Popular Articles

How Digital Disconnect Evening Rituals Can Transform Your Sleep Quality

The clock in the kitchen struck two. Jim sat in the heavy silence of his London flat. The only light...

The Great Energy Bifurcation: Why America is Drilling while China is Rewiring

The global economy is fracturing in plain sight. This is no longer a passing trade dispute globally or a bout...

The 5 Best Isekai Anime Airing This Season: Don’t Miss Out! [The Ultimate Guide]

Finding a new anime to watch can feel like a part-time job, especially when you’re craving a specific flavor of...

Beyond the Red Rose: Why Monogamy Meets Reality This Valentine’s Day 2026 [Part 2]

The white dress is still there. The champagne is still cold. But at a wedding in 2026, the vows have...

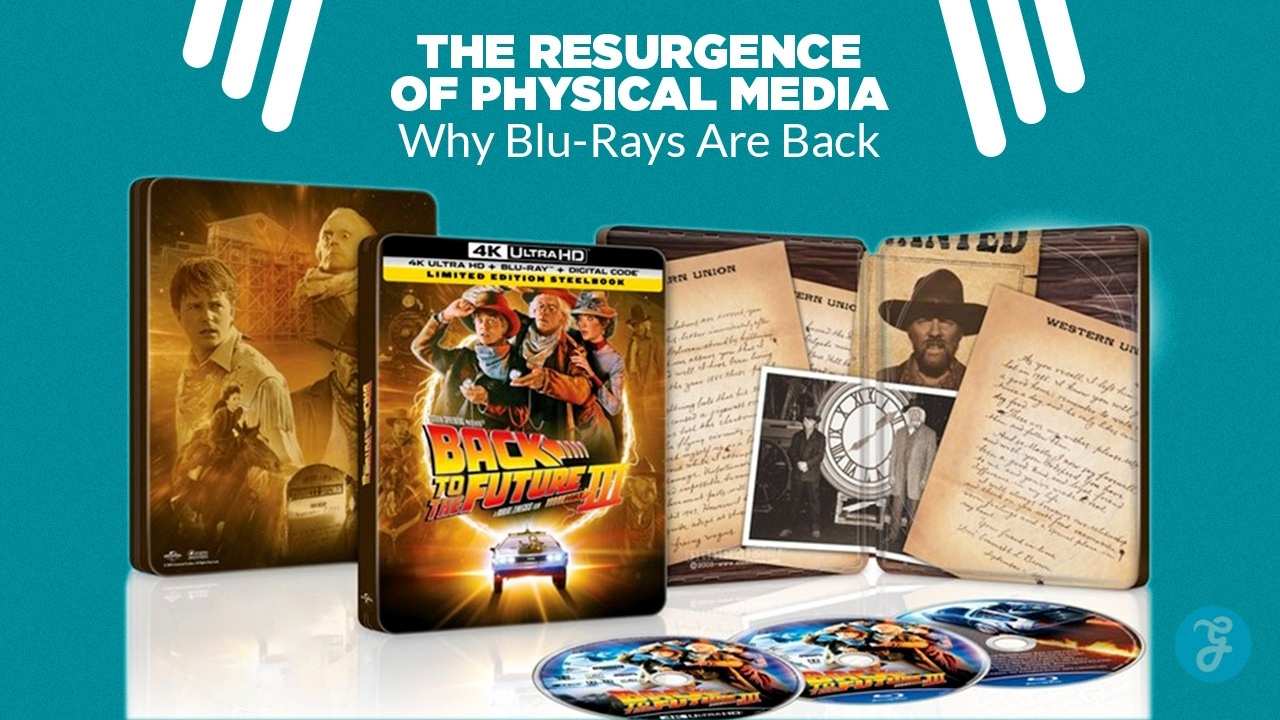

The Surprising Resurgence of Physical Media: Why Blu-Rays Are Back!

Have you ever sat down on a Friday night, popcorn in hand, ready to stream that one movie you’ve been...

The “Parasite SEO” Trend: Is It Still Viable in 2026? Find Out!

Are you tired of pouring hours into your website, only to see it stuck on page two or three? It’s...

Latest Articles

How Digital Disconnect Evening Rituals Can Transform Your Sleep Quality

The clock in the kitchen struck two. Jim sat in the heavy silence of his London flat. The only light...

The Great Energy Bifurcation: Why America is Drilling while China is Rewiring

The global economy is fracturing in plain sight. This is no longer a passing trade dispute globally or a bout...

Economic Prosperity is More Important than Religious Politics: The Gist of Bangladesh’s 13th National Election

On February 12, 2026, Bangladesh pulled off a democratic miracle. Eighteen months after the bloody July 2024 youth uprising that...

Top 6 Reusable Water Bottles That Last a Lifetime

Let’s be honest: we have all been there. You grab a cheap plastic bottle from the checkout aisle because you’re...

Top 10 Esports Tournaments to Watch in Q1 2026

The esports calendar doesn’t wait for anyone, and the start of 2026 has proven that emphatically. We used to have...

The 5 Best Isekai Anime Airing This Season: Don’t Miss Out! [The Ultimate Guide]

Finding a new anime to watch can feel like a part-time job, especially when you’re craving a specific flavor of...