Facing an error code on FintechAsia can interrupt your online banking or QR code payment. It’s frustrating, right? Well, you’re not alone. Many users encounter these bumps now and then.

One important fact to remember is that understanding and solving the FintechAsia error codes are essential steps toward smooth financial transactions.

In this post, we examine common FintechAsia error codes like authentication failure, insufficient funds, and transaction timeout. We’ll guide you through diagnosing issues related to system overloads or network disruptions and offer practical solutions for specific problems such as invalid account numbers or payment gateway unavailability.

By the end, you’ll have strategies for preventing future issues—all aimed at boosting user satisfaction.

Keep reading to access seamless fintech operations…

Common FintechAsia Error Codes

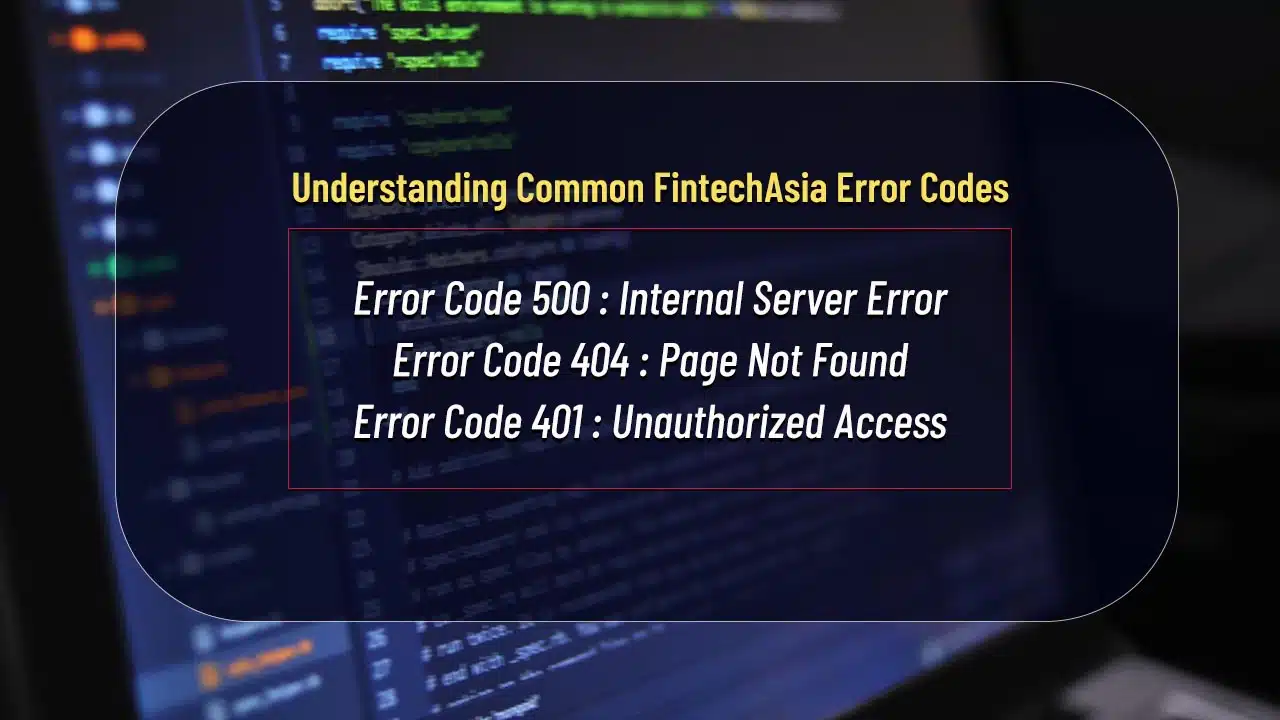

When you use FintechAsia, sometimes things go wrong. You might see messages like “Internal Server Error” or “Page Not Found.” These are error codes telling you there’s a problem. Let’s figure out FintechAsia error codes, what they mean and how to fix them.

