Imagine knowing you have a fortune in Bitcoin—worth hundreds of millions of dollars—but not being able to access a single cent. That’s the nightmare James Howells, a computer engineer from Wales, has been living since 2013 when he accidentally threw away a hard drive containing the private keys to 8,000 BTC. The drive is now buried somewhere in a landfill, and despite years of effort [and even offers to fund a massive excavation], he still hasn’t recovered it.

His story isn’t just an expensive mistake; it’s a warning. While most people won’t lose their crypto in quite such a dramatic way, plenty of investors still misplace wallets, forget passwords, or simply stop paying attention to their holdings—only to realize too late that they made a costly oversight.

Crypto isn’t like a traditional bank account. There’s no “Forgot Password?” button that can restore access to lost funds, and if you’re not actively managing your investments, you might be missing major opportunities—or worse, exposing yourself to unnecessary risk. Let’s break down some simple but essential ways to make sure you never lose sight of your crypto investments.

Choose the Right Wallet—And Actually Use It

If you’ve ever written down a password on a sticky note, stuffed it in a drawer, and then promptly forgotten where you put it, you already know how easy it is to misplace something important. Now imagine that sticky note was the only way to access thousands of dollars in Bitcoin. That’s exactly what happens when investors don’t take their crypto wallets seriously.

A good crypto wallet isn’t just a place to store your coins—it’s your main tool for keeping track of your holdings. The best wallets make it easy to manage multiple assets, track balances across blockchains, and stay on top of transactions. Some wallets even integrate price tracking and portfolio management features, so you can see everything in one place instead of bouncing between exchanges and apps. If you’re using multiple wallets and struggling to keep track of them, switching to a well-organized, user-friendly platform can help streamline everything. (source: https://apps.apple.com/us/app/best-wallet-bitcoin-crypto/id6451312105)

Check In on Your Crypto—Because “Set It and Forget It” is a Bad Strategy

Let’s be honest: Life gets busy. It’s easy to buy some crypto, stash it in a wallet, and then forget about it for months or even years. But that’s how people wake up one day to find out their holdings are worth way less—or, worse, that they’re locked out of their accounts entirely.

Crypto moves fast. One day, everything’s fine; the next, a major exchange collapses, a new regulatory rule changes the game, or a security flaw puts funds at risk. If you’re not checking in regularly, you could miss a critical update that directly impacts your investments.

