Long-term marriages often come with unique financial considerations during a divorce, especially regarding support arrangements. Understanding how these extended unions influence financial support is crucial for both parties. Whether navigating this process alone or seeking guidance from a spousal support attorney, being informed can help ensure a fair and equitable outcome.

Understanding Long-Term Marriages

A long-term marriage is typically defined as one lasting ten years or more. These marriages often involve deep financial and emotional interdependencies, with partners having shared assets and responsibilities over a significant period. The length of the marriage plays a critical role in determining financial support arrangements, as it influences factors like alimony duration and the division of assets. In Colorado, courts consider the duration of the marriage when assessing each spouse’s financial needs and contributions.

The Role Of Alimony In Long-Term Marriages

Alimony, or spousal support, is a key consideration in long-term marriages. In Colorado, the purpose of alimony is to provide financial assistance to the lower-earning spouse, helping them maintain a standard of living similar to what they experienced during the marriage. For long-term marriages, courts may be more inclined to award alimony for an extended duration, recognizing the substantial financial and lifestyle adjustments required. Factors such as the age and health of each spouse, their earning capacity, and their contributions to the marriage are considered when determining alimony arrangements.

Equitable Distribution Of Assets

In Colorado, marital assets and debts are divided based on the principle of equitable distribution. This means that assets are divided fairly, though not necessarily equally, with consideration given to each spouse’s circumstances. In long-term marriages, the division of assets can be more complex due to the accumulation of shared property and investments over time. Courts may award a larger share of assets to the lower-earning spouse to ensure they have the resources needed to adjust to post-divorce life. The goal is to achieve a fair settlement that respects both parties’ financial contributions and needs.

Impact On Retirement And Pensions

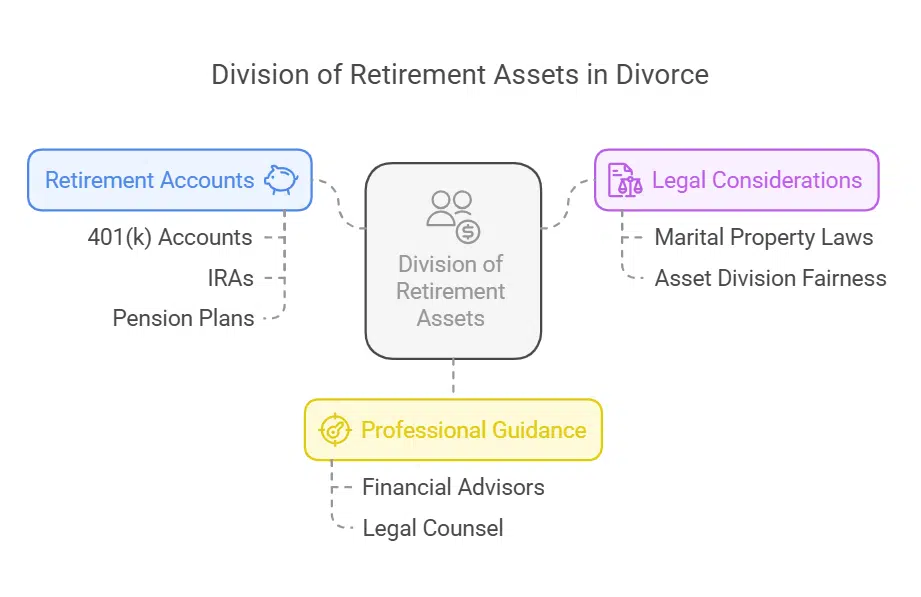

Long-term marriages often involve considerations related to retirement accounts and pensions. In Colorado, retirement savings accumulated during the marriage are typically considered marital property and subject to division. This can include 401(k) accounts, IRAs, and pension plans. Courts may divide these assets to ensure both parties receive a fair share of the retirement benefits. It’s important for divorcing couples to understand the implications of dividing retirement assets and to seek professional guidance when navigating this complex process.

Addressing Health And Age Factors

As couples in long-term marriages may be older, health and age factors often play a significant role in financial support arrangements. Courts consider each spouse’s ability to earn income and their potential healthcare needs when determining alimony and asset division. For older spouses, re-entering the workforce or acquiring new skills may be more challenging, influencing support arrangements. These considerations ensure both parties can maintain financial stability and access necessary resources post-divorce.

Seeking Professional Guidance

Given the complexities involved in divorcing after a long-term marriage, seeking professional guidance is highly recommended. Engaging experienced professionals such as divorce attorneys, financial advisors, and mediators can provide valuable insights and support. A skilled attorney can help you understand your rights and obligations, while financial experts can assist in evaluating assets and income potential. Mediation can facilitate open communication and negotiation, enabling couples to reach mutually agreeable settlements.

Preparing For Life After Divorce

Preparing for life after divorce is a crucial step for individuals coming out of long-term marriages. This preparation may involve creating a realistic budget, exploring new career opportunities, and planning for long-term financial stability. Building a secure financial foundation can help ease the transition and empower individuals to embrace their new chapter confidently. Proactively addressing financial concerns and seeking support can contribute to a smoother adjustment period.

Conclusion

Long-term marriages have a significant impact on financial support arrangements during a divorce, influencing factors like alimony and asset division. By understanding these dynamics and working with a spousal support attorney, couples can navigate the complexities with greater confidence. Addressing the unique challenges of long-term marriages ensures that both parties can move forward with the resources they need to build a new future.