Are you worried about how much energy cryptocurrencies use? Maybe you’ve seen headlines about huge power bills or rising carbon pollution from digital money. It can feel overwhelming when you care about the planet but want to use new tech.

Here is a fact: Ethereum, one of the biggest blockchains, switched to something called Proof-of-Stake. This change cut its energy use by over 99%.

In this blog post, we break it all down for you. We will explain what has changed since 2026, environmental impact of proof-of-stake and why it matters for our earth. Get ready to see if crypto can go green!

What is Energy consumption?

After exploring how blockchain changes our world, it is time to look at energy consumption. Energy consumption means the amount of energy people or things use to work, create, or move.

Each device plugged into a wall soaks up power. This is just like the thousands of computers in cryptocurrency networks do. Big blockchain projects once needed huge amounts of electricity. Bitcoin’s proof-of-work system could eat up as much electricity each year as some small countries did.

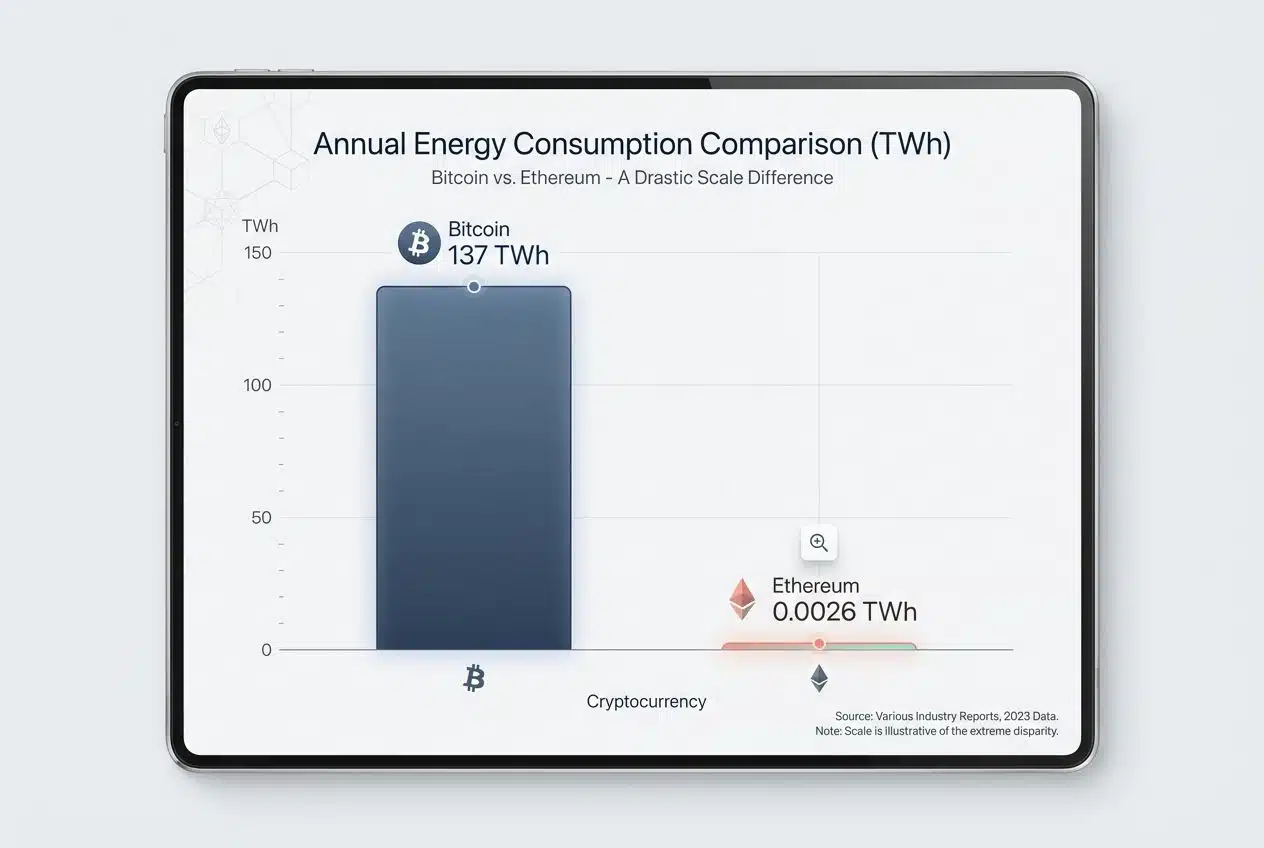

For example, in 2025, the Bitcoin network consumed about 137 terawatt-hours (TWh) of electricity. That is roughly the same amount of power used by the entire country of Argentina in a single year.

