Investing in real estate in Australia can be incredibly lucrative, but the taxes associated with property ownership can quickly eat into your profits.

Fortunately, with the right knowledge, you can implement strategic Tax-Saving Tips for Real Estate Investors in Australia that will minimize your tax burden and maximize your investment returns.

By following these expert strategies, you can take full advantage of deductions, tax exemptions, and efficient financial structures to retain more of your earnings.

In this guide, we’ll walk you through 8 actionable Tax-Saving Tips for Real Estate Investors in Australia that can transform your approach to property investing.

From leveraging negative gearing to exploring depreciation deductions, each tip is designed to help you optimize your financial strategy and reduce your taxes effectively.

Understanding the Basics of Real Estate Taxation in Australia

Before diving into Tax-Saving Tips for Real Estate Investors in Australia, it’s essential to understand how taxation works for property investors in the country.

Knowing the fundamentals will help you identify where you can save on taxes and maximize your investment returns.

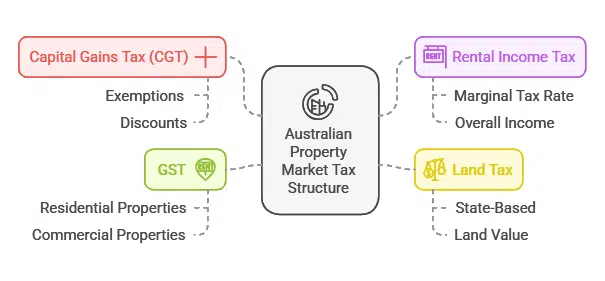

Overview of the Australian Property Market Tax Structure

The Australian property tax system is complex, but a thorough understanding can lead to substantial tax savings. Here’s an overview of the key taxes:

- Capital Gains Tax (CGT): When selling an investment property, profits are subject to CGT. However, certain exemptions and discounts can significantly reduce the taxable gain.

- Rental Income Tax: Income generated from renting out your property is taxed at your marginal tax rate, meaning it’s added to your overall income.

- Land Tax: Depending on the state, you may be required to pay land tax, which is based on the value of the land.

- GST: While GST usually doesn’t apply to residential properties, it may apply to new commercial properties.

These elements form the backbone of Tax-Saving Tips for Real Estate Investors in Australia, and understanding them is crucial for effective tax planning.

Common Tax Challenges Faced by Real Estate Investors

Tax-related challenges are common for property investors. High rental income taxes, capital gains tax upon the sale of properties, and missed deductions are some of the most significant obstacles. Knowing how to leverage Tax-Saving Tips for Real Estate Investors in Australia will help mitigate these challenges and maximize your returns.

8 Tax-Saving Tips for Real Estate Investors in Australia

Let’s dive into 8 powerful tax-saving tips that every real estate investor in Australia should consider.

By implementing these strategies, you can maximize your investment returns, minimize your tax burden, and keep more of your hard-earned money working for you.

Tip 1: Leverage Negative Gearing to Your Advantage

Negative gearing is a powerful strategy that allows you to reduce your taxable income by offsetting the losses from your investment property against your other income sources, such as salary.

This is one of the most popular Tax-Saving Tips for Real Estate Investors in Australia.

How Negative Gearing Can Lower Taxable Income

By using negative gearing, you can claim a deduction for the expenses of owning an investment property, such as loan interest, repairs, and depreciation.

The loss can be applied against your taxable income, effectively reducing the amount of tax you owe.

Example:

If your rental property incurs a loss of $10,000 and you have a salary of $150,000, you can reduce your taxable income to $140,000, lowering your tax bill.

| Item | Amount |

| Rental Income | $30,000 |

| Loan Interest Payments | $40,000 |

| Property Expenses | $5,000 |

| Net Loss | -$15,000 |

| Adjusted Taxable Income | $135,000 |

By strategically applying negative gearing, you can significantly reduce your taxable income and maximize your investment returns.

Calculating Negative Gearing on Your Investments

To effectively implement negative gearing, it’s crucial to calculate your losses and offset them correctly.

For example, if the property is costing you more than it generates, you can use that loss to reduce your overall income tax.

| Property Expense Type | Amount |

| Loan Interest | $18,000 |

| Repairs & Maintenance | $3,000 |

| Other Expenses | $2,000 |

| Total Expenses | $23,000 |

| Rental Income | $20,000 |

| Taxable Loss | -$3,000 |

This loss can be used to reduce your taxable income, thereby decreasing the amount of tax owed.