Error Code 500: Internal Server Error

Error Code 500 means something went wrong but it’s not your fault. This error happens when there are server problems that can’t handle your request. Think of it like trying to cook a big dinner but your stove isn’t working right.

The reasons might be coding mistakes, the server running out of power, or trouble connecting to the database where information is kept. To fix this, experts look at error logs to find out what went wrong.

Then they talk to hosting service providers for help. It’s like finding and fixing broken parts in the stove so you can cook again.

This Error often comes up without warning, making it hard for users and frustrating too. But by checking these logs and understanding server limits, companies like FintechAsia can work quickly to solve these issues.

They make sure their servers can handle lots of requests at once and keep everything running smoothly for QR code payments or logging into your account without issues.

Error Code 404: Page Not Found

Error code 404 means the page you want is not there. This happens if the page is gone, moved, or the link doesn’t work anymore. It’s like looking for a book in a library but finding its spot empty.

For users trying to log in, shop online, or use digital wallets on e-commerce platforms, this can be frustrating. They might have clicked on an old link from social media or typed the web address wrong.

To fix this, check if the web address is right. If you’re clicking a link and get this error, try finding the page through the site’s main menu instead. Websites often update their pages or move content around; that’s why links stop working sometimes. It’s not always about big problems like internet connection issues or website downtime.

Simple things like refreshing your browser or going back to the home page can also help find what you were looking for without running into error 404 again.

Error Code 401: Unauthorized Access

Error Code 401 means you are not allowed in. This happens because your login details are wrong, your session has expired, or you do not have permission. Fix this by checking your ID and password.

Make sure they are correct. If they keep saying no, it might be time to reset your password or talk to someone who can help.

This problem stops you from getting what you need from FintechAsia. Without the right access, things like online shopping, mobile payments, or using your e-wallet won’t work right.

To avoid FintechAsia error codes, always keep your login information safe and update it regularly. This way, financial technology stays easy and safe to use for things like bank transfers and buying now but paying later.

Troubleshooting FintechAsia Error Codes

Figuring out what’s wrong with FintechAsia error codes means looking at different parts, like if there’s too much traffic, or if the phone and computer aren’t getting along. We look for clues—like when lights blink in a car dash—to spot where the trouble is.

System Overloads

System overloads happen when too many users try to access FintechAsia at once. This can slow down the system or make it stop working. Think of it like a busy road. Too many cars cause traffic jams.

With FintechAsia, too much demand means slower service or no service at all.

To fix this, restarting the system can help clear the jam. Regular updates and routine maintenance also keep things running smoothly. Just like how fixing potholes and adding lanes makes roads better, these steps make sure FintechAsia can handle more users without trouble.

Software Compatibility Issues

Software Compatibility Issues can make or break your FintechAsia experience. Old versions of software on your device might not work well with FintechAsia’s newest features. This leads to messages like error codes popping up when you try to do something simple.

To fix this, always check if your device’s software needs an update. It’s a quick step that can save you lots of time and prevent headaches.

For example, if you’re using a mobile peer-to-peer (p2p) lending platform through an app, make sure the app is up-to-date. Outdated apps may not support the latest payment protocols, like the Unified Payments Interface (UPI), making transactions fail.

Regular updates help keep things smooth, keeping services like Paytm SoundBox operational for cashless payments. They also improve security by fixing vulnerabilities found in older versions, protecting sensitive data during digital banking activities.

Network Disruptions

Network disruptions stop you from completing tasks smoothly on FintechAsia. Think error codes like FINT-001 to FINT-005. These tell us there’s a hiccup with the connection between your device and FintechAsia.

It means the system can’t send or get data right now.

To fix these hitches, first check your internet link—is it strong? Next, see if FintechAsia is online; sometimes, they might be fixing things on their end. If both are fine, rebooting your router or switching to mobile data could help.

