Group insurance is a crucial financial safety net for businesses and organizations in India. It provides employees with life, health, and other essential coverage, often at a lower cost than individual policies.

With the rise of corporate employee benefits and increasing awareness of financial security, selecting the right group insurance provider has become a priority for many organizations.

This article explores the top Group Insurance Providers in India for 2025, analyzing their features, claim settlement ratios, and benefits to help businesses make informed decisions.

We will also look at key trends in the group insurance sector and how these providers are innovating to meet evolving needs.

Understanding Group Insurance in India

Group insurance is a policy that covers a defined group of individuals under a single plan. This is commonly offered by employers to their employees but can also be extended to other groups like professional associations or societies.

These policies typically include life insurance, health coverage, and other additional benefits, ensuring financial protection for employees and their families.

Group insurance policies often come with lower premiums than individual policies, making them a cost-effective option for businesses.

Employers may choose from various policy structures, including term life, medical insurance, or retirement benefits, to meet the specific needs of their workforce.

The top Group Insurance Providers in India offer diverse plans to cater to various organizational requirements.

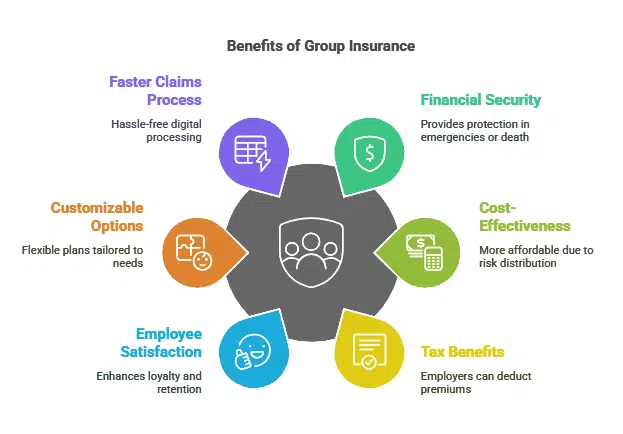

Benefits of Group Insurance for Businesses & Employees

- Financial security: Ensures protection for employees in case of medical emergencies or death.

- Cost-effective: Group policies are more affordable than individual plans due to risk distribution.

- Tax benefits: Employers can claim tax deductions on premiums paid for group insurance.

- Employee satisfaction: Enhances employee loyalty and retention by providing essential financial support.

- Customizable options: Many providers offer flexible plans that allow organizations to tailor benefits to employee needs.

- Faster claims process: Many insurers offer hassle-free digital claims processing.

Key Factors to Consider When Choosing a Group Insurance Provider

- Claim Settlement Ratio (CSR): A higher CSR indicates the company’s reliability in processing claims.

- Coverage Scope: Ensure the policy includes essential benefits like hospitalization, critical illness, and accidental death coverage.

- Premium Costs: Compare the cost of premiums against the benefits offered.

- Flexibility & Add-ons: Check if the policy allows customization based on business needs.

- Customer Support & Digital Services: A seamless claims process and digital access enhance the user experience.

- Network Hospitals: A vast hospital network ensures employees can easily access healthcare services.

- Turnaround Time for Claims: Quick claim settlements improve employee satisfaction.

Top Group Insurance Providers in India for 2025

To help you select the best group insurance policy, we have compiled a list of the top Group Insurance Providers in India based on claim settlement ratios, financial stability, and customer satisfaction.

1. Life Insurance Corporation of India (LIC)

LIC is the largest and most trusted insurance provider in India, with decades of experience in offering comprehensive insurance solutions.

Their group insurance policies cater to various organizations, ensuring robust financial security for employees. LIC’s extensive network and government backing make it one of the most reliable insurers in the country.

- Claim Settlement Ratio: 98.74%

- Solvency Ratio: 1.8

- Annual Premiums: ₹4,74,668.14 crores

- Key Features:

- Extensive reach across India.

- Competitive premium pricing.

- Offers additional riders for enhanced coverage.

- Simple and transparent claims process.