Tip 2: Claim Depreciation Deductions on Investment Properties

Another highly effective strategy for real estate investors is depreciation. By claiming depreciation on your property and its assets, you can reduce your taxable income significantly.

Depreciation is a crucial Tax-Saving Tip for Real Estate Investors in Australia that’s often overlooked.

Types of Depreciation You Can Claim

There are two main types of depreciation you can claim:

- Building Depreciation (Capital Works Deductions): The ATO allows you to claim depreciation on the building’s structure, typically at 2.5% of the construction cost each year.

- Plant and Equipment Depreciation: Items such as air conditioners, dishwashers, and carpets can be depreciated over their useful life. These deductions can add up quickly, especially in properties with multiple appliances.

Maximizing Depreciation Deductions Using a Quantity Surveyor

To fully benefit from depreciation, it’s advisable to hire a qualified quantity surveyor. These experts can prepare a detailed depreciation schedule, ensuring you claim all possible deductions and maximize your tax savings.

| Depreciation Item | Annual Depreciation |

| Building Depreciation | $1,500 |

| Dishwasher | $250 |

| Air Conditioner | $350 |

A quantity surveyor will help ensure you don’t miss out on valuable deductions and comply with ATO rules, which is key to maximizing your savings.

Tip 3: Take Advantage of Capital Gains Tax (CGT) Exemptions

When you sell a property, you may be subject to Capital Gains Tax (CGT). However, there are exemptions and strategies you can use to reduce the impact of CGT, making this one of the most valuable Tax-Saving Tips for Real Estate Investors in Australia.

Strategies to Minimize Capital Gains Tax

- The 50% CGT Discount: If you hold the property for over 12 months, you are eligible for a 50% CGT discount, which halves the amount of tax owed on capital gains.

- Primary Residence Exemption: If the property was your primary residence for all or part of the ownership period, you may qualify for a CGT exemption.

- Offsetting Gains with Losses: You can offset capital gains with capital losses from other investments, reducing your overall taxable gain.

| Holding Period | CGT Discount | Taxable Gain After Discount |

| Less than 12 months | 0% | Full taxable gain |

| More than 12 months | 50% | Half taxable gain |

By holding the property for more than 12 months, you can reduce your CGT liability by 50%, thus saving a significant amount on taxes.

Tip 4: Invest Through a Self-Managed Super Fund (SMSF)

Using a Self-Managed Super Fund (SMSF) to invest in real estate offers a tax-efficient way to grow your portfolio, making it one of the most powerful Tax-Saving Tips for Real Estate Investors in Australia.

Why SMSF Investment is Tax-Effective for Real Estate Investors

The income generated from an investment property in an SMSF is taxed at a concessional rate of 15%. When the property is sold, the SMSF may qualify for the CGT discount if held for over 12 months, reducing the tax liability even further.

Once you enter retirement and the SMSF transitions to pension mode, income and capital gains from SMSF investments can become tax-free.

Key Considerations Before Setting Up an SMSF for Real Estate

Setting up an SMSF requires careful consideration, including compliance with regulations, setup costs, and potential liquidity issues.

Consulting with an SMSF specialist is crucial to ensure that this strategy aligns with your long-term financial goals.

Tip 5: Maximize Your Deductions on Property Management Costs

Many real estate investors overlook the deductible expenses associated with property management.

Maximizing these deductions is an essential Tax-Saving Tip for Real Estate Investors in Australia that can reduce your taxable income.

Types of Property Management Expenses You Can Claim

Common property management expenses that are deductible include:

- Agent’s Fees: Fees paid to real estate agents for managing your property.

- Advertising Costs: Costs associated with advertising the property for rent.

- Repairs and Maintenance: Expenses for maintaining or repairing the property (excluding capital improvements).

- Insurance Premiums: Building and landlord insurance premiums are fully deductible.

How to Organize Property Management Costs for Tax Purposes

To ensure you claim every possible deduction, keep detailed records of your expenses. Using accounting software or hiring a tax professional can help you stay organized and maximize your deductions.

| Expense Type | Deductible Amount |

| Agent’s Fees | Full amount |

| Repairs & Maintenance | Full amount |

| Insurance Premiums | Full amount |

Tip 6: Utilize Tax-Effective Financing for Property Investment

The way you structure your financing for investment properties can have a significant impact on your taxes.

