Australia’s real estate market continues to be a hotbed for investment opportunities, drawing attention from both local and international investors. Known for its robust economy, stable political environment, and diverse housing markets, Australia offers a variety of cities that cater to different investment goals.

This article explores the 12 best cities for real estate investment in Australia, analyzing their unique attributes, growth potential, and market trends to help you make informed decisions.

With a mix of metropolitan hubs and regional gems, investors can tap into markets that align with their objectives and budgets.

Whether you’re looking for high rental yields or long-term capital growth, this guide to the best cities for real estate investment in Australia will provide actionable insights and strategies for success.

What Makes a City Ideal for Real Estate Investment?

Investing in real estate is a significant decision, and choosing the right city is crucial to maximize returns. Here are key factors that make a city ideal for real estate investment:

- Economic Growth and Employment Opportunities: Cities with thriving economies attract a growing workforce, increasing demand for housing.

- Population Growth and Housing Demand: Rapidly expanding populations often lead to higher rental yields and property appreciation.

- Infrastructure Development and Connectivity: The presence of infrastructure projects such as highways, public transport, and amenities enhances property values.

- Market Affordability and Rental Yield: Balancing affordability with high rental yields ensures steady cash flow and long-term growth.

The 12 Best Cities for Real Estate Investment in Australia

1. Sydney

Sydney remains a top choice for investors due to its strong economy, international appeal, and diverse housing market.

As Australia’s largest city, it consistently attracts both local and global interest, driving demand for residential and commercial properties. Key factors include proximity to corporate hubs, world-class educational institutions, and an evolving tech scene.

Despite its high property prices, Sydney remains one of the best cities for real estate investment in Australia due to its stability and long-term growth potential.

Best Neighborhoods for Investment

- Inner West: Offers excellent connectivity and a blend of residential and lifestyle amenities.

- Western Sydney: Suburbs like Parramatta and Blacktown are growth corridors with high rental demand.

- Northern Beaches: Popular for luxury properties and long-term capital growth.

Key Statistics and Insights

| Metric | Value |

| Median Property Price | $1,243,000 |

| Average Rental Yield | 3.2% |

| Annual Price Growth | 7.5% |

| Population Growth | 1.3% annually |

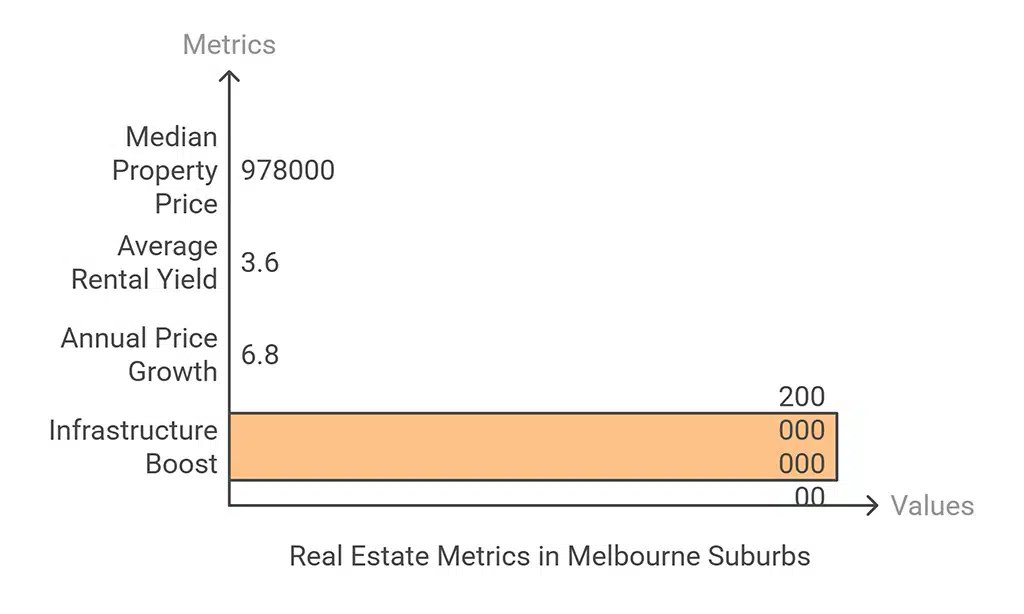

2. Melbourne

Melbourne’s cultural vibrancy, steady population growth, and infrastructure projects like the Metro Tunnel make it a hotspot for real estate investment.

