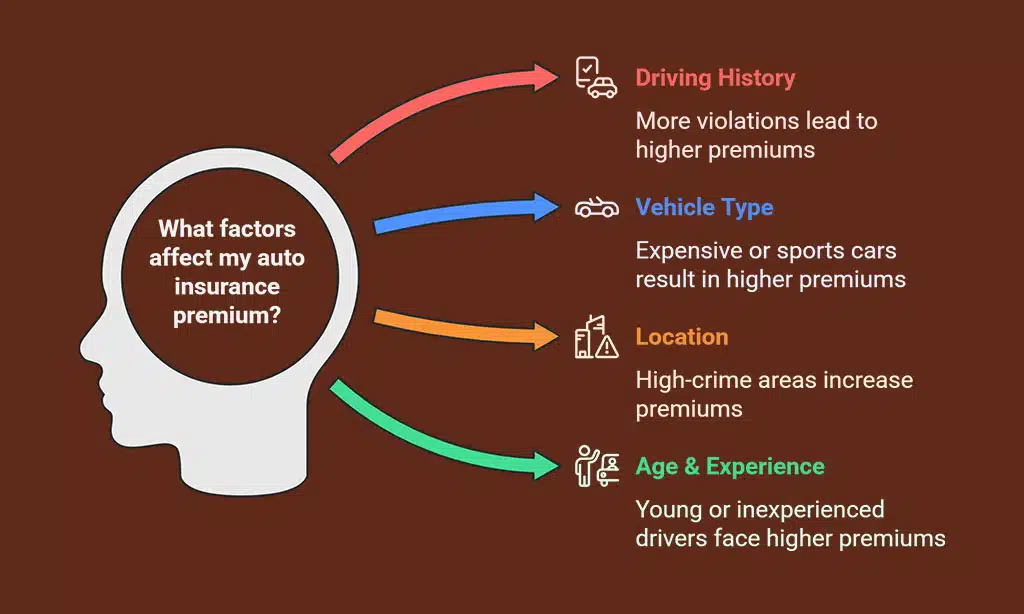

Auto insurance is a crucial financial safeguard, protecting you from unexpected expenses due to accidents, theft, or damage. However, not all policies are priced the same, and you may wonder why your rates are higher or lower than others. The reality is that multiple factors determine how much you pay.

Understanding the factors that affect your auto insurance premium can help you make informed decisions and find ways to lower your costs.

This article breaks down the key elements insurers consider and provides practical tips to reduce your premium. Additionally, we will include tables, examples, and case studies to make the information more practical and actionable.

Understanding Auto Insurance Premiums

Your auto insurance premium is the amount you pay to your insurance provider for coverage. It can be paid monthly, quarterly, semi-annually, or annually, depending on your policy agreement. The premium covers the cost of your policy and is influenced by various factors such as risk levels, claim history, and location.

Why Do Insurance Rates Vary?

Insurance rates vary based on risk assessment. Insurers use statistical models to analyze different factors, including your driving behavior, car type, and location. These factors help them determine how likely you are to file a claim, which influences your premium. Additionally, economic factors like inflation, vehicle repair costs, and legal claim settlements can also affect insurance rates.

How Insurers Calculate Your Premium

Insurance companies use complex algorithms that weigh multiple factors. While each provider may have slightly different criteria, most follow a similar framework when assessing risk. Here is a table summarizing the main elements affecting insurance rates:

| Factor | Impact on Premium |

| Driving History | More violations = Higher premium |

| Vehicle Type | Expensive/sports cars = Higher premium |

| Location | High-crime areas = Higher premium |

| Age & Experience | Young/inexperienced = Higher premium |

| Credit Score | Poor credit = Higher premium |

| Coverage Limits | More coverage = Higher premium |

| Annual Mileage | High mileage = Higher premium |

Key Factors That Affect Your Auto Insurance Premium

Understanding the key elements that shape your insurance premium can empower you to make informed financial decisions. Whether it’s your driving habits, the type of vehicle you own, or even where you live, these factors contribute significantly to your overall insurance costs. Let’s explore the primary determinants that insurers consider when calculating your premium.