Understanding tax-effective financing is a key Tax-Saving Tip for Real Estate Investors in Australia that allows you to reduce taxable income while leveraging the power of debt to grow your portfolio.

Interest Deductions on Investment Loans

When you borrow money to finance an investment property, the interest payments on the loan are tax-deductible.

This deduction reduces your taxable income, which can significantly lower your tax liability. Be sure to separate personal and investment loans so that you can accurately claim interest deductions on the loan used to finance the property.

Example:

Let’s assume you take out an investment loan of $300,000 at 4% interest per year. The interest of $12,000 ($300,000 x 4%) is deductible against your rental income.

Refinancing to Unlock Greater Tax Deductions

Refinancing can free up additional capital for further property purchases while keeping your interest payments deductible.

Refinancing allows you to consolidate existing loans, lower your interest rates, or take equity out of your property, all of which can enhance your tax savings and portfolio growth.

Example:

If you refinance and take out an additional $100,000 in equity for further property investment, the new loan will increase your interest deductions, reducing taxable income even further.

| Loan Type | Annual Interest Deduction |

| Existing Loan | $12,000 |

| Refinanced Loan | $16,000 |

| Total Tax Deduction | $28,000 |

By refinancing wisely, you can significantly increase your interest deductions, leading to greater tax savings.

Tip 7: Consider Holding Property in a Trust for Tax Benefits

Utilizing a trust to hold your investment property offers several tax advantages and asset protection benefits, making it a valuable Tax-Saving Tip for Real Estate Investors in Australia.

By structuring your investments through a trust, you can distribute income in a way that minimizes tax and provides flexibility for future planning.

Types of Trusts Used in Property Investment

- Discretionary Trusts: These trusts allow income to be distributed among the beneficiaries, which can help reduce taxes by distributing income to those in lower tax brackets.

This is particularly useful when the trust has multiple beneficiaries with varying income levels.

- Unit Trusts: A unit trust is used when multiple investors own a share in the property, and income is distributed based on each investor’s share. This type of trust is often used for larger investment portfolios and can be more tax-efficient when structured correctly.

How a Trust Can Help with Tax Planning and Asset Protection

Trusts offer flexibility in distributing income to beneficiaries, which can reduce the overall tax burden.

Trusts also provide asset protection because the property is held by the trust, not the individual investor, making it more difficult for creditors to claim assets.

For example, if you are a high-income earner, distributing rental income from a trust to family members in a lower tax bracket can help reduce the overall tax burden.

| Trust Type | Income Distribution Flexibility | Asset Protection |

| Discretionary Trust | High | Yes |

| Unit Trust | Fixed (based on shareholding) | Yes |

This flexible structure allows you to optimize your tax position while protecting your property from legal claims.

Tip 8: Stay Updated on Tax Law Changes and Claim More Deductions

Tax laws in Australia are frequently updated, and staying informed about these changes is a crucial Tax-Saving Tip for Real Estate Investors in Australia.

Regularly reviewing new tax reforms, exemptions, and deductions ensures that you’re always optimizing your tax strategy to reduce liabilities.

How Tax Reforms Affect Real Estate Investors

The Australian government frequently introduces changes to property taxes, depreciation allowances, and negative gearing rules.

For example, in recent years, some reforms have impacted the ability to claim depreciation on second-hand properties, making it more important than ever to stay updated on current laws.

By regularly reviewing tax law changes, you can adapt your strategy and ensure that you are taking advantage of the latest opportunities to save on taxes.

Regularly Consult with a Tax Professional

Consulting with a tax professional who specializes in real estate investments is one of the most effective ways to ensure that you’re maximizing your tax savings.

A tax advisor can help you navigate complex tax laws, identify new tax-saving strategies, and ensure your tax filings are accurate and compliant with the latest legislation.

Example:

If new tax laws allow you to claim additional deductions for property renovations or improvements, a tax professional will be able to inform you of these opportunities and help you claim them effectively.

Takeaways

Incorporating Tax-Saving Tips for Real Estate Investors in Australia into your investment strategy is essential for reducing your tax liability and boosting your portfolio’s profitability.

From leveraging negative gearing and depreciation to using an SMSF for investment properties, these strategies will help you retain more of your hard-earned money.

By staying informed and seeking professional advice, you can navigate the complexities of Australia’s property tax system while maximizing your returns.

Whether you’re new to real estate investing or a seasoned professional, these tips will ensure that you’re making the most of every available opportunity to save on taxes.