Having a baby is an exciting time, but it can also put a strain on your finances. With nappies, formula, clothes and all the other expenses that come with a new arrival, it’s important for families to get savvy with their spending. Whether you’re expecting your first child or expanding your existing brood, here are some tips to help you save smartly as your family grows.

Looking At Your Available Money

The first step when budgeting for a new baby is taking an honest look at the money you have coming in and going out. Make a list of your net monthly household income after any taxes and deductions. Be sure to include any government assistance you receive, such as child benefit payments.

If one parent will be staying home full-time or reducing their hours after the birth, account for this change in income. Then, make a list of your current monthly expenses, such as housing, transportation, food, utilities, debt payments, and discretionary spending. This exercise will help you see where your money is currently going.

With a new baby, there will be new costs like nappies, formula, and clothing. Don’t forget increased costs for housing, utilities and food as your family grows. Research typical costs for your area so you can accurately budget.

There are several government assistance programmes to help families with the costs of raising children in the UK. For example, you will be eligible for foster carer payments if you foster a child. Other options include child benefits, child tax credits, free early education entitlements, free school meals and NHS healthcare.

Review entitlement criteria and apply for any benefits you may qualify for. Reach out to your local council or citizen’s advice bureau for guidance navigating available assistance. Having a clear picture of both your income and expenses will enable you to make a realistic budget.

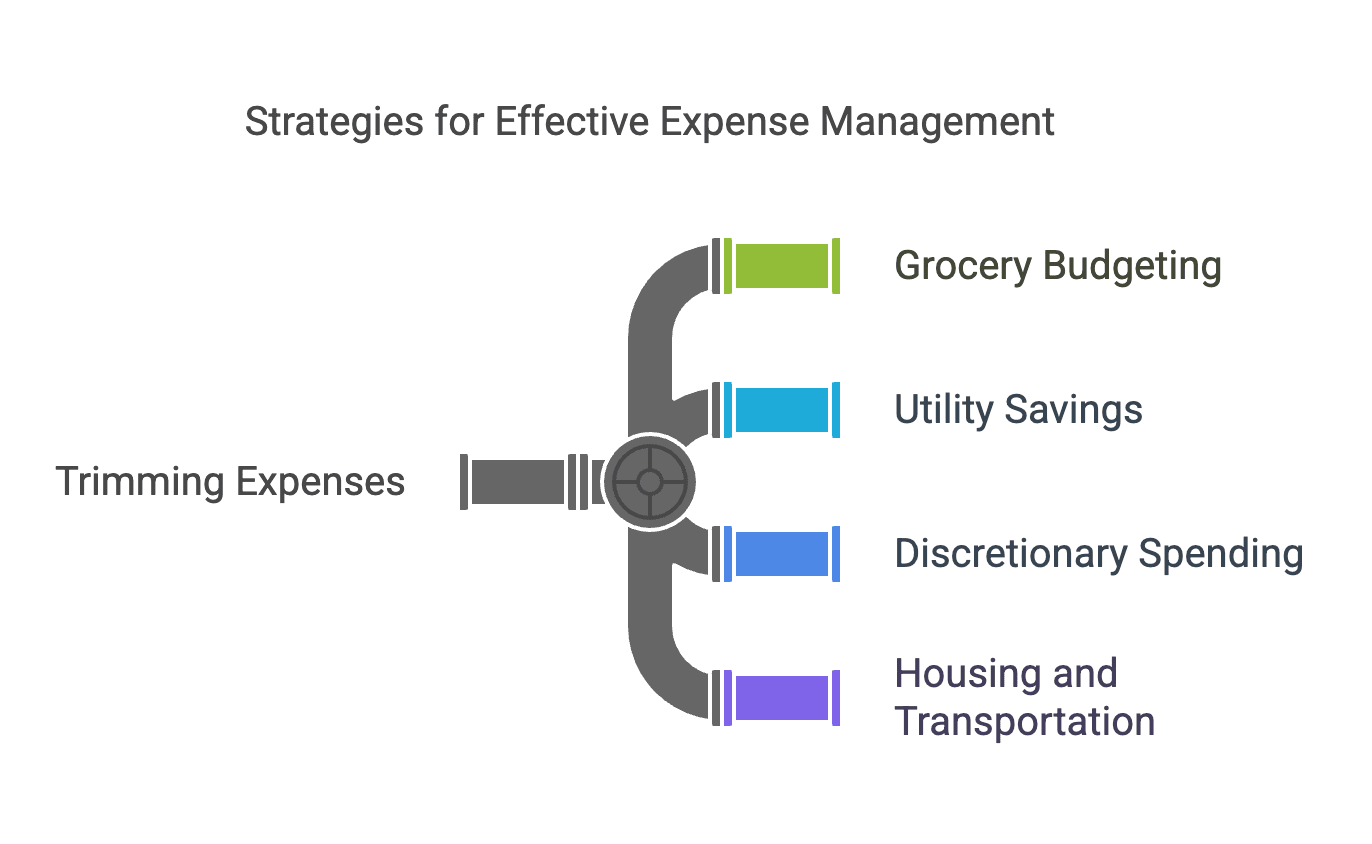

Trimming Your Current Expenses

Once you understand where your money is going, look for areas where you can trim spending. Avoid going into debt by living below your means. Set a disciplined grocery budget and meal plan to cut food costs. Buy generic brand items, use coupons and shop sales. Meal prep and bring lunch to work instead of eating out.

Examine your utility bills and call providers to negotiate better rates or make cutbacks like lowering the thermostat. Scale back discretionary purchases like takeaways, entertainment, clothes and holidays. Even small daily savings from coffee and snacks can add up.

Consider downsizing your housing, cars or childcare if possible. Move to a smaller home or flat, use public transportation, carpool or drive used vehicles. Seek more affordable childcare options and call your mortgage company to enquire about lower payments. Every pound counts when you’re budgeting for a new baby.

Buying and Accepting Hand-Me-Downs

From clothing and toys to furniture and equipment, babies require a lot of gear. The costs can really add up. Luckily, families don’t need to buy everything new. Accept hand-me-downs and seek out free or low-cost options.

When you do need to buy new, choose affordable, good-quality essentials that will last through multiple children. Shop end-of-season sales and clearance racks. Stick to your list and avoid impulse buys. With some creativity and resourcefulness, you can get ready for your baby without breaking the bank.

Budgeting for a growing family presents new financial challenges but also an opportunity to save money. Understanding your full financial picture is key. Buying second-hand and accepting hand-me-downs provides savings. Focus on needs while living simply.