The financial landscape is undergoing a massive transformation, thanks to the rise of financial technology (fintech). Traditional wealth management services, once dominated by banks and legacy financial institutions, are now being disrupted by innovative fintech startups.

These companies are redefining how individuals and businesses manage their wealth by leveraging artificial intelligence (AI), blockchain, and data-driven insights.

In this article, we explore five fintech startups disrupting wealth management, providing cutting-edge solutions that cater to modern investors. These startups are making wealth management more accessible, transparent, and efficient than ever before.

The Rise of Fintech in Wealth Management

Fintech startups disrupting wealth management are changing the financial landscape by making investment strategies more data-driven, automated, and accessible. With traditional wealth management services often being expensive and exclusive, fintech solutions offer a modern alternative that caters to a wider range of investors.

From AI-powered financial advisory services to blockchain-driven transparency, the rise of fintech is shaping the future of wealth management.

How Technology is Transforming Financial Advisory Services

Fintech is revolutionizing wealth management by introducing automated financial planning tools, robo-advisors, and AI-driven analytics. These advancements eliminate the traditional barriers to entry, allowing both seasoned and novice investors to make data-backed financial decisions.

- Robo-advisors offer automated portfolio management based on risk tolerance and financial goals.

- AI-driven analytics provide real-time insights and predictive investment strategies.

- Digital wealth platforms reduce dependency on expensive human advisors.

- Blockchain ensures greater transparency and security in financial transactions.

Key Trends Driving Fintech Disruption in Wealth Management

Several key trends are fueling the rise of fintech startups in wealth management:

- Personalization: AI-driven platforms tailor investment strategies to individual needs.

- Lower Costs: Automated platforms reduce management fees compared to traditional firms.

- Greater Accessibility: Fintech solutions provide wealth management tools to a broader audience, including millennials and retail investors.

- Regulatory Technology (RegTech): Ensures compliance with financial regulations through automated systems.

- Integration of Crypto Assets: More fintech firms are incorporating cryptocurrency investments into traditional wealth portfolios.

Benefits of Fintech Solutions for Investors and Advisors

Fintech startups disrupting wealth management bring numerous benefits, such as:

- Ease of Use: Digital wealth management platforms offer user-friendly interfaces.

- 24/7 Access: Investors can manage their portfolios anytime, anywhere.

- Data-Driven Decisions: AI-driven analytics help make more informed investment choices.

- Diversification: Access to a wide range of asset classes, including stocks, bonds, and cryptocurrencies.

- Enhanced Security: Blockchain-based solutions minimize fraud risks.

5 Fintech Startups Disrupting Wealth Management

Fintech startups disrupting wealth management are reshaping the way individuals and businesses handle their finances. By leveraging cutting-edge technologies like AI, machine learning, and blockchain, these companies provide personalized and automated solutions that rival traditional wealth management firms.

As the demand for digital-first financial services grows, these startups are leading the charge in transforming investment strategies, risk management, and portfolio optimization.

1. Arta Finance

Arta Finance is among the leading fintech startups disrupting wealth management by offering AI-powered investment solutions. The company is bridging the gap between retail investors and sophisticated financial strategies that were previously exclusive to high-net-worth individuals.

By automating wealth planning, risk assessment, and portfolio management, Arta Finance is democratizing access to institutional-grade investment expertise.

Unique Innovations and Offerings

Arta Finance, founded by ex-Google executives, is revolutionizing wealth management with AI-powered investment solutions tailored for high-net-worth individuals (HNWIs). The platform provides hedge-fund-level investment strategies to a broader audience.

How It’s Changing Wealth Management

- Offers AI-driven investment strategies similar to those used by institutional investors.

- Provides automated wealth management services with minimal human intervention.

- Utilizes machine learning to optimize risk-adjusted returns.

Who Can Benefit from This Fintech Solution?

- HNWIs looking for sophisticated investment strategies.

- Tech-savvy investors who prefer data-driven decision-making.

- Entrepreneurs and executives seeking diversified wealth management.

Key Details Table:

| Feature | Details |

| Founded | 2022 |

| Headquarters | Mountain View, CA, USA |

| Specialization | AI-driven wealth management |

| Target Users | High-net-worth individuals |

2. Addepar

Addepar is one of the most prominent fintech startups disrupting wealth management, offering data-driven portfolio analytics and reporting solutions. The platform is designed for financial advisors, family offices, and institutional investors, helping them make well-informed investment decisions.

With its strong data aggregation capabilities and intuitive interface, Addepar is streamlining wealth management processes and enhancing transparency.

Key Features and Technologies

Addepar is a fintech startup that specializes in data aggregation and portfolio analytics. Its platform serves financial advisors, family offices, and institutional investors.

Market Impact and User Adoption

- Manages over $4 trillion in assets globally.

- Enables advisors to provide personalized investment insights.

- Improves transparency in financial reporting through data visualization.

Key Details Table:

| Feature | Details |

| Founded | 2009 |

| Headquarters | Mountain View, CA, USA |

| Specialization | Portfolio analytics & data aggregation |

| Target Users | Financial advisors, institutions |

3. ET Money

ET Money is one of the fastest-growing fintech startups disrupting wealth management by offering AI-powered financial solutions. The platform aims to simplify investment planning, tax-saving, and insurance needs for retail investors. By leveraging AI and automation, ET Money provides seamless and efficient wealth management tools that help individuals optimize their financial portfolios.