The higher the need for speed and security, the more juice these systems gobbled up. This power often came from grids fueled by gas, coal, or renewables. Lowering that demand brings big wins for sustainability and cuts down carbon footprints across the technology sector.

Energy Efficiency Gains with Proof-of-Stake

Switching to proof-of-stake cuts back on power use in a big way. This new approach makes blockchain networks cleaner and smarter with their energy use.

Over 99% Reduction in Energy Consumption

Proof-of-stake is like turning off thousands of power-hungry computers at once. It slashes energy use by more than 99% compared to proof-of-work blockchains.

According to 2026 data from CoinLaw, Ethereum’s annual energy consumption has dropped to just 0.0026 TWh. Before its switch, it rivaled the energy needs of a small nation. Now, its footprint is comparable to a small town.

A single proof-of-stake transaction now uses about as much energy as streaming a short video. It no longer requires the power to run an entire household for days. Vitalik Buterin, the co-founder of Ethereum, once compared this shift to replacing a gas-guzzling car with a bicycle.

Case Study: Ethereum’s Transition to PoS

Ethereum made history in September 2022. The blockchain switched from proof-of-work to proof-of-stake.

This change cut its energy use by over 99 percent. It dropped from about 23 million megawatt-hours per year to under 2,600 megawatt-hours yearly. Users noticed huge gains for sustainability and lower emissions almost overnight.

“The Merge was the single biggest decarbonization event in crypto history, eliminating 99.99% of the network’s carbon emissions instantly.”

No more specialized mining computers burning through electricity at all hours. Now, validators help keep the network safe without needing big hardware or lots of power.

Ethereum’s carbon footprint shrank as dramatically as a deflated balloon. This set new standards for ecofriendly cryptocurrency operations everywhere.

Reduction in Electronic Waste

Proof-of-stake cuts down on old gadgets stacking up in landfills. Fewer machines means less junk, and that helps the planet breathe a little easier.

Elimination of Specialized Mining Hardware

No more noisy, power-hungry machines. Proof-of-stake threw out the need for specialized mining hardware like ASIC rigs and high-end graphics cards.

Research published in 2025 indicates that the Bitcoin network generates approximately 30.7 kilotons of electronic waste annually. This happens because mining machines burn out quickly and become obsolete.

Less hardware means less electronic waste piling up in landfills every year. That’s a real win for eco-friendly blockchain projects trying to shrink their environmental performance issues. On top of that, skipping all this heavy equipment helps cut down on greenhouse gas emissions tied to manufacturing and shipping those bulky machines.

Lower Carbon Footprint

Proof-of-stake networks give off far less pollution than old mining systems. Their use of clean energy means these blockchains keep their footprint small and steady.

Minimal Emissions and Renewable Energy Integration

Proof-of-stake networks barely sip power compared to proof-of-work blockchains. Gone are the clouds of smoke and roaring machines.

PoS cuts energy use by over 99 percent. This shrinks the carbon footprint to almost zero for many blockchain projects. For instance, the Cambridge Centre for Alternative Finance reported in 2025 that Bitcoin is responsible for nearly 40 million tons of CO2 annually.

In contrast, Ethereum emits less than 0.01 million tons. Most new chains plug straight into green technology sources like wind or solar. Places such as Solana now run nodes on grids powered fully by renewable energy.

Some platforms offer rewards for using clean electricity. Many developers pick data centers with strong sustainability records. This push helps meet global goals for carbon neutrality and boosts ecofriendly tech all around the cryptocurrency world in 2026.

Beyond kilowatt-hours: lifecycle greenhouse gas emissions

Energy use tells only part of the story. To see the true environmental performance, you have to look at every stage in a blockchain’s life. This means thinking about how hardware is made, used, and thrown away.

