Traveling for work can be exciting, but it often comes with costs that quickly add up. Many people overlook the fact that some of these business travel expenses are eligible for tax relief.

Ignoring these savings results in a loss of money.

In the UK, you can claim tax deductions for travel costs like public transport, accommodation expenses, and meals when traveling for work purposes. By understanding HMRC guidelines and allowable expenses, you can reduce your taxable income legally.

This blog will guide you through 7 Ways To Save On Taxes While Traveling For Work In UK. You’ll learn how to maximize your tax refunds without breaking any rules. Keep reading to make smarter financial choices while working away from home!

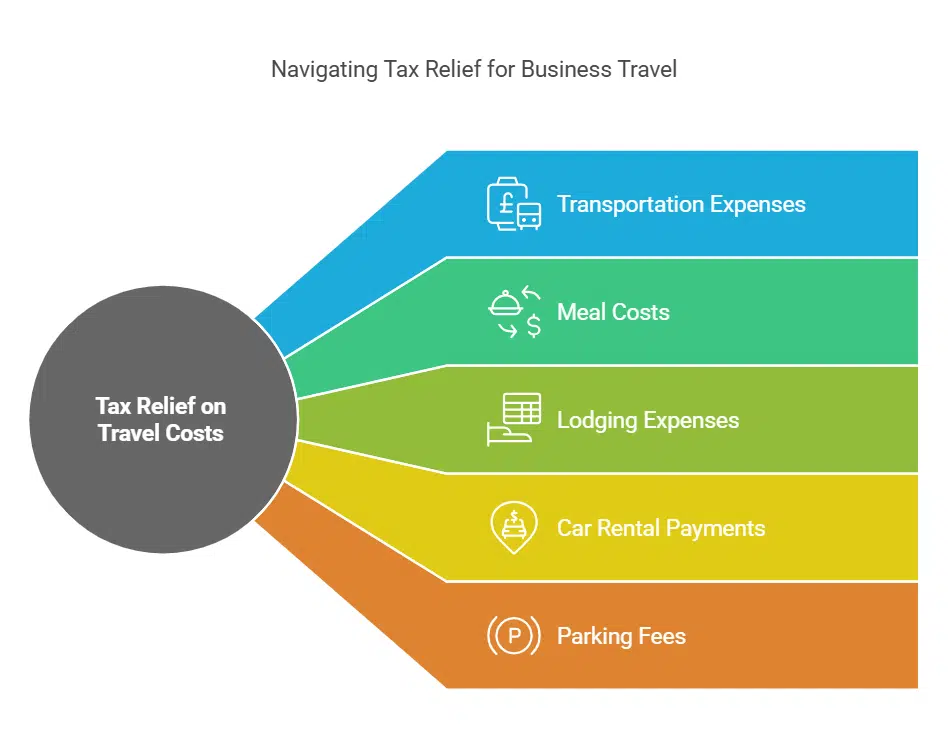

Understand What Qualifies as Business Travel Expenses

Business travel expenses cover costs incurred solely for work purposes. HMRC allows claims on travel costs like flights, train tickets, or car rentals to a business destination. Parking fees and congestion charges during work trips also qualify as tax-deductible.

Meals purchased while traveling overnight for work may fall under allowable subsistence expenses. Accommodation expenses like hotel stays are eligible if the trip requires staying away from home.

Ordinary commuting between home and a permanent workplace does not qualify for relief but travel to temporary workplaces does.

Claim Tax Relief on Travel and Accommodation Costs

Claim tax relief on travel costs by including expenses for transportation, meals, and lodging during business trips. HMRC allows deductions for allowable expenses like hotel stays or train tickets used specifically for work-related travel.

For example, if you attend trade shows or client meetings outside your permanent workplace, you can claim these as valid business expenses.

Exclude private travel or ordinary commuting from claims since these do not qualify under HMRC rules. Employees traveling to temporary workplaces may claim tax-relief-eligible accommodation costs but must provide receipts.

The same applies to car rental payments and parking fees tied to business purposes only. Keep detailed records of all such expenditures to ensure tax compliance while reducing taxable income efficiently.

Take Advantage of Subsistence Allowances

Subsistence allowances can cover meals, travel expenses, and accommodation costs during work trips. HMRC allows tax relief on these expenses if they meet specific conditions. For example, food purchased while traveling for a temporary workplace or staying overnight may qualify under subsistence expenses.

Employers often provide per diems to simplify this process and keep employees within allowable expense limits.

Employees traveling abroad for work can also use HMRC’s published per diem rates. These help calculate daily subsistence without detailed receipts. Workers commuting to permanent workplaces cannot claim such benefits as ordinary commuting costs are non-deductible expenses under UK tax laws.

Always ensure compliance with HMRC guidelines to avoid issues during audits or reviews.

Keep Detailed Records of Your Expenses

Track every penny spent on business travel expenses, from meals and accommodation costs to parking fees and rental car expenses. Use credit cards or debit cards for payments to create clear records.

Save all receipts, including those for VAT refunds, public transport tickets, and incidental expenses like tolls or congestion charges.

