Debt can be a double-edged sword. While it enables us to make significant investments such as buying a home or funding an education, it can also spiral out of control if not managed properly. Successful debt management is not about making radical lifestyle changes overnight but about developing consistent habits that promote financial stability.

If you find yourself struggling with debt or looking for ways to improve your financial health, adopting the 10 habits of people who successfully manage debt can set you on the right path. In this guide, we’ll explore the practical strategies that financially disciplined individuals use to stay ahead of their obligations.

Each habit discussed below includes actionable insights, relevant statistics, and practical tools that can help you regain financial control. By implementing these strategies, you’ll not only reduce your debt but also develop long-term financial resilience. Understanding and practicing these habits will not only help you stay out of debt but also improve your overall financial literacy and wealth-building capabilities.

10 Proven Habits of People Who Successfully Manage Debt

Successfully managing debt requires more than just paying bills on time—it’s about adopting smart habits that keep you on track financially. These habits are practiced by those who not only manage their debt but also build a strong financial future.

Whether it’s budgeting, saving, or educating yourself about finance, these habits empower individuals to stay in control and avoid falling into deeper debt.

By implementing these proven habits, you can take the necessary steps to regain control of your financial health, improve your credit score, and work toward a debt-free life. Let’s dive into the first habit, which lays the foundation for financial discipline and long-term success.

Habit 1: They Create and Follow a Budget

A well-structured budget is the foundation of successful debt management. Without one, it’s easy to lose track of expenses, overspend, and accumulate unnecessary debt. Creating a budget helps individuals allocate funds efficiently, ensuring that essential expenses, debt payments, and savings are prioritized.

A proper budget allows you to visualize your financial situation clearly, make necessary adjustments, and stay committed to financial goals. With careful planning, budgeting eliminates financial stress and brings peace of mind.

Budgeting Strategies That Work

| Budgeting Method | How It Works | Best For |

| 50/30/20 Rule | Allocating 50% to needs, 30% to wants, and 20% to savings/debt repayment. | Balanced financial planning. |

| Zero-Based Budgeting | Assigning every dollar a specific job. | People who want total control over spending. |

| Envelope System | Using cash for specific categories to control spending. | Those who struggle with impulse buying. |

| Digital Budgeting Apps | Automated tracking and financial planning tools like Mint or YNAB. | Tech-savvy individuals. |

Example:

John, a young professional, found himself accumulating credit card debt. After switching to a zero-based budget and using the Mint app to track spending, he successfully reduced his debt by 40% in one year. This structured approach helped him develop better financial habits and establish long-term financial security.

Habit 2: They Prioritize High-Interest Debt First

When managing debt, prioritizing high-interest loans helps minimize long-term financial burdens and accelerates overall repayment. By focusing on high-interest debt first, individuals can reduce the total amount repaid, lower financial stress, and improve their credit scores.

This strategy not only saves money in the long run but also frees up resources for other financial goals. Additionally, addressing high-interest debt early prevents it from compounding into an unmanageable liability, making financial stability more attainable.

Successful debt managers strategically allocate extra payments to high-interest loans while maintaining minimum payments on others to optimize their financial health.

| Strategy | How It Works | Best For |

| Debt Avalanche | Paying off the highest-interest debt first. | People looking to save on interest. |

| Debt Snowball | Paying off the smallest debts first to gain motivation. | People needing psychological wins. |

By focusing on high-interest debt, successful individuals reduce the overall amount they pay over time, keeping financial obligations manageable. This approach accelerates debt repayment and frees up resources for other financial goals.

Case Study:

Sarah had multiple debts, including student loans [5%], credit cards [18%], and a car loan [7%]. By using the debt avalanche method, she cleared her highest-interest debt first, saving over $10,000 in interest over five years. This strategy helped her regain financial stability and build a debt-free future.

Habit 3: They Make More Than the Minimum Payment

Making only the minimum payment significantly extends the debt repayment timeline, often turning what could have been a manageable financial obligation into a prolonged burden. The longer the debt remains unpaid, the more interest accumulates, making it increasingly difficult to break free from financial strain.

By paying only the minimum, individuals often end up paying two to three times the original amount borrowed due to compounding interest. This can negatively impact credit scores, limit future borrowing opportunities, and create unnecessary financial stress. Consider the example below:

| Debt Amount | Minimum Payment | Interest Rate | Total Interest Paid [Over Time] |

| $5,000 | $150 | 18% | $3,800 |

| $5,000 | $300 | 18% | $1,900 |

By increasing monthly payments, borrowers save thousands in interest and pay off debts much faster. This approach not only accelerates debt repayment but also improves credit scores and financial confidence.

Practical Tip:

Even an extra $50 per month towards debt repayment can shorten loan duration by months or even years, leading to significant financial relief.

Here are the overviews condensed into five lines each, with relevant tables for each habit:

Habit 4: They Avoid New Unnecessary Debt

- Using credit cards for emergencies only, not daily spending.

- Avoiding payday loans and high-interest personal loans.

- Understanding the difference between “good debt” [investments like education or real estate] and “bad debt” [high-interest consumer debt].

- Regularly reviewing financial commitments and assessing whether additional debt is necessary.

| Type of Debt | Interest Rate Range | Examples |

| Good Debt | 3% – 8% | Student loans, mortgages |

| Bad Debt | 15% – 30% | Credit card debt, payday loans |

Avoiding unnecessary debt ensures financial flexibility and allows for better wealth accumulation.

Habit 5: They Build an Emergency Fund

A financial cushion ensures that individuals are not forced to rely on credit cards or loans when unexpected expenses arise. Without an emergency fund, even minor financial setbacks—such as a car repair or medical bill—can lead to spiraling debt.

