Effective debt management is a cornerstone of financial stability and peace of mind. Managing debt doesn’t just free you from financial stress—it paves the way for smarter savings, better investments, and greater overall security.

In today’s digital era, free tools and apps for effective debt management have become indispensable for anyone looking to regain control of their finances.

These tools offer features like real-time tracking, automated budgeting, and debt repayment strategies to make financial planning accessible for everyone.

This article explores why free tools and apps for effective debt management matter, reviews 10 free tools and apps for effective debt management, and provides actionable tips for choosing and using these tools.

Why Debt Management is Crucial

Understanding Debt and Its Impact

Debt is an unavoidable part of life for many individuals and households, encompassing obligations like credit cards, student loans, mortgages, and car payments.

While manageable debt can support essential life goals, unchecked debt often leads to financial strain and emotional stress.

High-interest rates, late payment penalties, and mounting balances can trap individuals in a cycle of borrowing.

Poor debt management doesn’t just harm your wallet—it can also impact your mental well-being.

Anxiety, depression, and even physical health issues often correlate with financial stress.

That’s why leveraging free tools and apps for effective debt management is vital to track expenses, prioritize repayments, and build healthier financial habits.

The Role of Technology in Debt Management

Technology has transformed how we approach debt. Digital tools and apps simplify complex financial decisions by providing real-time insights into spending, debt repayment plans, and credit scores.

Features like automated tracking, notifications, and personalized suggestions make these apps invaluable for individuals seeking to take control of their financial future.

The rise of free tools and apps for effective debt management ensures that anyone can start improving their financial habits without upfront costs.

Top 10 Free Tools and Apps for Effective Debt Management

1. Mint

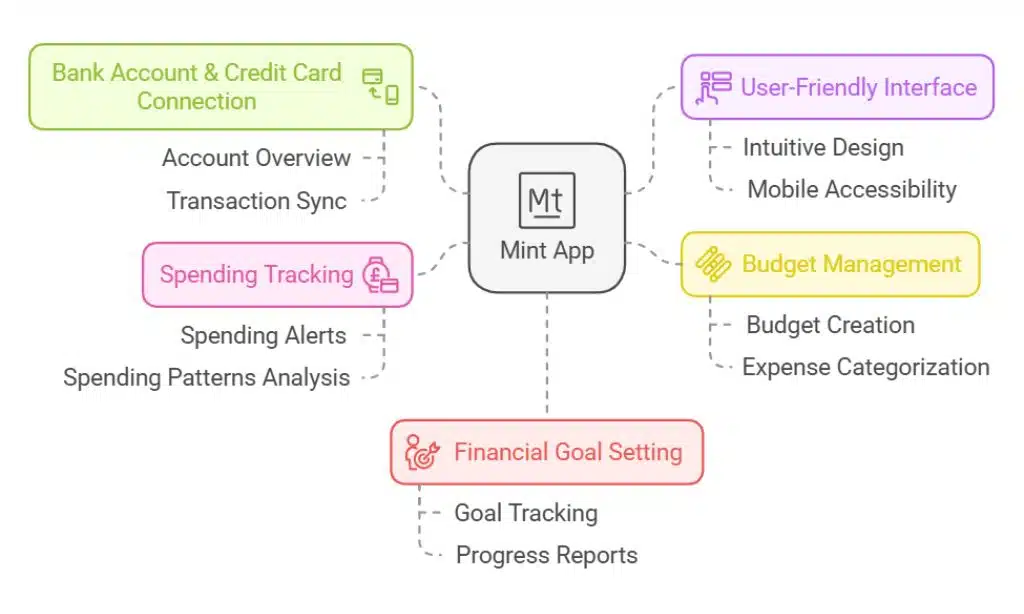

Mint is a comprehensive financial management app that connects to your bank accounts and credit cards, offering a holistic view of your finances.

It’s particularly popular for its user-friendly interface and robust features. Mint allows users to manage budgets, track spending habits, and set financial goals seamlessly.

Key Features:

- Budget tracking and spending categorization.

- Alerts for upcoming bills and unusual spending patterns.