Manufacturing chips and servers sends greenhouse gases into the air before blockchains even run. Proof-of-stake networks use less new hardware, so factories pump out fewer emissions from start to finish.

Devices last longer too. This cuts waste and shrinks each network’s carbon footprint over time. Some cryptocurrency projects now track their impact from birth to recycling day.

They aim for real carbon neutrality across their whole lifecycle. Up next, let’s shed light on physical devices themselves. We will look at hardware manufacturing and its growing electronic junkyard problem.

Hardware, manufacturing, and electronic waste footprint

Proof-of-stake networks use much less hardware than proof-of-work systems. Miners do not need to buy thousands of powerful computers. Instead, anyone can help run the network on a regular laptop or desktop.

- Reduced Material Demand: We save precious metals like gold and copper used in circuit boards.

- Longer Device Lifespan: A laptop used for staking lasts years, unlike mining rigs that burn out in 18 months.

- Less Shipping Pollution: We don’t need to ship heavy industrial equipment around the world.

This cuts down on huge piles of old mining machines filling up landfills each year. Fewer machines mean factories make less electronic equipment. This saves raw materials like metals and plastic.

The carbon footprint from shipping parts around the globe also drops fast as production needs fall. PoS helps keep more gadgets working longer. It stops large amounts of e-waste before it begins piling up behind houses or in giant dumps across cities.

Policy levers and industry commitments to decarbonize

Governments across the globe have set stricter rules for cryptocurrency. Many countries now push carbon-neutral goals. In 2024, the European Union passed laws that urge blockchains to show their energy use and lower emissions.

By January 2025, the EU’s Markets in Crypto-Assets (MiCA) regulation fully took effect. It requires service providers to obtain licenses and disclose their sustainability metrics. This forces companies to be honest about their carbon footprint.

In the United States, a March 2025 executive order established a “Strategic Bitcoin Reserve.” While this supports mining, it also encourages states to set their own environmental standards.

The “Green Mining Pledge” launched in Asia asks crypto projects to use more renewable energy. They must also report their carbon footprint each year. These moves push both small and big blockchain networks like Ethereum to focus on clean power.

Companies leading decentralized applications often join green technology groups. Some sign ecofriendly agreements with industry peers. In 2025, over 50 major blockchain players promised to cut greenhouse gases by at least 30 percent before 2030.

Grid interactions: location, energy sources, and demand

Clear rules and plans from companies set the stage for changes in energy use. Where blockchains operate matters a lot. Some locations have cleaner, greener grids. Others lean heavy on coal or natural gas, making their electricity dirtier.

Proof-of-stake systems can pick places with more renewable energy like wind or solar power. Demand for electricity shifts as networks grow or shrink.

If validators cluster near low-carbon sources, like hydro plants in Canada or solar farms in Texas, the carbon footprint falls fast. Unlike Bitcoin miners, who often need to be next to cheap power sources, PoS validators can be anywhere.

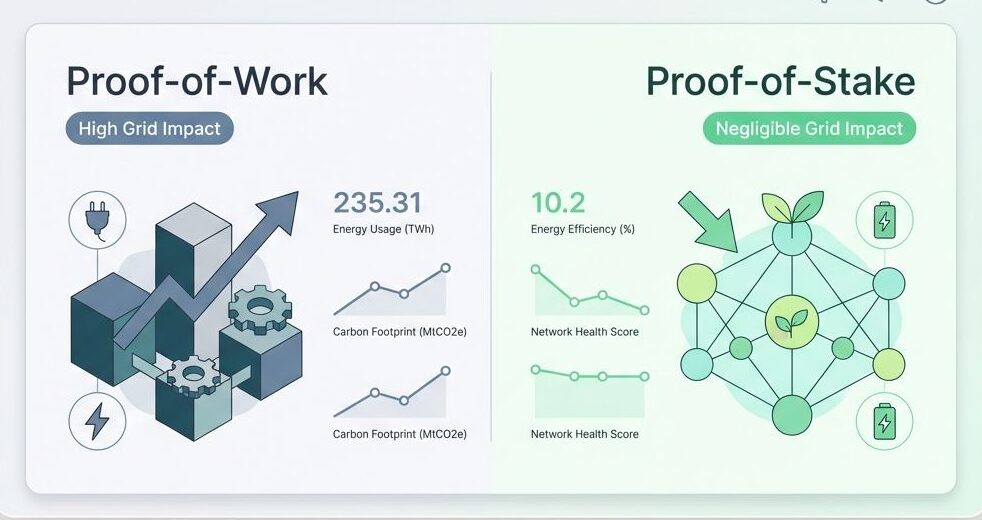

| Feature | Proof-of-Work (Miners) | Proof-of-Stake (Validators) |

|---|---|---|

| Location Flexibility | Low. Must be near cheap, industrial power. | High. Can run in a home office or cloud server. |