Known as Australia’s cultural capital, Melbourne attracts young professionals and students, creating a strong rental market.

The city’s ongoing urban development ensures sustainable growth, making it one of the best cities for real estate investment in Australia for those seeking diversified opportunities.

Emerging Suburbs for Investors

- Werribee: Affordable housing and ongoing development projects.

- Sunshine: A suburb undergoing significant transformation.

- Coburg: Offers a mix of historic charm and modern amenities.

Vital Data Points

| Metric | Value |

| Median Property Price | $978,000 |

| Average Rental Yield | 3.6% |

| Annual Price Growth | 6.8% |

| Infrastructure Boost | $20B projects |

3. Brisbane

Known for its affordable housing and strong rental demand, Brisbane is gaining traction among property investors.

The city’s role as a host for the 2032 Olympics is expected to drive infrastructure development and real estate growth.

Brisbane’s affordability compared to Sydney and Melbourne makes it attractive to first-time investors seeking the best cities for real estate investment in Australia.

High-Demand Areas and Hotspots

- South Brisbane: A cultural and commercial hub.

- Fortitude Valley: Ideal for young professionals.

- Springfield: A master-planned community with strong growth potential.

Investment Insights

| Metric | Value |

| Median Property Price | $720,000 |

| Average Rental Yield | 4.4% |

| Annual Price Growth | 6.1% |

| Rental Vacancy Rate | 1.1% |

Actionable Tip

Consider investing near the Brisbane Metro project route to capitalize on improved connectivity and rising property values.

Brisbane’s infrastructure plans further solidify its position as one of the best cities for real estate investment in Australia.

4. Perth

Perth’s economic revival, driven by the mining sector, has boosted its real estate market. Affordable property prices and high rental yields make it an attractive option for investors.

With ongoing projects in renewable energy, Perth’s diversified economy is enhancing its appeal as one of the best cities for real estate investment in Australia.

Key Suburbs for Long-Term Gains

- Joondalup: Excellent amenities and strong rental demand.

- Rockingham: Proximity to beaches and infrastructure projects.

- Baldivis: Family-friendly suburb with growth potential.

Insights into Rental Market Trends

| Metric | Value |

| Median Property Price | $580,000 |

| Average Rental Yield | 4.8% |

| Annual Price Growth | 4.3% |

| Population Growth | 1.2% annually |

5. Adelaide

Adelaide’s affordability and steady growth make it an ideal destination for real estate investment. The city is gaining recognition as a hub for education and technology, contributing to its increasing population and housing demand.

With a mix of affordable housing and premium suburbs, Adelaide offers opportunities for both first-time investors and seasoned buyers.

Key Suburbs for Investment

- Glenelg: A seaside suburb with strong appeal to renters and buyers.

- Prospect: Proximity to the CBD and excellent amenities.

- Mawson Lakes: Known for its modern housing developments and high rental demand.

Market Insights

| Metric | Value |

| Median Property Price | $570,000 |

| Average Rental Yield | 4.7% |

| Annual Price Growth | 5.4% |

| Rental Vacancy Rate | 1.0% |

6. Canberra

As Australia’s capital city, Canberra benefits from a high demand for housing due to its concentration of government employment and universities.

The city’s planned infrastructure and high standard of living make it a solid choice for real estate investors.

Prime Areas for Real Estate

- Belconnen: Known for its vibrant town center and strong rental demand.

- Gungahlin: Rapidly growing suburb with new housing developments.

- Tuggeranong: Family-friendly area with a balance of affordability and amenities.

Key Metrics

| Metric | Value |

| Median Property Price | $870,000 |

| Average Rental Yield | 4.1% |

| Annual Price Growth | 5.9% |

| Population Growth | 1.5% annually |

7. Gold Coast

The Gold Coast offers a dynamic mix of lifestyle appeal and economic growth, driven by tourism, construction, and infrastructure projects.