- Debt repayment planning with detailed insights.

Example Use Case: Sarah, a young professional with limited financial knowledge, used Mint to track her monthly expenses. Over six months, she identified unnecessary subscriptions and reallocated those funds to pay off her credit card debt faster.

Ideal For: Beginners seeking an intuitive and user-friendly app to manage their finances.

| Feature | Description |

| Budgeting Tools | Track spending by category. |

| Alerts & Notifications | Stay updated on bills and due dates. |

| Financial Insights | Analyze spending and saving patterns. |

2. You Need a Budget (YNAB)

YNAB is a goal-driven budgeting app that emphasizes proactive financial planning. Its philosophy of assigning every dollar a purpose ensures that users allocate their income effectively.

YNAB is ideal for individuals aiming to create and stick to structured budgets while eliminating debt.

Key Features:

- Zero-based budgeting for smarter money allocation.

- Tools to create realistic debt payoff strategies.

- Progress tracking to keep users motivated.

Example Use Case: Mark, a freelancer with fluctuating income, relied on YNAB to allocate every dollar toward bills, savings, and debt payments.

The app’s progress-tracking feature motivated him to clear his $5,000 credit card debt within a year.

Ideal For: Individuals committed to detailed financial planning and disciplined budgeting.

| Feature | Description |

| Goal Setting | Create specific financial objectives. |

| Progress Tracking | Monitor debt reduction over time. |

| Detailed Reports | Gain insights into spending habits. |

3. PocketGuard

PocketGuard simplifies budgeting by analyzing your income, bills, and spending habits. It helps users identify how much disposable income they have left, promoting better financial decisions.

The app’s intuitive features are great for anyone who struggles with impulsive spending.

Key Features:

- Automated spending analysis.

- Bill tracking to avoid late payments.

- Insights into potential savings opportunities.

Example Use Case: Emily, a college student managing part-time income, used PocketGuard to set daily spending limits. She successfully saved $300 over three months, which she used to pay off a small personal loan.

Ideal For: People with fluctuating incomes or those who struggle with overspending.

| Feature | Description |

| Smart Budgeting | Automatically calculates disposable income. |

| Bill Tracking | Keeps tabs on due dates and payments. |

| Savings Insights | Suggests areas for reducing expenses. |

4. Credit Karma

Credit Karma combines credit score monitoring with tailored debt management advice. Its focus on improving credit health makes it a standout option for users looking to rebuild or strengthen their credit.

The platform also provides educational resources to demystify credit reports and scores.

Key Features:

- Free credit score and report updates.

- Debt repayment recommendations based on credit utilization.

- Alerts for changes in credit activity.

Example Use Case: David, who wanted to buy a house, monitored his credit score with Credit Karma. By following its tips, he improved his score by 70 points, making him eligible for better mortgage rates.

Ideal For: Users aiming to boost their credit score while managing debt.

| Feature | Description |

| Credit Monitoring | Provides free updates and insights. |

| Debt Recommendations | Suggests repayment strategies. |

| Alerts | Notifies users of credit changes. |

5. Debt Payoff Planner

This app helps users visualize their journey to becoming debt-free with customizable payoff plans.

Its visual timelines and progress charts make financial goals feel more attainable, providing a clear roadmap to success.

Key Features:

- Visual debt payoff timelines.

- Supports snowball and avalanche methods.

- Progress tracking with detailed charts.

Example Use Case: Lisa used Debt Payoff Planner to create a snowball strategy for her $10,000 credit card debt.

By celebrating each small milestone, she stayed motivated and paid it off in 18 months.

Ideal For: Individuals focused on achieving specific debt-free goals.

| Feature | Description |

| Payoff Strategies | Choose between snowball or avalanche. |

| Progress Tracking | Visualize debt reduction milestones. |

| Customization | Tailor strategies to personal preferences. |

6. Tally

Overview: Tally is designed to simplify credit card debt management by consolidating multiple credit card balances into a single automated payment.

It also offers a low-interest line of credit to reduce the cost of high-interest debts.

Key Features:

- Credit card consolidation for streamlined payments.

