Crop insurance plays a crucial role in securing the livelihoods of Indian farmers, especially in an era of increasing climate unpredictability and market volatility.

As we step into 2025, understanding the nuances of crop insurance is more important than ever for farmers looking to protect their crops and ensure financial stability.

This comprehensive guide, titled “Crop Insurance FAQs for Indian Farmers,” answers the most pressing questions, offering actionable insights to help farmers make informed decisions.

What Is Crop Insurance and Why Is It Important for Indian Farmers?

Understanding the Basics of Crop Insurance

Crop insurance is a risk management tool designed to protect farmers from financial losses due to natural disasters, pests, diseases, and market fluctuations.

It ensures that farmers receive compensation for their losses, allowing them to recover and continue their agricultural activities without facing significant financial strain.

By acting as a safety net, crop insurance also helps to stabilize rural economies and encourages investment in agriculture.

Why Crop Insurance Matters in 2025

With climate change leading to more frequent droughts, floods, and unseasonal rains, Indian farmers face heightened risks. Crop insurance serves as a safety net, reducing the financial impact of these unpredictable events.

In 2025, government-backed initiatives and private insurance schemes have become more accessible, making crop insurance a vital tool for safeguarding livelihoods.

For example, in regions like Maharashtra and Tamil Nadu, farmers have seen significant recovery support through government schemes, enabling them to reinvest in their fields after major losses.

Key Benefits of Crop Insurance

| Benefit | Explanation |

| Financial Security | Protects farmers from major financial setbacks due to crop losses. |

| Risk Mitigation | Reduces risks associated with climate and market volatility. |

| Investment Encouragement | Encourages farmers to adopt modern farming practices without fear of loss. |

What Types of Crop Insurance Are Available in India?

Government-Sponsored Schemes

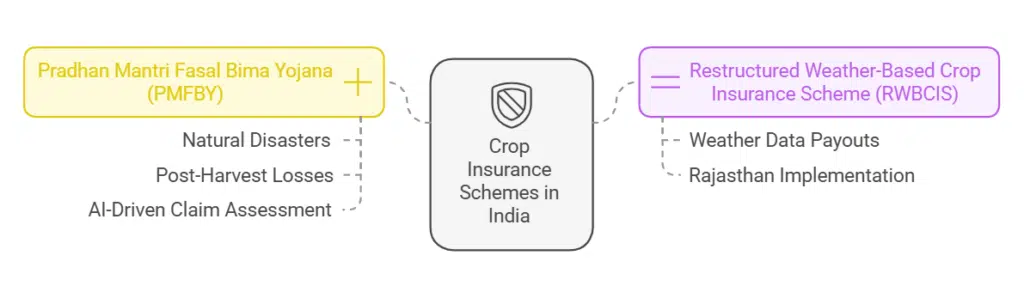

- Pradhan Mantri Fasal Bima Yojana (PMFBY):

- Covers a wide range of risks, including natural disasters and post-harvest losses.

- Offers subsidized premiums to make insurance affordable for farmers.

- In 2025, PMFBY introduced a new AI-driven claim assessment system to speed up payouts.

- Restructured Weather-Based Crop Insurance Scheme (RWBCIS):

- Focuses on protecting farmers from weather-related risks.

- Payouts are triggered based on weather data rather than crop loss assessment.

- Particularly effective in areas like Rajasthan, where erratic rainfall is common.

Private Insurance Options

Private companies also offer tailored crop insurance plans, often with added benefits such as quicker claim settlements and additional coverage for specialized crops. For instance, HDFC ERGO’s crop insurance includes coverage for high-value horticulture crops. Farmers have increasingly turned to private options for customizable coverage that suits their unique needs.

Comparison Table: Government vs. Private Crop Insurance

| Feature | Government Schemes | Private Schemes |

| Affordability | Subsidized premiums | Slightly higher premiums |

| Claim Settlement Speed | Often delayed | Typically faster |

| Customization Options | Limited | Highly customizable |

| Accessibility | Widely available | May be restricted to specific areas |

Who Is Eligible for Crop Insurance in India?

Eligibility Criteria for Farmers

To avail of crop insurance, farmers must meet specific criteria, including:

- Ownership of farmland or tenancy agreements.

- Enrollment in government schemes or private policies before the specified deadline.

Farmers cultivating crops on leased lands can also apply under certain schemes, provided they have valid tenancy agreements.

Documents Required for Enrollment

Farmers need to provide:

- Proof of Identity: Aadhaar card or voter ID.

- Land Ownership/Tenancy Documents: Revenue records or lease agreements.

- Bank Account Details: For premium payments and claim settlements.

Quick Checklist for Enrollment

| Document | Purpose |

| Aadhaar Card | Identity proof |

| Revenue Records | Verification of land ownership |

| Bank Passbook | Direct benefit transfer registration |

How Can Indian Farmers Apply for Crop Insurance?

Step-by-Step Guide to Enrollment

- Visit Local Authorities: Approach the nearest bank, agricultural office, or insurance provider.

- Choose a Scheme: Opt for PMFBY, RWBCIS, or private plans based on your needs.

- Submit Required Documents: Provide proof of identity, land records, and bank details.

