The global financial landscape has undergone significant shifts, with persistently low interest rates shaping new challenges and opportunities for various sectors. As a critical component of financial planning, life insurance must adapt to changing economic dynamics to continue delivering value to policyholders.

This article explores how life insurance providers are transforming their offerings to remain competitive and meet the evolving needs of customers in today’s low-interest-rate environment.

Challenges posed by low interest rates for life insurance

Low interest rates directly impact the profitability of life insurers, especially for products with guaranteed returns. Traditional plans like whole life policies and endowment plans rely on investment returns to sustain payouts, which become harder to achieve in a low-rate economy.

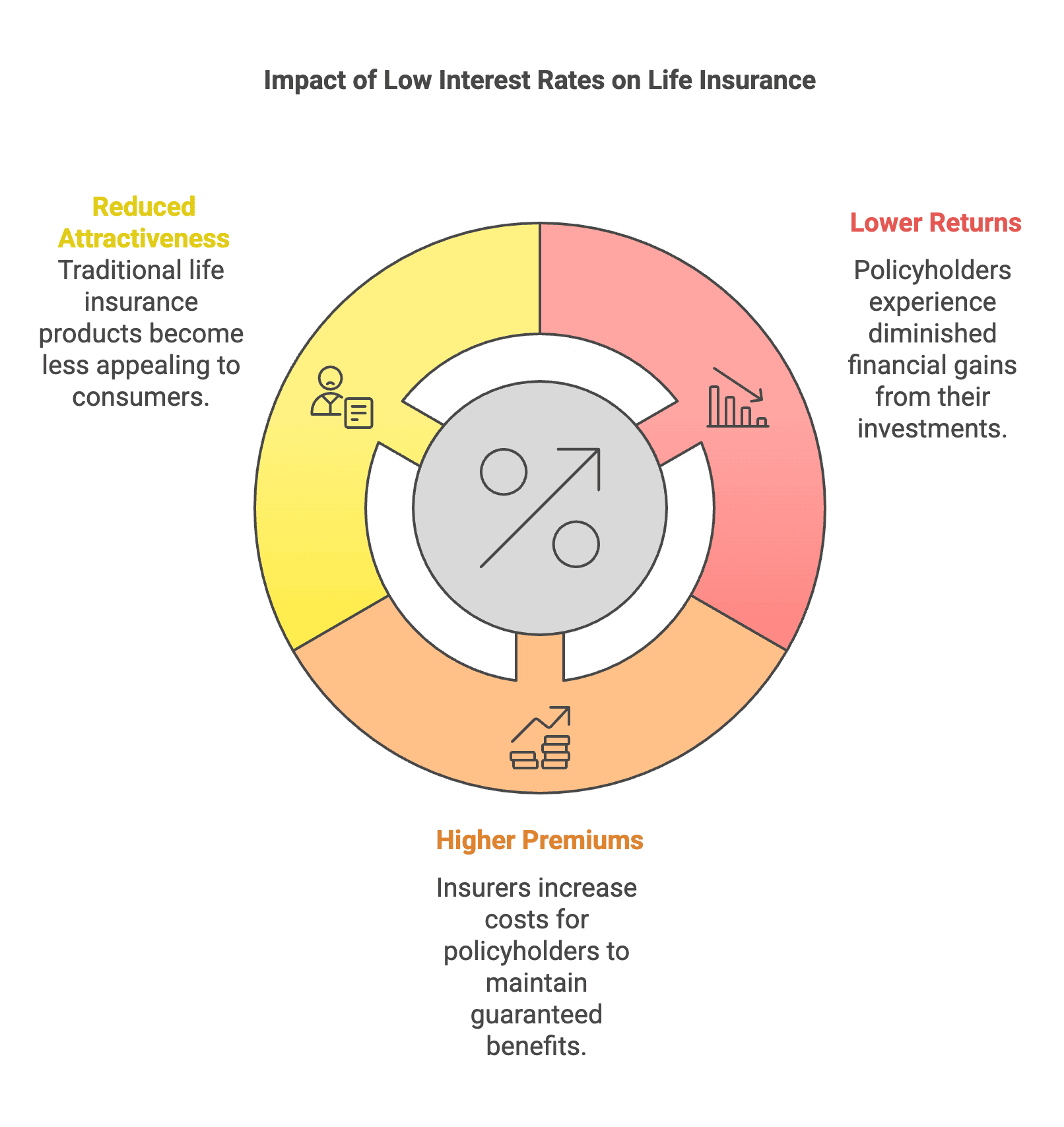

For policyholders, this often translates to:

- Lower returns on savings and investment-linked policies.

- Higher premiums for guaranteed products.

- Reduced attractiveness of traditional life insurance products.

These challenges require insurers to innovate and restructure their product portfolios to remain relevant and competitive.

Shifting focus to term insurance

One of the most significant shifts in the life insurance market has been the increased emphasis on term insurance. Unlike savings-oriented products, term insurance focuses purely on providing financial protection at affordable premiums.

Key benefits of term insurance in a low-rate economy include:

- High sum assured at low costs, making it accessible to a broader audience.