1. Your Driving History

Among the many factors that affect your auto insurance premium, your driving history plays a crucial role. Insurers assess your past behavior on the road to determine how much risk you present as a driver. A clean record leads to lower premiums, while frequent infractions and claims result in higher costs.

Your past behavior on the road is one of the biggest influences on your premium. Insurance companies look at:

- Traffic violations: Speeding tickets, reckless driving, and other infractions increase your premium.

- Accidents: A history of at-fault accidents makes you a higher-risk driver.

- DUI/DWI offenses: Driving under the influence results in significantly higher rates.

- Claim history: Frequent claims suggest a higher likelihood of future incidents.

Case Study:

A study conducted in 2024 by the Insurance Information Institute found that drivers with one speeding ticket pay 20% more on average than those with a clean record. Those with multiple violations or DUIs can see increases of 50% or more.

How to Lower Your Premium:

- Drive safely and follow traffic laws.

- Take defensive driving courses to qualify for discounts.

- Avoid making small claims that could raise your premium.

| Driving Record | Impact on Premium |

| Clean Record | Lowest Premium |

| 1-2 Minor Violations | 10-20% Increase |

| Multiple Violations | 30-50% Increase |

| DUI/DWI Conviction | 50%+ Increase |

2. Your Vehicle Type and Model

Among the many factors that affect your auto insurance premium, the type of vehicle you drive is a crucial one. Insurance companies assess risk based on the make, model, and year of your car.

High-end luxury vehicles, sports cars, and vehicles with expensive repair costs typically come with higher premiums, whereas safer, more affordable models may qualify for discounts. Understanding how insurers evaluate different vehicles can help you make a cost-effective decision when purchasing a car.

The car you drive plays a significant role in determining your insurance premium. Factors include:

- Car value: Expensive cars cost more to repair or replace, leading to higher premiums.

- Safety features: Vehicles with anti-lock brakes, airbags, and collision prevention technology may qualify for lower rates.

- Theft risk: Cars that are frequently stolen tend to have higher insurance costs.

- Performance: Sports cars and high-performance vehicles usually come with increased premiums.

Vehicle Comparison Table:

| Vehicle Type | Insurance Cost Impact |

| Economy Sedan | Lower Premiums |

| Luxury Car | Higher Premiums |

| Sports Car | Highest Premiums |

| SUV with Safety Features | Lower Premiums |

3. Your Location and ZIP Code

Among the key factors that affect your auto insurance premium, your location is a significant one. Insurance companies analyze ZIP codes to assess risk levels based on crime rates, traffic congestion, and environmental hazards.

Living in a densely populated urban area may lead to higher premiums, while rural locations often offer lower insurance costs. Understanding how your geographic location influences your rates can help you make strategic decisions when selecting coverage.

Where you live has a major impact on your auto insurance premium. Insurers consider:

- Urban vs. rural areas: Cities tend to have higher rates due to more traffic and accidents.

- Crime rates: Areas with high vehicle theft and vandalism lead to higher premiums.

- Weather conditions: Regions prone to hurricanes, floods, or snowstorms may have increased rates.

Table: Impact of Location on Insurance Premiums

| Location Type | Average Insurance Cost |

| Rural Area | Lower Premiums |

| Suburban Area | Moderate Premiums |

| Urban Area | Higher Premiums |

| High-Crime Area | Highest Premiums |

4. Your Age and Experience

Age and driving experience are critical factors that affect your auto insurance premium. Insurers use statistical data to assess risk, and younger, inexperienced drivers tend to have higher accident rates, leading to increased premiums. Conversely, middle-aged drivers with years of experience typically enjoy lower rates. As drivers enter their senior years, premiums may rise again due to potential age-related impairments.

Insurance companies assess age and driving experience when setting rates:

- Teen drivers (16-25 years): High premiums due to inexperience and higher accident risk.

- Middle-aged drivers (25-65 years): Typically receive the best rates.

- Senior drivers (65+ years): May face higher premiums due to potential health-related driving risks.

