Listen to the Podcast:

Forex trading is an art and a science. While beginner traders start with the basics of trading, experienced traders develop their own advanced trading strategies to make profitable trades consistently on forex sites. In this article, we will discuss some of the advanced forex trading strategies that experienced traders use to gain an edge in the market.

1. Breakout Trading Strategy

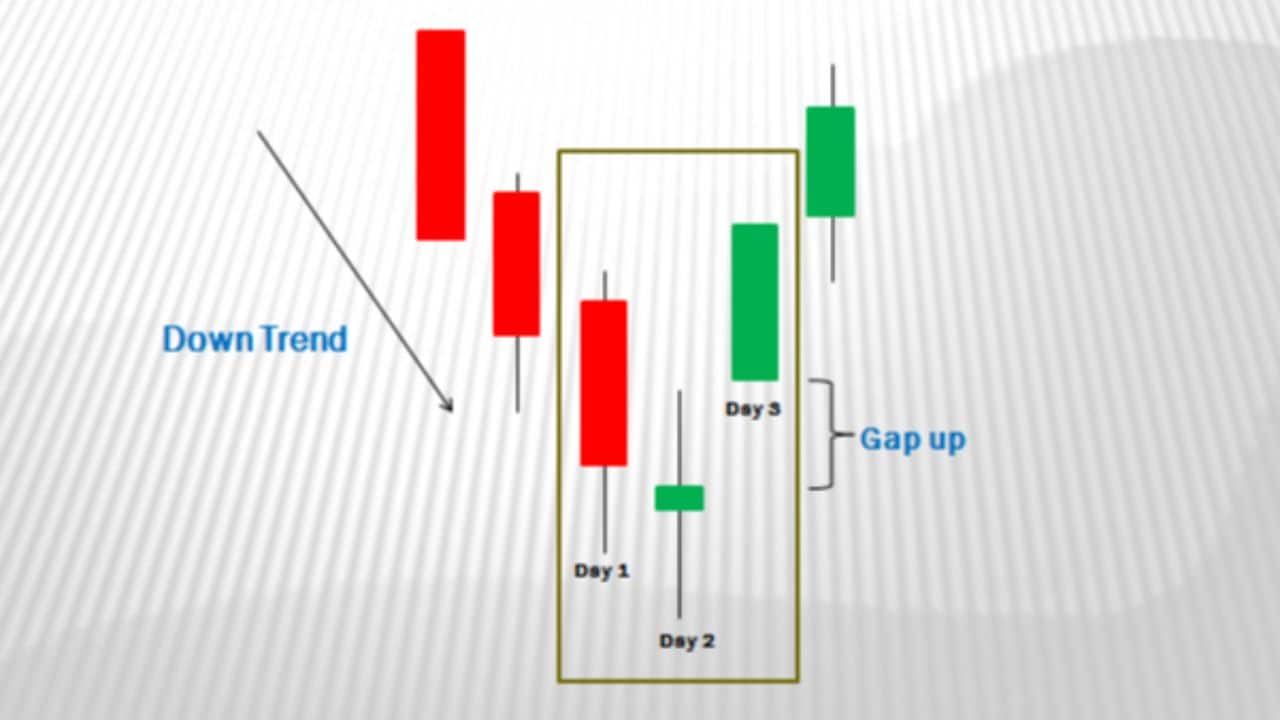

Forex breakout trading is a trading strategy that aims to capitalise on sharp price movements that occur when a currency pair breaks through an established level of support or resistance. Traders using this strategy look for key levels of support or resistance on charts, and when the price breaks through these levels, they enter a trade in the direction of the breakout.

The basic idea behind the forex breakout trading strategy is that once a currency pair breaks through a significant level of support or resistance, it is likely to continue moving in the same direction. Traders using this strategy seek to capitalise on this momentum by entering a trade in the direction of the breakout.

The first step in using the forex breakout trading strategy is to identify key levels of support and resistance. These levels can be identified through technical analysis, by drawing trendlines, or by using indicators such as moving averages. Once a key level has been identified, traders wait for the price to break through that level before entering a trade.

There are different types of breakouts that traders can look for. A bullish breakout occurs when the price breaks through a level of resistance, indicating that buyers are gaining strength and the price is likely to continue rising. A bearish breakout occurs when the price breaks through a level of support, indicating that sellers are gaining strength and the price is likely to continue falling.

To be successful with the forex breakout trading strategy, traders must have a good understanding of technical analysis and chart patterns. They must also be able to identify key levels of support and resistance and have a good understanding of market trends and momentum. Risk management is also important, as breakouts can sometimes result in false signals or reversals, leading to losses if the trader doesn’t manage risk properly.

2. Scalping Strategy

Forex scalping is a trading strategy that involves making numerous small trades within a short period, usually a few seconds to a few minutes. The aim is to make small profits on each trade, which can add up to a significant amount over time. This strategy requires quick decision-making, intense focus, and a good understanding of market movements.

Forex scalpers use charts, technical indicators, and real-time market data to identify short-term price movements and execute trades quickly. They focus on liquid currency pairs with tight spreads, such as EUR/USD and GBP/USD. The objective is to capture small price movements that frequently occur throughout the day.

Forex scalping is a high-frequency trading strategy that requires traders to monitor the market constantly. Traders must be able to make quick decisions based on technical analysis, news events, and market sentiment. They must also be able to manage risk effectively, as losses can add up quickly if a trade goes against them.

One of the main advantages of forex scalping is that it allows traders to make small profits consistently throughout the day. This can be appealing to traders who do not have a large amount of capital to trade with or who want to supplement their income with short-term trading.

However, forex scalping also has some disadvantages. It requires traders to constantly monitor the market, which can be mentally exhausting. Traders must also be able to manage risk effectively, as losses can add up quickly if a trade goes against them. Additionally, forex scalping is not suitable for all traders, and some brokers may have restrictions on this type of trading strategy.

3. Position Trading Strategy

Position trading is a long-term trading strategy that involves holding a position for an extended period, usually weeks or months. Unlike day trading or swing trading, which involve buying and selling within a short time frame, position traders aim to profit from major market trends and movements.

The primary objective of position trading is to capture long-term trends in the market. Traders who use this strategy will often use fundamental analysis to identify macroeconomic factors that could affect currency prices. They will also analyse charts and technical indicators to identify trends and entry and exit points for their trades.

Once a position trader has identified a potential trade, they will enter a position and hold it for an extended period. This may involve holding a position through periods of volatility and short-term price fluctuations. Position traders will typically have a longer-term view of the market and will be willing to weather short-term losses in pursuit of their long-term objectives.

One of the key advantages of position trading is that it allows traders to benefit from long-term market trends without the need to monitor their positions constantly. This can be especially appealing for traders who do not have the time or resources to trade on a daily basis. Position trading can also help to reduce the impact of short-term price fluctuations, as traders are less likely to be affected by day-to-day market movements.

For a comprehensive guide on forex trading, visit the Babypips School of Pipsology.