- Flexibility to customise coverage with riders such as critical illness and accidental death benefits.

- Greater focus on protection rather than investment, aligning with policyholders’ immediate financial security needs.

Emergence of hybrid insurance products

To bridge the gap between traditional life insurance and investment products, insurers are introducing hybrid solutions that combine life cover with investment opportunities. These plans balance the need for financial protection and savings, even in a low-interest-rate scenario.

Some of the popular hybrid products include:

- Unit-Linked Insurance Plans (ULIPs): These plans allow policyholders to invest in equity or debt funds, offering market-linked returns while providing life cover.

- Savings-oriented term plans: These include add-ons like return of premium, ensuring that policyholders receive a portion of their contributions back if no claim is made.

These innovations cater to customers seeking flexible and value-driven insurance solutions.

Technology-driven transformation in life insurance

Technology continues to play a pivotal role in transforming the insurance industry, especially in adapting to economic challenges. Digitalisation is enabling insurers to streamline operations, enhance customer experiences, and optimise costs.

Key technological advancements include:

- Data analytics: Helps insurers assess customer needs and tailor policies accordingly.

- Automation: Simplifies underwriting, claims processing, and policy servicing.

- Online platforms: Make it easier for customers to compare, purchase, and manage policies.

Digital tools have also empowered customers with real-time access to their policies, fostering transparency and trust.

Focus on customer-centric solutions

In a low-rate economy, customer expectations are evolving. Policyholders now prioritise products that offer flexibility, transparency, and long-term value. Insurers are addressing these demands by introducing:

- Customisable policies: Allowing policyholders to adjust coverage and benefits based on their financial goals.

- Wellness-linked plans: Offering rewards for maintaining a healthy lifestyle, such as premium discounts or additional benefits.

- Simplified terms: Providing clear and transparent policy structures to build customer trust.

Adapting investment strategies

Insurers are rethinking their investment strategies to optimise returns in a low-interest-rate environment. This includes diversifying their portfolios into alternative assets such as real estate, infrastructure, and private equity. By adopting a balanced approach, insurers can generate stable returns while minimising risks.

These strategic changes ensure that life insurance products remain sustainable and continue to deliver value to policyholders.

The role of term insurance in financial planning

As the focus shifts from savings-oriented products to protection-focused solutions, term insurance has emerged as a cornerstone of financial planning. Its affordability and high coverage make it an ideal choice for individuals looking to secure their family’s financial future.

Key features of term insurance in a low-rate economy include:

- Flexibility: Policyholders can add riders like critical illness cover to enhance protection.

- Affordability: Premiums remain low, making it accessible for a wide audience.

- Ease of purchase: Online platforms simplify the process of comparing and buying policies.

By prioritising financial protection over returns, term insurance ensures stability even in uncertain economic times.

Sustainability in life insurance

In addition to economic challenges, the insurance industry is embracing sustainability as a core value. Insurers are incorporating Environmental, Social, and Governance (ESG) principles into their operations and investment portfolios.

Key initiatives include:

- Investing in green projects and renewable energy.

- Offering policies that support sustainable practices.

- Aligning business goals with global sustainability efforts.

These measures not only address environmental concerns but also appeal to socially conscious customers.

Conclusion

The insurance industry is undergoing a significant transformation to navigate today’s low-rate economy. From a greater emphasis on term insurance to the adoption of hybrid products and technological innovations, insurers are redefining their offerings to meet evolving customer needs.

Policyholders, too, are adapting by prioritising protection-focused solutions and leveraging digital tools to make informed decisions. Whether you’re considering a traditional life insurance policy or exploring hybrid options, the key is to choose a plan that aligns with your financial goals and offers long-term value.

As the industry continues to evolve, life insurance remains an essential part of financial planning, providing stability and security in uncertain times.

Disclaimer: *T&C Apply – Bajaj Finance Limited (‘BFL’) is a registered corporate agent of third-party insurance products of Bajaj Allianz Life Insurance Company Limited, HDFC Life Insurance Company Limited, Future Generali Life Insurance Company Limited, Bajaj Allianz General Insurance Company Limited, SBI General Insurance Company Limited, ACKO General Insurance Limited, ICICI Lombard General Insurance Company Limited, HDFC ERGO General Insurance Company Limited, Tata AIG General Insurance Company Limited, The New India Assurance Company Limited, Cholamandalam MS General Insurance Company Limited, Niva Bupa Health Insurance Company Limited , Aditya Birla Health Insurance Company Limited, Manipal Cigna Health Insurance Company Limited and Care Health Insurance Company Limited under the IRDAI composite CA registration number CA0101. Please note that, BFL does not underwrite the risk or act as an insurer. Your purchase of an insurance product is purely on a voluntary basis after your exercise of an independent due diligence on the suitability, viability of any insurance product. Any decision to purchase insurance product is solely at your own risk and responsibility and BFL shall not be liable for any loss or damage that any person may suffer, whether directly or indirectly. Please refer insurer’s website for Policy Wordings. For more details on risk factors, terms and conditions and exclusions please read the product sales brochure carefully before concluding a sale. URN No. BFL/Advt./23-24/605