Digital lending platforms have transformed how individuals and small businesses [SMEs] access financing. Unlike traditional banks that require lengthy paperwork and high credit scores, digital lenders offer fast approvals, flexible repayment terms, and AI-driven assessments that make borrowing more accessible.

With the rise of fintech, these platforms cater to various financial needs, including:

- Personal Loans: For emergency expenses, medical bills, or home improvements.

- Business Loans: For startups, cash flow management, or equipment purchases.

- Invoice Factoring: To help businesses leverage unpaid invoices for instant liquidity.

- Lines of Credit: Flexible borrowing where businesses can withdraw funds as needed.

Why Digital Lending?

According to a 2024 report by Statista, the global digital lending market is expected to reach $350 billion by 2025, fueled by the demand for faster, more convenient borrowing solutions.

| Key Advantages | Traditional Banks | Digital Lending Platforms |

| Approval Time | 2-4 weeks | As fast as 24 hours |

| Eligibility Criteria | Strict credit score & collateral | Alternative credit scoring |

| Application Process | Paper-intensive | Fully online & automated |

| Loan Disbursement | 5-10 business days | Same-day to 72 hours |

What Are Digital Lending Platforms?

Digital lending platforms leverage artificial intelligence [AI], big data, and automation to assess creditworthiness and disburse funds efficiently. Unlike traditional lending institutions, they evaluate multiple factors such as bank transactions, cash flow, and alternative data points instead of just credit scores.

How Digital Lending Works

- Application: Borrowers submit personal or business details online.

- Automated Credit Assessment: AI algorithms analyze financial behavior.

- Approval & Offer Selection: The system provides personalized loan offers.

- Disbursement: Funds are transferred within 24 hours to a few days.

Example: A freelancer with inconsistent income may struggle to get a bank loan, but platforms like Upstart assess income patterns instead of credit history, improving approval chances.

Top 10 Digital Lending Platforms for Individuals and SMEs

With the increasing demand for quick and hassle-free financing, digital lending platforms have become the go-to solution for both individuals and SMEs. These platforms provide fast approvals, flexible repayment terms, and AI-driven risk assessments, making borrowing more accessible than ever.

Below is a curated list of 10 Digital Lending Platforms for Individuals and SMEs that simplify the borrowing process, ensuring you find the right financial solution based on your needs.

1. Kabbage [Now American Express Business Blueprint]

Kabbage, rebranded as American Express Business Blueprint, is ideal for small business owners needing flexible funding. Unlike traditional lenders, it offers real-time underwriting, assessing your business’s financial health instantly.

| Feature | Details |

| Loan Type | Business Line of Credit |

| Loan Amount | Up to $250,000 |

| Approval Time | Instant to 24 hours |

| Repayment | Monthly fees instead of interest rates |

| Best For | SMEs needing fast, short-term financing |

Pro Tip: Business owners can connect their accounting software [like QuickBooks] for quicker approvals.

2. OnDeck

OnDeck is a leading lender offering short-term business loans and credit lines, with no collateral required. It’s perfect for businesses needing capital within a day.

| Feature | Details |

| Loan Type | Term Loans, Business Credit Line |

| Loan Amount | $5,000 – $250,000 |

| Interest Rate | Starts at 9.99% |

| Funding Speed | Same-day approval & funding |

| Best For | Businesses needing quick capital |

Example: A restaurant owner needing emergency repairs can get an OnDeck loan in less than 24 hours instead of waiting weeks for a bank loan.

3. LendingClub

LendingClub is a peer-to-peer [P2P] lending platform connecting borrowers with investors for personal and business loans. It’s known for fixed-rate loans with no hidden fees.

| Feature | Details |

| Loan Type | Personal & Business Loans |

| Loan Amount | Up to $500,000 |

| Approval Time | 2-5 days |

| Repayment Term | 1 to 5 years |

Best For: Borrowers looking for lower interest rates through investor-backed funding.

