Two years post-approval, the “Spot ETF” narrative has transcended its initial hype. While headlines celebrate BlackRock’s IBIT crossing major milestones, the reality is even more staggering: with over $70 billion in assets under management (AUM) as of January 2026, BlackRock hasn’t just participated in the market—it has structurally captured it. This analysis unpacks the “BlackRock Effect,” the dampening of volatility through options hedging, and the emerging race for Sovereign Strategic Reserves.

Key Takeaways

- The “Kingmaker” Effect: BlackRock’s iShares Bitcoin Trust (IBIT) has not just led the pack; it has effectively become the market’s liquidity black hole, influencing price discovery more than offshore exchanges.

- Volatility Dampening: The influx of passive institutional capital (pension funds, 401ks) has structurally lowered Bitcoin’s notorious volatility, making it behave more like a risk-on tech asset than a rogue commodity.

- Regulatory Evolution: The 2025 approval of options trading on Spot ETFs and the passing of legislation like the “Genius Act” have integrated Bitcoin deeply into the U.S. financial plumbing.

- Next Frontier: The narrative for 2026 is shifting toward “Sovereign Strategic Reserves” and the use of tokenized funds as collateral in traditional markets.

Gamble to Foundation Layer

To understand the gravity of January 2026, we must look back at the trajectory. On January 11, 2024, the U.S. SEC approved 11 Spot Bitcoin ETFs, ending a decade of regulatory purgatory. The consensus then was cautious optimism. By early 2025, the “Fee Wars” had claimed their victims, leaving a consolidated field.

Now, as we mark the second anniversary, the market has bifurcated. There is BlackRock (IBIT) and Fidelity (FBTC), and then there is everyone else. The “News” is no longer about if institutions will buy, but about how the sheer mass of their holdings—now exceeding 1.3 million BTC collectively—has fundamentally altered the asset’s DNA. The $40 billion AUM milestone mentioned in retrospect was merely the sound barrier; today, we are traveling at Mach 2.

The BlackRock Gravity Well: Liquidity Kingmaker

BlackRock’s iShares Bitcoin Trust (IBIT) is not merely an investment vehicle; it has become the primary venue for Bitcoin price discovery, superseding offshore exchanges like Binance in influence during U.S. trading hours.

The Aggregation of Flows

As of January 9, 2026, IBIT holds approximately 773,000 BTC, valued at nearly $70.8 billion. This dwarfs the initial projections of most analysts. The “Why” behind this dominance lies in the liquidity loop: massive AUM begets tighter spreads, which attracts high-frequency traders and market makers, which in turn deepens liquidity, attracting even larger institutional tickets.

The ETF Leaderboard — The “Power Law” in Effect (Jan 2026)

| Ticker | Issuer | AUM (Est. USD) | BTC Holdings | Market Share % | Key Insight |

| IBIT | BlackRock | ~$70.8 Billion | ~773,000 | ~52% | The default choice for wealth managers and model portfolios. |

| FBTC | Fidelity | ~$48.2 Billion | ~520,000 | ~35% | Strong uptake in private wealth and 401(k) allocations. |

| GBTC | Grayscale | ~$12.5 Billion | ~135,000 | ~9% | Stabilized after 2024 outflows; now a high-fee legacy hold. |

| BITB | Bitwise | ~$3.8 Billion | ~41,000 | ~3% | Niche player focusing on crypto-native RIA transparency. |

| Others | Ark, VanEck, etc. | ~$2.1 Billion | ~22,000 | ~1% | Fighting for scraps; consolidation or closure likely in 2026. |

Structural Shift: The “Great Dampening” of Volatility

Perhaps the most profound change in the last two years is the death of Bitcoin’s infamous 20% daily candles. The market structure has matured from a “wild west” casino to a hedged, regulated derivative market.

Options Market Supremacy

In late 2024/early 2025, the SEC approved options trading on Spot ETFs. This was the turning point. By January 2026, Options Open Interest (OI) surpassed Futures OI for the first time—$65B vs. $60B.

Why This Matters:

- Volatility Suppression: Institutions use options to write “Covered Calls” (selling upside for yield). This creates massive sell walls above the current price, dampening rallies, and buy walls below, cushioning falls.

- The “Gamma Pin”: Dealers who sell these options must hedge their exposure. As price moves, they buy or sell the underlying asset in opposition to the trend to stay neutral, effectively pinning the price in tighter ranges ($88k–$95k in early Jan 2026).

