The digital world is undergoing a massive transformation with Web3 leading the charge.

At the heart of this revolution are Web3 tokens, the fundamental building blocks enabling decentralized applications, smart contracts, and the broader blockchain ecosystem.

In this article, we explore the 10 most popular Web3 tokens and their use cases, shedding light on how they are shaping industries and empowering decentralized economies.

What Are Web3 Tokens?

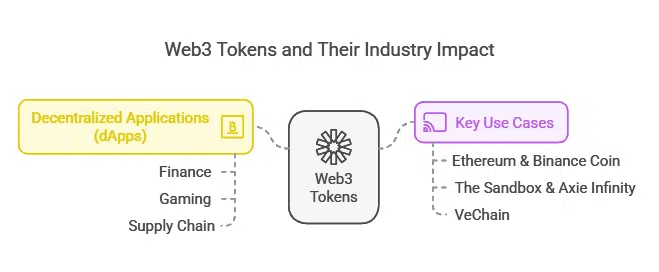

Web3 tokens are digital assets native to the Web3 ecosystem—the next evolution of the internet characterized by decentralization, transparency, and user empowerment. These tokens power decentralized applications (dApps) and blockchain platforms, facilitating functionalities such as smart contracts, governance, and value exchange. Understanding the most popular Web3 tokens and their use cases is key to appreciating their role in reshaping the digital economy.

Understanding the Concept of Web3

Web3 refers to an internet ecosystem built on blockchain technology. Unlike Web2, which relies on centralized platforms, Web3 ensures data ownership, enhanced security, and decentralization. Web3 tokens are pivotal to this vision, serving as tools to interact with decentralized systems.

How Web3 Tokens Differ from Traditional Cryptocurrencies?

While cryptocurrencies like Bitcoin function as digital currencies, Web3 tokens serve a broader purpose, including governance, utility, and staking. For example, Ethereum (ETH) fuels smart contracts, while Filecoin (FIL) powers decentralized storage solutions. This distinction makes the most popular Web3 tokens and their use cases even more critical for blockchain adoption.

Why Are Web3 Tokens Gaining Popularity?

The Rise of Decentralized Applications (dApps)

Web3 tokens underpin the functionality of dApps, which are disrupting industries like finance, gaming, and healthcare. These decentralized systems eliminate intermediaries, enabling trustless, peer-to-peer interactions. For instance, DeFi platforms like Compound and gaming ecosystems such as Axie Infinity thrive on the efficiency of Web3 tokens.

Key Use Cases of Web3 Tokens Across Industries

- Finance: Tokens like Ethereum and Binance Coin are the backbone of decentralized finance (DeFi) applications, enabling lending, borrowing, and trading without intermediaries.

- Gaming: The Sandbox (SAND) and Axie Infinity’s AXS power gaming ecosystems, allowing players to own and trade in-game assets.

- Supply Chain: Web3 tokens like VeChain ensure transparency and traceability by recording every transaction on immutable ledgers.

These examples highlight how the most popular Web3 tokens and their use cases are redefining traditional industries.

The 10 Most Popular Web3 Tokens

Below, we delve into the 10 most popular Web3 tokens and their use cases, highlighting how they contribute to the Web3 ecosystem.

1. Ethereum (ETH)

Ethereum is often referred to as the “world computer” due to its ability to support smart contracts and decentralized applications. Its blockchain allows developers to build a wide array of projects, from financial systems to games and marketplaces, with unparalleled flexibility. As the pioneer of smart contracts, Ethereum remains the leading platform for Web3 innovation.

Use Case: The backbone of decentralized applications and smart contracts.

Notable Example: Powers DeFi platforms like Uniswap and lending protocols like Aave.

| Key Features | Details |

| Smart Contract Support | Facilitates automated, trustless contracts. |

| DeFi Integration | Supports lending, borrowing, and trading. |

| Scalability Updates | Transitioning to Ethereum 2.0 for better performance. |

2. Polkadot (DOT)

Polkadot is designed to solve the problem of blockchain interoperability. It allows different blockchains to communicate and share information securely, which is critical for building a truly decentralized internet. Polkadot’s unique architecture promotes scalability and customization, making it a favorite among developers.

Use Case: Interoperability between blockchains.

Notable Example: Enables multi-chain applications with cross-network connectivity.

| Key Features | Details |

| Interoperability | Connects multiple blockchain networks. |

| Scalability | Supports parallel transactions for faster processing. |

| Governance Mechanism | Allows stakeholders to influence protocol upgrades. |

3. Chainlink (LINK)

Chainlink is the leading decentralized oracle network that bridges blockchain applications with real-world data. This makes it indispensable for use cases like insurance, DeFi, and gaming, where external data inputs are essential for functionality.

Use Case: Decentralized oracles for data integration.

