The business landscape is evolving rapidly, and payment solutions are at the forefront of this transformation. As digital transactions become the norm, companies must adopt game-changing payment solutions for businesses to stay competitive.

Whether it’s AI-powered processing, blockchain transactions, or biometric authentication, the right payment methods can enhance security, improve efficiency, and streamline financial operations.

This article explores 10 game-changing payment solutions for businesses in 2025, their advantages, and how they can future-proof your financial transactions with in-depth insights, trends, and practical applications. We will also include actionable tips and case studies to help businesses make informed decisions.

Why Businesses Need Game-Changing Payment Solutions in 2025

- The global digital payments market is expected to surpass $10 trillion by 2026.

- Consumers and businesses are shifting to digital transactions, leaving behind cash and traditional banking.

- Innovations such as AI and blockchain are reshaping the way companies handle payments.

- Contactless and mobile payments are becoming the standard, reducing dependency on physical cards.

Rising Demand for Fast, Secure, and Seamless Payments

- Customers expect instant and frictionless transactions.

- Fraud and cyber threats necessitate more secure payment methods.

- Businesses seek cost-effective solutions that reduce transaction fees and improve efficiency.

- Adoption of multi-currency and cross-border payment solutions is growing.

The Role of AI, Blockchain, and Automation

- AI-powered fraud detection helps prevent cybercrimes.

- Blockchain ensures transparency and eliminates intermediaries.

- Automation reduces human errors and streamlines payment processes.

- Smart contracts facilitate instant and secure B2B payments.

10 Game-Changing Payment Solutions for Businesses in 2025

In today’s fast-paced digital economy, businesses must leverage game-changing payment solutions for businesses to remain competitive. From AI-powered fraud detection to blockchain-based transactions, emerging technologies are revolutionizing the way companies handle payments. These innovations ensure secure, seamless, and efficient transactions that cater to modern consumer expectations.

1. AI-Powered Payment Processing

AI is revolutionizing financial transactions by enhancing security, automating processes, and predicting fraudulent activities. AI-powered payment processing helps businesses handle large transaction volumes efficiently. By leveraging machine learning, AI-driven systems can analyze spending behaviors, detect suspicious activity, and approve or decline transactions in real-time. Many companies are adopting AI-based payment solutions to reduce human intervention and operational costs.

Benefits:

| Feature | Description |

| Real-time fraud detection | Uses AI to analyze transactions and detect anomalies instantly. |

| Automated approvals | Reduces the need for manual verification, speeding up transactions. |

| Cost savings | Decreases operational expenses by automating payment processing. |

| Personalization | AI can analyze consumer behavior and offer customized payment experiences. |

Example: PayPal’s AI-driven fraud detection system has significantly reduced fraudulent transactions, improving trust and security for businesses and consumers.