Organize these records weekly. Separate allowable expenses from non-deductible ones to align with HMRC guidelines. Digital tools can help automate bookkeeping tasks while ensuring you meet tax compliance standards efficiently.

Use HMRC’s Mileage Allowance for Business Travel

Claim HMRC’s mileage allowance for using personal vehicles during business travel to reduce taxable income. The standard rate allows 45p per mile for the first 10,000 miles driven in a tax year and drops to 25p per mile after that.

If traveling by motorcycle, claim at 24p per mile. Cycling for work purposes lets you deduct 20p per mile.

Keep logs of dates, destinations, purposes of trips, and miles traveled to simplify claims. Expenses like parking fees qualify as allowable expenses but not congestion charges or fines.

Employers reimbursing less than HMRC rates let employees apply for the difference as tax relief through their self-assessment tax return or payroll adjustments.

Separate Business and Personal Travel Costs

Label all travel expenses clearly to avoid confusion. Use separate credit cards for business and private travel spending whenever possible. Maintain distinct records for flights, accommodation, meals, or other costs related to business purposes.

Mixing personal and business travel can lead HMRC to reject claims or classify them as non-deductible expenses.

Plan bleisure trips carefully by calculating the portion of time spent on work versus leisure. Only claim tax relief on allowable expenses incurred during the business component of your trip.

For example, if a five-day trip includes three days of meetings and two days of personal sightseeing, allocate costs accordingly.

Utilize the 24-Month Rule for Temporary Workplaces

The 24-month rule allows tax relief on travel costs if your workplace qualifies as temporary. Work becomes temporary when assignments last less than 24 months. For instance, working at a client site for one year may allow you to claim allowable expenses like mileage or accommodation expenses.

Once work exceeds two years, HMRC treats it as ordinary commuting to a permanent workplace. Tax deductions no longer apply in such cases. Keep clear records of start and end dates for each assignment to stay compliant with HMRC guidelines.

Claim Tax Relief on International Business Travel

Claim tax relief for flights, car rentals, and accommodation expenses tied to business travel abroad. HMRC allows deductions for transport costs like airfare or train tickets required for work-related trips.

Travelers may also include vehicle mileage if using a personal car in another country.

Track subsistence expenses such as meals or lodging while overseas. These allowable expenses fall under specific per diem rates provided by HMRC guidelines. Ensure expenses meet requirements to qualify as deductible and do not mix private travel with work visits to avoid non-deductible costs.

Always keep receipts for submission during tax filing.

Automate Expense Tracking with Digital Tools

Use apps like PayPal or corporate travel management software to track business travel expenses easily. These tools can categorize costs, such as accommodation expenses, car expenses, and dining, saving time for tax relief claims.

Many digital platforms calculate allowable expenses automatically using HMRC guidelines.

Switching to automated systems reduces errors and organizes receipts in one place. Tools with features like VAT/GST tracking or exchange rate conversion help handle international business travel costs faster.

This ensures accurate reports while staying compliant with UK taxation policies on value-added taxes and per diem rates.

Stay Updated on HMRC Guidelines and Allowances

Check for updates on HMRC guidelines to stay compliant with tax rules. These include changes in travel allowances, mileage rates, and subsistence expenses. For instance, the current per diem rates help determine allowable expenses during business trips.

Keeping track of adjustments ensures accurate claims on travel costs like accommodation expenses and car mileage.

Take note of new rules affecting temporary workplaces or hybrid working arrangements. Ordinary commuting between home and a permanent workplace is not tax-deductible under HMRC rules.

However, you may claim relief for transportation to trade shows or work-related events in the UK or abroad.

Takeaways

Saving on taxes during business travel in the UK requires smart planning. By claiming allowable expenses like travel, meals, and accommodation costs, you can reduce your tax bill. Use HMRC guidelines to make accurate claims and avoid non-deductible charges.

Keep organized records to simplify tax compliance. These steps can help you maximize savings while staying within legal limits.

FAQs on Ways To Save On Taxes While Traveling For Work In UK

1. What business travel expenses are tax-deductible in the UK?

Allowable expenses include travel costs, accommodation expenses, subsistence allowance, parking fees, and rental car expenses related to a temporary workplace or trade shows.

2. Can I claim tax relief for commuting to my permanent workplace?

No, ordinary commuting to a permanent workplace is considered non-deductible under UK tax rules.

3. How does working from home affect business travel deductions?

If you work from home and travel directly to a temporary workplace or client site, those travel expenses may qualify for tax relief.

4. Are bleisure trips eligible for tax deductions?

Only the portion of the trip strictly related to business activities can be claimed as allowable expenses; private travel costs are non-deductible.

5. Can I save on VAT rates while traveling for work in the European Union?

Yes, businesses can reclaim VAT on certain qualifying business-related purchases like hotel stays and car rentals if they comply with local VAT regulations.

6. Do umbrella companies help reduce taxes during work-related trips?

Umbrella companies can assist by managing your employment benefits and ensuring proper handling of per diem rates and other reimbursable allowances under tax compliance laws in the UK.