As retirees in Germany enter this new chapter of life, effective financial management becomes a cornerstone of enjoying a comfortable and fulfilling retirement.

With a robust social security system and various retirement savings options, understanding how to optimize your income while minimizing taxes is crucial.

In this article, we’ll explore 10 Tax-Saving Tips for Retirees in Germany that can empower you to maximize your retirement funds. From strategic pension withdrawals to leveraging tax deductions, we aim to provide you with practical insights and actionable strategies to enhance your financial well-being.

Understanding the German Tax System

The German tax system can be quite intricate, especially for retirees who depend on diverse income sources, such as pensions, savings, and investments. Understanding how income is taxed is essential for planning your finances effectively.

Key Tax Rates for Retirees

Germany employs a progressive income tax system, where rates increase as income rises. Here’s a detailed breakdown of the tax brackets for the year 2023:

| Income Range (€) | Tax Rate |

| Up to €10,347 | 0% |

| €10,348 to €58,596 | 14% – 42% |

| €58,597 to €277,825 | 42% |

| Over €277,826 | 45% |

This structure means that retirees can effectively manage their taxable income by controlling how much they withdraw from retirement accounts and other income sources.

Tax Exemptions and Allowances

Germany offers specific exemptions and allowances that can significantly benefit retirees.

Basic Tax Allowance for Retirees

The basic tax allowance is a fundamental feature of the German tax system. As of 2023, it stands at €10,347. This means that if your total income falls below this threshold, you are exempt from paying any income tax, allowing you to retain more of your retirement savings.

Special Exemptions Applicable to Pensions

In addition to the basic allowance, retirees may also benefit from additional exemptions specific to pension income. For example, if you are receiving a pension from a public fund, only a portion of that income may be subject to taxation, depending on when you started receiving it.

Tip 1: Optimize Your Pension Withdrawals

One of the most effective Tax-Saving Tips for Retirees in Germany is to carefully strategize your pension withdrawals. The way you withdraw funds can significantly influence your tax obligations.

Monthly vs. Annual Withdrawals

Opting for monthly withdrawals instead of a lump sum can help you manage your taxable income more effectively.

| Withdrawal Method | Tax Implications |

| Monthly Withdrawals | Keeps income within lower brackets |

| Annual Lump Sum | May push income into higher brackets |

By spreading out your withdrawals, you may avoid exceeding the €58,596 threshold, thus benefiting from a lower overall tax rate.

Impact on Tax Brackets

Consider a retiree named Anna, who has a total pension income of €30,000. If she withdraws this amount monthly, she remains comfortably below the taxable threshold, minimizing her tax liability. However, if she opts for a lump sum withdrawal, her annual income could place her in a higher tax bracket, increasing her tax rate significantly.

Tip 2: Utilize Tax Deductions

Retirees in Germany have access to various tax deductions that can help lower their taxable income. Understanding these deductions is vital for effective tax planning.

Healthcare Expenses

Healthcare costs often rise in retirement, and many of these expenses can be deducted from your taxable income.

| Deductible Healthcare Expenses | Description |

| Prescription Medications | Costs incurred for necessary medications. |

| Medical Treatments | Expenses for treatments not covered by insurance. |

| Long-Term Care | Costs related to care facilities or in-home care. |

Charitable Donations

Making charitable contributions can also reduce your taxable income. Retirees can claim up to 20% of their total income in charitable donations, which not only supports worthy causes but also offers financial benefits.

Practical Example: Healthcare Deductions

For instance, if a retiree spends €5,000 on medical expenses, and their total income is €30,000, they can deduct these costs, effectively reducing their taxable income to €25,000. This reduction could shift them into a lower tax bracket.

Tip 3: Explore Capital Gains Tax Benefits

Investing in assets such as stocks, bonds, or real estate can yield significant returns. Fortunately, Germany offers capital gains tax exemptions that can benefit retirees.

Current Limits and How to Apply Them

As of 2023, individuals can earn up to €1,000 in capital gains tax-free. Here’s how this works:

| Capital Gains | Tax-Free Allowance | Tax Rate (Exceeding Allowance) |

| Up to €1,000 | Tax-free | 26.375% on gains exceeding €1,000 |

Investment Strategies to Minimize Tax

Retirees should consider holding investments for longer periods to fully benefit from tax-free allowances.