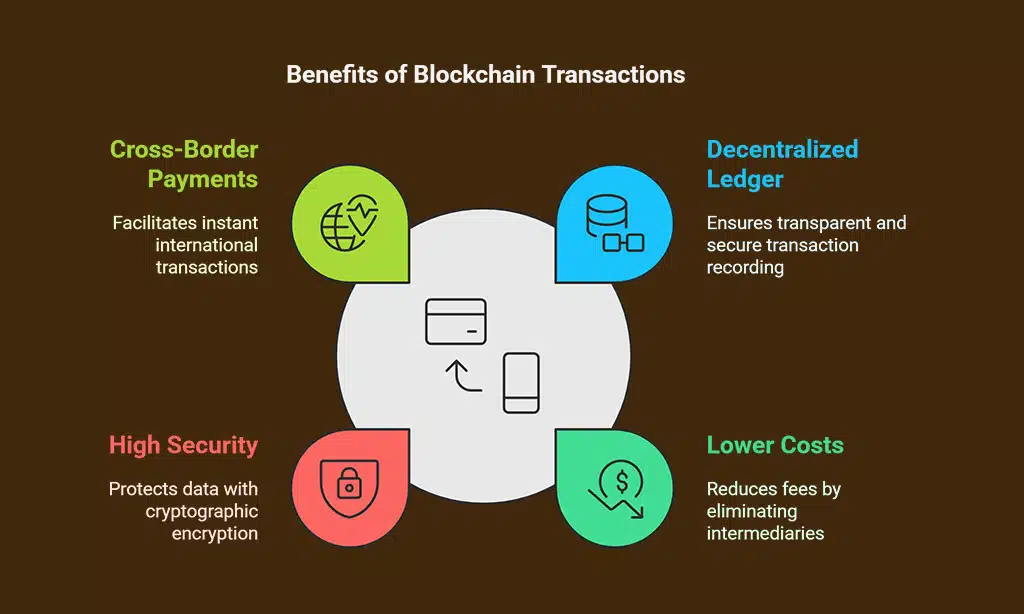

2. Blockchain-Based Transactions

Blockchain is one of the most game-changing payment solutions for businesses as it removes the need for intermediaries, enhances security, and reduces transaction fees. Unlike traditional banking systems, blockchain transactions are decentralized, reducing the risk of fraud and cyber-attacks. Companies using blockchain can benefit from instant transactions, lower processing fees, and a high level of transparency.

Benefits:

| Feature | Description |

| Decentralized ledger | Transactions are recorded transparently and securely. |

| Lower costs | Eliminates intermediary banks, reducing transaction fees. |

| High security | Cryptographic encryption prevents unauthorized access. |

| Cross-border payments | Instant, low-cost international transactions are possible. |

Example: Companies like IBM and Ripple have integrated blockchain into their payment ecosystems, reducing international remittance costs and increasing transaction speeds.

3. Biometric Payment Authentication

Biometric authentication is gaining traction as a highly secure and convenient way to process payments. From fingerprint scanning to facial recognition, biometric authentication enhances security while ensuring frictionless transactions. This technology reduces the dependency on traditional passwords and PINs, which are vulnerable to hacking and phishing attacks.

Benefits:

| Feature | Description |

| No passwords required | Uses fingerprints, face, or voice recognition for authentication. |

| Fraud prevention | Reduces identity theft and unauthorized transactions. |

| Faster checkout | Eliminates manual input, speeding up the payment process. |

| Multi-device authentication | Works across smartphones, ATMs, and POS systems. |

Example: Mastercard’s biometric payment card allows users to authenticate transactions with a fingerprint, improving both security and user convenience.

4. Real-Time Payment Systems (RTPs)

Real-Time Payment Systems enable instant fund transfers between accounts, eliminating delays associated with traditional bank transactions. These systems operate 24/7, allowing businesses to send and receive payments anytime, increasing cash flow efficiency.

Benefits:

| Feature | Description |

| Instant settlements | Transactions clear within seconds, improving liquidity. |

| Better cash flow | Businesses can access funds immediately. |

| Enhanced security | Uses encryption and real-time authentication. |

| Global adoption | More countries are implementing RTPs. |

Example: FedNow, a real-time payment service by the Federal Reserve, is expected to revolutionize the U.S. financial ecosystem.

5. Contactless and NFC Payment Expansion

Near Field Communication (NFC) technology allows businesses to accept contactless payments, providing a seamless checkout experience. NFC-enabled payment solutions have gained widespread adoption, offering a quick and secure way for consumers to make purchases.

Benefits:

| Feature | Description |

| Fast transactions | Customers simply tap their device or card to pay. |

| Hygiene-friendly | Reduces physical contact, enhancing safety. |

| Increased customer adoption | NFC payments are widely used in retail and transport. |

| Wide compatibility | Works with mobile wallets and smart devices. |

Example: Apple Pay and Google Pay have seen rapid growth, with millions of businesses adopting NFC technology for frictionless transactions.

