Raising a child with special needs in Canada is a journey filled with love, patience, and unique financial responsibilities. From therapy sessions and medical care to special education tools and home modifications, the costs can add up quickly. Thankfully, the Canadian government offers a range of tax benefits to help ease this financial burden. Understanding and using these tax credits and deductions can make a significant difference in your family’s financial well-being.

In this article, we explore the top 10 tax benefits for parents of kids with special needs in Canada. Whether you’re a new parent or have been navigating this path for years, this guide will help you make the most of your eligible tax savings.

Understanding Tax Support for Special Needs Families in Canada

Who Qualifies?

To access these benefits, your child must meet certain conditions defined by the Canada Revenue Agency (CRA). In general, children with physical or mental impairments that are severe and prolonged (lasting at least 12 months) may qualify. A medical practitioner must certify the condition using Form T2201, the Disability Tax Credit Certificate.

Key Terminology Explained

| Term | Meaning |

| DTC (Disability Tax Credit) | A non-refundable tax credit for people with disabilities or their supporting family members. |

| CDB (Child Disability Benefit) | A tax-free monthly payment for families who care for a child under 18 with a disability. |

| RDSP (Registered Disability Savings Plan) | A savings plan to help parents and others save for the long-term financial security of a person with a disability. |

Understanding these terms is essential to claiming the correct benefits.

The Top 10 Tax Benefits for Parents of Kids with Special Needs

Here are the ten most important tax benefits available to Canadian parents caring for children with disabilities. These programs are designed to provide financial support and help reduce your taxable income or give you direct cash benefits.

1. Disability Tax Credit (DTC)

The Disability Tax Credit is one of the most significant benefits available. It helps reduce the amount of income tax you may have to pay.

Eligibility: Your child must have a prolonged impairment that significantly restricts one or more daily activities.

This credit can reduce your overall tax burden and may even be transferred to you if your child doesn’t have taxable income. Once approved, it opens the door to many other benefits.

| Feature | Details |

| Benefit Type | Non-refundable tax credit |

| Annual Amount (2023) | Up to $9,428 federally (plus provincial amounts) |

| How to Apply | Submit Form T2201 certified by a medical practitioner |

Once approved, you can also claim previous years (up to 10 years) if eligible.

2. Child Disability Benefit (CDB)

The Child Disability Benefit is a tax-free monthly payment for low- and modest-income families with a child who qualifies for the DTC.

This benefit is automatically assessed when you apply for the Canada Child Benefit. It is an essential support tool that gives families additional monthly income to manage the costs of special needs care.

| Feature | Details |

| Monthly Amount (2023-2024) | Up to $261.41 per child |

| Eligibility | Based on adjusted family net income and DTC approval |

| Application Process | Automatically assessed when you apply for the CCB and DTC |

The CDB is added to the Canada Child Benefit (CCB) payment each month.

3. Registered Disability Savings Plan (RDSP)

An RDSP helps parents and guardians save for the long-term financial security of their child with a disability.

This plan allows investment growth to occur tax-free. The government may contribute additional money through grants and bonds based on income levels, which makes it a valuable long-term planning tool.

| Feature | Details |

| Contribution Limit | Lifetime limit of $200,000 |

| Government Grants | Up to $3,500/year in Canada Disability Savings Grant |

| Withdrawal Rules | Funds can be withdrawn after 10 years to avoid repayment |

Contributions are not tax-deductible, but income earned grows tax-free until withdrawn.

4. Canada Caregiver Credit (CCC)

This credit helps if you support a dependent with a mental or physical impairment, such as your child with special needs.

The CCC replaces previous caregiver credits and combines them into one, making it easier for families to apply. It is intended to assist with non-refundable tax relief to offset some of the care costs.

| Feature | Details |

| Claim Amount (2023) | Up to $7,999 per dependent |

| Eligibility | Child must be dependent on you due to impairment |

| Claiming Method | Included on your annual income tax return (Schedule 5) |

You must keep documentation, such as medical notes, to support your claim.

5. Medical Expense Tax Credit (METC)

The Medical Expense Tax Credit allows parents to claim many healthcare costs related to their child’s disability.

This is a flexible credit that includes expenses like therapy, travel costs for medical appointments, special equipment, and more. It helps recover part of what you spend out-of-pocket.

| Feature | Details |

| Eligible Expenses | Therapy, mobility aids, medical devices, travel for treatment |

| Minimum Threshold | 3% of net income or $2,635, whichever is less |

| Claiming Process | Include receipts on Line 33099 of your tax return |

Many parents are unaware that tutoring, speech therapy, and occupational therapy may also qualify.

6. Refundable Medical Expense Supplement

For working parents with low incomes, this supplement provides additional tax relief if they claim the METC.

It serves as a bonus for families who may not benefit fully from non-refundable tax credits due to low income. This is one of the few refundable tax benefits for families.

| Feature | Details |

| Maximum Amount (2023) | Up to $1,316 |

| Eligibility | Earned income required; must claim medical expenses |

| Claim Line | Line 45200 of the tax return |

This benefit is especially helpful for single parents in the workforce.

