President Donald Trump has announced that he will soon introduce reciprocal tariffs—duties that match those imposed on U.S. goods by other countries. These tariffs could take effect as early as Tuesday, and businesses across Asia are scrambling to understand the potential consequences.

While Trump did not specify which countries would be targeted, analysts believe the policy is part of a broader strategy to reduce the United States’ trade deficits with major global economies. The move comes amid rising concerns that many Asian economies—particularly those with significant trade surpluses with the U.S.—could face higher import duties.

Countries That Could Be Affected

According to Barclays analysts, most emerging Asian economies are likely to see increased tariffs, with a few exceptions. The U.S. runs trade surpluses with Singapore and Hong Kong, making them less vulnerable to immediate tariff hikes. However, major trading partners like China, Vietnam, Taiwan, Japan, South Korea, and India are at risk.

Data from the World Trade Organization (WTO) shows that many Asian economies impose higher tariffs on imports compared to the U.S. For example, as of 2023:

- India’s simple average tariff rate was 17%, the highest among major economies.

- Vietnam’s average tariff was 9.4%.

- The United States’ average tariff on most-favored-nation (MFN) countries stood at just 3.3%.

- The U.S. maintains MFN status with most of the world, except for Russia.

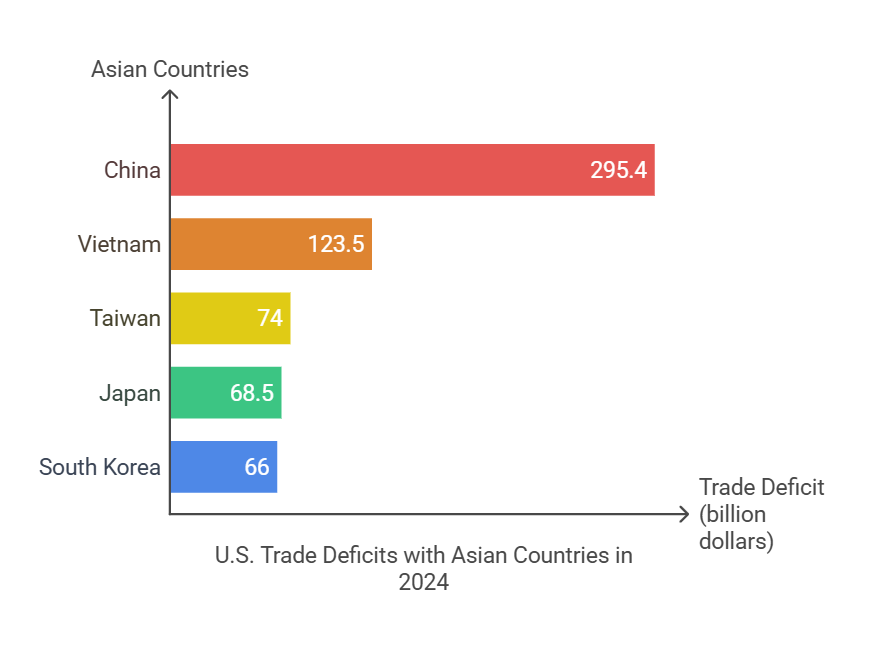

U.S. Trade Deficits With Asian Countries

According to the U.S. Census Bureau, these are the top Asian countries that ran a trade surplus with the U.S. in 2024:

- China: $295.4 billion

- Vietnam: $123.5 billion

- Taiwan: $74 billion

- Japan: $68.5 billion

- South Korea: $66 billion

While Japan and South Korea have deep security and investment ties with the U.S., other countries—like Vietnam—may face significant pressure due to their growing surpluses.

Vietnam Braces for Possible Economic Fallout

Vietnam is in a precarious position. The country has rapidly expanded its trade relationship with the U.S., but this success may now put it squarely in Trump’s crosshairs.

Why Vietnam Is at Risk

- High Trade Surplus:

- Vietnam’s trade surplus with the U.S. increased nearly 18% last year, hitting a record high.

- High Tariffs on Imports:

- Vietnam has an average tariff of 9.4% on MFN partners.

- Beverages and tobacco face tariffs of up to 45.5%.

- Clothing, transport equipment, and food products see tariffs between 14% and 34%.

- Chinese Investments in Vietnam:

- Many Chinese companies moved operations to Vietnam during the U.S.-China trade war, making Vietnam a major manufacturing hub.

- Trump may view these shifts as a way for China to bypass U.S. tariffs, putting Vietnam in a vulnerable position.

How Vietnam Is Responding

The Vietnamese government is taking steps to address U.S. concerns:

- November 2024: Vietnam promised to increase imports of U.S. goods, including aircraft and liquefied natural gas (LNG).

- February 2025: Prime Minister Pham Minh Chinh ordered his government to prepare for the impact of a potential trade war.

India Prepares to Make Concessions

India is another major economy at risk. The country imposes significantly higher tariffs on U.S. goods than it receives in return.

India’s Tariff Structure vs. U.S. Tariffs

- India’s average tariff: 17% (highest among major economies)

- U.S. tariffs on Indian goods: 3%

This imbalance could lead to steep tariff hikes for Indian products, potentially raising them above 15%. To counteract this, India has already begun lowering tariffs on various products:

- Motorcycles

- Electronic goods

- Critical minerals

- Lithium-ion batteries

India’s Response

- Prime Minister Narendra Modi is expected to discuss further tariff reductions with Trump this week.

- India might shift oil imports from Russia to the U.S. to align with Trump’s energy policies.

- Some analysts believe the U.S. and India may reopen talks on a Free Trade Agreement (FTA).

Japan May Avoid the Worst Tariffs

Unlike other Asian countries, Japan seems to have secured a favorable relationship with Trump. Prime Minister Shigeru Ishiba recently concluded a visit to Washington, during which Japan agreed to:

- Increase natural gas imports from the U.S.

- Join a pipeline project to deliver LNG from Alaska.

- Invest heavily in U.S. Steel, rather than acquiring it outright.

Why Japan Might Be Spared

- Low Tariffs: Japan already maintains a relatively low tariff rate of 3.7%.

- Largest Foreign Investor in the U.S.:

- Japan has been the biggest investor in the U.S. for five consecutive years.

- Tokyo has pledged to expand its investment in the U.S. to $1 trillion.

China’s Calculated Response

Unlike other countries, China has already been hit with a 10% blanket tariff. However, Beijing’s response has been measured:

- Retaliatory tariffs took effect on February 12, 2025.

- New Chinese tariffs include:

- 15% on U.S. coal and liquefied natural gas

- 10% on crude oil, farming equipment, and automobiles

Why China Is Holding Back

- Lower Tariff Coverage:

- The new tariffs only affect $13.9 billion of U.S. goods—far lower than the $50 billion in tariffs imposed during Trump’s first term.

- Seeking Negotiations:

- Beijing is leaving room for diplomatic discussions rather than escalating the dispute further.

- China may also use non-tariff measures like export controls and regulatory probes to pressure the U.S.

What’s Next?

With Trump’s reciprocal tariff policy set to take effect soon, Asian economies are moving quickly to avoid economic disruptions. Countries like Vietnam and India are preparing to make concessions, while Japan has strengthened its trade and investment ties with Washington. Meanwhile, China is signaling a willingness to negotiate, aiming to avoid a full-scale trade war.

While some economies may dodge tariffs for now, experts caution that Washington’s stance can change rapidly. Businesses and governments in Asia must remain prepared for further policy shifts as Trump’s trade agenda unfolds in the coming months.