Notable Example: Provides real-world data for smart contracts in DeFi platforms.

| Key Features | Details |

| Oracle Network | Decentralized oracles for secure data feeds. |

| Use in DeFi | Powers price feeds and insurance contracts. |

| Cross-Chain Compatibility | Integrates with various blockchains. |

4. Solana (SOL)

Solana is known for its lightning-fast transaction speeds and low fees, making it a preferred platform for developers looking to create scalable dApps. It’s particularly popular in the NFT and DeFi spaces, where high throughput is critical.

Use Case: High-speed transactions for dApps and NFTs.

Notable Example: Supports NFT marketplaces like Magic Eden.

| Key Features | Details |

| Transaction Speed | Processes over 65,000 transactions per second. |

| Low Fees | Transaction costs are a fraction of a cent. |

| Developer Ecosystem | Offers tools for building scalable applications. |

5. Binance Coin (BNB)

Binance Coin is the native token of the Binance ecosystem. Originally launched as a utility token for trading fee discounts, it has grown into a multi-purpose asset that powers Binance Smart Chain, DeFi applications, and more.

Use Case: Powers the Binance ecosystem, including trading and DeFi applications.

Notable Example: Enables transactions on the Binance Smart Chain.

| Key Features | Details |

| Utility Token | Used for trading fee discounts on Binance. |

| Ecosystem Integration | Supports DeFi, NFTs, and staking. |

| Deflationary Mechanism | Regular token burns reduce supply. |

6. Avalanche (AVAX)

Avalanche is a highly scalable blockchain platform known for its speed and energy efficiency. Its consensus mechanism allows it to process thousands of transactions per second, making it ideal for DeFi and enterprise use cases.

Use Case: Scaling solutions for blockchain ecosystems.

Notable Example: Runs DeFi protocols like Trader Joe and lending platforms.

| Key Features | Details |

| High Throughput | Processes over 4,500 transactions per second. |

| Energy Efficiency | Environmentally friendly blockchain. |

| Custom Blockchain Support | Enables creation of custom subnets. |

7. Tezos (XTZ)

Tezos is a self-amending blockchain, meaning it can upgrade itself without hard forks. This ensures long-term stability and adaptability, making it a strong choice for enterprise applications and NFTs.

Use Case: Self-amending blockchain networks.

Notable Example: Used for corporate blockchain solutions and NFT platforms.

| Key Features | Details |

| Self-Amending Capability | Updates without disruptive forks. |

| Security | Uses formal verification for smart contracts. |

| Energy Efficiency | Operates on a proof-of-stake mechanism. |

8. Cardano (ADA)

Cardano is focused on sustainability and scientific rigor, with every update peer-reviewed before implementation. It aims to provide a more secure and scalable infrastructure for developers and enterprises.

Use Case: Enhancing sustainability in blockchain operations.

Notable Example: Empowers peer-reviewed smart contract development.

| Key Features | Details |

| Scientific Approach | Peer-reviewed protocol updates. |

| Scalability | Supports high-performance applications. |

| Low Energy Consumption | Operates on proof-of-stake. |

9. Filecoin (FIL)

Filecoin is a decentralized storage network that allows users to rent unused storage space. It provides a secure, cost-effective alternative to traditional cloud storage providers like AWS.

Use Case: Decentralized storage solutions.

Notable Example: Provides storage for dApps and secure data hosting.

| Key Features | Details |

| Decentralized Storage | Distributes data across multiple nodes. |

| Cost-Effective | Reduces costs compared to traditional cloud providers. |

| Security | Ensures data integrity with redundancy. |

10. The Sandbox (SAND)

The Sandbox is a virtual metaverse where players can buy, sell, and monetize virtual assets and land. It is a cornerstone in the emerging metaverse economy, offering opportunities for both creators and gamers.

Use Case: Virtual real estate and gaming ecosystems.

Notable Example: Drives the metaverse economy through digital asset trading.

| Key Features | Details |

| Metaverse Integration | Facilitates virtual asset creation and trade. |

| User-Generated Content | Empowers creators to monetize their assets. |

| Community Governance | Allows players to influence platform decisions. |

Key Takeaways on Web3 Tokens

- Web3 tokens are transforming industries by powering decentralized applications and blockchain ecosystems.

- Each of the 10 most popular Web3 tokens and their use cases demonstrates the versatility and potential of blockchain technology.

- As adoption grows, these tokens will continue to play a pivotal role in the decentralized internet.

Takeaways

The 10 most popular Web3 tokens and their use cases highlight the transformative potential of blockchain technology. From enabling decentralized finance to fueling the metaverse, these tokens are at the forefront of the Web3 revolution.

As we move towards a decentralized future, understanding these tokens will be key to navigating and benefiting from this new digital era.