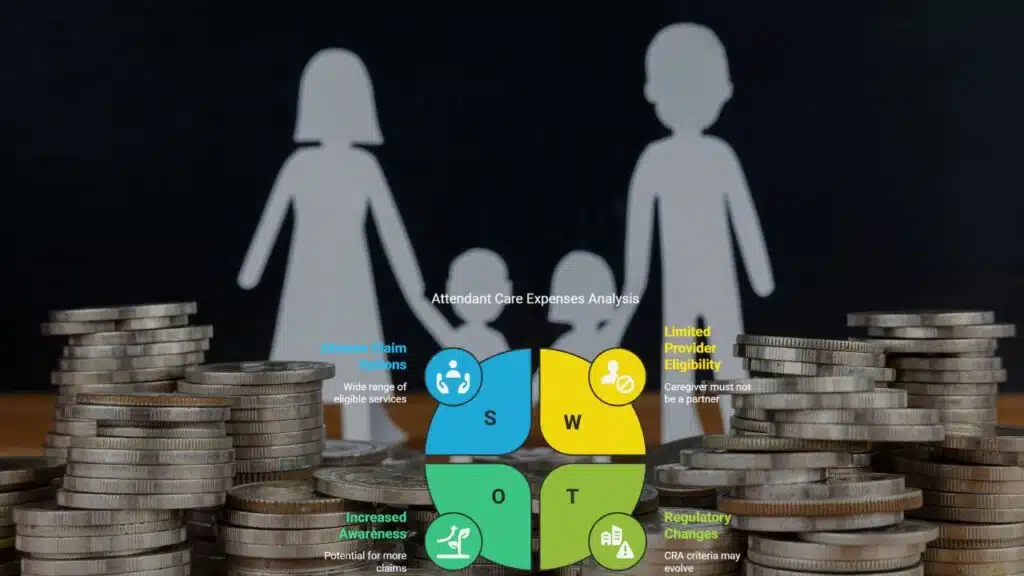

7. Attendant Care and Caregiver Expenses

These expenses include payments made to individuals who provide care to your child, either at home or in certain institutions.

Parents can claim a wide variety of services under this benefit, as long as they meet the CRA’s criteria and can provide proper documentation.

| Feature | Details |

| Eligible Costs | Salaries, wages, and fees for attendants |

| Where to Claim | Under Medical Expenses or as a caregiver deduction |

| Documentation | Contracts, receipts, proof of services provided |

You must ensure the care provider is not your spouse or common-law partner.

8. Education-Related Deductions

If your child requires specialized education services due to their disability, you may be able to claim tuition or tutoring costs.

These expenses can be significant over time. If your child attends a special school or receives one-on-one instruction from a certified tutor, you could receive relief through this credit.

| Feature | Details |

| Eligible Expenses | Special schools, tutors for learning disabilities |

| Conditions | Must be recommended by a medical practitioner |

| Claiming Method | Included under METC |

Keep documentation, including letters from your child’s doctor and school.

9. Disability Supports Deduction

This deduction is available to help people with disabilities who are working or studying.

If your child is older and earning income, or if you pay for certain supports they use for school or work, this deduction can help lower their taxable income.

| Feature | Details |

| Eligible Expenses | Text-to-speech software, interpreters, note-takers |

| Who Can Claim | The person with the disability, or parents if the child earns income |

| Tax Line | Line 21500 |

It helps reduce taxable income, unlike a tax credit.

10. Provincial and Territorial Tax Credits

Each province and territory in Canada may offer additional credits or supplements.

Provincial benefits can vary widely but often include child care subsidies, additional disability supplements, or educational supports. It’s important to explore what your province offers.

| Province | Unique Benefit |

| Ontario | Ontario Child Benefit (extra amount for disabilities) |

| British Columbia | BC Child Opportunity Benefit |

| Quebec | Deduction for care of disabled dependents |

Check your local government’s website for up-to-date programs.

Bonus Tips for Maximizing Your Tax Return

Keep Detailed Records All Year

Save receipts, doctor’s notes, invoices, and education documentation. These documents support your claims and protect you in case of an audit.

Use a Tax Professional with Disability Tax Experience

Some credits and deductions are complex. An experienced tax advisor can help you:

- Identify all eligible claims

- File retroactive claims

- Avoid common errors

File on Time to Maximize Credits

Filing on time ensures that you receive all eligible benefits without delay or penalty. The CRA’s tax deadline is usually April 30 each year.

Frequently Asked Questions (FAQs)

Q: Can I claim multiple credits for the same child?

A: Yes. You can claim the DTC, METC, CCC, and others together, as long as you meet the eligibility rules.

Q: Do I need to reapply for the DTC every year?

A: Not always. If the CRA approves your child’s DTC for an indefinite period, you don’t need to reapply annually.

Q: Can both parents claim the same child?

A: In shared custody situations, parents may share certain benefits, but only one can claim the DTC in a given year.

Q: Are tax benefits retroactive?

A: Yes. Some benefits like the DTC and METC can be claimed for up to 10 years retroactively if eligible.

Takeaways

Navigating the tax system as a parent of a child with special needs can feel overwhelming. But knowing what support is available can lift a significant financial burden off your shoulders. From the Disability Tax Credit to education-related deductions and provincial supports, these benefits can help you better provide for your child’s future.

Take the time to explore and apply for all the benefits you qualify for. With the right information, support, and planning, you can secure more financial peace of mind for your family.

If you’re unsure where to begin, consider speaking with a tax professional who specializes in disability-related benefits. And always keep good records—they’re key to maximizing your claims.