Spain has long been a prime destination for real estate investors, offering a mix of historical charm, modern infrastructure, and strong rental demand. Whether you are looking for high rental yields, long-term property appreciation, or a foothold in the Spanish market, choosing the right city is crucial.

In this comprehensive guide, we’ll explore the 12 Best Cities for Real Estate Investment in Spain, highlighting their unique advantages, average property prices, and potential returns.

Whether you’re a seasoned investor or a first-time buyer, this guide will help you make an informed decision.

Why Invest in Spanish Real Estate?

- Strong economic recovery and increasing property demand

- High tourism rates contributing to short-term rental success

- Attractive investment opportunities with property price appreciation

- Recent Market Trends: According to the Spanish Land Registry, property prices have seen a 6.4% annual increase in key cities, with steady growth expected in 2025.

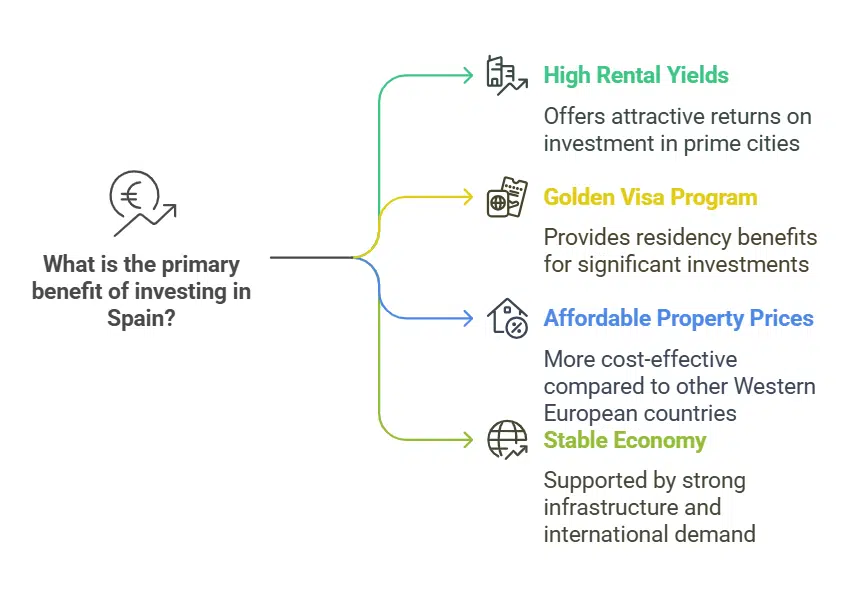

Key Benefits of Investing in Spain

- High rental yields: Prime cities offer yields between 4% to 7%

- Golden Visa Program: Investing €500,000+ grants residency benefits

- Affordable property prices: Compared to other Western European countries

- Stable economy: Spain’s property market is supported by strong infrastructure and international demand

- Diverse Investment Options: From beachfront villas in Marbella to city apartments in Madrid, Spain offers a variety of investment opportunities to suit different budgets and goals.

Factors to Consider Before Investing

Location and Market Trends

Choosing the Best Cities for Real Estate Investment in Spain requires analyzing local trends, rental demand, and price fluctuations.

Rental Yield vs. Property Appreciation

- Rental Yield: Ideal for investors looking for passive income

- Capital Appreciation: Perfect for long-term investors planning resale profits

- Current Insights: The National Institute of Statistics reports that Madrid and Barcelona continue to show strong capital appreciation rates, whereas Valencia and Malaga offer higher rental yields.

Legal and Tax Considerations for Foreign Investors

- Property purchase tax varies from 6% to 10% depending on the region

- Income tax on rental income for non-residents (19% for EU citizens, 24% for non-EU citizens)

- Recent regulatory changes in short-term rentals have impacted some tourist-heavy areas like Barcelona, where licensing requirements have become stricter.

12 Best Cities for Real Estate Investment in Spain

Below, we break down the 12 Best Cities for Real Estate Investment in Spain, covering rental demand, property prices, and investment potential.

| City | Best For | Avg. Price per m² | Rental Yield | Tourist Demand |

| Madrid | High rental demand & capital growth | €4,000+ | 4-5% | High |

| Barcelona | Tourism & short-term rentals | €4,500+ | 4-6% | Very High |

| Valencia | Affordable with high ROI | €2,500+ | 5-7% | Moderate |

| Seville | Cultural hub with steady demand | €2,300+ | 4-5% | High |

| Malaga | Fast-growing coastal investment | €3,000+ | 5-6% | Very High |

| Alicante | Popular expat destination | €2,200+ | 5-6% | High |

| Marbella | Luxury real estate hotspot | €5,500+ | 3-4% | High |

| Palma de Mallorca | Exclusive island investments | €4,800+ | 4-5% | Very High |

| Bilbao | Emerging real estate market | €3,000+ | 4-5% | Moderate |

| Granada | Student-friendly market | €2,000+ | 5-6% | High |

| Tenerife | Year-round tourism demand | €2,500+ | 5-7% | Very High |

| Zaragoza | Affordable & growing market | €1,800+ | 5-6% | Moderate |

1. Madrid – Spain’s Thriving Capital for Investors

Madrid is Spain’s financial hub, attracting businesses, students, and tourists. With consistent rental demand and long-term property appreciation, it remains a top investment choice. Investors benefit from a strong job market, excellent infrastructure, and high-end commercial real estate options.

| Investment Factor | Details |

| Population Growth | Increasing, driven by professionals and students |

| Best Investment Type | Long-term rentals, luxury apartments |

| Key Neighborhoods | Salamanca, Chamberí, Retiro |

2. Barcelona – A Tourism and Tech Investment Hub

Barcelona’s mix of tourism, tech companies, and expatriates ensures strong demand for both short-term and long-term rentals. The city is home to one of Europe’s largest startup ecosystems, making it ideal for high-end urban properties.

