Health insurance plays a pivotal role in safeguarding your family’s health and financial well-being.

With the landscape of healthcare evolving constantly, choosing the best health insurance plan for your family in 2025 is a critical decision that requires careful consideration and understanding. Finding an insurance provider that utilizes a core insurance solution that balances affordability, comprehensive coverage, and access to quality care is essential for protecting your family’s health and financial well-being.

This comprehensive guide will walk you through the process of selecting the most suitable plan, ensuring your family’s needs are met without straining your budget.

Understanding Health Insurance Basics

Health insurance is a contract between you and an insurance provider that covers a portion of your medical expenses in exchange for a premium. It acts as a safety net, helping you manage the financial burden of healthcare costs. For instance, a family health plan might cover 80% of hospitalization costs after meeting your deductible, significantly reducing your out-of-pocket expenses. This financial relief ensures access to necessary medical care when needed most.

Key Terms You Need to Know

Familiarity with these terms is crucial when evaluating the best health insurance plan for your family:

- Premiums: The monthly cost you pay for your health insurance coverage.

- Deductibles: The amount you must pay out-of-pocket before your insurance kicks in.

- Co-payments: Fixed amounts you pay for specific services, such as doctor visits or prescriptions.

- Out-of-pocket maximums: The total amount you’ll pay in a year, after which your insurance covers 100% of costs.

- Network providers: Healthcare providers and facilities contracted with your insurance company to offer services at reduced rates.

| Term | Definition | Example |

| Premium | Monthly fee for insurance coverage | $300 per month |

| Deductible | Amount you pay before insurance starts covering costs | $1,500 annually |

| Co-payment | Fixed fee for services | $20 per doctor visit |

| Out-of-pocket Maximum | Maximum you’ll pay annually before insurance covers 100% | $6,000 |

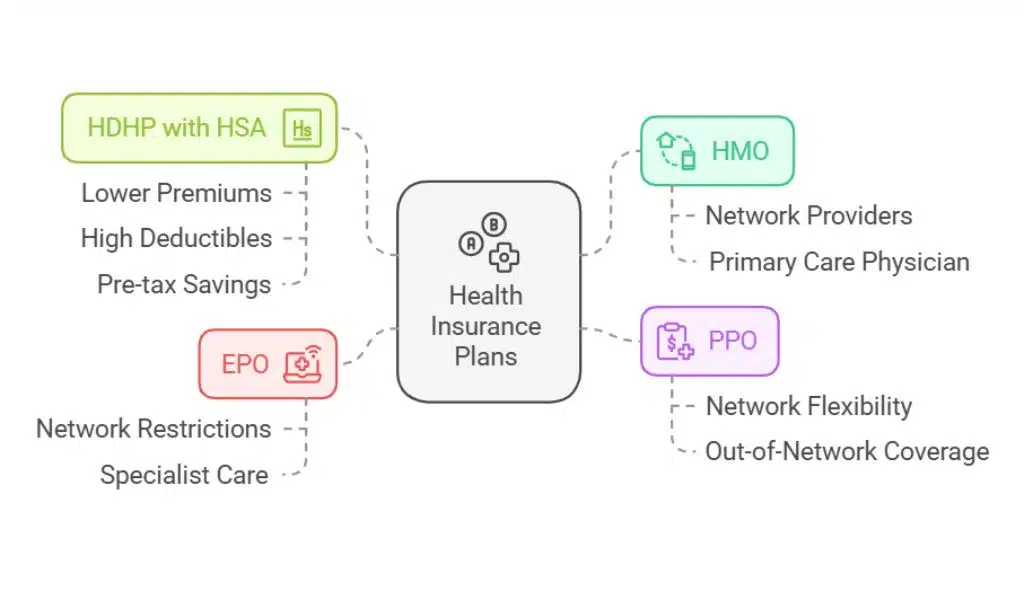

Types of Health Insurance Plans

To choose the best health insurance plan for your family, it’s essential to understand the different types of plans available:

- HMO (Health Maintenance Organization): Requires you to use network providers and select a primary care physician (PCP) for referrals. These plans often have lower premiums but limited flexibility.

- PPO (Preferred Provider Organization): Offers more flexibility with network and out-of-network providers but at a higher cost, ideal for families with diverse healthcare needs.

- EPO (Exclusive Provider Organization): Combines HMO’s network restrictions with PPO’s flexibility, often at a mid-range cost, suitable for families needing specialist care within a defined network.

- HDHP (High Deductible Health Plan) with HSA (Health Savings Account): Features lower premiums but higher deductibles, allowing you to save pre-tax dollars for medical expenses, making it a great option for healthy families wanting to plan for unexpected events.

| Plan Type | Monthly Premium | Deductible | Flexibility | Suitable For |

| HMO | $200 | $1,500 | Limited | Routine care and lower costs |

| PPO | $300 | $1,000 | Extensive | Families needing diverse specialists |

| EPO | $250 | $1,200 | Moderate | Specialist care within a network |

| HDHP | $150 | $3,000 | High flexibility | Healthy families or savings planners |

Assessing Your Family’s Needs

Every family has unique healthcare needs. To select the best health insurance plan for your family, consider:

- Routine Care: How often family members need check-ups or preventive care.

- Specialized Care: Requirements for specialists, surgeries, or chronic condition management.

- Family Size and Age: Larger families or families with young children may require broader coverage options. For instance, a family with young children might prioritize pediatric care, while a family with older members might need comprehensive coverage for chronic conditions or regular check-ups.