A well-funded emergency savings account acts as a buffer, preventing financial disruptions from derailing long-term financial goals.

Those who successfully manage debt prioritize building and maintaining this fund to cover at least three to six months’ worth of essential expenses. By having this safety net in place, they can handle life’s surprises without adding to their financial burdens.

| Emergency Fund Goal | Recommended Amount |

| Starter Fund | $1,000 |

| Moderate Fund | 3 months’ expenses |

| Fully Funded Emergency Fund | 6-12 months’ expenses |

By maintaining an emergency fund, individuals safeguard themselves from falling into a cycle of financial instability.

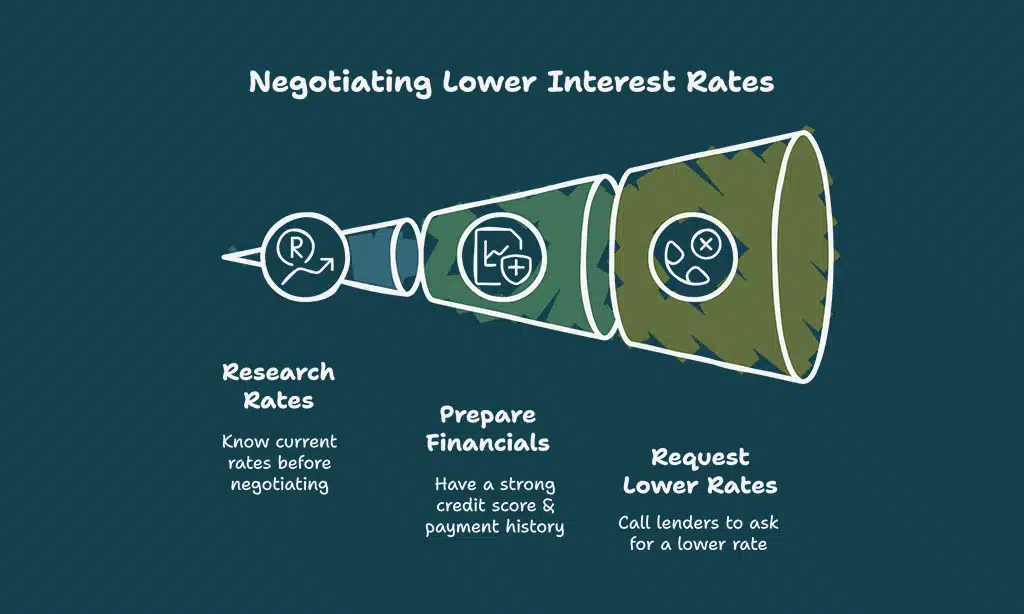

Habit 6: They Negotiate Lower Interest Rates

People who successfully manage debt proactively negotiate with creditors to secure better rates, leading to significant long-term savings.

They research current market interest rates, maintain a strong credit score, and present a compelling case to lenders. By reducing interest rates, they lower overall debt costs, freeing up more funds for savings and investments.

This approach not only shortens repayment periods but also enhances financial stability. Lower interest rates mean less money spent over time, allowing individuals to allocate resources more effectively toward their financial goals.

| Step | Action |

| Research | Know current rates before negotiating. |

| Prepare | Have a strong credit score & payment history. |

| Request | Call lenders to ask for a lower rate. |

Successful negotiators save thousands of dollars over the course of a loan.

Habit 7: They Monitor Their Credit Score Regularly

Regularly checking credit scores helps individuals stay informed about their financial health. Tools like Credit Karma and Experian allow free monitoring and error correction, preventing setbacks. By staying vigilant, individuals can catch inaccuracies early and take steps to improve their scores.

| Tool | Description | Benefit |

| Credit Karma | Free credit score monitoring tool | Tracks credit score changes and provides error alerts. |

| Experian | Offers free credit score updates | Provides access to credit report and score, including dispute options. |

Habit 8: They Live Below Their Means

Financially disciplined individuals avoid unnecessary spending, prioritizing saving and investing over lifestyle inflation. By living within their means, they ensure a secure financial future. This habit reduces the pressure of debt accumulation and supports wealth-building over time.

| Action | Description | Benefit |

| Conscious Spending | Avoid impulsive purchases. | Enhances savings and builds wealth. |

| Prioritize Saving | Focus on building an emergency fund. | Provides financial security. |

Habit 9: They Automate Their Payments

Automating payments helps prevent late fees and ensures consistent debt repayment. It improves credit scores by maintaining a timely payment history. This habit removes the risk of missed payments, ensuring better financial management and stress-free payments.

| Payment Type | Description | Benefit |

| Automatic Bill Pay | Set recurring payments for bills | Ensures timely payments, avoids fees. |

| Credit Card Payments | Automate monthly credit card payments | Boosts credit score and maintains consistency. |

Habit 10: They Continuously Educate Themselves About Finance

Successful debt managers stay informed by consuming financial content like books, podcasts, and courses. This continuous learning allows them to make smarter financial decisions, stay on top of trends, and refine their wealth-building strategies.

| Learning Resource | Description | Benefit |

| Books | Read personal finance and investment books | Deepens understanding of financial strategies. |

| Podcasts | Listen to financial advice and news | Stay updated on trends and tips. |

| Online Courses | Take financial courses to learn new strategies | Enhances knowledge and decision-making. |

Takeaways

Managing debt successfully is not about having a high income or financial luck—it’s about cultivating 10 habits of people who successfully manage debt. From budgeting wisely to prioritizing high-interest debt and maintaining an emergency fund, these habits empower individuals to take control of their finances and achieve long-term financial freedom.

By staying committed and applying these habits consistently, financial security is within reach! Implementing these proven strategies will not only help in debt management but also contribute to a financially independent and stress-free future.