Volatility & Market Structure Transformation

| Metric | Pre-ETF Era (2020–2023) | Post-ETF Era (Jan 2026) | The “Why” |

| 30-Day Realized Volatility | ~65% – 80% | ~35% – 45% | Passive flows and options overwriting compress variance. |

| Dominant Derivative | Perpetual Futures (Offshore) | ETF Options (Nasdaq/CBOE) | Regulated hedging replaces degenerate leverage. |

| Leverage Source | Binance/Bybit (100x) | Prime Brokerage / Repo | Credit-based leverage is stickier and less prone to “wicks”. |

| Primary Trading Hour | Asian Open (UTC 00:00) | U.S. Close (UTC 20:00) | The “Fixing Window” for ETFs dictates global price. |

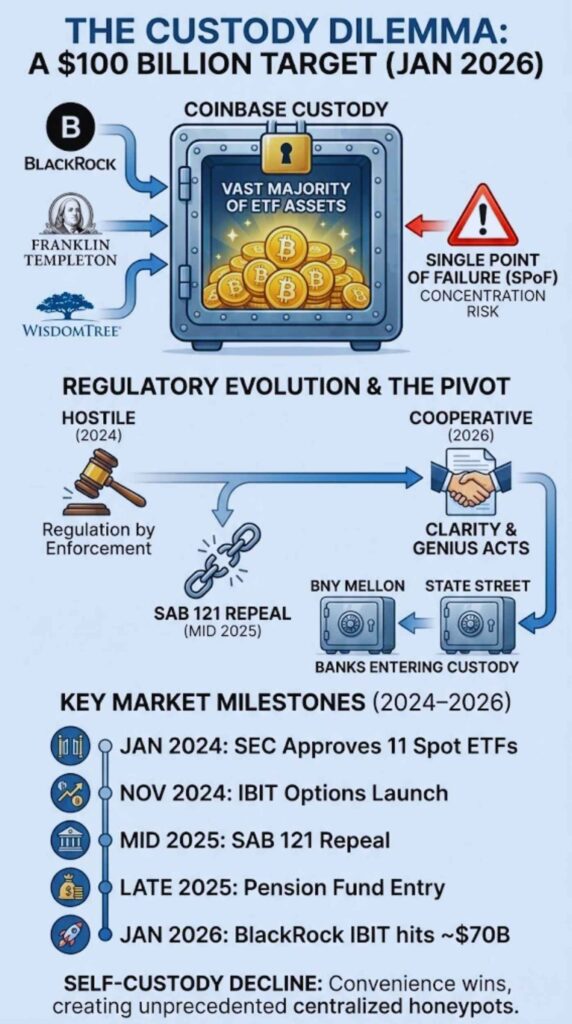

The Custody Dilemma: A $100 Billion Target

While the financialization of Bitcoin is a success, the operational infrastructure reveals a glaring fragility. The vast majority of ETF assets—including those of BlackRock, Franklin Templeton, and WisdomTree—are custodied by a single entity: Coinbase.

The “Single Point of Failure” (SPoF)

In 2026, Coinbase Custody effectively holds the keys to the U.S. institutional crypto market. While their track record is pristine, risk managers are increasingly vocal about the concentration risk.

- The Pivot: We are seeing the first signs of diversification. Banks like BNY Mellon (following the repeal of SAB 121 constraints in 2025) are entering the custody game.

- Self-Custody Decline: As ETF convenience wins, the ethos of “Not your keys, not your coins” is fading from the institutional memory, creating a centralized honeypot of unprecedented scale.

From “Regulation by Enforcement” to Clarity

The political landscape of 2026 has shifted from hostile to cooperative, driven largely by the sheer amount of voter wealth now tied to crypto assets via ETFs.

The “CLARITY Act” & “Genius Act”

Legislative advancements in 2025 paved the way for the current stability.

- The CLARITY Act (2026 Progress): Currently advancing through the Senate, this bill aims to classify digital assets definitively as commodities or securities based on decentralization metrics.

- Stablecoin Legislation: The passing of frameworks for stablecoin issuance has allowed banks to settle ETF creations/redemptions faster, blurring the lines between T+1 stock settlement and T+0 crypto speed.

Key Regulatory & Market Milestones (2024–2026)

| Date | Event | Impact |

| Jan 2024 | SEC Approves 11 Spot ETFs | The floodgates open; legitimacy established. |

| Nov 2024 | IBIT Options Launch | Institutional hedging becomes possible; volatility begins to drop. |

| Mid 2025 | SAB 121 Repeal / Adjustment | Banks (BNY, State Street) allowed to custody crypto assets. |

| Late 2025 | Pension Fund Entry | State of Wisconsin/Michigan expand allocations; others follow. |

| Jan 2026 | BlackRock IBIT hits ~$70B | ETF assets eclipse holdings of major exchanges; supply shock deepens. |

The Sovereign Bid: The Next Adoption S-Curve

With corporations and retail fully onboarded, the frontier for 2026 is the Nation State.

The Strategic Reserve Theory

Discussions in Washington regarding a “U.S. Strategic Bitcoin Reserve” have graduated from fringe podcasts to Congressional committees. The logic is defensive: if rival nations (or allies like El Salvador and Bhutan) are accumulating non-seizable reserves, the U.S. cannot afford to have zero exposure.

