Have you ever set up a crypto wallet, then froze when you saw all the options on big exchanges? Decentralized exchanges, or DEXs, use smart contracts on blockchain technology to let you trade digital assets peer to peer, with no middleman.

This guide walks you through setting up your crypto wallet, finding a DEX, using liquidity pools, and swapping tokens step by step. Keep reading.

Key Takeaways

- DEXs use smart contracts on blockchains. They run on networks like Ethereum and BNB Chain. Uniswap, SushiSwap, and PancakeSwap are popular DEXs.

- You keep private keys in a non-custodial wallet like MetaMask. You skip KYC/AML checks and tap into thousands of tokens in liquidity pools.

- AMM DEXs act like digital vending machines. Users deposit equal-value tokens, and the code swaps coins. Liquidity providers earn fees but face impermanent loss and price slippage. A $5,000 ETH/USDC swap in a small pool can trigger big slippage.

- Order book DEXs use on-chain limit orders. IDEX, EtherDelta, and Binance DEX show live bids and asks. They match traders without a central server.

- Beginners should install MetaMask from the official site and write down the 12–24-word seed phrase on paper. Run a small test trade to check gas fees. Track deals on block explorers like Etherscan.

How Decentralized Exchanges (DEXs) Work

Smart contracts on a blockchain network execute peer-to-peer trades with no central server. They tap liquidity pools and let a crypto wallet like MetaMask swap tokens via AMMs.

Peer-to-peer trading

Blockchain technology links buyers and sellers in a giant notebook. On Ethereum, smart contracts run trades automatically. Users keep control of private keys and funds, so no one else can touch their digital assets.

Uniswap, a popular decentralized exchange, uses liquidity pools and liquidity providers to make trades fast.

This peer-to-peer trading feels like a community swap meet, minus the old lawn mower. You set bids and asks, and market makers or other traders match your token swaps. The code locks in each trade in a smart contract until both sides finish.

You dodge counterparty risk and pay lower trading fees than on a centralized exchange.

Automated Market Makers (AMMs)

Automated market makers work like a digital vending machine for cryptocurrencies on a decentralized exchange. They run on smart contracts that hold liquidity pools of equal asset values.

Users drop in, they pick tokens, the code swaps. Uniswap, SushiSwap, PancakeSwap all follow this model. They let traders skip banks and brokers.

Liquidity providers lock crypto assets in a pool. They earn trading fees for market making. This setup cuts counterparty risk and fuels decentralized finance (DeFi). Pools sit on public blockchains like Ethereum network and BNB chain.

Traders may face impermanent loss if price ratios shift fast. Still, many join in to swap tokens peer-to-peer at lower fees.

Benefits of Using DEXs

You keep your private keys in a browser extension wallet. You tap into vast liquidity pools on blockchain networks, and you dodge prying eyes while you snap up rare digital assets.

Enhanced privacy

Decentralized exchanges run on smart contracts, so traders swap tokens without ID checks. They skip the usual KYC/AML procedures that crypto exchanges use. This model uses peer-to-peer trading and liquidity pools.

It hides personal info but still faces regulatory challenges. Its code on blockchain networks keeps deals visible yet private.

Traders keep full control of private keys and digital assets at all times. They tap blockchain technology to record token swaps on public ledgers. Automated market makers let users trade in AMMs without a middleman.

That cuts counterparty risk and avoids data leaks. This setup shields user info better than a typical crypto exchange.

Greater control of funds

Trading on a decentralized exchange keeps your crypto wallet keys in your hands. That setup gives you full control over private keys and digital assets. Blockchain technology uses smart contracts to approve token swaps inside automated market makers and liquidity pools.

Centralized exchanges ask users to transfer funds into their custody. This step raises counterparty risk and can invite hacks. DEX users skip that step. They pay trading fees on-chain and trade peer-to-peer.

Wide range of token options

DEXs host thousands of digital assets. Smart contracts drive each trade. Liquidity pools fill with tokens from many projects. Traders find coins on the Ethereum blockchain and BNB chain.