Keep an eye out for any announcements from FintechAsia about outages or downtime—they’ll let you know what’s up and when everything will be back to normal.

User-Related Errors

Users often make mistakes that lead to errors. Typing wrong passwords is a common error. This causes an unauthorized access alert or Mistake Code 401. Many forget their passwords or mix them up with other accounts.

Another issue is entering incorrect account numbers during transactions, which brings up the invalid account number error. These problems need simple fixes, like double-checking details before submitting them.

Sometimes, users face transaction timeout issues because it takes them too long to finish their payment process on mobile peer-to-peer (p2p) lending platforms. They might also struggle with software updates, not realizing that keeping their apps updated is crucial for a smooth experience and avoiding operational disruptions.

Regularly updating apps can prevent many FintechAsia error codes, making ease of use better and improving the user experience on the internet and social networking platforms.

Interoperability Challenges

Interoperability challenges mean big troubles for FintechAsia’s users and systems. When banks, credit/debit card systems, and payment gateways don’t work well together, errors pop up.

Imagine trying to complete a transaction but the different financial networks can’t talk to each other. This leads to problems like Error Code 4004 – where an account number doesn’t make sense across systems.

Or worse, Error Code 3003 happens when these mismatches cause delays, making transactions time out.

Solving this needs a focus on making everything work seamlessly together; it’s not just about fixing one side of the issue. For instance, addressing Error Code 1000 requires smoothing out communication between various authentication mechanisms.

And when dealing with Payment Gateway Unavailability (Error Code 5005), the solution lies in making sure that all platforms involved in processing payments can interact without hitches.

It takes diagnostic tools and system indicators to pinpoint where things aren’t lining up right, and then patching these gaps promptly keeps reliability and consumer trust intact.

Resolving Specific FintechAsia Error Codes

Fixing FintechAsia error codes can help stop big problems. By figuring out the issue, steps can be taken to fix things like wrong password inputs or money transfer delays.

Addressing Authentication Failure

Solving authentication failure means checking login details first. Error Code 1001 pops up if you enter wrong information or your token expires. Make sure you use the right username and password.

Sometimes, simply resetting your password fixes the problem. Two-factor authentication can also help keep your account safe while using FintechAsia services like credit and debit cards or QR code-based payment systems.

If issues keep happening, it’s not just about losing access for a moment; it risks customer trust and could lead to people moving away from using these platforms for their transactions.

Regular security audits and updating passwords are often the best practices to prevent this error from coming back. This approach aligns with PCI DSS standards that protect card information during buy-now-pay-later deals or basic troubleshooting steps when using cellphones for payments.

Handling Insufficient Funds

Check your bank balance if you see Error Code 2002. This means not enough money is there for what you’re trying to do. Move the needed money into your account first. Businesses, on their side, should always make sure there’s enough money before trying a transaction.

This helps avoid any mistakes and keeps customers happy.

Also, use tools like mobile apps or online banking to keep an eye on your funds easily. This way, you can quickly move money when needed. Plus, getting alerts about your balance can stop a problem before it starts.

Remember, staying ahead of the game saves time and avoids trouble with payments or purchases.

Correcting Invalid Account Number Errors

Fixing Invalid Account Number Errors means making sure the numbers are right. If you get Error Code 4004, your account details need a check. Always double-check and verify account numbers before you hit send on any transaction.

This simple step stops mistakes and saves time.

I once entered the wrong number for an online payment and faced this error. The solution was quick—I just had to go back, make sure every digit matched my credit card, and try again.

Verifying your information can prevent loss of customer trust and meet consumer demand for user-friendly experiences.

Resolving Transaction Timeout Issues

To tackle Transaction Timeout errors, always check your internet connection first. Strong and stable internet is a must for successful transactions. If the error persists, try the transaction again after a few minutes.

This issue often happens because of network problems or server delays. So, patience and retrying can solve it most of the time.