Case Study: Successful Capital Gains Management

Consider Peter, a retiree who invested in stocks and generated €2,500 in capital gains. By holding his investments for over a year, he is eligible for the €1,000 tax-free allowance. Consequently, he pays taxes only on the remaining €1,500, leading to a tax liability of €396.375 (26.375% of €1,500).

Tip 4: Consider Income Splitting

For married retirees, income splitting can be a powerful strategy to reduce overall tax liability.

How It Reduces Overall Tax Liability

Distributing income between partners can leverage lower tax brackets, significantly minimizing the tax burden.

| Income Distribution | Overall Tax Liability |

| High Income (One Partner) | Higher tax bracket |

| Split Income | Lower tax brackets for both partners |

Scenarios Where This Applies

For example, if one spouse earns €40,000 and the other earns €10,000, splitting the income can keep both partners in lower tax brackets. This strategy could lead to an overall tax savings of hundreds or even thousands of euros.

Tip 5: Invest in Tax-Advantaged Accounts

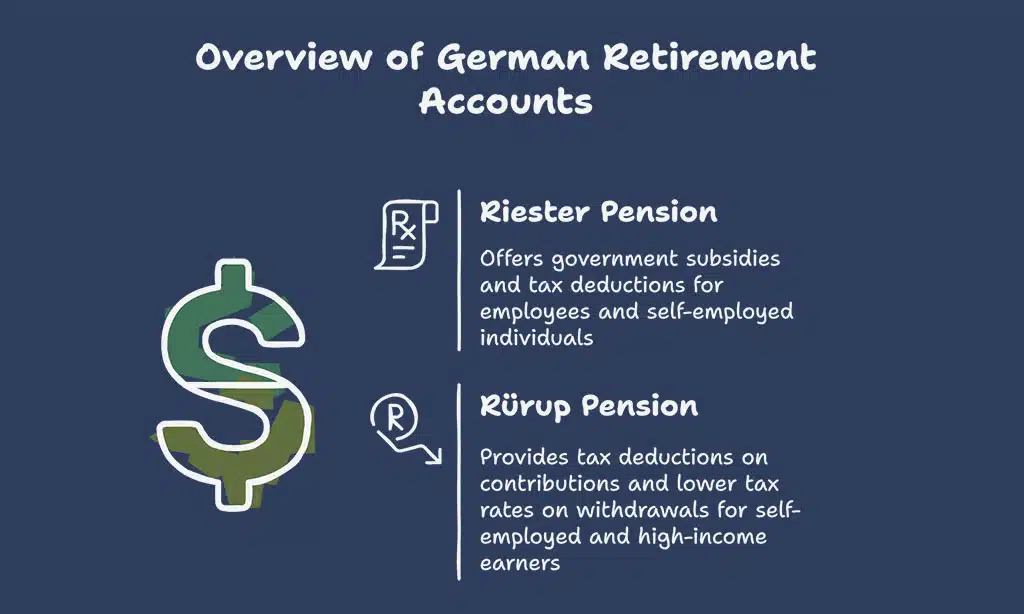

Overview of Retirement Accounts

Germany offers several tax-advantaged retirement accounts that can provide significant benefits for retirees.

| Type of Account | Target Group | Key Benefits |

| Riester Pension | Employees and self-employed | Government subsidies, tax deductions on contributions. |

| Rürup Pension | Self-employed and high-income earners | Tax deductions on contributions, pension payments are taxable at lower rates upon withdrawal. |

Tax Benefits Associated with Each

Both Riester and Rürup pensions offer substantial tax advantages. Contributions to these accounts can be deducted from taxable income, thus lowering your overall tax burden.

Practical Application: Choosing the Right Account

Retirees should assess their income levels and financial goals to determine which account best suits their needs. For example, a self-employed retiree may benefit more from a Rürup pension due to its higher contribution limits and favorable tax treatment.

Tip 6: Take Advantage of Local Tax Incentives

Certain regions in Germany provide unique tax incentives specifically designed to support retirees.

| Type of Local Benefit | Description |

| Reduced Property Taxes | Some regions offer lower tax rates for seniors. |

| Local Tax Incentives | Specific allowances for retirees in certain municipalities. |

How to Find Local Resources

Retirees should consult their local tax office or financial advisor to identify available regional benefits. These incentives can include exemptions from property taxes, rebates, or special allowances.