| Investment Factor | Details |

| Rental Demand | Extremely high due to tourism & digital nomads |

| Best Investment Type | Airbnb-style rentals, commercial spaces |

| Key Neighborhoods | Eixample, Gràcia, Poble-sec |

3. Valencia – Affordable Properties with High ROI

Valencia offers a balance of affordability and profitability. With property prices significantly lower than Madrid and Barcelona, it’s an excellent choice for investors seeking high rental yields and capital appreciation. The city’s growing economy, vibrant cultural scene, and expanding expat community make it a compelling investment destination.

| Investment Factor | Details |

| Rental Demand | Strong due to students and professionals |

| Best Investment Type | Buy-to-let apartments, short-term rentals |

| Key Neighborhoods | Ruzafa, El Carmen, Malvarrosa |

4. Seville – A Cultural Hub with Strong Rental Demand

Seville’s rich cultural heritage and warm climate attract tourists year-round. The city has a strong student population, making it a great option for both short-term vacation rentals and long-term student housing investments. The cost of living is lower compared to other major cities, ensuring competitive property prices.

| Investment Factor | Details |

| Rental Demand | Steady due to tourism and students |

| Best Investment Type | Holiday homes, student apartments |

| Key Neighborhoods | Triana, Santa Cruz, Nervión |

5. Malaga – A Fast-Growing Coastal Investment Destination

Malaga’s property market has been booming due to its increasing popularity among digital nomads, retirees, and tourists. Its coastal location and vibrant lifestyle offer strong rental yields and long-term appreciation potential. New infrastructure developments and a surge in international buyers contribute to the city’s investment appeal.

| Investment Factor | Details |

| Rental Demand | High, driven by expats and tourism |

| Best Investment Type | Beachfront apartments, buy-to-let properties |

| Key Neighborhoods | La Malagueta, Soho, El Palo |

6. Alicante – Popular Among Expats & Retirees

Alicante is a favorite among retirees and international buyers due to its warm climate, affordable property prices, and excellent quality of life. The city has a strong expat community and a thriving rental market, making it an attractive destination for long-term investments and holiday rentals.

| Investment Factor | Details |

| Rental Demand | High, especially among retirees and expats |

| Best Investment Type | Holiday homes, long-term rentals |

| Key Neighborhoods | Playa de San Juan, El Campello, Central Alicante |

7. Marbella – A Luxury Real Estate Hotspot

Marbella is synonymous with luxury living, offering high-end villas, exclusive beachfront properties, and a vibrant lifestyle. It attracts wealthy investors from around the world, leading to a strong demand for premium real estate. Although property prices are high, they continue to appreciate due to limited supply and international demand.

| Investment Factor | Details |

| Rental Demand | High for luxury short-term rentals |

| Best Investment Type | Luxury villas, exclusive beachfront apartments |

| Key Neighborhoods | Puerto Banús, Golden Mile, Nueva Andalucía |

8. Palma de Mallorca – Exclusive Island Investments

Palma de Mallorca is a top destination for investors looking for exclusivity and high-value property appreciation. With a strong tourism industry and limited land availability, property prices continue to rise, making it a lucrative market for high-end real estate investments.

| Investment Factor | Details |

| Rental Demand | Very high due to tourism |

| Best Investment Type | Holiday rentals, luxury apartments |

| Key Neighborhoods | Old Town, Portixol, Santa Catalina |

9. Bilbao – An Emerging Real Estate Market

Bilbao is undergoing rapid economic and infrastructure growth, making it a promising destination for property investors. Its industrial past is giving way to modern developments, with increasing demand for residential and commercial properties.

| Investment Factor | Details |

| Rental Demand | Steady growth in demand |

| Best Investment Type | Residential apartments, commercial properties |

| Key Neighborhoods | Indautxu, Casco Viejo, Deusto |

10. Granada – A Student-Friendly Real Estate Market

Granada is home to a large student population, making it a great choice for buy-to-let investments. The city’s affordability and cultural appeal attract both domestic and international tenants, ensuring a stable rental income.

| Investment Factor | Details |

| Rental Demand | High due to student population |

| Best Investment Type | Student housing, short-term rentals |

| Key Neighborhoods | Albaicín, Realejo, Centro |

11. Tenerife – Strong Year-Round Tourism Demand

Tenerife benefits from a stable year-round tourism industry, driven by its warm climate and stunning beaches. The island’s short-term rental market is particularly strong, making it a great option for investors looking for high returns from vacation rentals.

| Investment Factor | Details |

| Rental Demand | Very high, driven by tourism |

| Best Investment Type | Holiday rentals, beachfront apartments |

| Key Neighborhoods | Costa Adeje, Los Cristianos, Santa Cruz |

12. Zaragoza – An Affordable & Growing Market

Zaragoza is an up-and-coming city with relatively low property prices and increasing rental demand. Its strategic location between Madrid and Barcelona makes it an attractive option for investors seeking long-term appreciation.

| Investment Factor | Details |

| Rental Demand | Moderate, with growth potential |

| Best Investment Type | Affordable apartments, commercial properties |

| Key Neighborhoods | Casco Antiguo, Delicias, Universidad |

Takeaways

The Best Cities for Real Estate Investment in Spain offer diverse opportunities depending on your investment goals. Whether you prioritize rental income, capital appreciation, or lifestyle benefits, Spain’s market is rich with potential.

Next Steps

- Define your investment strategy (buy-to-let, short-term rental, or resale)

- Choose a cit based on your goals

- Consult with local real estate experts to navigate legal and tax considerations

With the right strategy, investing in Spain’s real estate market can be a profitable and rewarding experience. Ready to make your move?