Why Term Life Insurance Still Matters?

Term life insurance is an attractive bet that stands out in a world of complex financial instruments and insanely cheap insurance. One of the simplest ways of providing your dear ones with a financial safety net for a period of say 10 – 30 years. In fact, if you pass away during that term, your beneficiaries will get a lump sum payment. Term life is pure protection, unlike more complicated policies, so it is best for those who have clear, time bound financial obligations.

Term vs. Whole Life: Choosing the Right Tool for the Job

That’s where the life insurance landscape can seem so daunting; there are options from term life to whole life. It is important to understand the main differences. The coverage period is limited by term life, which will expire unless a claim is made. In contrast, whole life coverage is for life, usually (as long as premiums are paid) and sometimes (depending on the policy) can accrue cash value. Of course, whole life is appealing as one can get lifelong security, but the premiums are high – sometimes five to fifteen times higher than comparable term coverage.

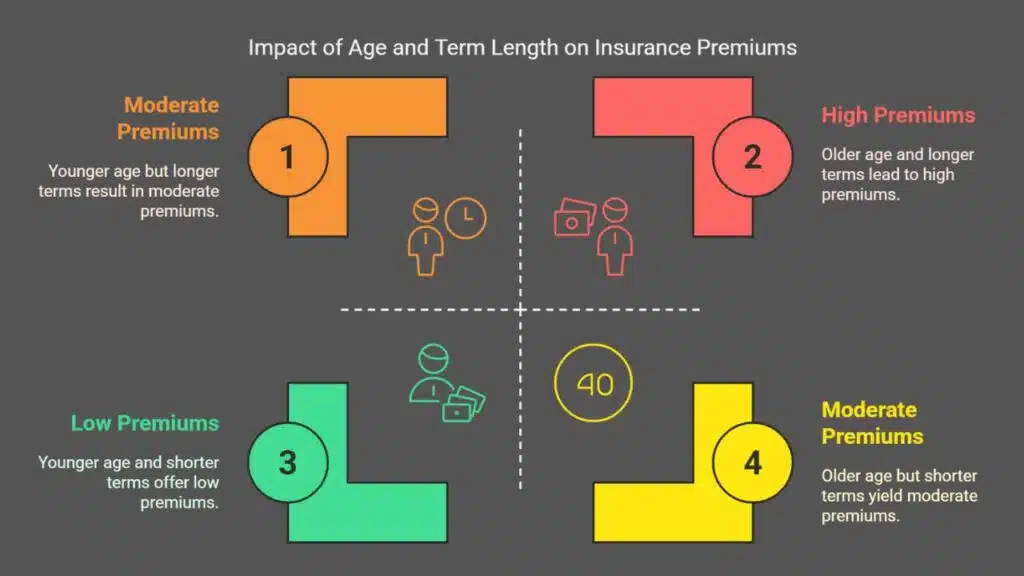

The Age Factor: Unlocking the Secrets of Life Insurance Rates

Term life insurance rates greatly depend on age. Since we age, the more likely we are to have health issues and therefore a higher risk to insurers. For that reason, younger people often lock in lower, lower premiums when securing a policy — and keep paying them for the life of the term. It is important to know how rates change with age when making educated decisions and planning ahead.

2025 Term Life Rates: A Sneak Peek (Example Chart)

Please note that the following chart is for illustrative purposes only and is intended to be used as an estimate of rates for the average healthy non-smoking individual. Rates may vary actual dependent on the specific circumstance. Always obtain personalized quotes.

| Age | $250,000 Coverage (10-Year Term) | $500,000 Coverage (20-Year Term) |

|---|---|---|

| 25 | $15/month | $30/month |

| 35 | $18/month | $36/month |

| 45 | $35/month | $70/month |

| 55 | $80/month | $160/month |

Decoding the Numbers: What the Rates Tell You?

It is easy to see doing nothing costs when you refer to the life insurance rates by age chart. The more you pay for a certain coverage, the older you are. Making the decision to delay could have a large impact on your premiums. Longer term lengths also tend to mean higher monthly payments, as the insurance company is taking a greater risk.

Analyzing the Trends: What the Chart Reveals?

Life insurance rates age chart clearly shows the link between age and premium costs. For example, someone who is 55 and wishes to buy coverage will pay a lot more than a 25-year-old. This difference illustrates the value of securing coverage at an earlier age to secure lower rates. Also, premiums are higher with longer term lengths since the insurance company is at greater risk of having to pay out since the insured is getting older.

Beyond the Basics: The Hidden Perks of Term Life Insurance

Term life insurance has more uses than just a death benefit. Because of its affordability, the house is perfect for young families, homeowners, and people with substantial debt. It can be used to plug in lost income, mortgage, education expenses, and to pay for final arrangements, a necessary peace of mind.

Beyond the Years: What Else Impacts Your Premium?

Age is certainly not the only factor involved. The term life insurance rates you pay are determined by your health, your lifestyle, as well as the specifics of the policy. They will take into consideration your pre-existing conditions, your smoking habits and how much coverage you select. Certain companies might register you and skip the medical exam for a thorough questionnaire about your health.

Finding the Right Fit: Expert Advice and Personalized Solutions

The decision of selecting the right term life insurance policy is personal. You need to take into account all your individual needs, financial obligations, as well as your long-term goals. If you have no idea whatsoever, don’t wait to ask for guidance from licensed agents and ask them questions, they will help you find a policy that suits your situation. Find flexible choices which enable you to specify coverage quantities and lengths of term to suit your needs.

Claims and Payouts: What Your Family Needs to Know?

Usually, the term life insurance claims process is fairly easy. If there are no unusual circumstances, the beneficiaries fill out a claim with the insurer, present necessary documentation, and get a tax free, lump sum payment. The policy can be denied if the application contains false information or if death is by suicide in the first two years of the policy.

End of the Line: What Happens When Your Term Expires?

At the end of the term, you have a few options: renew your existing policy (rates will likely be higher), apply for a new policy, or simply let the coverage lapse. Term life insurance doesn’t build cash value, so there’s no “cash out” option at the end of the term.

Take Control Today: Protecting Your Family’s Future in 2025

Term life insurance remains a crucial tool for financial planning in 2025. Understanding how term life insurance rates by age chart affects premiums, considering individual needs and exploring available options enables individuals to secure affordable protection and ensure their loved ones’ financial well-being. The importance of safeguarding sensitive information through a well-structured data breach response plan should be also considered to ensure the safety of sensitive information and minimize the cyber threats for businesses. By acting now, individuals can gain peace of mind and protect their family’s future.