- Pay the Premium: Government schemes often deduct premiums directly from bank accounts.

Example: A farmer in Punjab applied for PMFBY through their local cooperative bank, submitting an Aadhaar card and crop sowing details. The process took less than a week, ensuring coverage for the Rabi season.

Key Deadlines for 2025

Farmers must enroll before the cut-off dates for each cropping season (Kharif and Rabi). Missing these deadlines can result in ineligibility for coverage. For Kharif 2025, the last date for enrollment is June 30.

Application Process at a Glance

| Step | Action Required |

| Visit Local Authority | Choose a suitable scheme |

| Submit Documents | Provide proof of eligibility |

| Pay Premium | Ensure payment before the deadline |

What Risks and Losses Are Covered Under Crop Insurance?

Comprehensive Coverage Overview

Crop insurance in India typically covers:

- Natural Disasters: Floods, droughts, hailstorms, and cyclones.

- Pests and Diseases: Losses caused by widespread infestations.

- Post-Harvest Losses: Damages occurring within 14 days of harvest.

Exclusions Farmers Should Be Aware Of

Certain situations are not covered, such as:

- Intentional damage or negligence.

- Losses due to war or nuclear risks.

- Crops not included in the policy.

Coverage Breakdown Table

| Type of Coverage | Included Risks | Excluded Risks |

| Natural Disasters | Floods, droughts, hailstorms | Man-made risks like negligence |

| Pest Infestation | Severe crop damage | Minor infestations |

| Post-Harvest Losses | Rain damage within 14 days | Losses after 14 days |

How Are Premium Rates Determined for Crop Insurance?

Factors Affecting Premiums

Premiums depend on:

- Crop Type: High-risk crops often have higher premiums.

- Geographical Location: Areas prone to disasters may face higher rates.

- Sum Insured: The total value of the crop being insured.

Premium Calculator Tools for 2025

Many insurance providers offer online calculators to help farmers estimate premiums. For example:

- Farmers can enter details such as crop type, acreage, and location to get accurate premium estimates.

Sample Premium Table for 2025

| Crop Type | Premium Rate (% of Sum Insured) | Government Subsidy (%) |

| Food Crops | 2% | Up to 50% |

| Oilseeds | 1.5% | Up to 50% |

| Commercial Crops | 5% | Up to 25% |

How Are Claims Processed and Settled?

Claim Filing Procedure

- Report Losses: Notify the insurance provider or government authorities within 72 hours of the incident.

- Submit Documentation: Include photos, field reports, and other evidence of crop loss.

- On-Site Assessment: Authorized officials verify the extent of the damage.

Timeline for Claim Settlement

- Claims are usually settled within 30-45 days after verification. In 2025, efforts are being made to streamline processes for faster payouts.

Claims Process Overview

| Step | Description |

| Report Losses | Notify within 72 hours |

| Submit Proof | Include required documentation |

| Await Assessment | Official damage verification |

What Are the Challenges of Crop Insurance in India?

Key Challenges Farmers Face

- Lack of Awareness: Many farmers remain unaware of the benefits and processes.

- Delayed Claims: Bureaucratic hurdles often lead to payment delays.

How Farmers Can Overcome These Challenges

- Use Digital Tools: Mobile apps and online platforms can simplify enrollment and claims.

- Collaborate with Cooperatives: Farmer groups can negotiate better terms and spread awareness.

Are There Any New Developments in Crop Insurance for 2025?

Policy Updates and Innovations

- The government is integrating AI-based crop monitoring to ensure accurate assessments.

- Expansion of subsidies to cover additional crops and regions.

Trends Shaping the Future of Crop Insurance

- Increased private sector participation.

- Adoption of satellite technology for weather and crop loss monitoring.

Innovations in 2025

| Innovation | Benefit |

| AI-Based Monitoring | Accurate and faster claim settlements |

| Expanded Subsidies | Coverage for more crops and regions |

How Can Farmers Maximize Benefits from Crop Insurance?

Tips for Effective Utilization

- Stay informed about policy terms and conditions.

- Opt for coverage that aligns with specific risks in your region.

Financial Planning for Insured Farmers

- Use crop insurance as part of a broader financial strategy, combining it with savings and credit options.

Maximizing Benefits Table

| Action | Benefit |

| Timely Enrollment | Ensures uninterrupted coverage |

| Policy Awareness | Reduces risks of claim rejections |

| Financial Integration | Supports long-term planning |

Frequently Asked Questions (FAQs) About Crop Insurance in India

Common Queries Addressed

- What if a claim is rejected? Farmers can appeal and provide additional evidence.

- Can crop insurance be transferred? Policies can be transferred if land ownership changes.

Expert Tips for Farmers

- Avoid delays in reporting losses.

- Consult local agricultural officers for guidance.

Takeaways: Why Crop Insurance Is a Must for Indian Farmers in 2025

In a rapidly changing agricultural landscape, crop insurance remains a cornerstone of financial security for Indian farmers. By addressing key questions and providing clear, actionable information, this guide on “Crop Insurance FAQs for Indian Farmers” empowers farmers to protect their livelihoods and navigate risks effectively.

Don’t wait until disaster strikes—explore your crop insurance options today and invest in a safer future for your farm.