AMMs like Uniswap and PancakeSwap fuel token swaps. Cross-chain DEXs link assets across networks. Market makers add depth to pools. Peer-to-peer trading cuts out middlemen. Fees stay lower than on centralized exchanges.

Non-custodial wallets keep private keys safe. You control your crypto wallet and seed phrase. DEXs list unverified tokens too. That brings wide choice. It also drives risks like rug pulls.

Liquidity providers must vet each listing. Limit orders can curb price slippage and counterparty risk. Smart users test with small trades. Yield farming gains call for caution.

Risks and Challenges of Using DEXs

Liquidity pools can thin out, spawning brutal price slippage and harsh impermanent loss on a smart contract network. You guard all private keys in your crypto wallet, so one wrong click wipes your coins, and no rescue squad shows up when code bites back.

Price slippage

Price slippage means a trade fills at a worse rate than shown. In an automated market maker like Uniswap, a large swap changes the balance in the pool. Smart contracts recalc token ratios after each swap.

Traders pay extra cost due to lower pool depth or high volatility.

AMMs require equal asset values for liquidity pool deposits. A small ETH/USDC pool can see big slippage on a $5,000 swap. Liquidity providers earn trading fees, but they also face impermanent loss.

Low liquidity and heavy trades fuel slippage, hurting cost-conscious traders.

Lack of customer support

Decentralized exchanges run on smart contracts, not support staff. You can’t call a help desk if you lose your private keys or mess up a token swap. Users turn to forums, Reddit threads, or Discord channels for answers.

This self-directed style can spook new crypto traders.

A newbie once fired off a swap on the Ethereum blockchain at midnight. He stared at a failed transaction, then searched Telegram groups and a blockchain platform wiki for tips. He adjusted his gas fees and recovered his tokens on his own.

That peer-to-peer journey through liquidity pools feels more like a solo voyage than a guided walkthrough.

Common DEX Models

Your crypto wallet talks directly to each protocol, so you hold your keys, no babysitting needed. Limit book chains match bids to asks like a silent auction; pool swaps run like a self-serve snack bar, powered by liquidity tokens.

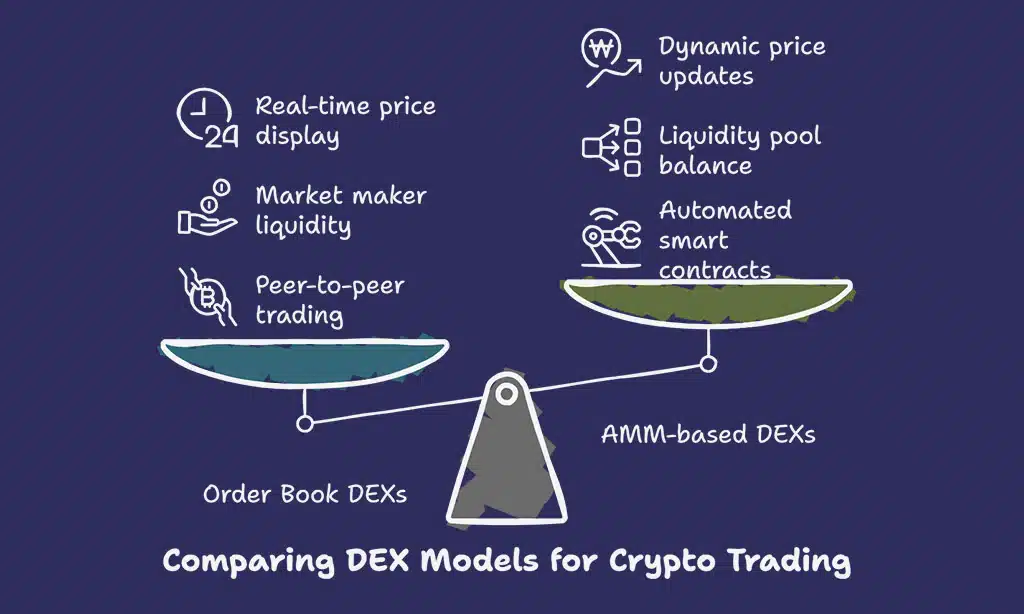

Order Book DEXs

Order Book DEXs form a decentralized exchange that links buyers and sellers with peer-to-peer trading. They use blockchain technology and enforce trades via smart contracts. Traders set limit orders in an on-chain ledger.

