Money problems can feel overwhelming. The rise of digital finance has helped, but risks like fraud, bad credit scores, and poor advice still keep many people up at night. Fintech companies face pressure to make systems faster, safer, and smarter while meeting customer demands.

AI-Driven Innovations Reshaping Fintech are changing the game entirely. Did you know AI in fintech is now worth over $44 billion? It’s driving fraud prevention, faster loans, better trading tools, and much more.

This blog will explore how artificial intelligence is solving some of the biggest challenges in finance today. You’ll discover the top 10 innovations making waves right now. Keep reading—you won’t want to miss this!

Fraud Detection and Prevention

AI-powered systems detect fraud by spotting unusual patterns in transactions. They can quickly identify anomalies like sudden large fund transfers or access from unknown locations.

These tools help stop scams, account takeovers, and identity theft before they grow into bigger problems.

In 2023, data breaches in finance cost $5.9 million yearly on average. AI reduces these losses, saving organizations $1.76 million per year through better cybersecurity measures. Companies like Feedzai and Hawk AI use advanced techniques to combat synthetic threats such as deep fakes or voice cloning that trick users into giving up sensitive information.

Personalized Financial Advisory Services

AI simplifies financial planning for everyone. It studies your spending patterns, income, and goals to create individualized financial advice. For example, it might suggest saving $200 more each month or lowering specific expenses based on your lifestyle data.

This approach removes guesswork, helping you plan smarter.

Chatbots powered by AI improve customer experiences by about 25%, according to IBM. They can answer questions like “How can I save for a down payment?” with fast and personalized answers.

These tools don’t just talk; they offer action-based budgeting recommendations that fit real-life needs.

About 80% of customers care as much about experience as the product itself. Personalized investment guidance makes users feel valued while supporting wealth growth. Whether it’s finding low-risk options or high-return plans, these services adapt to unique risks and preferences efficiently through automation!

AI-Driven Credit Scoring Models

AI-driven credit scoring models use machine learning to assess creditworthiness more accurately. They analyze alternative data like utility bills, social media activity, and payment histories.

This approach helps evaluate borrowers with limited traditional credit records. Predictive modeling reduces human errors while improving risk assessment.

Banks save time through automated decision-making systems powered by AI. According to Juniper Research, AI-based identity checks may cut $900 million in operational costs for banks.

These models also enhance financial inclusion by providing fairer evaluations for underserved groups. With 67% of companies investing in new tech like this [Accenture], digital transformation reshapes the future of lending practices.

Algorithmic Trading for Smarter Investments

AI transforms trading with speed and precision. Algorithms analyze market trends, adapt strategies in real time, and execute trades at lightning-fast speeds. High-speed trading allows investors to act in milliseconds, spotting opportunities others may miss.

For example, a US bank saw an 8% revenue boost through AI-powered analytics.

Data drives smarter investments. Machine learning refines trading algorithms as new information emerges. This means better decision-making and optimized profits during volatile markets.

Rapid execution minimizes risks while maximizing returns—making this method a game-changer for modern traders seeking efficiency and growth simultaneously!

Automated Loan Underwriting Systems

Automated loan underwriting systems use AI to evaluate loan applications in minutes. They cut review times drastically, from over seven days to just a few hours or less. This means approvals can now be completed within two days instead of waiting weeks.

Advanced technology like Zest AI’s software enables faster processing by analyzing credit risk efficiently.

These systems make smarter decisions by assessing data more accurately than humans. They review income, spending patterns, and credit history without bias. Credit scoring automation reduces errors and improves fairness in lending decisions.

By 2030, these technologies could save banks $31 billion on underwriting and collections costs [Deloitte]. With such tools, both lenders and borrowers benefit from quicker and smoother processes.

Robotic Process Automation in Financial Operations

RPA speeds up financial tasks like payment processing, invoice reconciliation, and accounts payable management. Bots handle repetitive jobs nonstop without mistakes. This saves companies time and reduces human errors significantly.

Financial firms are investing 5–20% of their digital budgets in analytical AI to boost productivity. Automation also ensures smoother reports for regulatory compliance. With fewer manual steps, businesses can focus on strategic goals instead of mundane work.