Table: Age & Premium Impact

| Age Group | Impact on Premium |

| 16-25 | Highest Premium |

| 26-50 | Lowest Premium |

| 51-65 | Moderate Premium |

| 66+ | Higher Premium |

5. Your Credit Score and Financial History

Your credit score plays a crucial role in determining your auto insurance premium. Many insurance companies view credit history as an indicator of financial responsibility and predictability. A good credit score suggests that you are reliable in making payments, while a poor score may indicate a higher risk of missed payments or claims. As a result, insurers often adjust premiums based on creditworthiness.

Many insurers use credit scores to predict how likely a driver is to file claims. A higher credit score often results in lower premiums.

Factors Insurers Consider:

- Payment history: Late payments or defaults can increase rates.

- Credit utilization: High debt may lead to higher premiums.

- Length of credit history: Longer histories with responsible use can reduce costs.

Case Study:

A 2024 study by the National Association of Insurance Commissioners (NAIC) found that drivers with poor credit scores paid up to 50% more in premiums compared to those with excellent credit. This demonstrates the importance of maintaining good financial habits.

Tips to Improve Your Credit Score:

- Pay bills on time.

- Reduce outstanding debts.

- Regularly check and correct errors on your credit report.

| Credit Score Range | Estimated Impact on Premium |

| 750+ (Excellent) | Lowest Premium |

| 650-749 (Good) | Moderate Premium |

| 550-649 (Fair) | Higher Premium |

| Below 550 (Poor) | Highest Premium |

6. Your Coverage Limits and Deductibles

Selecting the right coverage limits and deductibles is essential when managing your auto insurance expenses. Insurers evaluate how much risk they take on when determining your premium, which means that higher coverage limits and lower deductibles generally lead to increased costs. Understanding these trade-offs can help you make the best financial decision while ensuring adequate protection.

The amount of coverage you choose affects your premium:

- Higher coverage limits = higher premium

- Lower coverage limits = lower premium

- Higher deductible (what you pay before insurance kicks in) = lower premium

- Lower deductible = higher premium

Example Scenario:

Lisa, a 35-year-old driver, chooses a $500 deductible policy and pays $1,200 per year for auto insurance. If she increases her deductible to $1,000, her premium reduces to $950 per year, saving her $250 annually.

How to Optimize Your Coverage:

- Assess your financial situation to determine the best deductible.

- Only purchase necessary coverage—avoid unnecessary add-ons.

- Compare different coverage plans and choose a balance of protection and affordability.

| Coverage Option | Impact on Premium |

| High Coverage, Low Deductible | Higher Premium |

| Moderate Coverage, Medium Deductible | Moderate Premium |

| Basic Coverage, High Deductible | Lowest Premium |

7. Your Annual Mileage and Driving Habits

Your driving habits and the total miles you cover each year are among the critical factors that affect your auto insurance premium. Insurers believe that higher mileage increases the probability of accidents, making frequent drivers a greater risk. On the other hand, those who drive less often are rewarded with lower premiums. Understanding how insurers assess mileage can help you adopt habits that reduce your insurance costs.

The more you drive, the greater your risk of an accident. Insurers assess:

- Daily commute distance: Longer commutes may mean higher premiums.

- Usage type: Personal vs. business use can affect rates.

- Annual mileage: Low-mileage drivers often get discounts.

Case Study:

John, a remote worker, drives only 6,000 miles per year. By switching to a pay-per-mile insurance policy, he saves 30% compared to his previous traditional plan, proving how mileage-based policies can benefit low-mileage drivers.

How to Reduce Mileage-Based Premiums:

- Consider public transport or carpooling.

- Opt for a usage-based insurance plan.

- Work remotely if possible to lower daily mileage.

| Annual Mileage | Estimated Impact on Premium |

| Below 7,500 miles | Lowest Premium |

| 7,500 – 15,000 miles | Moderate Premium |

| 15,000+ miles | Highest Premium |

Final Thoughts

By understanding the factors that affect your auto insurance premium, you can make smarter financial decisions and reduce your costs. Whether through safer driving, choosing the right vehicle, or adjusting your coverage, small changes can lead to significant savings. Stay informed, shop around, and take proactive steps to get the best insurance rates possible.

Implementing these strategies and keeping up with the latest trends in the insurance industry will help ensure you get the best coverage at the most affordable price.