In recent years, cryptocurrency has garnered both attention and controversy, not just for its innovative technology and potential financial impact but also for its environmental footprint.

While digital currencies like Bitcoin and Ethereum have become household names, the energy consumption required to mine and validate these digital assets has raised concerns about their sustainability. The question many are asking is: Can crypto go green?

With initiatives like Ethereum 2.0, solar-powered mining farms, and carbon-neutral cryptocurrencies on the rise, the digital currency industry is taking bold steps toward reducing its environmental impact.

This article will explore the ways in which the cryptocurrency world is evolving to become more sustainable, focusing on Ethereum 2.0, solar-powered mining, and carbon-neutral coins.

The Environmental Impact of Traditional Crypto Mining

Traditional cryptocurrency mining, especially Bitcoin and Ethereum, continues to be one of the most energy-intensive activities in the world. Bitcoin mining, using the Proof-of-Work (PoW) consensus mechanism, has been a major source of environmental concern due to the vast energy required for mining operations.

Updated Bitcoin’s Energy Consumption

As of 2023, Bitcoin’s energy consumption has dropped slightly due to a shift in mining activity from countries like China (where energy policies became stricter) to places with cheaper renewable energy sources like Iceland and Canada.

However, Bitcoin’s energy consumption still remains high. According to the Cambridge Centre for Alternative Finance (CCAF), Bitcoin’s estimated annual electricity consumption is still around 140 TWh. This is comparable to the energy consumption of countries like Argentina and Norway.

| Bitcoin Network Energy Consumption | Country Comparisons |

| Annual Energy Consumption | 140 TWh (estimated) |

| Country Equivalent | Argentina or Norway |

Carbon Emissions

Bitcoin’s carbon footprint largely depends on the energy mix used by miners. While some regions are now using cleaner energy, others, especially in regions with cheap coal-based power, still contribute to significant carbon emissions.

Estimates from Digiconomist suggest that the carbon footprint of Bitcoin is approximately 61.3 MtCO2 (metric tons of CO2) per year.

Ethereum 2.0 and the Shift to Proof-of-Stake (PoS)

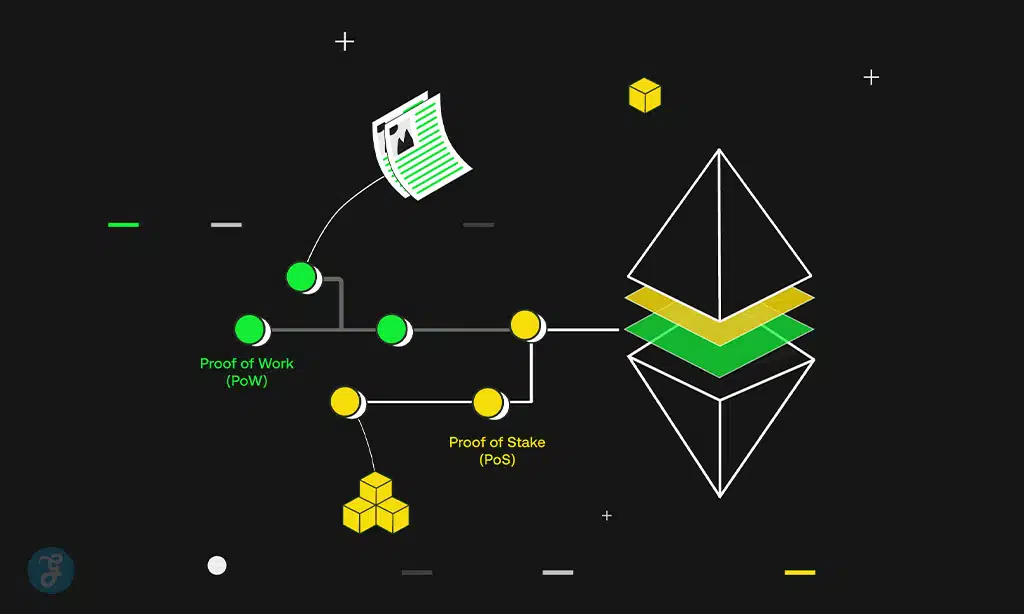

Ethereum completed its transition to Ethereum 2.0 in 2022, with the full migration from Proof-of-Work (PoW) to Proof-of-Stake (PoS) through an upgrade called “The Merge.” This move drastically reduced Ethereum’s energy consumption by over 99.95% compared to its previous PoW mechanism.

- Ethereum’s Energy Consumption Post-Merge: Ethereum’s energy consumption after the PoS upgrade is estimated to be just 0.005 TWh annually, making it one of the most energy-efficient blockchains.