6. Digital Wallet Integration

Digital wallets like Apple Pay, Google Pay, and PayPal have become an essential part of modern transactions. Businesses that integrate digital wallets into their payment systems offer customers a seamless, secure, and convenient way to pay. These wallets store payment credentials and enable quick transactions across different devices.

Benefits:

| Feature | Description |

| Convenience | Quick and easy transactions with stored details. |

| Enhanced security | Uses tokenization to protect sensitive data. |

| Multi-currency support | Works with different currencies globally. |

| Loyalty & rewards | Supports cashback and loyalty points integration. |

Example: Starbucks’ mobile app integrates a digital wallet and a rewards program, encouraging customer engagement and repeat transactions.

7. Buy Now, Pay Later (BNPL) for B2B Transactions

BNPL solutions are no longer limited to retail consumers. Businesses can leverage BNPL services to make large purchases while managing cash flow effectively. Many fintech providers now offer tailored BNPL solutions for B2B transactions.

Benefits:

| Feature | Description |

| Improved cash flow | Spread payments over time without large outlays. |

| Increased purchasing power | Enables businesses to afford larger investments. |

| Low or no interest | Many providers offer 0% interest financing. |

| Simplified approvals | Faster and easier approvals compared to loans. |

Example: Shopify Capital provides BNPL solutions to merchants, allowing them to fund inventory purchases and expand operations.

8. Cryptocurrency Payment Solutions

Cryptocurrency is becoming a mainstream payment option, with businesses accepting Bitcoin, Ethereum, and stablecoins. Crypto payments offer decentralized and borderless transactions, reducing the reliance on traditional banking.

Benefits:

| Feature | Description |

| Lower fees | Reduces transaction costs compared to banks. |

| Borderless transactions | Enables global payments without currency exchange. |

| Decentralized | Eliminates the need for central financial bodies. |

| Faster settlements | Reduces processing time from days to minutes. |

Example: Tesla briefly accepted Bitcoin for vehicle purchases, demonstrating the potential of crypto as a payment method.

9. Central Bank Digital Currencies (CBDCs)

CBDCs are government-backed digital currencies that offer businesses a stable and regulated alternative to cryptocurrencies. With central banks exploring digital currencies, businesses must prepare for their integration into financial systems.

Benefits:

| Feature | Description |

| Stability | Backed by governments and central banks. |

| Increased transparency | Reduces illicit financial activities. |

| Faster transactions | More efficient than traditional banking methods. |

| Secure and regulated | Maintains financial stability. |

Example: China’s Digital Yuan is a leading example of a CBDC being actively tested in retail and business transactions.

10. Embedded Payment Systems

Embedded payments allow businesses to integrate seamless, frictionless payment solutions directly into their platforms or apps. This eliminates the need for third-party payment gateways and enhances the overall user experience.

Benefits:

| Feature | Description |

| Seamless integration | Payments happen within the platform. |

| Increased customer retention | Eliminates payment friction and improves UX. |

| Automated transactions | Reduces manual payment processing. |

| Supports subscriptions | Ideal for recurring and automated billing models. |

Example: Uber’s embedded payment system allows users to pay seamlessly within the app without redirecting to external gateways.

Future Trends in Payment Solutions Beyond 2025

- AI-driven decision-making in payments.

- Expansion of CBDCs in mainstream economies.

- Quantum computing enhancing payment security.

- Integration of IoT (Internet of Things) with payment systems.

- Voice-activated payments via smart assistants like Alexa and Google Assistant.

Takeaways

The future of business transactions depends on adopting game-changing payment solutions for businesses. From AI-powered fraud detection to blockchain and real-time payments, staying ahead in the digital payment landscape is crucial. By integrating these solutions, businesses can enhance security, improve efficiency, and offer seamless transactions to customers worldwide.

Are you ready to upgrade your business with the latest payment solutions? Start implementing these innovative payment technologies today! 🚀