The city attracts domestic and international buyers seeking beachfront properties and long-term investment opportunities.

High-Yield Suburbs

- Broadbeach: Iconic beachfront suburb with strong rental yields.

- Southport: Emerging as a commercial and residential hub.

- Robina: Modern suburb with excellent amenities and connectivity.

Investment Data

| Metric | Value |

| Median Property Price | $780,000 |

| Average Rental Yield | 4.0% |

| Annual Price Growth | 6.2% |

| Rental Vacancy Rate | 1.2% |

8. Hobart

Hobart’s growing popularity as a cultural and lifestyle destination has resulted in a tight housing market, driving up property values and rental yields.

The city’s affordability compared to mainland capital makes it an attractive option for investors.

Popular Suburbs

- Sandy Bay: High-end area with stunning waterfront properties.

- West Hobart: Offers a mix of heritage homes and modern housing.

- Kingston: Family-friendly suburb with strong demand.

Key Statistics

| Metric | Value |

| Median Property Price | $650,000 |

| Average Rental Yield | 4.9% |

| Annual Price Growth | 8.1% |

| Population Growth | 1.0% annually |

9. Darwin

Darwin’s real estate market is characterized by high rental yields and a steady influx of workers in the mining and defense sectors.

While the market can be volatile, the potential for short-term gains is significant.

Suburbs to Watch

- Palmerston: Affordable housing with strong rental demand.

- Nightcliff: Coastal suburb with high growth potential.

- Larrakeyah: Proximity to the CBD and waterfront attractions.

Market Metrics

| Metric | Value |

| Median Property Price | $550,000 |

| Average Rental Yield | 5.4% |

| Annual Price Growth | 4.0% |

| Rental Vacancy Rate | 1.5% |

10. Newcastle

Newcastle offers a blend of affordability and growth, supported by its coastal appeal and proximity to Sydney.

The city’s revitalization efforts have boosted property values and rental demand.

High-Growth Areas

- Hamilton: Known for its vibrant café scene and urban charm.

- Charlestown: Major commercial hub with strong housing demand.

- Mayfield: Emerging suburb with growing appeal.

Data Snapshot

| Metric | Value |

| Median Property Price | $710,000 |

| Average Rental Yield | 4.3% |

| Annual Price Growth | 5.5% |

| Population Growth | 1.2% annually |

11. Wollongong

Wollongong’s strong connectivity to Sydney and its expanding urban amenities make it a desirable location for investors.

The city’s coastal lifestyle attracts both renters and buyers, ensuring stable demand.

Investment Hotspots

- Figtree: Affordable housing with high growth potential.

- Shellharbour: Popular for its beaches and family-friendly vibe.

- Corrimal: Proximity to the city center and natural attractions.

Insights

| Metric | Value |

| Median Property Price | $820,000 |

| Average Rental Yield | 4.1% |

| Annual Price Growth | 5.6% |

| Rental Vacancy Rate | 1.1% |

12. Geelong

Geelong’s strategic location near Melbourne and its evolving infrastructure have made it a standout option for property investment.

The city’s growing population and affordability compared to Melbourne enhance its appeal.

High-Demand Suburbs

- Belmont: Affordable properties with strong rental demand.

- Highton: Family-friendly suburb with excellent schools.

- Lara: Emerging growth corridor with new developments.

Key Data

| Metric | Value |

| Median Property Price | $690,000 |

| Average Rental Yield | 4.2% |

| Annual Price Growth | 5.8% |

| Population Growth | 1.4% annually |

Takeaways

The 12 best cities for real estate investment in Australia offer diverse opportunities for investors. From metropolitan hubs like Sydney and Melbourne to regional stars like Hobart and Geelong, each city has unique advantages.

By considering factors like economic growth, infrastructure development, and rental yields, you can make informed decisions to maximize your returns.

Start exploring these thriving markets and secure your place in Australia’s dynamic real estate landscape.

Whether you are a seasoned investor or a beginner, these best cities for real estate investment in Australia provide the foundation for building a lucrative portfolio.