- Automated payment scheduling to avoid late fees.

- Credit line options to lower interest rates on debt.

Example Use Case: Jenna, who had five credit cards with varying due dates, used Tally to consolidate her debts. The app’s automation feature ensured she never missed a payment, and she saved hundreds of dollars in interest over a year.

Ideal For: Credit card users managing multiple accounts and high-interest rates.

| Feature | Description |

| Debt Consolidation | Combines multiple credit card balances. |

| Automated Payments | Ensures timely bill payments. |

| Low-Interest Credit | Provides affordable credit options. |

7. EveryDollar

Overview: EveryDollar is based on the zero-based budgeting method, which allocates every dollar of income to a specific purpose.

Its simple design and integration with the Dave Ramsey system make it a top choice for disciplined savers.

Key Features:

- Zero-based budgeting to maximize financial efficiency.

- Real-time spending tracking for transparency.

- Goal-setting features to encourage saving and debt repayment.

Example Use Case: Tom and Maria used EveryDollar to plan their monthly expenses and allocate extra funds to their student loans. Over two years, they paid off $15,000 in debt.

Ideal For: Fans of structured budgeting methods and the Dave Ramsey philosophy.

| Feature | Description |

| Budget Creation | Helps plan zero-based monthly budgets. |

| Real-Time Tracking | Monitors spending in real-time. |

| Goal Setting | Encourages savings and debt reduction. |

8. Goodbudget

Goodbudget uses the envelope budgeting system, which allocates money to specific categories like rent, groceries, and savings.

It’s ideal for those who want to maintain disciplined spending while working toward debt repayment.

Key Features:

- Virtual envelope system for precise budgeting.

- Cross-device synchronization for shared financial goals.

- Expense tracking to monitor spending trends.

Example Use Case: A couple, Alex and Jamie, used Goodbudget to manage joint expenses while saving for a down payment.

By tracking their spending carefully, they achieved their savings goal in 18 months.

Ideal For: Families or couples collaborating on financial goals.

| Feature | Description |

| Envelope Budgeting | Allocates money into virtual categories. |

| Shared Accounts | Synchronizes budgets across devices. |

| Spending Insights | Tracks and categorizes expenses. |

9. Spendee

Overview: Spendee is designed for collaborative budgeting, allowing users to manage shared expenses with family, friends, or roommates.

Its visually engaging reports simplify understanding of financial habits.

Key Features:

- Collaborative budgeting for multiple users.

- Customizable categories to suit individual needs.

- Visual spending analysis with charts and graphs.

Example Use Case: A group of roommates used Spendee to track shared expenses for rent, utilities, and groceries.

They avoided misunderstandings and evenly split costs every month.

Ideal For: Groups or families managing shared expenses.

| Feature | Description |

| Group Collaboration | Simplifies expense-sharing processes. |

| Custom Categories | Tailors budgeting to unique needs. |

| Spending Analytics | Provides visual breakdowns of expenses. |

10. Zeta

Overview: Zeta is tailored for couples, offering tools to manage shared budgets, joint goals, and expense tracking.

It’s especially useful for partners working together on long-term financial objectives.

Key Features:

- Shared financial dashboards for transparency.

- Joint goal-setting for aligned financial priorities.

- Tools for splitting and tracking shared expenses.

Example Use Case: Anna and Chris, newlyweds, used Zeta to combine their finances and save for a honeymoon.

The app helped them allocate joint savings while keeping individual spending transparent.

Ideal For: Couples managing shared finances and joint goals.

| Feature | Description |

| Shared Budgets | Combines financial resources effectively. |

| Goal Setting | Aligns spending with mutual objectives. |

| Transparency Tools | Enhances trust through financial clarity. |

Takeaways

Free tools and apps for effective debt management are powerful resources for taking control of your financial future.

From comprehensive budgeting platforms like Mint to specialized debt repayment tools like Debt Payoff Planner, there’s an app for every financial need.

Start exploring these tools today, set clear goals, and take the first step toward a debt-free life. Remember, with the right tools and consistent effort, financial freedom is within reach.