| Grid Impact | High. Can strain local grids during peak hours. | Negligible. Uses same power as a standard PC. |

| Renewable Access | Variable. Often relies on whatever is cheapest. | High. Can easily choose green cloud providers. |

Rapid demand spikes during big network events may strain local grids. However, they need far less power than old proof-of-work mining ever did.

Unlike those giant server warehouses used by miners before 2022, today’s ecofriendly blockchain tools work quietly. They sip rather than gulp juice from the grid. The result is better environmental performance and fewer headaches about high bills or blackouts for everyone nearby.

Trade-offs: security, decentralization, and sustainability

After looking at how energy choices shape crypto networks, it becomes clear that every choice has a flip side. Proof-of-Stake shines for its low carbon footprint and high energy efficiency, but no system is perfect.

Lower power use means lower hardware needs and less e-waste. But questions still pop up about security when fewer people control the network’s key decisions.

Ethereum’s switch to PoS in 2022 slashed its energy consumption by over 99 percent. This was a win for green technology. Yet, critics sometimes worry this makes it easier for big players with lots of cryptocurrency to sway outcomes.

For example, in August 2025, Lido DAO held about 24.7% of all staked Ethereum. While this is down from previous highs, it still raises concerns about centralization.

Security often takes center stage. Validators must hold enough tokens as a show of good faith to protect against fraud or attacks. This helps keep blockchain safer than most think.

Sustainability gets a boost as grid demand drops and emissions fall. However, not everyone agrees on where the balance should sit between ecofriendly practices and equal voting power across cryptocurrency users.

Economic incentives and their environmental consequences

Rewards push people to keep their crypto coins locked up in proof-of-stake (PoS) systems. This action helps secure the blockchain, but it also guides how money and resources move around.

Lower costs mean more folks can join and help run the network. Compared to proof-of-work mining, there’s no need for massive piles of computers or expensive hardware eating up energy day and night.

Instead, anyone with some coins can take part using just a basic laptop or even a phone. Easy entry sounds great for growth and sustainability on paper.

Yet bigger rewards sometimes spark arms races too, just in new forms. Large holders might pile up even more coins over time since they get most rewards.

This could make things less fair if small players see fewer gains while big ones keep growing. More staking means less coin movement. This cuts down trading volume and lowers electronic waste compared to mining rigs wearing out fast in PoW networks.

What is a consensus mechanism?

A consensus mechanism helps cryptocurrencies agree on which transactions are valid. Each blockchain network uses this system to keep its records secure and correct without needing a boss or central group.

People who join the network must follow set rules. This ensures everyone stays on the same page. Think of it like a group of friends deciding on a movie to watch.

You need a fair way to vote so that everyone agrees on the final choice. Blockchains like Bitcoin use proof-of-work, while others like Ethereum switched to proof-of-stake for better energy efficiency and lower carbon footprint.

With a good consensus mechanism, blockchains stay safe and ecofriendly as they grow. This keeps trust high between users in decentralized applications powered by green technology.

What is the proof of work consensus mechanism?

Proof of work is a process that secures many cryptocurrencies. Computers solve hard math puzzles, and only the fastest one gets to add new data to the blockchain.

How much energy is required for proof-of-work networks to operate?

Proof-of-work networks, like Bitcoin, use huge amounts of electricity. In 2025, the Bitcoin network alone used about 137 terawatt-hours per year. That is more power than the entire country of Argentina needs in a year.

Most of this energy powers rows and rows of special computers called miners. These machines run day and night to solve math puzzles.

Each successful puzzle uses enough power to run an average U.S. household for several weeks. Because so many people compete at once, only one gets the reward each time. But everyone burns energy in the race.