- The “Game Theory” Activation: Analysts predict that if one G7 nation formally announces a Bitcoin purchase program in 2026, it will trigger a “Sovereign FOMO” event that ETFs cannot absorb, forcing a repricing of the asset entirely.

Expert Perspectives

“The shift toward options dominance signals a deeper institutionalization… Bitcoin is increasingly behaving like a macro asset with institutional risk controls, rather than a purely speculative instrument.”

— Binance Research Desk (Jan 14, 2026)

“We are seeing the ‘Netscape Moment’ for digital assets. The ETFs were the browser; now we are building the applications on top. Tokenized collateral is the next logical step.”

— Samara Cohen, BlackRock (Contextualized from 2025 statements)

Future Outlook: What Happens Next?

As we look toward the remainder of 2026, three trends will dominate:

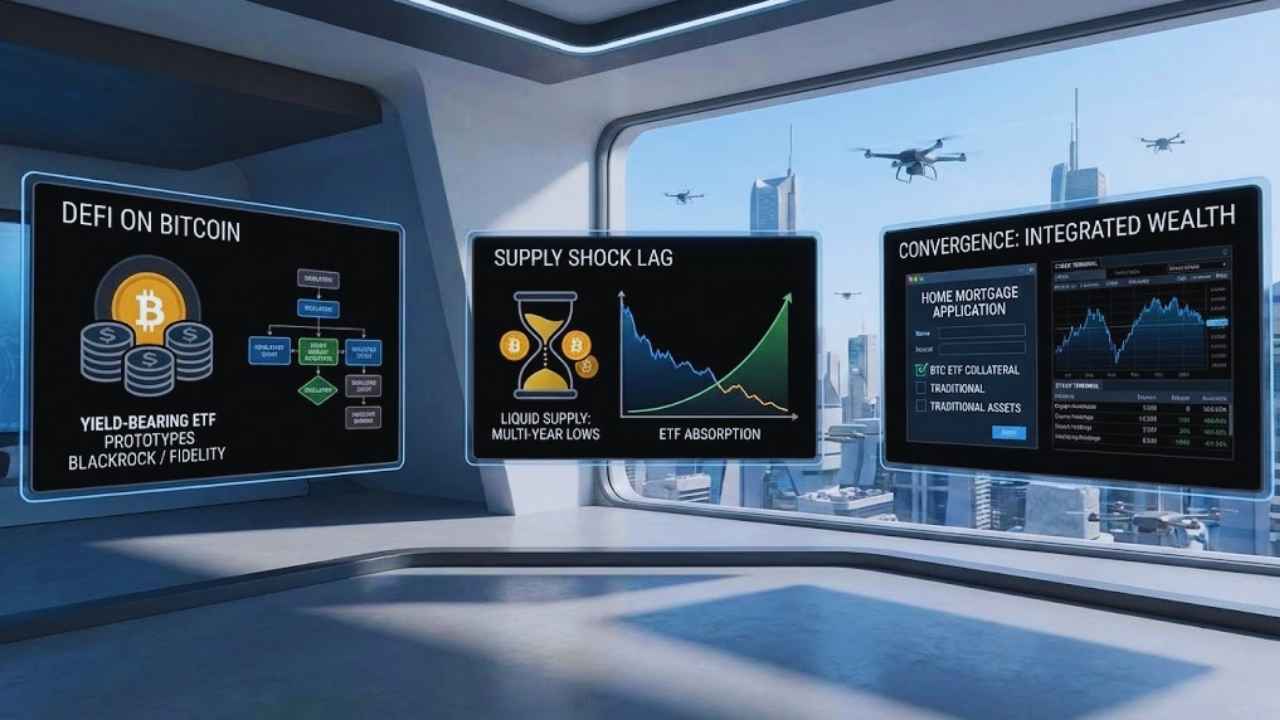

- DeFi on Bitcoin: With the success of the ETFs, the demand to use that Bitcoin for yield (beyond just price appreciation) is growing. Expect BlackRock or Fidelity to explore “staked” or “yield-bearing” ETF products, likely triggering a new regulatory battle.

- The Supply Shock Lag: Halving 2024 reduced issuance. ETF absorption has been massive. The “Liquid Supply” on exchanges is at multi-year lows. A supply squeeze is mathematically probable if demand remains constant.

- Convergence: By the end of 2026, you will likely be able to use your Bitcoin ETF shares as collateral to buy a house or margin trade stocks, fully integrating crypto wealth into the legacy credit system.

Final Verdict

The 2nd Anniversary of the Bitcoin Spot ETF is not just a celebration of inflows; it is the funeral for “Crypto as a Toy.” With BlackRock holding $70B+ and options markets dictating price, Bitcoin is now a serious, boring, and essential part of the global financial plumbing. The revolution is over; the occupation has begun.