AI and Automation in Wealth Advisory

ET Money simplifies wealth management through AI-driven automation. The platform offers:

- Mutual fund investments.

- Insurance services.

- Fixed deposits and pension planning.

- AI-driven tax-saving strategies.

How It Competes with Traditional Firms

- Low-cost investment solutions.

- User-friendly mobile app with seamless integration of financial products.

- Personalized financial planning based on user behavior.

Key Details Table:

| Feature | Details |

| Founded | 2015 |

| Headquarters | India |

| Specialization | Automated wealth management |

| Target Users | Retail investors |

4. Kuvera

Kuvera is another leading fintech startup disrupting wealth management by providing commission-free direct mutual fund investments and comprehensive financial planning solutions.

The platform stands out by offering users a transparent and cost-effective way to grow their wealth, making professional investment strategies accessible to retail investors. By leveraging AI and automation, Kuvera ensures a seamless investing experience while helping users optimize tax efficiency and portfolio diversification.

Disruptive Business Model and Innovation

Kuvera is an online wealth management platform that offers direct mutual fund investments without commissions. It emphasizes transparency and long-term wealth growth.

Key Use Cases and Success Stories

- Helps retail investors save on commissions.

- Provides tax optimization strategies for long-term wealth growth.

- Offers portfolio rebalancing based on AI-driven insights.

Key Details Table:

| Feature | Details |

| Founded | 2016 |

| Headquarters | India |

| Specialization | Zero-commission investment platform |

| Target Users | Retail investors, tax-conscious individuals |

5. Abra

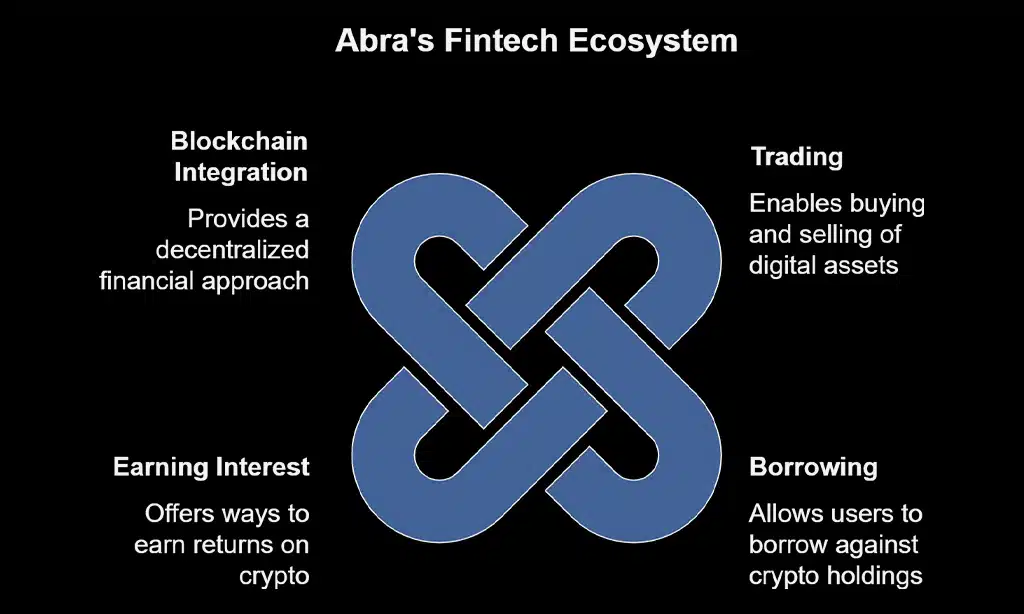

Abra is another major player among fintech startups disrupting wealth management, particularly in the cryptocurrency space. The platform enables investors to trade, borrow, and earn interest on digital assets, offering a comprehensive suite of crypto wealth management tools.

By integrating blockchain technology, Abra provides a decentralized approach to financial services, making it an attractive option for modern investors looking to diversify their portfolios with digital assets.

Unique Selling Proposition

Abra is a crypto wealth management platform offering trading, lending, and yield-generating opportunities.

Industry Challenges and Future Prospects

- Expanding crypto regulations pose challenges.

- Increasing adoption of digital assets presents growth opportunities.

- Abra is exploring ways to integrate traditional investment options with cryptocurrencies.

Key Details Table:

| Feature | Details |

| Founded | 2014 |

| Headquarters | USA |

| Specialization | Crypto wealth management |

| Target Users | Crypto investors, digital asset enthusiasts |

Takeaways

Fintech startups disrupting wealth management are transforming how individuals and institutions handle investments. With AI-driven analytics, automation, and blockchain technology, these companies are making financial services more accessible, efficient, and transparent.

As fintech continues to evolve, investors and wealth managers must stay informed about the latest advancements to capitalize on new opportunities. Whether you’re an individual investor or a financial professional, embracing fintech solutions can lead to smarter, data-driven investment decisions.