Cryptocurrency is changing lives. It gives power to people who were often left out by traditional systems. By 2025, new crypto tools are helping underserved groups in big ways. Over 1.7 billion adults worldwide lack access to banks, but many have smartphones.

Decentralized finance (DeFi) now offers financial services through these phones.

Crypto reduces fees for migrant workers sending money home fast and safely. Groups like GiveDirectly use blockchain tech to send aid without wasting resources or losing funds along the way.

Also, Ethereum 2.0’s eco-friendly upgrades make mining less harmful to nature.

Education platforms teach communities about crypto and money skills too—helping them grow stronger futures. Small businesses get micro-loans with blockchain, sparking local success stories everywhere.

There’s more ground-breaking progress ahead!

Key Takeaways

- Crypto helps 1.7 billion unbanked adults join the financial system through DeFi tools like wallets and peer-to-peer loans.

- Blockchain-based solutions make Universal Basic Income (UBI) faster, cheaper, and fairer for underserved communities worldwide.

- Smart contracts support small businesses by offering secure microloans without needing banks, empowering entrepreneurs to grow.

- Blockchain makes crisis relief better by sending direct aid safely and quickly, cutting costs and avoiding middlemen delays.

- Tools like tokenized carbon credits promote green projects while helping underserved areas earn from eco-friendly initiatives like tree planting.

Financial Inclusion Through Decentralized Finance (DeFi)

DeFi opens doors for 1.7 billion unbanked adults worldwide. It uses blockchain technology to offer financial services without banks. Decentralized exchanges and cryptocurrency wallets let people save, borrow, or send money directly.

These tools cut costs and build trust in underserved regions.

Two-thirds of the unbanked own mobile phones. DeFi platforms use this link to bridge the digital divide. Peer-to-peer lending connects lenders and borrowers quickly using smart contracts.

In the Global South, initiatives like Crypto For Good Fund IV work hard to expand financial inclusion through blockchain-based solutions.

Enabling Access to Universal Basic Income (UBI)

Crypto makes UBI easier to reach underserved communities. Blockchain technology allows fast and low-cost payments. With smart contracts, money is sent directly to people without a middleman.

This stops fraud and saves resources for social impact projects. Digital assets also let governments or charities use e-money for fair distribution of funds.

Worldwide, many people lack access to banks, making cash hard to receive. Using decentralized solutions solves this digital divide issue. For example, blockchain-based systems can work with mobile wallets even in rural areas.

These tools help the unbanked and underbanked join the global economy while supporting sustainable development goals like reducing poverty.

Empowering Entrepreneurs with Microfinance Solutions

Small business owners often struggle to get loans. Blockchain-based micro-lending changes this. Decentralized platforms let people lend small amounts of electronic money to entrepreneurs in underserved communities.

This gives them a chance to grow their businesses without relying on traditional banks.

Smart contracts make these loans secure and transparent. Borrowers can access capital quickly, helping them buy tools or expand services. Think of a farmer buying better seeds or a tailor getting new machines.

These solutions boost economic empowerment and encourage social entrepreneurship worldwide.

Facilitating Transparent and Secure Remittances

Helping small business owners often involves sending money home. Many migrant workers send remittances to support families abroad. Cryptocurrencies make this cheaper and quicker. Using blockchain technology, fees drop compared to banks or services like Western Union.

The Latino community has embraced digital assets for cross-border transfers. Transactions are faster and safer through crypto wallets. Smart contracts ensure that funds reach the right hands without delays or middlemen interference.

This method reduces corruption risks while saving time and money for underserved communities globally.

Land Title Authentication for Property Ownership

Owning land can be life-changing, but proving ownership is often tricky. Blockchain technology makes this process easier for underserved communities. It creates tamper-proof records of property rights using smart contracts.

These digital agreements are stored securely and cannot be changed without clear proof. This helps solve the problem of fake documents or disputes over land ownership.

Many people in rural areas lack access to fair systems that protect their land titles. Blockchain-based solutions make title authentication cheaper and faster than traditional methods.

With secure digital tools, individuals can safeguard what they own without extra costs or complex steps. Such transparency also builds trust within local economies, boosting economic empowerment for those who need it most.

Next up, learn how crypto aids crisis relief efforts!

Supporting Crisis Relief and Aid Distribution

Crypto speeds up aid during crises. Groups like GiveDirectly send funds directly to those in need using blockchain technology. This avoids middlemen, cutting delays and costs. Smart contracts manage donations fairly, ensuring money goes where it’s needed most.

Blockchain keeps everything clear and open. It tracks every dollar sent for humanitarian aid or food distribution without errors. The United Nations World Food Program uses crypto to help disaster victims quickly and safely.

Blockchain-Based Voting Systems for Greater Representation

Blockchain voting makes elections safer and fairer. It keeps votes secure using smart contracts, stopping tampering or fraud. Voters can check their choices without fear of them being changed.

This builds trust in the process, especially for underserved communities.

These systems allow people to vote from anywhere with internet access. They help those who can’t travel to polling stations or face barriers like long lines. More voices get heard this way, giving stronger representation for everyone.