- Digital claim submission for faster processing.

| Feature | Details |

| Claim Settlement Ratio | 98.74% |

| Solvency Ratio | 1.8 |

| No. of Policies Issued | Over 250 million |

| Types of Group Insurance | Term Life, Gratuity Plans, Superannuation Plans |

| Claim Processing Time | 7-10 Days |

2. HDFC Life Insurance

HDFC Life has built a strong reputation for providing flexible and innovative group insurance solutions tailored to corporate clients.

Their policies offer high customization to fit varying business needs. HDFC Life has introduced AI-driven claims settlement systems to enhance efficiency.

- Claim Settlement Ratio: 98.66%

- Solvency Ratio: 1.9

- Annual Premiums: ₹57,533.42 crores

- Key Features:

- Customizable group term plans.

- Digital claim processing for faster settlement.

- Wellness programs integrated with insurance plans.

- Dedicated relationship managers for corporate clients.

| Feature | Details |

| Claim Settlement Ratio | 98.66% |

| Solvency Ratio | 1.9 |

| Major Clients | IT Firms, Startups, SMEs |

| Additional Benefits | Wellness Programs, Rider Add-ons |

| Claim Processing Time | 5-7 Days |

3. ICICI Prudential Life Insurance

ICICI Prudential Life offers an impressive mix of traditional and modern group insurance solutions, making them one of the most reliable providers in India.

Their digital-first approach has streamlined policy issuance and claims processing, making it an attractive choice for tech-savvy companies.

- Claim Settlement Ratio: 97.82%

- Solvency Ratio: 2.0

- Annual Premiums: ₹39,932.78 crores

- Key Features:

- Competitive pricing for SMEs and large corporations.

- 24/7 customer support for policyholders.

- High flexibility in benefit structuring.

- AI-based fraud detection for faster and secure claim processing.

| Feature | Details |

| Claim Settlement Ratio | 97.82% |

| Solvency Ratio | 2.0 |

| Major Clients | SMEs, Large Corporations |

| Additional Benefits | AI-Based Fraud Detection, Digital Claim Processing |

| Claim Processing Time | 6-8 Days |

4. SBI Life Insurance

SBI Life is a trusted name in the Indian insurance industry, backed by the country’s largest bank.

Their group insurance plans cater to businesses of all sizes.

The company has consistently focused on improving customer service and digital accessibility.

- Claim Settlement Ratio: 97.05%

- Solvency Ratio: 2.1

- Annual Premiums: ₹67,315.60 crores

- Key Features:

- Strong financial backing by SBI.

- Various customizable plans.

- Affordable premium rates.

- Seamless claim settlement with mobile app supportt.

| Feature | Details |

| Claim Settlement Ratio | 97.05% |

| Solvency Ratio | 2.1 |

| Major Clients | Large Corporations, SMEs |

| Additional Benefits | Mobile App Support, Custom Plans |

| Claim Processing Time | 7-9 Days |

5. Aditya Birla Sun Life Insurance

Aditya Birla Sun Life has made a mark in the group insurance sector with its tailor-made policies and digital-first approach.

Their focus on wellness initiatives and mental health benefits sets them apart.

- Claim Settlement Ratio: 98.07%

- Solvency Ratio: 1.9

- Annual Premiums: ₹15,069.69 crores

- Key Features:

- Strong focus on digital policy management.

- Competitive premium rates for businesses.

- Employee wellness and financial literacy initiatives.

- Mental health and stress management programs.

| Feature | Details |

| Claim Settlement Ratio | 98.07% |

| Solvency Ratio | 1.9 |

| Major Clients | Corporate Firms, Startups, SMEs |

| Additional Benefits | Mental Health Support, Wellness Programs |

| Claim Processing Time | 5-7 Days |

Takeaways

Choosing the top Group Insurance Providers in India requires careful evaluation of coverage, claim settlement history, and overall benefits.

The right provider ensures financial security for employees while offering cost-effective solutions for employers.

By comparing top insurers like LIC, HDFC Life, and ICICI Prudential, businesses can make informed decisions that align with their long-term goals.

For the latest updates on insurance policies and financial planning, stay tuned to our blog!