Real-Life Example

Consider a family of four with two school-aged children. If the children require regular pediatric visits and vaccinations while one parent manages a chronic condition, a PPO plan might offer the necessary flexibility to access both pediatric specialists and ongoing treatment for chronic care.

Analyzing Health History and Future Needs

Reflect on your family’s medical history and anticipate potential future needs:

- Chronic Conditions: Identify ongoing treatments or medications. For example, if a family member has diabetes, ensure coverage includes medication and specialist visits.

- Planned Procedures: Consider upcoming surgeries or maternity care. Anticipating these needs can help you select a plan with lower deductibles.

- Emerging Needs: Account for changes like aging parents moving in or adding dependents, which may necessitate more extensive coverage.

Determining Budget Constraints

Balancing affordability with coverage is key. Evaluate:

- Monthly Premiums: Ensure they fit your financial plan.

- Out-of-pocket Costs: Assess deductibles, co-pays, and maximums for a complete picture. For instance, lower premiums may mean higher out-of-pocket costs for services.

- Tax Implications: Certain plans, like HDHPs with HSAs, offer tax advantages that can offset higher deductibles.

| Budget Consideration | Key Factor | Example |

| Monthly Premium | Regular cost for coverage | $250/month |

| Deductible | Upfront expense before benefits | $2,000 annually |

| Tax Benefits | Savings with HSA contributions | Up to $3,850/year (single) in 2025 |

Comparing Health Insurance Plans

Take advantage of comparison tools to simplify your search for the best health insurance plan for your family. Platforms like HealthCare.gov or private comparison sites allow you to input your family’s needs and budget to filter plans. These tools often provide side-by-side comparisons to help you identify key differences.

Key Factors to Compare

Coverage and Benefits

Ensure the plan covers essential benefits such as:

- Hospitalization: Does the plan include inpatient and emergency care?

- Prescription Medications: Are common drugs covered under the formulary?

- Preventive Services: Does the plan cover vaccinations, screenings, and annual check-ups?

| Benefit Type | Coverage Inclusions | Typical Exclusions |

| Hospitalization | Inpatient care, ICU | Private rooms (in some plans) |

| Prescription Drugs | Generic and brand-name medications | Experimental drugs |

| Preventive Services | Vaccines, wellness exams | Services without network providers |

Costs

Compare the financial aspects, including:

- Monthly Premiums: Ensure affordability.

- Deductibles and Co-pays: Verify upfront costs.

- Out-of-network Expenses: Evaluate additional charges for out-of-network care.

| Cost Factor | Key Consideration | Example |

| Monthly Premium | Recurring cost of coverage | $250 |

| Deductible | Amount before insurance kicks in | $1,500 annually |

| Out-of-Network Costs | Additional charges | 20% higher fees |

Network Availability

Confirm the plan includes your preferred healthcare providers and facilities. For example, families living in rural areas should check if the network includes local doctors.

Customer Support and Reviews

Look for feedback on:

- Claims processing

- Customer service quality

- Plan user satisfaction scores

Tips for Making an Informed Decision

Avoid Common Pitfalls

When selecting the best health insurance plan for your family, be mindful of these common mistakes:

- Overlooking Hidden Fees: Review all plan details to identify extra costs.

- Choosing Insufficient Coverage: Ensure the plan meets your family’s medical and financial needs.

Leverage Employer-Sponsored Plans

If available, employer-sponsored health insurance often provides:

- Lower premiums

- Additional benefits like dental and vision coverage

Consult with a Licensed Agent

An insurance agent can offer tailored advice and help you understand complex policy details. For example, they can clarify how out-of-pocket maximums impact long-term costs.

Enhancing Your Health Insurance Experience

Maximizing Benefits

To get the most from the best health insurance plan for your family:

- Take advantage of free preventive services, such as flu shots and annual wellness exams.

- Understand your plan’s claims submission process to avoid delays in reimbursements.

Staying Updated

Stay informed about:

- Annual policy renewals

- Changes in healthcare regulations for 2025, such as updates to tax credits or subsidies.

Exploring Supplemental Insurance

Supplemental policies can provide additional coverage for:

- Dental and Vision Care: Often excluded from standard plans.

- Critical Illness and Accident Insurance: Offers financial protection for unexpected events.

| Supplemental Coverage Type | Key Benefits | Ideal For |

| Dental Insurance | Covers routine cleanings, x-rays, and fillings | Families with frequent dental needs |

| Vision Insurance | Includes eye exams, glasses, and contact lenses | Individuals with prescription eyewear |

| Critical Illness Insurance | Lump-sum payouts for serious conditions | High-risk individuals |

Interactive Resources

Sample Comparison Table

| Plan Type | Monthly Premium | Deductible | Network Flexibility | Best For |

| HMO | $200 | $1,500 | Limited | Routine care and lower costs |

| PPO | $300 | $1,000 | Extensive | Families needing diverse specialists |

Checklist for Choosing the Best Plan

- Assess family health needs.

- Calculate your budget.

- Compare plan options using trusted tools.

- Review network coverage.

- Consult with an expert if needed.

Takeaways

Choosing the best health insurance plan for your family in 2025 empowers you to safeguard their well-being while managing healthcare costs effectively. By understanding the basics, assessing your family’s needs, and comparing plans carefully, you can make an informed decision.

Take action today to secure a healthier and financially stable future for your family.