Example: Local Tax Incentives

For instance, a retiree living in Bavaria might discover they qualify for a property tax reduction due to their age and income level, leading to savings that enhance their overall retirement budget.

Tip 7: Utilize Tax Consultants

Employing a tax consultant can be one of the best decisions retirees can make for effective tax management.

When to Hire a Tax Consultant

Retirees with complex financial situations—such as multiple income sources, investments, or foreign accounts—should consider hiring a tax consultant.

How They Can Help Maximize Savings

A tax consultant can provide tailored advice, helping you identify deductions you may have missed, optimize your withdrawal strategy, and even assist with future planning.

Case Study: Successful Consultation

For example, if a retiree named Klaus hires a tax consultant and discovers he’s eligible for several overlooked deductions, he could save thousands on his tax bill, making the consultant’s fee worthwhile.

Tip 8: Plan for Inheritance Tax

Inheritance tax can significantly impact the wealth you pass on to your heirs.

Thresholds and Exemptions

Germany has specific thresholds for inheritance tax, which vary depending on the relationship between the deceased and the beneficiary.

| Beneficiary Type | Exemption Threshold (€) |

| Spouses | 500,000 |

| Children | 400,000 |

| Other Relatives | 20,000 |

Strategies to Minimize Inheritance Tax

Retirees can utilize strategies such as gifting assets during their lifetime to reduce the taxable estate.

Example: Effective Estate Planning

Consider a retiree who plans to gift €100,000 to their child. Since the child has a €400,000 exemption, this gift may not incur any inheritance tax. Effective planning can ensure that more wealth is preserved for heirs.

Tip 9: Keep Accurate Records

Importance of Documentation

Maintaining accurate records is essential for retirees to substantiate their tax claims and deductions.

| Type of Document | Purpose |

| Receipts for Medical Expenses | Support healthcare deductions. |

| Proof of Charitable Donations | Verify donations for tax purposes. |

| Bank Statements for Investment Income | Track income and capital gains. |

How Records Can Support Deductions

Keeping organized documentation can simplify the tax filing process, ensuring you don’t miss out on potential deductions.

Practical Tip: Record Keeping Strategy

Consider using a digital tool or app to track expenses and store receipts. This method can help you easily access necessary documents come tax time.

Tip 10: Stay Informed About Tax Law Changes

Resources for Keeping Updated

Tax laws in Germany can change frequently, making it crucial for retirees to stay informed.

| Resource Type | Examples |

| Government Websites | Federal Ministry of Finance |

| Financial Newsletters | Retirement-focused publications |

Importance of Adapting to New Laws

By staying updated on tax law changes, you can adjust your financial strategies to remain compliant and take advantage of new benefits.

Example: Leveraging Updated Regulations

For instance, if a new tax incentive for retirees is introduced, those who are informed can quickly adapt their financial strategies to maximize the benefits.

Wrap Up

Navigating the tax landscape in retirement can seem daunting, but with the right strategies, you can significantly reduce your tax liability and preserve your wealth.

The 10 Tax-Saving Tips for Retirees in Germany outlined in this article provide a comprehensive approach to managing your finances effectively. By optimizing your pension withdrawals, utilizing deductions, and staying informed about tax regulations, you can enjoy a financially secure retirement. Remember, planning and proactive management of your tax situation will empower you to make the most of your hard-earned retirement funds.

Additional Resources

| Tip Number | Description | Key Action |

| 1 | Optimize Pension Withdrawals | Choose monthly withdrawals to lower tax. |

| 2 | Utilize Tax Deductions | Keep records of healthcare and donations. |

| 3 | Explore Capital Gains Benefits | Stay under the €1,000 tax-free allowance. |

| 4 | Consider Income Splitting | Plan income distribution with your partner. |

| 5 | Invest in Tax-Advantaged Accounts | Contribute to Riester or Rürup pensions. |

| 6 | Take Advantage of Local Incentives | Research regional tax benefits. |

| 7 | Utilize Tax Consultants | Seek professional guidance for tax planning. |

| 8 | Plan for Inheritance Tax | Use trusts and gifting strategies. |

| 9 | Keep Accurate Records | Document all expenses and income sources. |

| 10 | Stay Informed About Tax Law Changes | Follow relevant financial news. |