Each entry shows a price and digital asset amount. Users stay in charge of private keys throughout. IDEX, EtherDelta, and Binance DEX use this system.

Market makers add liquidity to the book and collect trading fees. A live order book displays bids and asks in real time. This model contrasts AMM-based DEXs with liquidity pools and price curves.

Traders spot clear rates before any swap of digital assets. It may feel like a stock market on blockchain.

AMM-based DEXs

Automated market makers run smart contracts and liquidity pools to set token prices on a decentralized exchange. Traders deposit assets equally, keeping pools balanced. One popular DeFi platform, Uniswap, set this trend on Ethereum.

Another swap service, PancakeSwap, lives on Binance Smart Chain. Liquidity providers earn a share of trading fees.

By cutting classic book systems, venues keep trades swift. Smart contracts auto execute swaps with no middlemen. Pool ratios shift as people swap tokens, updating prices. This setup handles any digital asset, from Ethereum-based coins to Binance Smart Chain tokens.

Tips for Beginners Using DEXs

Pick a secure digital vault and link it to Keymask fast; you sign each autonomous deal with ease. Scan trading fees, peek at vault depth, and mind slippage to keep your coins from slipping through the cracks.

Setting up a secure crypto wallet

A secure wallet guards your digital assets. It gives you non-custodial control over private keys.

- Install a trusted crypto wallet app or browser plugin, such as MetaMask, from the official site, so you avoid fake software.

- Record the seed phrase on paper, stash it in a fireproof safe, to keep it away from hackers and floods.

- Keep private keys offline, treat them like gold bars in a vault, and never share them online.

- Lock your wallet with a strong PIN or passcode, change it often, to block unwanted access.

- Connect your wallet to a decentralized exchange, choose an AMM or order book DEX, like Uniswap or Binance DEX.

- Send a small token swap on Ethereum blockchain or BNB Chain, test trading fees and gas costs, confirm the transaction.

- Track your balance on a block explorer tool, watch smart contracts and spot liquidity providers.

- Backup your wallet file in an encrypted folder on a spare drive, so a crash or malware cannot wipe out your funds.

Understanding transaction fees

Transaction fees on decentralized exchanges stay small. Smart contracts power each swap, cut overhead, and keep costs tight. Liquidity pools lock tokens, while liquidity providers earn rewards from trading fees.

AMMs like Uniswap show how blockchain technology can trim costs.

A token swap on the Ethereum blockchain needs a gas fee, paid with crypto wallets such as MetaMask or Trust Wallet. Peer-to-peer trading flows direct, with no gatekeeper. Lower fees mean you save more digital assets per trade.

Takeaways

You now hold the map to peer-to-peer trading fun. You guard your private keys and choose each step. Smart contracts and liquidity pools power your token swaps on any blockchain network.

A solid crypto wallet feels like a digital vault, safe and ready. Start small, grin at each gas fee, and grow skills as a liquidity provider.

FAQs

1. What is a decentralized exchange?

A DEX is peer-to-peer trading running on blockchain technology. It uses smart contracts so you trade digital assets without a middleman.

2. How do automated market makers work?

AMMs use liquidity pools and smart contracts, not order book dexs. You swap tokens and pay trading fees to liquidity providers.

3. How do I keep my crypto assets safe?

You use a crypto wallet and you hold private keys. Keep them offline, they are like a toothbrush, never share.

4. What is impermanent loss?

Impermanent loss happens when price shifts make your share in a pool worth less than simply holding tokens. It ties to liquidity mining and you can limit it with stable token pools.

5. How is a DEX different from a centralized exchange?

A DEX runs in decentralized finance (defi), so you avoid counterparty risk and strict know your customer and anti-money laundering checks. It may face scalability issues but often has lower fees.

6. Can I swap tokens across different blockchains?

Cross-chain dexs use bridges and smart contracts to move digital assets. They let you make token swaps on networks like the Ethereum blockchain or BNB Chain.