As a high-net-worth individual (HNWI) in the USA, effective tax planning is essential to preserving wealth, minimizing liabilities, and ensuring compliance with IRS regulations.

Without a strategic approach, high-income earners can face significant tax burdens that impact financial growth and legacy planning. With the right strategies, you can legally reduce your tax burden, optimize investments, and transfer wealth efficiently.

This guide explores 8 advanced tax planning strategies for high-net-worth individuals in the USA, equipping you with the tools to protect and grow your wealth while staying compliant with tax laws.

Understanding Tax Planning for High-Net-Worth Individuals

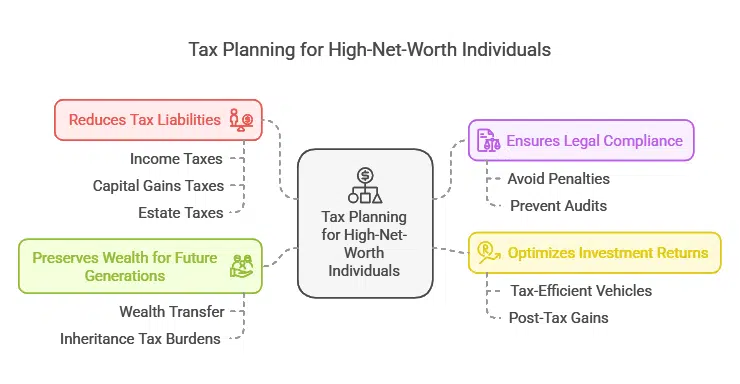

- Reduces Tax Liabilities: Proper structuring can lower income, capital gains, and estate taxes, ensuring more wealth retention.

- Ensures Legal Compliance: Avoid costly penalties and audits by aligning with IRS guidelines.

- Optimizes Investment Returns: Invest in tax-efficient vehicles that maximize post-tax gains.

- Preserves Wealth for Future Generations: Effective estate planning ensures smooth wealth transfer and minimizes inheritance tax burdens.

Key Tax Challenges for High-Net-Worth Individuals

- Higher Tax Brackets: The top federal income tax rate is 37%, with additional state taxes in some jurisdictions.

- Estate and Gift Tax: Up to 40% tax applies to estates exceeding the federal exemption limit.

- Investment Taxation: Long-term capital gains tax can reach 20%, plus a 3.8% Net Investment Income Tax (NIIT).

- Complex Compliance Requirements: Foreign accounts, trusts, and business entities require extensive reporting.

8 Advanced Tax Planning Strategies for High-Net-Worth Individuals in the USA

To navigate the complexities of the U.S. tax system, high-net-worth individuals must adopt proactive measures to minimize tax liabilities while ensuring compliance. These strategies help protect assets, reduce taxable income, and maximize wealth transfer efficiency.

Below are 8 advanced tax planning strategies for high-net-worth individuals in the USA to help you optimize your financial future.

1. Leveraging Trusts for Estate Tax Reduction

Trusts are powerful tools for minimizing estate taxes and protecting wealth. By placing assets in trusts, individuals can strategically control how wealth is distributed to beneficiaries while reducing estate tax exposure. Additionally, trusts offer privacy and asset protection against lawsuits and creditors.

Types of Trusts for Tax Planning:

| Trust Type | Benefits |

| Irrevocable Trusts | Removes assets from taxable estate, reducing estate taxes. |

| Grantor Retained Annuity Trusts (GRATs) | Transfers assets with minimal tax implications and provides annuity payouts. |

| Charitable Remainder Trusts (CRTs) | Reduces taxable income, provides lifetime income, and benefits charity. |

| Dynasty Trusts | Preserve wealth for multiple generations while minimizing estate taxes. |

Case Study:

A wealthy entrepreneur placed $10 million into a GRAT, allowing appreciation to pass tax-free to heirs while retaining annuity payments for a set term. This strategy saved millions in estate taxes.

2. Maximizing Tax-Advantaged Investment Strategies

Investing in tax-efficient assets can significantly lower tax burdens by reducing taxable investment income and optimizing capital gains treatment. These strategies also allow for increased portfolio diversification and long-term wealth growth.

