On March 6, 2025, President Donald Trump signed an executive order establishing a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, marking a significant shift in the United States’ approach to digital assets.

Background and Rationale

Bitcoin, introduced in 2009, is the first decentralized cryptocurrency, often referred to as “digital gold” due to its capped supply of 21 million coins and robust security features. Recognizing its potential as a strategic asset, the U.S. government aims to harness Bitcoin’s unique properties to strengthen its financial position in the global market.

Establishment of the Strategic Bitcoin Reserve

The executive order mandates the creation of the Strategic Bitcoin Reserve, managed by the Department of the Treasury. This reserve will be capitalized with Bitcoin that the government has acquired through criminal and civil asset forfeiture proceedings. Notably, the order stipulates that Bitcoin held in this reserve shall not be sold but maintained as reserve assets to meet governmental objectives.

Creation of the U.S. Digital Asset Stockpile

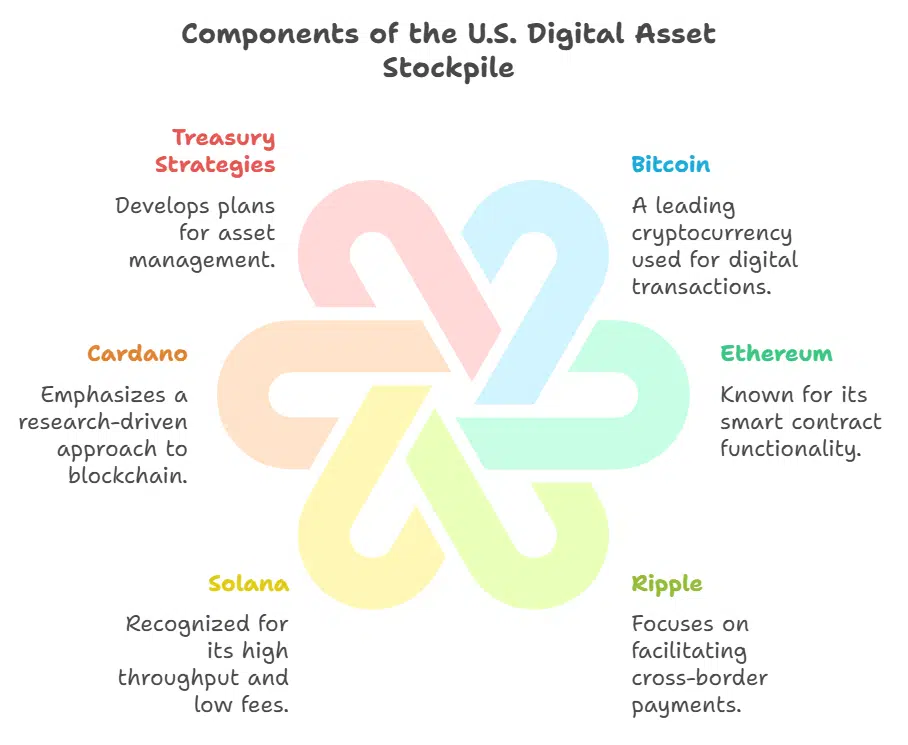

In addition to Bitcoin, the executive order establishes the U.S. Digital Asset Stockpile to manage other digital assets obtained through similar forfeiture proceedings. This stockpile includes cryptocurrencies such as Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA). The Department of the Treasury is tasked with developing strategies for the responsible stewardship of these assets.

The administration emphasizes that the establishment of these reserves is designed to be budget-neutral, ensuring no additional costs to taxpayers. The Secretaries of Treasury and Commerce are directed to develop strategies for acquiring additional Bitcoin without imposing incremental costs on taxpayers. However, the government does not plan to acquire additional digital assets for the stockpile beyond those obtained through forfeitures without further executive or legislative action.

Market Reaction and Industry Perspectives

The announcement of the Strategic Bitcoin Reserve had a notable impact on the cryptocurrency market. Bitcoin’s price experienced a sharp decline, dropping over 5% to below $85,000, reflecting investor disappointment over the lack of immediate government purchases of new bitcoins. This reaction underscores the market’s sensitivity to government policies and the anticipation of more aggressive accumulation strategies.

Industry reactions are mixed. Some stakeholders view the establishment of the reserve as a symbolic acknowledgment of Bitcoin’s legitimacy as a reserve asset. However, others express concerns about the absence of a clear acquisition strategy and the potential implications for market dynamics.

Administration’s Stance and Future Initiatives

David Sacks, the White House’s crypto and AI lead, emphasized that this initiative would not incur any costs to taxpayers. He highlighted that the reserve would be funded through already seized assets, positioning the U.S. advantageously in the evolving digital financial landscape.

In line with this initiative, the administration plans to host a “crypto summit” at the White House, bringing together industry leaders to discuss the future of digital assets in the U.S. This summit aims to foster dialogue between the government and the crypto industry, addressing regulatory challenges and exploring opportunities for innovation.

Historical Context and Global Implications

This move marks a significant shift in the U.S. government’s approach to digital assets. Historically, the government has seized cryptocurrencies through law enforcement actions but has typically auctioned them off to convert them into fiat currency. By retaining these assets, the U.S. acknowledges the growing importance of cryptocurrencies in the global financial system.

The establishment of a Strategic Bitcoin Reserve positions the United States alongside other nations that have integrated cryptocurrencies into their financial strategies. For instance, Bhutan has been running a large-scale Bitcoin mining operation, utilizing the country’s abundant hydroelectric resources, allowing it to accumulate significant Bitcoin holdings.

The executive order establishing the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile represents a pivotal moment in the integration of cryptocurrencies into the U.S. financial system. While the immediate market reaction was mixed, the long-term implications of this policy shift are poised to influence the global digital asset landscape. The administration’s commitment to fostering innovation while ensuring regulatory oversight will likely shape the future trajectory of digital assets in the United States.