For those facing regular timeouts, it might help to switch networks or devices if possible. Sometimes, specific devices or networks have issues that disrupt connections to FintechAsia’s servers.

Keep an eye on any patterns that lead to these errors and adjust accordingly—switching from Wi-Fi to cellular data might just do the trick for smoother transactions without hiccups.

Overcoming Payment Gateway Unavailability

Sometimes, you try to pay and see Error Code 5005: Payment Gateway Unavailable. This means the gateway is down, maybe for fix-ups or tech hiccups. First things first, don’t panic. Just wait a bit, then try your credit/debit card again.

If you are still stuck, switch to another payment method, like a different card or online wallet.

Let’s say you’re in a rush and can’t wait. Check if multifactor authentication (2FA) might help with another transaction mode. Use it. SSL certificates also play a big role here—they make sure your alternative payment is safe to go through without snagging on similar issues.

Strategies for Preventing Future Issues

To keep FintechAsia running smoothly, it’s smart to have good security and always check the system for problems. Think about using things like tests that are run by computers and making sure two ways of checking who you are are in place.

Implementing Robust Security Measures

To boost security, add two-factor authorization (2FA) and advanced secret writing. These measures stop unauthorized access to accounts. Two-factor authorization means users need two kinds of proof before they get in.

It’s like having a second lock on your door. Advanced secret writing scrambles data so only the right person can read it.

Teach users about safe practices and push for strong, not easily guessed passwords. This step cuts down risk of FintechAsia error codes from the start. Users learn how to protect their own information better with guidance on creating tough passwords that mix letters, numbers, and symbols.

Credit card safety also gets better when everyone follows these rules carefully.

Regularly Updating and Testing the System

Keeping the system up to date is a must. This means frequently installing the latest security patches and software updates. These actions protect against new threats. By doing so, we prevent problems before they happen.

Testing is just as crucial. With penetration testing and automated testing, we find weak spots in security. This way, we can fix them quickly.

We also make sure that all parts of our system work well together after each update or change. For instance, if two-factor authentication (2FA) gets an update, we test it with both credit and debit cards immediately.

This ensures users won’t face unexpected errors during transactions or when accessing their accounts. Through regular monitoring and updating tools like automated systems for verification, transparency remains at the forefront of operations, making every transaction safe and reliable for users.

Monitoring Transactions Regularly

Keeping an eye on your transactions every day helps catch mistakes quickly. It means you can spot when something doesn’t match up, like a payment you didn’t make or if there’s not enough money in your account.

This step is crucial to stopping problems before they grow big. For example, checking your credit card activity often lets you see errors or odd charges right away.

Using tools that track spending and payments makes this job easier. These tools can alert you about unusual action on your account or if your balance gets too low. Think of it as having a guard who watches over your financial moves 24/7, ready to warn you of any trouble brewing with credit/debit cards or BCD number issues.

Always updating information and talking to customer support also play a big part in solving FintechAsia error codes quickly and keeping everything running smoothly.

Leveraging Customer Support

Customer support solves error code problems quickly. A good team knows how to fix issues like “Error Code 500: Internal Server Error” or “Error Code 404: Page Not Found.” They help with FintechAsia error codes and make things run smoothly again.

Since customer happiness is top priority, the team works hard to avoid payment mishaps and system errors. With 90% of people saying solving problems is crucial, a strong support crew ensures that.

They use tools and knowledge to tackle common mistakes, such as invalid credit card entries or access denials. By guiding users through steps for correcting an “Error Code 401: Unauthorized Access,” they prevent bigger headaches later on.

So, when you hit a snag with your account or transaction, reaching out makes all the difference in keeping your financial tasks on track without delay.

Takeaways

Decoding FintechAsia error codes boosts financial operations in Asia. Clear steps to tackle codes like Authentication Failure and Insufficient Funds make transactions smooth. Regular updates, strong security, and customer support play a big role.

This makes handling finance online easier for everyone. Solve these issues quickly to keep your money moving on track.