4. Fundbox

Fundbox is an AI-powered lender specializing in business credit lines, ideal for companies with cash flow challenges.

| Feature | Details |

| Loan Type | Business Line of Credit |

| Loan Amount | Up to $150,000 |

| Funding Speed | 24 hours |

| Repayment Term | 12-24 weeks |

Example: A marketing agency waiting on client payments can use Fundbox for payroll expenses.

5. BlueVine

BlueVine is best known for invoice factoring, where businesses can sell unpaid invoices for instant cash flow.

| Feature | Details |

| Loan Type | Invoice Factoring, Credit Line |

| Loan Amount | Up to $250,000 |

| Approval Time | 10 minutes |

Best For: Businesses needing cash against outstanding invoices.

6. Prosper

Prosper is a top-rated P2P lending platform for personal loans, best suited for debt consolidation or major purchases.

| Loan Amount | Interest Rate | Repayment Term |

| $2,000 – $50,000 | Starts at 7.95% | 2 – 5 years |

Example: A borrower consolidating multiple high-interest credit cards into a single Prosper loan saves on interest.

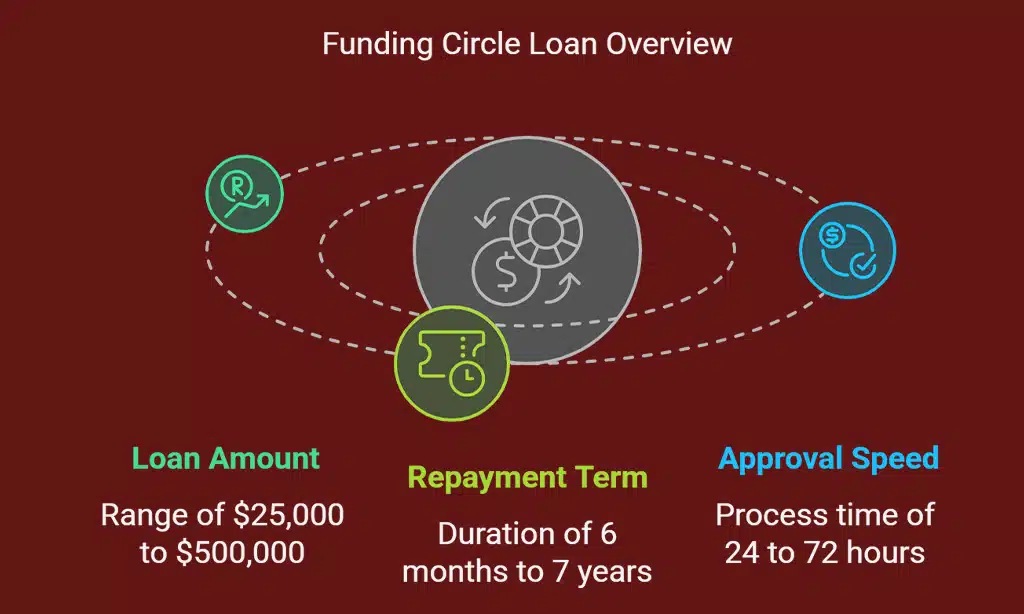

7. Funding Circle

Funding Circle provides long-term business loans with fixed interest rates, making it great for SMEs planning large investments.

| Loan Amount | Repayment Term | Approval Speed |

| $25,000 – $500,000 | 6 months – 7 years | 24-72 hours |

8. Square Loans

Designed for Square users, this lending option deducts repayments from daily sales, making it seamless for small business owners.

| Feature | Details |

| Loan Type | Business Loan |

| Repayment | Auto-deducted from Square sales |

9. Upstart

Upstart uses AI to evaluate borrowers beyond credit scores, making it ideal for those with thin credit files.

| Loan Amount | Approval Time |

| $1,000 – $50,000 | 24 hours |

Best For: Borrowers with limited credit history.

10. Credibly

Credibly offers merchant cash advances and business loans, ideal for companies with lower credit scores.

| Feature | Details |

| Loan Amount | Up to $400,000 |

| Funding Speed | 24 hours |

Takeaways

Choosing the right digital lending platform depends on your financial needs, credit profile, and repayment flexibility. Compare rates, terms, and borrow wisely to maximize benefits.

Would you like help selecting the best platform for your situation?