversees federal crop insurance in the United States?

The Federal Crop Insurance Corporation (FCIC), part of the U.S. Department of Agriculture, manages it with help from state insurance departments and approved private insurers.

4. What are premium subsidies in government crop insurance?

Premium subsidies reduce costs for farmers by covering part of their premium payments, making coverage more affordable as a farm safety net.

5. Can specialty crops be insured under these programs?

Yes, both government and private options provide coverage for specialty crops along with high-yielding agricultural commodities to protect food supplies.

6. Why do taxpayers fund parts of federal crop insurance?

Taxpayer funding supports premium subsidies and risk-sharing mechanisms to ensure agriculture remains stable during inflationary periods or after natural disasters, benefiting both producers and consumers alike.