Almost every lender does a soft or hard credit check before providing a loan. As a result, acquiring a loan as a business with a bad credit score can be challenging.

This is where bad credit business loans come in. Read on to get a comprehensive understanding of this alternative loan-acquiring process:

What is a Bad Credit Business Loan?

A bad credit business loan is a financing option designed for business owners who have a low credit score but need funding. Traditional banks often reject loans to a business that has a poor credit history.

In such a situation, you can seek financing from alternative lenders or private financial institutions. These loans can be used to cover operational costs, buy inventory, expand business operations, or even pay off other high-interest loans.

Types of Bad Credit Business Loans

There are many different types of loans for bad credit, such as:

1. Invoice Financing

If your business generates revenue from invoices but doesn’t collect payment right away, this type of bad credit loan might be suitable. With invoice financing, you can receive a short-term loan based on your business’s outstanding invoices. Businesses with a B2B model, such as retail stores and warehouses, often apply for invoice financing.

2. Secured Loans

Secured loans are acquired by collateral, such as real estate, equipment, or inventory. They generally have low interest rates since the lender holds a guarantee in case of default.

3. Microloans

As the name indicates, microloans are small sums of money provided to small businesses that have bad credit scores. They have flexible repayment requirements, making them a great option for startups or struggling businesses.

4. Equipment Financing

If you need to purchase machinery, equipment, or vehicles, to keep your business running, you can apply for equipment financing. The equipment itself serves as collateral, reducing the lender’s risk.

5. Merchant Cash Advances [MCA]

A merchant cash advance provides businesses with a lump sum of cash in exchange for a percentage of their future debit or credit card sales.

6. Business Line of Credit

A business line of credit allows businesses to borrow amounts up to a certain limit and repay only what they have used. You can secure loans multiple times as long as the previous one has been repaid.

Each type of loan has its pros and cons. Carefully examine your business needs and predict future financial conditions. Compare different types of loans and apply for the one that meets your unique situation.

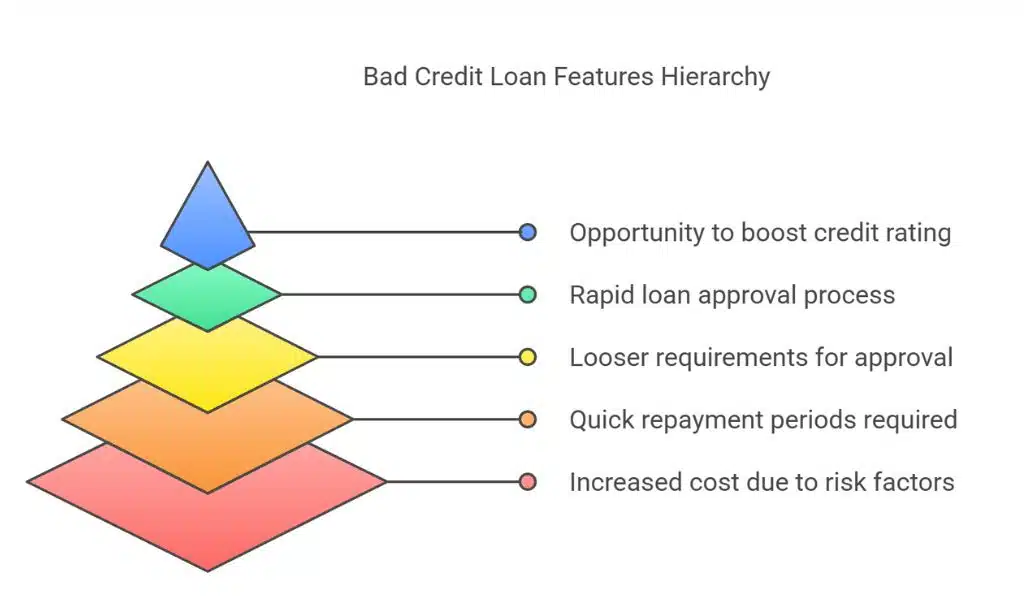

Key Features of Bad Credit Loans

Before you apply for a bad credit business loan, take a look at these features to deepen your understanding:

1. Higher Interest Rates

One of the most notable features of bad credit loans is higher interest rates. Businesses with poor credit histories are considered high-risk lenders. Therefore, borrowers compensate by charging higher annual percentage rates [APUs]. With robust financial planning, businesses can repay the loans before the interest rates become too high.

2. Shorter Repayment Times

Due to high risk, lenders often require businesses to pay back the loans in a short period of time. The repayment time can range from a few months to a few years. This condition can be managed if you apply for invoice financing or a business line of credit.

3. Flexibility in Eligibility

Unlike traditional financial institutions that rely heavily on the credit score history of a business, alternative lenders pay less consideration to this factor. They assess a business’s revenue, cash flow, and potential for growth. Some lenders are even willing to give loans to businesses that have a history of bankruptcy.

4. Fast Approval

One of the biggest advantages of acquiring a bad credit business loan is the fast approval procedures. In many cases, businesses are able to acquire loans as quickly as 24 hours. If you need capital for urgent expenses such as payroll, inventory, equipment, or emergency repair, a bad credit business loan can be incredibly beneficial.

5. Potential for Credit Score Improvement

Bad credit business loans might come with high interest rates but they can help businesses regain financial stability. By reducing debts, you can improve your credit history and qualify for better loan options in the future.

How to Improve Loan Approval Chances

Securing a business bad credit loan can be challenging but there are some steps you can take to improve your chances. Consider the following tips:

- Show strong cash flow and revenue potential. Lenders are more likely to approve your loan if you show detailed financial records, including bank statements and profit-loss reports.

- Consider providing collateral, such as equipment or real estate, to reduce lender risk.

- Always acquire bad credit loans from a reputable lender that provides transparent terms and conditions for interest rates, fees, and repayment schedules.

- Try to improve your credit score before applying. Paying off small existing debts can increase the lender’s confidence in getting a successful payback.

By following these tips, you can increase your chances of acquiring a loan despite your bad credit history.