The consumption of processed foods and energy drinks is at an all-time high, leading to an increase in dental problems, both minor and severe.

Additionally, dental issues can arise due to various medical conditions. Well! The reasons why dental problems occur are numerous. Depending on their severity, dental treatments can often be more expensive than anticipated.

It’s important to find ways to address these issues without breaking the bank. This is where dental insurance becomes crucial.

Are you wondering how to choose the best dental insurance plan for your needs? If that’s the case, you’re now at the right place! Delve into this detail-oriented blog post, which sheds light on eight essential factors to consider when selecting the right dental insurance.

1. Coverage Options

Any insurance plan you think of should cover a broad spectrum of dental treatments, so it is essential to evaluate them closely.

Seek thorough coverage, including regular checkups and cleaning and basic treatments like extractions and fillings. Make sure you can also get significant treatments, including crowns, bridges, and root canals, without any financial worries.

Ask whether special services, including orthodontia or periodontal care, are part of it. Securing a comprehensive plan can protect you from major out-of-pocket costs for vital dental treatments.

2. Network of Providers

Never underestimate the value of choosing a plan with a network of dentists. Take the time to research the best dentists near me – be it general dentists, specialists, or orthopedic surgeons. Once you make this time investment, be aware that they are part of the insurance provider’s network.

A wider network expands your options for caregivers. Not just that, it also cuts costs since in-network specialists generally charge less than out-of-network providers.

3. Cost of Premiums

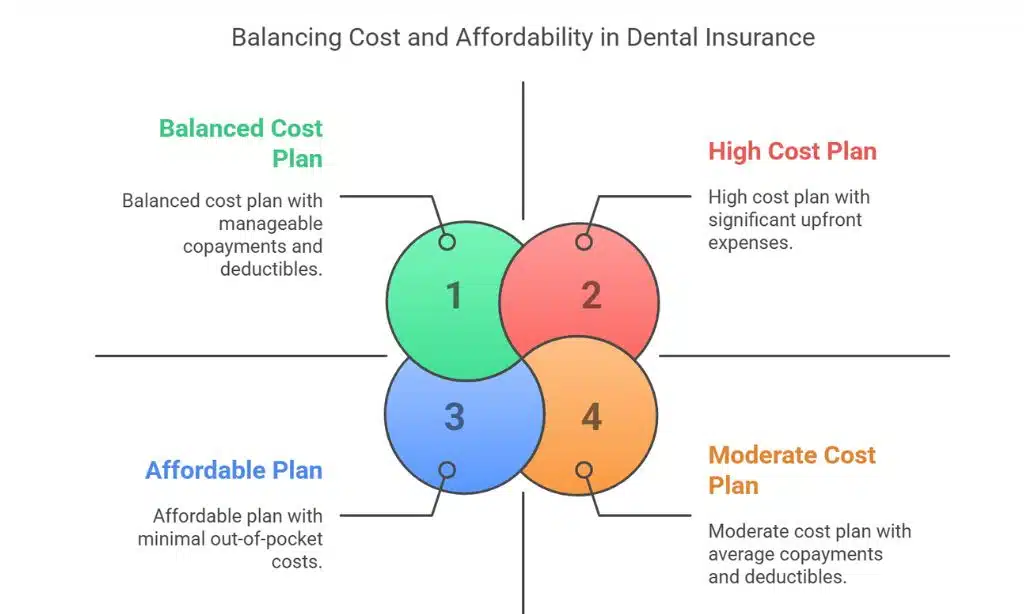

When comparing dental insurance plans, look for the monthly premium rates. Remember to evaluate how they correspond to the coverage benefits offered.

Looking beyond the price tag is crucial; evaluate how the premium fits with your future dental requirements and the total worth of the coverage. Just be sure that the more expensive plan offers more advantages.

Hence, investing in an all-inclusive dental insurance plan might save you more over time in case you need frequent dental treatments.

4. Deductibles and Copayments

Know the copayment schemes and deductibles for each insurance coverage. Copayments are the sums you owe at the time of service. On the contrary, the deductible is the amount you must pay before your insurance takes effect.

Since they might significantly affect your total financial investment in dental treatment, knowing these expenses is absolutely vital. A dental insurance plan with sensible copayments and easy deductibles matching your budget is what you should prioritize choosing.

5. Annual Maximums

Be aware of the annual maximum benefit limit imposed by dental insurance providers. This limit is the cumulative yearly limit of covered services for which the insurance will pay.

Setting the maximum too low might leave insufficient coverage for major treatments ranging from surgery to several procedures.

Think about your dental history as well as any expected future demands to guarantee that the plan corresponds to your possible yearly costs.

6. Waiting Periods

Be watchful of the waiting times related to particular dental treatments. Before you may go for major treatments, many dental insurance plans stipulate that you wait a time—usually six to twelve months.

It’s strongly advisable to choose a plan with little or no waiting times. The right selection will guarantee quick access to required dental treatment if you expect to need it right away.

7. Exclusions and Limitations

Now, you need to check the policy details carefully to find out any exclusions or limitations that may affect your coverage. Be informed that some dental insurance plans may not cover pre-existing conditions or could impose restrictions on specific dental procedures.

If you enquire about these specifics well in advance, you will feel more empowered to prevent any unexpected costs. Furthermore, you will be in the position to determine whether the insurance policy caters to your long-term dental needs.

8. Customer Reviews and Satisfaction Ratings

This step revolves around gathering insights from customer feedback, testimonials, and professional ratings for prospective dental insurance providers. Don’t forget to look into the claims procedure. Pay attention to how quick and responsive their customer service is.

Don’t stop there! Continue your search for general satisfaction rates among both existing and ex policy holders. Browse online review platforms or aggregating websites to gain valuable insights.

Thus, you can better determine whether your intended insurance providers are honest and trustworthy when managing claims efficiently.

Takeaways

Careful consideration of these critical elements will enable you to choose a dental insurance policy that satisfies your dental health needs. Ultimately, you will feel confident knowing you are well-covered for possible dental costs, contributing to ensure your financial position.