Tax-Efficient Investment Vehicles:

| Investment Type | Tax Benefits |

| Municipal Bonds | Generate tax-free interest income at the federal (and sometimes state) level. |

| 1031 Exchange | Defers capital gains taxes on real estate transactions by reinvesting proceeds. |

| Capital Gains Harvesting | Offsets gains with losses to lower taxable income. |

| Roth IRA Conversions | Provides tax-free withdrawals in retirement. |

Example:

An investor with $500,000 in appreciated stock used tax-loss harvesting to offset $50,000 in gains, reducing their taxable income significantly.

3. Strategic Use of Retirement Accounts

Maximizing contributions to tax-advantaged retirement accounts ensures tax-efficient growth and provides long-term financial security. Additionally, using employer-sponsored plans like SEP-IRAs and Solo 401(k)s can significantly reduce taxable income for self-employed individuals.

Key Retirement Strategies:

| Strategy | Benefit |

| Max Out 401(k) & IRA Contributions | Tax-deferred growth and reduced taxable income. |

| Roth IRA Conversions | Reduces future tax liabilities on retirement withdrawals. |

| Self-Directed IRAs | Allows alternative investments like real estate and private equity, increasing diversification. |

4. Optimizing Business Tax Structures

Entrepreneurs and business owners can leverage tax-efficient structures to reduce liabilities and optimize income. A well-structured business entity ensures maximum deductions and tax deferrals.

Business Tax Strategies:

| Strategy | Benefit |

| Choosing the Right Business Entity | LLCs, S Corps, and C Corps offer different tax advantages. |

| Qualified Business Income (QBI) Deduction | Allows pass-through entities to deduct up to 20% of qualified income. |

| Tax-Deferred Reinvestments | Business owners can defer taxes through reinvestment strategies. |

5. Utilizing Charitable Giving for Tax Benefits

Strategic philanthropy can significantly reduce taxable income while supporting causes. Donating highly appreciated assets instead of cash can further maximize tax savings.

Charitable Tax Strategies:

| Strategy | Benefit |

| Donor-Advised Funds (DAFs) | Immediate tax deduction with flexible charitable donations. |

| Charitable Lead Trusts (CLTs) | Reduces estate tax while benefiting charities. |

| Gifting Appreciated Assets | Avoids capital gains tax while supporting charities. |

6. Effective Estate and Gift Tax Planning

Proper estate planning minimizes the impact of estate and gift taxes on wealth transfer. Making strategic lifetime gifts ensures the preservation of family wealth.

| Strategy | Benefit |

| Annual Gift Exclusion | Gift up to $18,000 per person tax-free. |

| Lifetime Estate Tax Exemption | Use exemptions strategically ($13.61M in 2024). |

| Family Limited Partnerships (FLPs) | Protects assets and reduces estate tax liability. |

7. International Tax Strategies for Global Wealth Holders

HNWIs with international assets must navigate complex tax laws to minimize liabilities and avoid double taxation.

| Strategy | Benefit |

| Foreign Earned Income Exclusion (FEIE) | Excludes up to $126,500 in foreign income (2024). |

| Tax Treaties & Credits | Reduces double taxation on foreign income. |

| FATCA & FBAR Compliance | Ensures legal compliance for offshore accounts. |

8. Tax-Efficient Wealth Transfer and Succession Planning

Wealth transfer should be tax-efficient to preserve assets for future generations. Leveraging generational wealth planning tools can ensure financial security for heirs.

| Strategy | Benefit |

| Family Trusts | Maintains control over assets while reducing taxes. |

| Life Insurance | Provides tax-free payouts to beneficiaries. |

| Private Foundations | Establishes a legacy while benefiting from tax deductions. |

Takeaways

Implementing advanced tax planning strategies for high-net-worth individuals in USA is crucial for optimizing financial success. By leveraging trusts, tax-efficient investments, and strategic charitable giving, HNWIs can legally reduce their tax burdens while growing wealth.

Consult with a tax expert to tailor these strategies to your specific needs and maximize your wealth protection today!