Next up: how crypto aids education through scholarships…

Enhancing Education Through Crypto-Powered Scholarships

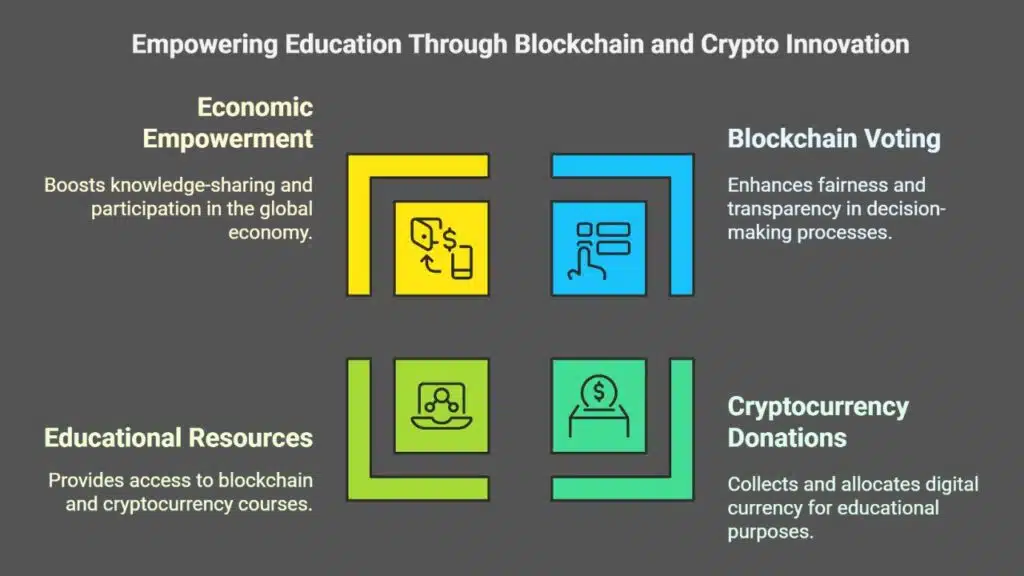

Voting systems using blockchain improve fairness. This same technology helps students through crypto scholarships. These programs give financial aid to those in need, breaking the digital divide.

Platforms like The Giving Block collect cryptocurrency donations for education. Such tools fund learning while promoting digital literacy. Schools can use these resources to teach about financial inclusion and smart contracts.

Many platforms now offer courses on blockchain and cryptocurrency basics. Coursera and Udemy have affordable lessons for all ages in underserved communities. Crypto scholarships cover fees for such classes, boosting economic empowerment through knowledge-sharing.

With digital assets supporting education, more people understand tools like decentralized finance (DeFi) and participate in the global economy confidently!

Tokenized Carbon Credit Programs for Environmental Impact

Crypto can help fight climate change. Tokenized carbon credits let people and companies support green projects easily. These digital assets are stored on blockchain, making them transparent and secure.

Ethereum 2.0’s proof-of-stake uses less energy than older mining methods. Crypto-backed platforms now promote sustainable finance by tracking carbon emissions accurately. This pushes businesses to adopt cleaner practices while helping underserved communities earn from eco-friendly efforts like tree planting or renewable energy projects.

Promoting Fair Trade Through Transparent Supply Chains

Tokenized carbon credits improve the environment, but fair trade uplifts people. Blockchain technology tracks goods like coffee or cocoa from farms to stores. This helps consumers see where their products come from and how workers are treated.

Smart contracts make sure payments go directly to farmers without middlemen. Fair trade becomes more than a label—it becomes proof of ethical sourcing. Social enterprises use these tools to support underserved communities while advocating for transparent governance in supply chains.

Takeaways

Crypto is changing lives. It gives hope to underserved communities by breaking old barriers. From fair trade to secure voting, it opens doors for growth and voice. Digital tools like DeFi boost access, while education spreads knowledge about using these systems.

Crypto isn’t just money—it’s a lifeline for millions reaching for brighter futures.

FAQs

1. How does cryptocurrency promote financial inclusion for underserved communities?

Cryptocurrency allows people without access to traditional banks to use digital assets for payments, savings, and investments through decentralized finance platforms.

2. What role does blockchain technology play in humanitarian aid?

Blockchain-based solutions improve transparency in distributing food aid and charitable donations by tracking funds and ensuring they reach the right people.

3. Can smart contracts help with economic empowerment?

Yes, smart contracts automate agreements like property rights or fundraises, reducing costs and giving underserved communities more control over their resources.

4. How are decentralized autonomous organizations (DAOs) making a social impact?

DAOs enable participatory governance where members vote on policies or charitable purposes, creating transparent governance systems that benefit local economies.

5. Why is digital literacy important in bridging the digital divide?

Digital literacy helps individuals understand how to use cryptocurrency safely while navigating blockchain technology for better opportunities in the global economy.

6. Are there any examples of crypto aiding global programs like food assistance?

Yes, projects like The United Nations World Food Programme use blockchain tools to distribute food aid efficiently without intermediaries slowing down delivery times or increasing costs.