This system drives up both energy consumption and hardware waste across cryptocurrency blockchains that rely on proof-of-work consensus mechanisms.

What is the proof-of-stake consensus mechanism?

Proof-of-stake is a method where people use their coins to help run and secure blockchains, making things fast, safe, and far less wasteful. Stick around if you’re curious how this changes the game!

How much energy is required for proof-of-stake networks to operate?

Proof-of-stake networks use very little energy. Most of the work gets done by regular computers, not huge mining machines.

To run Ethereum’s proof-of-stake system in 2026, the network needs about 0.0026 terawatt-hours per year. That is less than what a small town uses over twelve months. In fact, it’s roughly 0.005% of what Bitcoin uses.

No fancy hardware clanks away in giant server rooms. Validators join with laptops or simple desktops, sipping power instead of gulping it down like proof-of-work miners do.

As a result, running these green technology blockchains keeps carbon footprints tiny. It supports stronger sustainability for cryptocurrencies worldwide.

Comparison: Proof-of-Stake vs. Proof-of-Work Environmental Impact

If you’ve ever wondered how these two consensus mechanisms stack up for the environment, here’s a quick, side-by-side look. This data reflects the latest 2025 and 2026 estimates.

| Aspect | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

|---|---|---|

| Energy Consumption | Massive demand; Bitcoin used about 137 TWh in 2025. That’s more than Argentina. | Drastically less; Ethereum dropped to about 0.0026 TWh, a 99.99% cut. |

| Carbon Emissions | High emissions, tied to fossil-fueled grids. About 40 megatons of CO₂ yearly for Bitcoin in 2025. | Minimal; PoS blockchains run easily on renewable energy. Ethereum’s footprint is roughly 0.01 megatons. |

| Hardware Requirements | Needs specialized ASICs. Frequent upgrades and short hardware life. | Runs on everyday computers. Reduces electronic waste by skipping mining rigs. |

| Electronic Waste | Staggering; Bitcoin mining created about 30.7 kilotons of e-waste in 2025. | Tiny; only regular computers needed, much less thrown away. |

| Network Distribution | Mining pools can centralize power. Large miners dominate. | Anyone with coins can join. Encourages wider participation. |

| Lifecycle Greenhouse Gases | Fossil energy and hardware manufacturing ramp up emissions. | Slashes emissions across the board. Lower impact from birth to end-of-life. |

| Policy Impact | Draws regulatory scrutiny. Some countries ban PoW for energy waste. | Seen as sustainable. More welcome in eco-minded regions like the EU. |

| Economic Incentives | Rewards competitive mining, which drives energy use higher. | Rewards stakers, not energy burn. Greener by design. |

| Security Trade-Offs | Security depends on energy and hardware. Expensive to attack. | Security baked into stake. Cheaper for participants, still tough for attackers. |

| Notable Example | Bitcoin | Ethereum, Cardano, Solana |

The Future of Green Blockchain Innovations

Big changes are coming in blockchain technology. More blockchains now use renewable energy and ecofriendly tools. Some networks link with solar or wind farms to cut their carbon footprint.

Proof-of-stake systems keep growing since they use far less power than old proof-of-work models. For example, Solana emerged as a revenue leader in 2025, generating $1.3 billion while maintaining a minimal environmental impact.

Developers work hard to make cryptocurrency both fast and green. In January 2026, Lido launched its “V3” update. This introduced modular staking vaults that allow for even more efficient capital use.

Innovation does not slow down, even as demand for speed and security rises. Expect more green tech solutions, from recycled hardware to stronger carbon neutrality efforts in new decentralized applications. Every year brings cleaner ways to secure blockchain without harming the planet.

Wrapping Up: Balancing Security, Utility, and Climate Goals

Striking a balance in blockchain is key. Security must stay strong, even as networks cut energy use and chase carbon neutrality.

Proof-of-stake helps keep energy consumption down. This means less harm to the planet and lower costs for everyone. Easier access draws more people into decentralized applications.

New green technology keeps pushing boundaries. Developers face tough choices: guard against attacks, keep things fair, but also hit high marks for environmental performance.

Getting all three, security, utility, and climate goals, is not easy. Still, each step forward gets us closer to sustainable cryptocurrency use worldwide.