Enhancing Regulatory Compliance with AI

AI simplifies regulatory compliance by analyzing complex financial regulations. It scans documents to spot potential non-compliance issues quickly. This reduces human error and saves time in reviewing lengthy policies.

AI also automates customer verification, cutting digital onboarding time by 30%, as noted by Juniper Research. Faster onboarding improves process efficiency while maintaining strict regulatory oversight.

Financial institutions use AI-driven compliance tools to lower operational costs. These systems monitor transactions for red flags, ensuring adherence to rules without constant manual checks.

With advanced data analysis, banks identify risks earlier and manage them effectively. McKinsey highlights how AI enhances security and lowers costs, making regulatory adherence more efficient than ever before.

Predictive Analytics for Market Trends

AI-powered predictive analytics changes how we read market trends. It processes huge amounts of data in real time, spotting patterns no human could see. This helps financial firms forecast market shifts with higher accuracy.

For example, an automated trading system can identify signals and execute trades in mere milliseconds. Faster decisions mean better profits and fewer missed opportunities.

Predictive modeling also plays a major role in managing risks during algorithmic trading. AI systems analyze historical data to predict potential losses or gains under different scenarios.

Traders use these insights to adjust strategies quickly, reducing costly mistakes. With AI applications like this, fintech companies gain a clear edge over competitors who rely solely on traditional methods for market trend analysis.

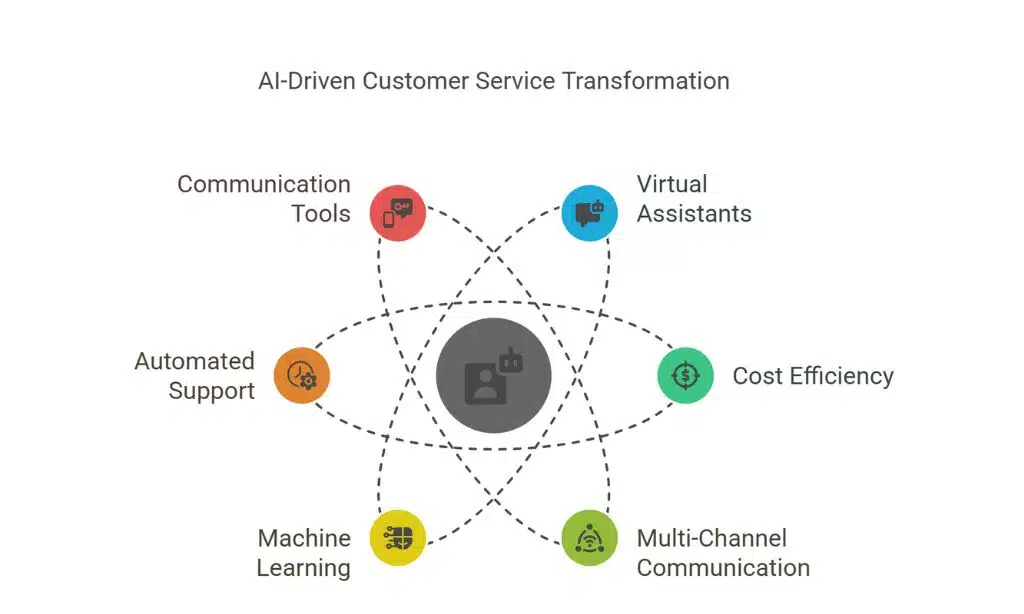

AI-Powered Customer Support and Chatbots

Virtual assistants like Devexa and Twilio transform customer service. They handle questions fast, using Natural Language Processing [NLP] to mimic human tone. These AI chatbots cut costs by up to 80%, according to IBM, saving companies money while boosting efficiency.

Platforms such as Webex Connect ensure smooth chats across multiple channels for a seamless experience.

Machine learning improves how these chatbots learn from past interactions. This creates better responses over time, making conversations feel more natural. Automated systems allow 24/7 support without waiting on hold.

Tools like Infobip and Vonage further enhance communication speed and accuracy, keeping customers satisfied with quick resolutions every time!

Improved Cybersecurity Measures in Fintech

AI is reshaping fintech security. Real-time threat detection stops cyberattacks before they cause harm. Intrusion detection systems, powered by AI, act like digital guards, spotting suspicious activity fast.

These tools respond instantly to protect sensitive financial data.