- Environmental Benefits: Ethereum 2.0’s PoS system requires far less computational power. Instead of miners competing to solve complex mathematical problems, validators simply lock up Ethereum (stake) and are rewarded for verifying transactions.

| Ethereum 2.0 Energy Consumption | Traditional PoW Mining |

| Annual Energy Consumption | 0.005 TWh (estimated) |

| Traditional PoW (Bitcoin) | 140 TWh (estimated) |

Impact on Sustainability and Scalability

Ethereum 2.0’s PoS system has not only made the network more sustainable but also improved its scalability. PoS allows Ethereum to process more transactions with less energy, which is crucial as demand for decentralized applications and smart contracts continues to grow.

Solar-Powered Crypto Mining: A Game Changer?

Solar-powered mining is growing, but it still represents a small fraction of the total global mining activity. While major mining hubs like China have cracked down on energy-intensive mining operations, regions with abundant sunlight, such as Texas, Chile, and Australia, have seen a rise in solar-powered mining projects.

- 2023 Solar Mining Farms: Several mining farms are now fully powered by renewable energy, including solar power. For instance, SolarCoin is a cryptocurrency aimed at encouraging the use of renewable energy, and it incentivizes solar mining farms.

Benefits of Solar-Powered Mining

- Cost Efficiency: As solar panel technology has become cheaper, it has made solar-powered mining more cost-effective over time.

- Environmental Impact: Solar-powered mining eliminates carbon emissions, making it one of the most sustainable forms of mining.

| Solar-Powered Mining Farm | Traditional Mining Farm |

| Energy Source | Solar panels (renewable) |

| Carbon Emissions | Zero |

| Cost Over Time | Lower (due to solar power) |

Carbon-Neutral Cryptocurrencies: The Rise of Eco-Friendly Coins

In 2023, several cryptocurrencies have emerged that focus on carbon neutrality, meaning they aim to neutralize the carbon emissions generated by their network activities. These cryptocurrencies invest in initiatives like tree planting, renewable energy projects, and carbon capture technologies to offset their emissions.

- Chia (XCH): Chia uses a unique Proof-of-Space mechanism, drastically reducing energy consumption compared to traditional mining methods. This makes Chia one of the most energy-efficient and sustainable cryptocurrencies.

- Nano (NANO): Nano is a block lattice architecture cryptocurrency that doesn’t require mining at all. Instead of PoW or PoS, it uses a system where users can validate transactions through a blockchain-like structure without relying on energy-intensive processes.

- Algorand (ALGO): Algorand has committed to being carbon-neutral, offsetting its emissions by investing in environmental programs and utilizing energy-efficient consensus mechanisms (Pure Proof of Stake).

| Crypto | Consensus Mechanism | Carbon Offset Method |

| Chia | Proof-of-Space | Reduced energy use through innovative mechanism |

| Nano | Block Lattice Architecture | Zero energy consumption, no mining required |

| Algorand | Pure Proof-of-Stake (PoS) | Carbon offset projects |

Growing Demand for Green Cryptos

The increasing demand for environmentally friendly coins is being driven by growing awareness of climate change, as well as an increasing number of institutional investors and eco-conscious traders. As a result, blockchain projects are being pushed to adopt sustainable models in order to attract investment and meet public expectations for environmental responsibility.

Can Crypto Go Green: Regulatory and Market Trends

Several countries are now considering stricter regulations for the crypto industry to ensure sustainability. For example:

- EU’s Digital Finance Package: The European Union is taking steps to regulate crypto in a more environmentally conscious way, with discussions around including sustainability disclosures for crypto assets.

- US Initiatives: In the U.S., states like New York and California are working on legislation that could limit high-energy-consuming mining operations, especially those powered by non-renewable energy sources.

Investor and Market Demand for Green Crypto

As investors increasingly focus on sustainability, the demand for green blockchain investments is likely to rise. Major cryptocurrency investment funds are now prioritizing projects with transparent sustainability initiatives, such as carbon-neutral cryptocurrencies and eco-friendly mining operations.

Can Crypto Truly Go Green?

While the journey to a fully green crypto ecosystem is still ongoing, significant progress has been made. Ethereum 2.0 has proven that a massive blockchain can drastically reduce energy consumption, while solar-powered mining and carbon-neutral coins are gaining ground in the market.

However, the road ahead requires continued innovation and investment in clean energy sources, as well as broader adoption of sustainable practices across the cryptocurrency industry.

Final Thoughts

The cryptocurrency industry is at a crossroads when it comes to sustainability. While its early days were marked by high energy consumption and environmental harm, innovations like Ethereum 2.0, solar-powered mining, and carbon neutral cryptocurrencies are changing the landscape.

With these advancements, crypto can indeed go green—it’s just a matter of continuing to push for innovation, sustainability, and regulatory support.

The future of cryptocurrency may very well be green, and as the industry continues to evolve, it will be crucial for investors, users, and developers to prioritize environmental responsibility.