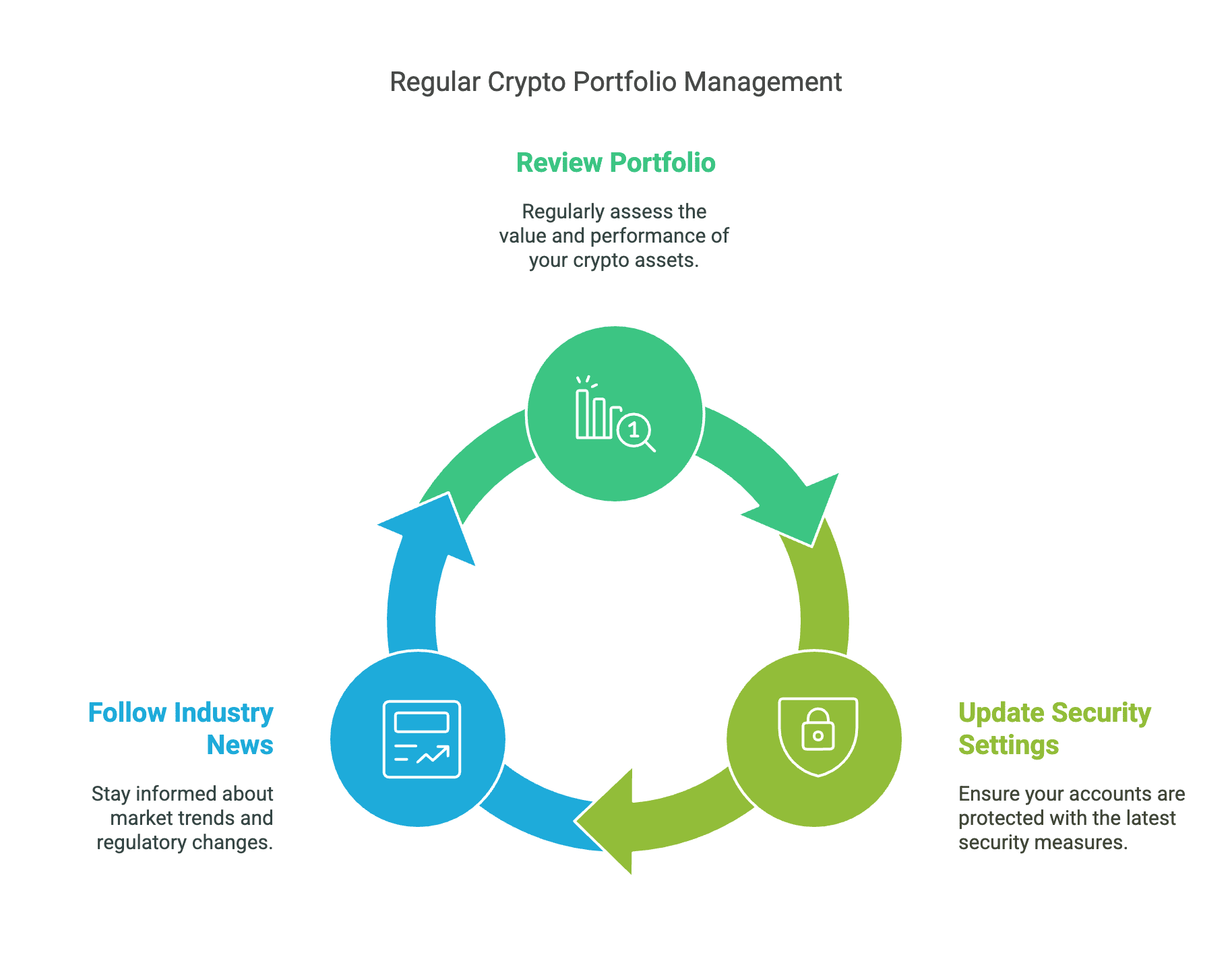

You don’t need to stare at price charts 24/7, but setting aside a little time each week to review your portfolio, update security settings, and follow key industry news can save you from a lot of headaches later on.

Don’t Lose Your Private Keys [Seriously, Just Don’t]

Losing access to your crypto is way too easy if you’re not careful. Unlike a credit card, there’s no customer support line to call if you forget your private key. Once it’s gone, there’s no way to recover it, so do everything you can to keep it safe.

Some investors think they’re being extra cautious by storing their seed phrases in a single, ultra-secure location—only to realize later that they misplaced it. Others take the opposite approach, jotting down passwords on random pieces of paper, using the same login details across multiple platforms, or storing everything on their computer [which, by the way, is a hacker’s dream].

The best approach? Redundancy. Keep multiple backups of your private keys in secure, separate locations. Store a paper copy in a safe, use an encrypted digital backup, and never, ever share your seed phrase with anyone. The extra effort now can save you a lot of stress in the future.

Stay in the Loop—Because the Crypto Market Won’t Wait for You

One of the biggest mistakes crypto investors make is thinking they don’t need to stay informed. But the market is constantly shifting—new projects launch, exchanges shut down, governments introduce new regulations, and security vulnerabilities pop up all the time.

If you’re not paying attention, you might miss major developments that affect your holdings. Maybe a coin you invested in is getting delisted. Maybe a new tax law is about to take a chunk out of your profits. Maybe there’s a security breach on an exchange you use.

Following reputable news sources, joining crypto communities, and setting up alerts for big industry updates can help you stay one step ahead. It’s not just about protecting what you have—it’s about making smarter, more informed investment decisions.

Use a Portfolio Tracker to Keep Everything in Check

If you have investments spread across multiple wallets, exchanges, and blockchains, keeping track of everything can get overwhelming and fast. This is how people lose sight of their holdings—especially if they have small amounts of different assets that they forget about over time.

A good portfolio tracker can help you monitor everything in one place. These tools let you see your total balance across multiple wallets, track performance over time, and even get alerts when major price movements happen. Instead of scrambling to remember where you stored a specific token, you’ll have a clear, real-time overview of your entire portfolio.

Think Long-Term—And Make Sure Someone Else Can Access Your Crypto If Needed

Here’s something a lot of people don’t think about: If something happens to you, what happens to your crypto? Unlike traditional assets, your family can’t just call up a bank and claim your holdings. If no one knows how to access your wallets, those funds could be lost forever.

Setting up a plan for the long term—whether that’s documenting key account details, using a secure password manager, or even setting up smart contracts that transfer funds after a certain period of inactivity—can prevent your investments from becoming digital ghosts.

Keep Your Crypto Safe and Stay Engaged

James Howells‘ story is an extreme case of losing crypto, but many investors make costly mistakes daily—forgetting passwords, skipping security updates, or neglecting portfolios.

Treat crypto like any valuable investment. Stay engaged, secure your assets, and don’t assume they’ll manage themselves. A little effort now prevents big regrets later.