Behavioral biometrics adds another layer of safety. It monitors patterns in typing speed or login habits to detect fraud attempts. Improved authentication methods like facial recognition and advanced access controls keep accounts safe from hackers.

Even IoT devices in banks now work with AI for physical security through better surveillance systems and user behavior analysis.

Streamlined Payment Processing with AI

AI speeds up payment processing by automating crucial steps. It eliminates manual errors, ensuring transactions flow smoothly and accurately. Businesses gain efficiency, completing processes 108 days faster than systems without AI support.

Transaction matching becomes quicker and more precise, helping financial institutions save time and money.

Peer-to-peer lending platforms use AI to match borrowers with lenders efficiently. This technology analyzes borrower profiles in seconds, offering better matches instantly. Fraud detection tools powered by AI scan payments for unusual activity, stopping threats before they cause damage.

Financial reporting is automated too, reducing human error while providing fast insights into cash flows.

User Behavior Analysis for Personalized Offerings

AI studies customer behavior to offer better services. It tracks how users interact across apps, websites, and other channels. This helps businesses provide seamless experiences. For example, if a user often buys groceries online, they might get discounts or recommendations for related products.

Behavioral tracking uses AI algorithms and predictive analytics to predict what customers want next. Over 80% of people value experience as much as the product itself. Personalized recommendations increase engagement and foster loyalty.

Data-driven insights allow companies to improve customer satisfaction at every step.

Advanced Data-Driven Strategic Planning

AI-powered analytics help financial companies optimize revenue streams. By automating checks, AI models ensure data integrity, catching anomalies before they cause issues. Automated financial reporting tools save time and improve accuracy in strategic decision-making.

About 5–20% of a company’s digital budget often goes to analytical AI, highlighting its importance in advanced planning.

Smart algorithms analyze vast datasets to find growth opportunities. They streamline strategies by forecasting trends and risks with precision. This enhances both short-term goals and long-term plans seamlessly.

Financial leaders use insights from these advanced tools to boost efficiency while cutting costs effectively.

Real-Time Decision-Making with AI Technology

Artificial intelligence allows financial companies to make split-second decisions. Using machine learning, systems analyze massive data sets in seconds. For example, AI detects fraud by flagging unusual transactions instantly.

This keeps customer accounts safe and reduces losses.

In trading, algorithms respond quickly to market changes. A sudden drop in stock value triggers an instant buy or sell decision. With predictive analytics, businesses foresee risks before they happen.

Credit risk assessments also benefit from automation by evaluating a borrower’s profile in real-time.

Personalization is another key feature of this technology. Data analysis tailors recommendations for each user based on their spending habits or financial goals. Chatbots handle customer service requests immediately with accurate solutions, saving time for both sides while increasing satisfaction rates greatly.

Challenges and Limitations of AI Integration in Fintech

AI in fintech faces hurdles like data privacy concerns. Protecting sensitive customer information is tough, especially with increasing cyber threats. Hackers target financial platforms, exposing weak points.

Privacy protection demands strong security measures and strict data governance rules.

Bias in AI algorithms also creates problems. Historical inequalities may continue if fairness isn’t prioritized. Consumers lose confidence when systems seem unfair or unclear. Regulations around ethical AI and transparency add to the challenge too, as companies must follow complex laws while ensuring trustworthy advice for users.

The Future of AI in Transforming Financial Services

AI is transforming financial services at an extraordinary pace. It’s expected to increase the fintech market value from $44.08 billion in 2023 to $50 billion within five years, according to Statista and Fortune Business Insights.

Early adopters are already gaining a competitive edge by using AI for hyper-personalization, more intelligent risk analysis, and decentralized financial systems.

Collaborations such as LendingX-DeepMind or Mint-OpenAI could result in advancements in personalized services and cutting-edge RegTech tools. Quantum computing may also improve real-time decision-making processes.

Strategic use of AI enhances efficiency and helps firms maintain an edge in regulatory compliance while meeting customer demands seamlessly.

Takeaways

AI is changing fintech faster than ever. From fraud prevention to smarter investments, its impact is undeniable. These tools save time, cut costs, and boost efficiency for businesses and users alike.

While challenges exist, the future looks bright with endless possibilities ahead. Fintech’s transformation has only just begun!